East of Suez Market Update 22 Apr 2025

Most prices in East of Suez ports have moved up, and bad weather keeps bunkering suspended in Zhoushan’s OPL area since Saturday.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore, Fujairah ($3/mt), and down in Zhoushan ($9/mt)

- LSMGO prices up in Zhoushan ($22/mt), Fujairah ($12/mt) and Singapore ($8/mt)

- HSFO prices up in Zhoushan ($10/mt), Singapore and Fujairah ($1/mt)

Zhoushan's VLSFO price has dropped by $9/mt over the past day, while prices in Singapore and Fujairah have remained largely unchanged. Despite this decline, Zhoushan’s VLSFO price is still at a premium of $12/mt over Fujairah and $5/mt over Singapore.

Lead times for both VLSFO and LSMGO in Zhoushan have increased from 4–6 days last week, to 5–7 days now.

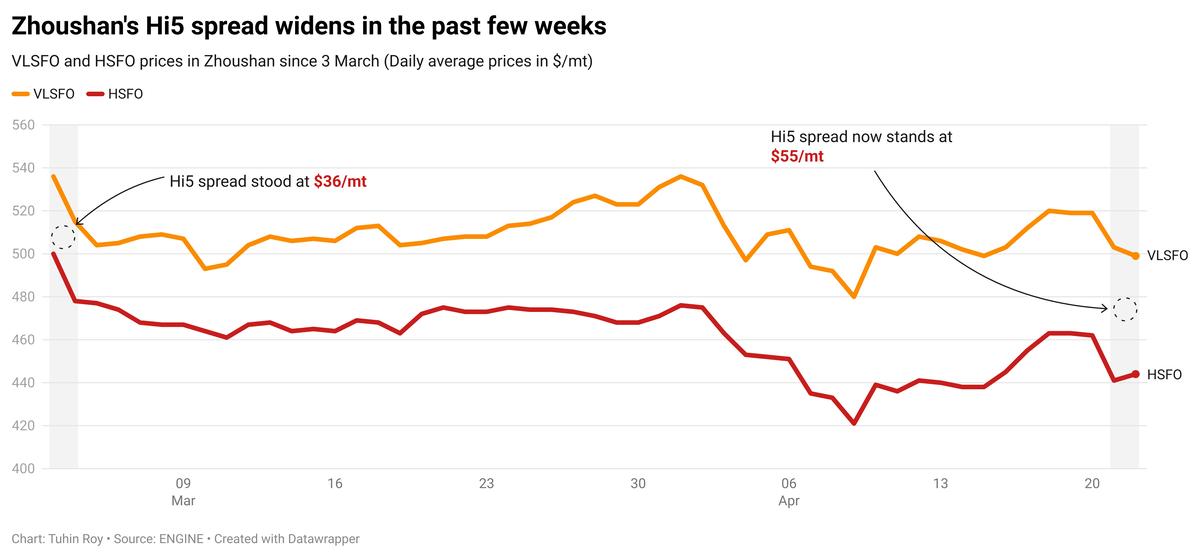

The port's HSFO benchmark has climbed by $10/mt. As a result, Zhoushan’s Hi5 spread has narrowed by $19/mt, reaching $56/mt — now closely aligned with the Hi5 spreads in Fujairah ($59/mt) and Singapore ($58/mt).

HSFO availability has tightened significantly, despite weak demand, due to several suppliers running low on stocks. Lead times have consequently been extended to the end of April, up from 4–6 days last week, contributing to the upward pressure on the benchmark’s price.

Additionally, bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages have been suspended since Saturday due to adverse weather. However, operations have resumed at the more sheltered Xiushandong anchorage and the inner anchorage of Mazhi from yesterday. Several suppliers anticipate that bunkering operations in the OPL area will fully resume by tomorrow.

In Hong Kong, rough weather between 25–26 April may affect bunkering operations. Currently, lead times for all fuel grades in Hong Kong remain steady at about seven days, unchanged from recent weeks.

Brent

The front-month ICE Brent contract has added $0.64/bbl on the day, to trade at $67.15/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price moved higher as market participants continue to focus on supply concerns in the global oil market.

Over the weekend, several US airstrikes on Ras Isa fuel port – a key oil terminal along Yemen’s Red Sea coast – caused a major fire and killed at least 74 people, the BBC reported citing the country’s Houthi-run health ministry.

The US Central Command (CENTCOM) has taken responsibility of the attack. “The Iran-backed Houthis use fuel to sustain their military operations,” CENTCOM said.

“Despite the Foreign Terrorist Designation that went into effect on 05 April, ships have continued to supply fuel via the port of Ras Isa,” the US military agency added in a statement on its official social media handle X (formerly Twitter).

The news has heightened the security concerns around the region largely controlled by the Iran-backed Houthi militants and supported Brent futures.

Downward pressure:

Brent crude’s price has come under pressure amid heightened global trade uncertainty, as Washington and Beijing continue to exchange tariffs and retaliatory measures.

Meanwhile, US President Donald Trump launched a fierce attack against US Federal Reserve chairman Jerome Powell on Monday, sending US stocks lower. Trump criticised Powell for not cutting interest rates, according to media reports.

“US President Donald Trump launched another broadside at Federal Reserve Chairman Jerome Powell on Monday, dialling up investor jitters,” VANDA Insights’ founder and analyst Vandana Hari said.

On the supply side, Iran and the US held another round of talks in Rome this weekend. Both parties met to address concerns over Tehran’s advancing nuclear programme, as Trump warned earlier of a potential military action should negotiations fail to yield a deal.

“A variety of factors put downward pressure on the market: persistent demand concerns amid tariff uncertainty; Trump’s pressure on the Fed; and progress in nuclear talks between the US and Iran,” analysts from ING Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.