East of Suez Market Update 26 May 2025

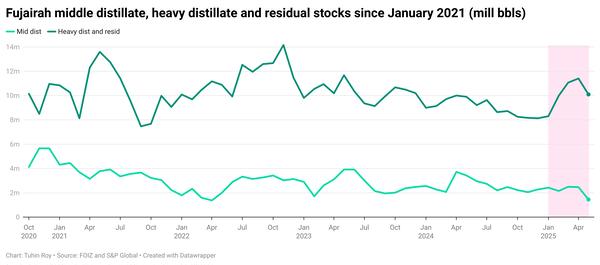

Most prices in East of Suez ports have moved up, and prompt availability of all grades is tight in Fujairah.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

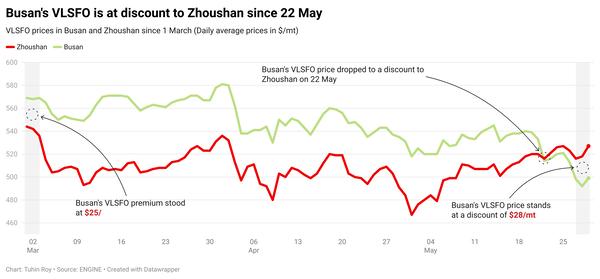

- VLSFO prices up in Zhoushan ($11/mt) and Singapore ($10/mt), and down in Fujairah ($4/mt)

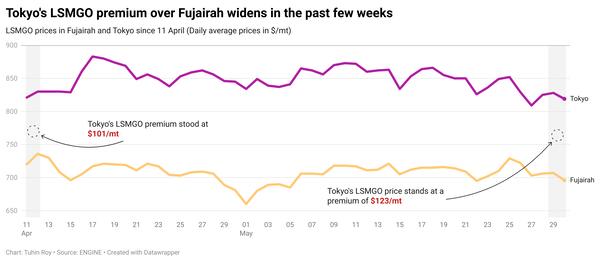

- LSMGO prices up in Fujairah ($40/mt), Singapore ($15/mt) and Zhoushan ($13/mt)

- HSFO prices up in Zhoushan ($13/mt), Singapore ($5/mt) and Fujairah ($4/mt)

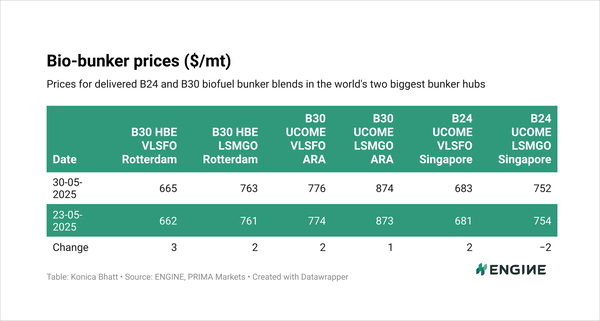

- B24-VLSFO at a $214/mt premium over VLSFO in Singapore

- B24-VLSFO at a $242/mt premium over VLSFO in Fujairah

VLSFO benchmarks in Zhoushan and Singapore have risen over the weekend, while the grade's price in Fujairah has declined. A lower-priced 150-500 mt VLSFO stem fixed in Fujairah has contributed to the drop in its benchmark. Fujairah's VLSFO now stands at discounts of $31/mt and $22/mt to Zhoushan and Singapore, respectively.

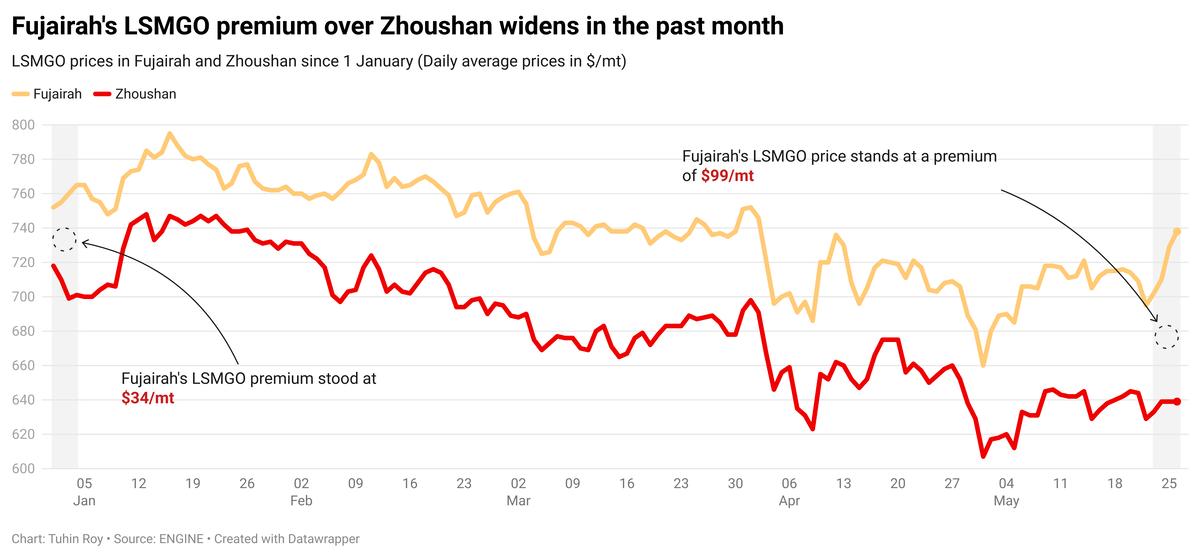

In contrast, Fujairah’s LSMGO price has risen by $40/mt—the sharpest increase among the three key Asian bunker hubs—supported by a higher-priced 150–500 mt LSMGO stem fixed at the port. Fujairah’s LSMGO now stands at a premium of $135/mt over Singapore and $99/mt over Zhoushan.

Prompt availability in Fujairah remains tight, with lead times across all fuel grades steady at 5–7 days.

In Zhoushan, VLSFO availability has tightened due to low stocks with several suppliers. Recommended VLSFO lead times have increased to 7–10 days, up from 4–7 days last week. HSFO lead times have also extended from 3–5 days to 5–7 days. Meanwhile, LSMGO lead times in Zhoushan remain stable at 3–5 days.

Brent

The front-month ICE Brent contract has gained by $1.11/bbl on the day from Friday, to trade at $65.16/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices have gained over the weekend amid diminishing prospects of a US-Iran nuclear deal.

Both nations concluded a fifth round of talks last week, that showed “some but not conclusive progress” according to media reports citing Iran’s foreign minister Abbas Araghchi.

Tehran has not agreed to stop its nuclear enrichment program, Iran's foreign ministry spokesperson Esmail Baghaei said, as quoted by Reuters, adding that no timeline has been set for the sixth round of talks with Washington.

The agreement could potentially lead the US administration to lift some sanctions on Iranian oil and bring more supply back to the market.

“There are concerns that the Trump administration may tighten sanctions on Iran to force it to drop its nuclear ambitions,” ANZ Bank’s senior commodity strategist Daniel Hynes noted.

Downward pressure:

Oil investors' focus is now shifting toward concerns over excess supply as OPEC+ prepares to meet again on 1 June.

“We’re likely to hear lots of noise this week ahead of the OPEC+ meeting on Sunday, 1 June, where the group will decide on output policy for July,” two analysts from ING Bank said.

Market analysts expect the Saudi Arabia-led group to increase output by another 411,000 b/d in July – the third time in a row.

“This should keep the market well supplied over the second half of this year,” the two analysts added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.