East of Suez Fuel Availability Outlook 22 Apr 2025

HSFO availability is tight in Zhoushan

Bunker demand is low in South Korean ports

Availability improves in Sri Lankan ports

PHOTO: Vessels entering the port of Busan, South Kora. Getty Images

PHOTO: Vessels entering the port of Busan, South Kora. Getty Images

Singapore and Malaysia

In Singapore, VLSFO lead times currently vary significantly, ranging from 6-18 days. This is a notable shift from last week, when most suppliers recommended lead times of 8-12 days. HSFO lead times have also widened, now at 7-11 days compared to the previous 5-9 days. LSMGO availability remains stable, with recommended lead times holding steady at 6-8 days.

Singapore’s residual fuel oil inventories have averaged 17% higher so far in April compared to March, according to Enterprise Singapore. Fuel oil stocks have risen above 22 million bbls—marking the highest level recorded this year. The increase is supported by a 12% rise in net fuel oil imports this month, with imports growing by 680,000 bbls, far surpassing the 171,000-bbl increase in exports. In contrast, middle distillate inventories in Singapore have averaged 7% lower in April than in March.

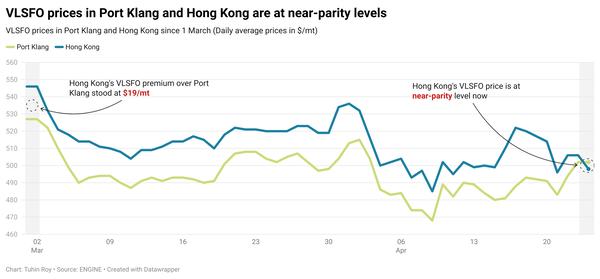

At Malaysia’s Port Klang, both VLSFO and LSMGO remain readily available, with prompt delivery possible for smaller volumes. However, HSFO continues to face limited availability.

East Asia

Lead times for VLSFO and LSMGO in Zhoushan have increased from last week’s 4–6 days to 5–7 days currently. HSFO supply has tightened considerably despite weak demand, as several suppliers face low stock levels. As a result, HSFO lead times have been pushed back to the end of April, compared to the previous 4–6 days.

Adverse weather has led to a suspension of bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages since Saturday. However, operations resumed on Monday at the more sheltered Xiushandong anchorage and Mazhi’s inner anchorage. Several suppliers expect full resumption of bunkering in the OPL area by Wednesday.

In northern China, Dalian and Qingdao have healthy stocks of VLSFO and LSMGO, though HSFO remains limited in Qingdao. Tianjin continues to face tight supply for both VLSFO and HSFO, while LSMGO availability is stable.

Shanghai is also experiencing pressure on VLSFO and HSFO availability, but LSMGO remains readily accessible. Further south, Fuzhou maintains strong supply of both VLSFO and LSMGO. Xiamen has good VLSFO availability, though LSMGO supply is limited. Prompt deliveries of both VLSFO and LSMGO remain challenging in Yangpu and Guangzhou.

In Hong Kong, lead times for all fuel grades remain steady at around seven days, consistent with recent weeks. However, rough weather forecasted for 25–26 April may disrupt bunkering operations.

In Taiwan, VLSFO and LSMGO supplies remain steady at Hualien, Keelung, Kaohsiung and Taichung, with lead times unchanged from last week at around two days.

Fuel availability across all grades remains stable at several South Korean ports amid “slow” demand. Lead times are largely unchanged, ranging from 3-7 days.

However, bunker operations are likely to be disrupted by high waves and strong winds in Ulsan and Onsan between 22–27 April, and in Busan, Daesan, Taean, and Yeosu from 22–28 April.

Prompt VLSFO supply remains tight across multiple Japanese ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, and Mizushima.

LSMGO availability is generally stable, though securing prompt deliveries can be challenging in Osaka, Kobe, Sakai, Nagoya, Yokkaichi, and Mizushima. HSFO supply is similarly constrained at many ports. In Oita, availability for all fuel grades is offered only upon enquiry.

Rough weather may disrupt bunker deliveries in Koh Sichang and Leam Chabang, Thailand, on 24 April.

Oceania

In Western Australia, VLSFO and LSMGO supplies remain strong in Kwinana, Fremantle, and Kembla, with recommended lead times of 7–8 days. In New South Wales, Sydney has ample LSMGO availability, but prompt HSFO deliveries continue to be challenging.

Victoria’s ports - Melbourne and Geelong - report robust stocks of both VLSFO and LSMGO, though prompt HSFO remains hard to secure. Similarly, Queensland’s Brisbane and Gladstone maintain sufficient supplies of VLSFO and LSMGO with 7–8 day lead times, while HSFO availability in Brisbane is limited.

In New Zealand, Tauranga and Auckland have adequate VLSFO stocks. However, bunker operations in Tauranga may face intermittent disruptions on 23 and 28 April due to adverse weather conditions.

South Asia

Adverse weather is forecast to disrupt bunker deliveries in Kandla between 23–26 April, in Sikka on 24 and 26 April, and in Visakhapatnam from 23–26 April.

Meanwhile, fuel availability has improved across all grades in Sri Lanka, with recommended lead times reduced to around four days - down from approximately eight days last week.

Middle East

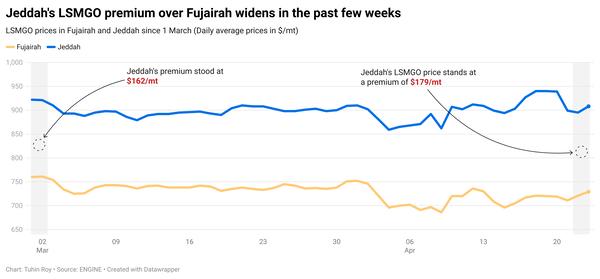

In Fujairah, prompt availability remains tight despite subdued demand, with lead times for all fuel grades holding steady at 5–7 days, unchanged from last week. Suppliers in Khor Fakkan report similar lead times.

In Jeddah, VLSFO supply remains limited, while LSMGO is readily available. Bunker supply in Djibouti is under strain, with both VLSFO and LSMGO in short supply.

Bunker deliveries at Egypt’s Port Said could be impacted by bad weather on 23 April.

At Omani ports—Sohar, Salalah, Muscat, and Duqm—LSMGO availability remains robust.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.