Americas Market Update 22 May 2025

Bunker prices across key Americas ports have tracked Brent down, and availability in Zona Comun remains volatile amid tightening supply.

IMAGE: New York Harbor. Getty Images

IMAGE: New York Harbor. Getty Images

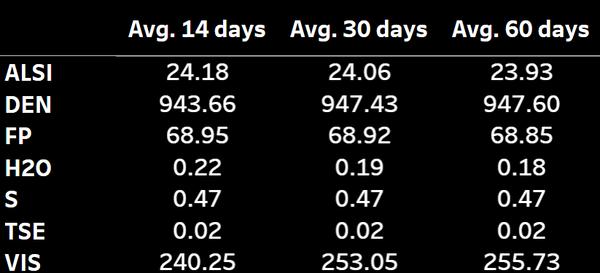

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices down in Zona Comun ($23/mt), Los Angeles, Houston ($19/mt), New York ($17/mt) and Balboa ($15/mt)

- LSMGO prices down in Los Angeles ($23/mt), Houston ($22/mt), New York and Balboa ($20/mt)

- HSFO prices down in Los Angeles ($16/mt), Balboa ($15/mt), Houston ($13/mt) and New York ($12/mt)

Zona Comun’s VLSFO and Los Angeles’ LSMGO have made the steepest drops, each falling by $23/mt.

Los Angeles' LSMGO benchmark is currently at a $39/mt premium over Houston's and at a small $4/mt premium over New York.

Port officials in Los Angeles have said that for May, approximately 80 sailings were expected to arrive in the port, but 17 of those have already been cancelled as a result of the ongoing tariffs and retaliatory tariffs. Another 10 sailings have been cancelled for June.

The port's executive director Gene Seroka does not expect a dramatic surge in cargo volumes during the 90-day tariff reprieve, but rather a modest, measured increase as shippers adjust to the new environment.

In Zona Comun, the bunker barge Sara H has now been sold after an inspection. The barge was formerly operated by Minerva and recently underwent maintenance at drydock. A local supplier confirmed a replacement barge is expected by the end of the month.

There are currently 3-4 barges operating in Zona Comun, sources say.

VLSFO availability at the anchorage remains volatile amid tight supply, with suppliers recommending lead times of at least 10 days.

Balboa’s VLSFO and HSFO prices have each dropped by $15/mt in the latest session. The two grades have been trading close to parity, with the Hi5 spread briefly turning into rare negative territory on Tuesday. It has since recovered slightly and now stands at $8/mt.

Brent

The front-month ICE Brent contract has lost $2.31/bbl on the day, to trade at $63.81/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

Brent has found support as supply concerns in the Middle East resurfaced after a CNN report stated that Israel was preparing for a major airstrike on Iranian nuclear facilities.

The risk of a wider conflict in the Middle East could affect oil supplies from other regional producers.

“Crude oil rallied in early trading amid heightened geopolitical risk,” ANZ Bank’s senior commodity strategist Daniel Hynes noted.

The news has raised concerns that negotiations between the US and Iran over Tehran's nuclear program may falter, according to market analysts.

“While the likelihood of a strike appears low, it has snapped the market out of a calm that developed as some hostilities in the region appeared to cool slightly,” Hynes said.

Downward pressure:

Brent’s price has declined after the US Energy Information Administration (EIA) reported a surprise gain in US crude stocks.

Commercial US crude oil inventories increased by 1.3 million bbls to touch 443 million bbls for the week ending 16 May, according to data from the EIA.

The build in crude stocks was “was much higher than expected,” Hynes said. A buildup in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.