LNG Bunker Snapshot: Singapore price rises amid Trump’s tariff review talks

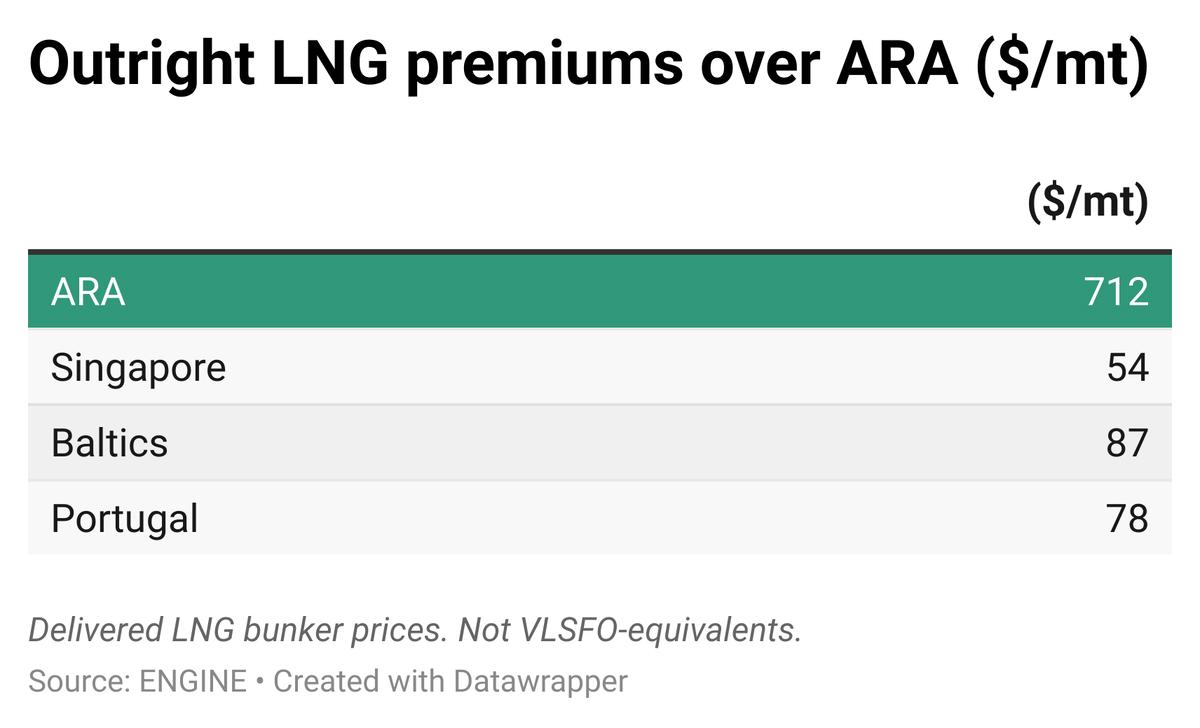

Rotterdam’s LNG bunker price held steady, supported by a stable Dutch TTF contract, while Singapore’s price rose amid tariff review talks by the Trump administration and unplanned outages at several LNG terminals in Asia.

Changes in weekly LNG bunker prices:

- Rotterdam up by $2/mt to $712/mt

- Singapore up by $12/mt to $766/mt

Rotterdam

Rotterdam’s LNG bunker price has remained steady compared to last week, reflecting the stability of the front-month Dutch TTF Natural Gas contract, a key European benchmark.

The TTF rose slightly by 3%, attributed to the “unplanned shutdown of Norwegian gas production facilities,” according to the Japan Organization for Metals and Energy Security (JOGMEC).

“There were potential supply disruptions in Norway over the past week, with Aasta Hansteen, Dvalin and Troll all experiencing unplanned outages,” Rystad Energy reported.

“The market is still on guard as to the insecure geopolitical situation, with the US-China trade war still ongoing, and a potential US-EU trade fight likely coming up in the next months,” Energi Danmark added.

As of 18 April, underground gas storage levels across the EU stood at 36.4%, up from 35.1% the previous week but still 41.4% below the same period last year, according to Gas Infrastructure Europe, as cited by JOGMEC.

Singapore

Over the past week, Singapore’s LNG bunker price rebounded by $12/mt after eight straight weeks of decline. This was driven by an improvement in the bearish market sentiment “as the Trump administration began to review the introduction of tariffs, and unplanned outages occurred at several LNG shipping terminals in Asia, including Bintulu,” according to JOGMEC.

Brunei LNG—a joint venture between the Brunei government, Shell, and Japan’s Mitsubishi—suffered an outage on 11 April, impacting regional supply. Simultaneously, Australia's Inpex-operated Ichthys LNG project is facing disruptions, with loading schedules for several cargoes delayed by one day, Rystad Energy noted.

As of 13 April, LNG inventories for power generation remained steady at 2.13 million mt, unchanged from the previous week, according to Japan’s Ministry of Economy, Trade and Industry (METI).

Meanwhile, the NYMEX Japan/Korea Marker (JKM) fell by $0.46/MMBtu over the same period, pushing the front-month contract down to $12.09/MMBtu ($629/mt).

The price premium over Rotterdam widened from $44/mt to $54/mt during the week.

However, “mild weather forecasts in the shoulder-month period will likely limit gas consumption in East Asian countries for the remainder of April,” Rystad Energy cautioned.

A shoulder month refers to the period between peak and off-peak seasons, typically marked by milder weather and lower energy demand.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.