East of Suez Market Update 13 Mar 2025

Most prices in East of Suez ports have moved up, and bunkering remains suspended in Zhoushan’s OPL area due to adverse weather since Monday.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($13/mt), Singapore and Fujairah ($8/mt)

- LSMGO prices up in Zhoushan ($14/mt), Fujairah ($11/mt) and Singapore ($3/mt)

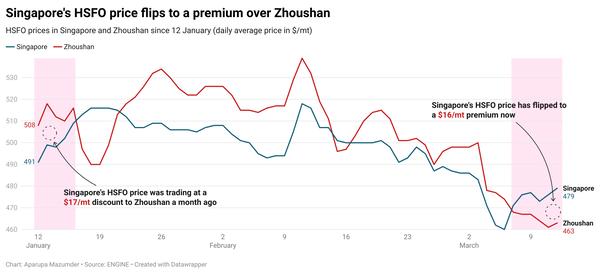

- HSFO prices up in Zhoushan ($9/mt) and Fujairah ($4/mt), and down in Singapore ($1/mt)

- B24-VLSFO at a $155/mt premium over VLSFO in Singapore

- B24-VLSFO at a $227/mt premium over VLSFO in Fujairah

Zhoushan’s VLSFO price has increased by $13/mt in the past day, marking the sharpest rise among the three major Asian bunker ports. Despite this, Zhoushan’s VLSFO price remains nearly on par with Singapore and Fujairah.

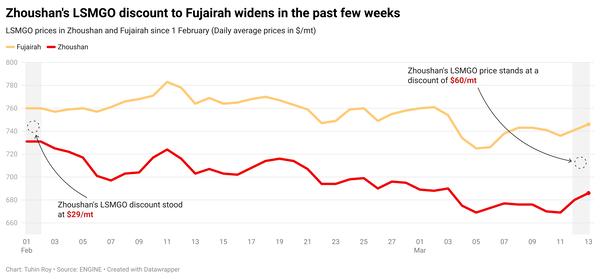

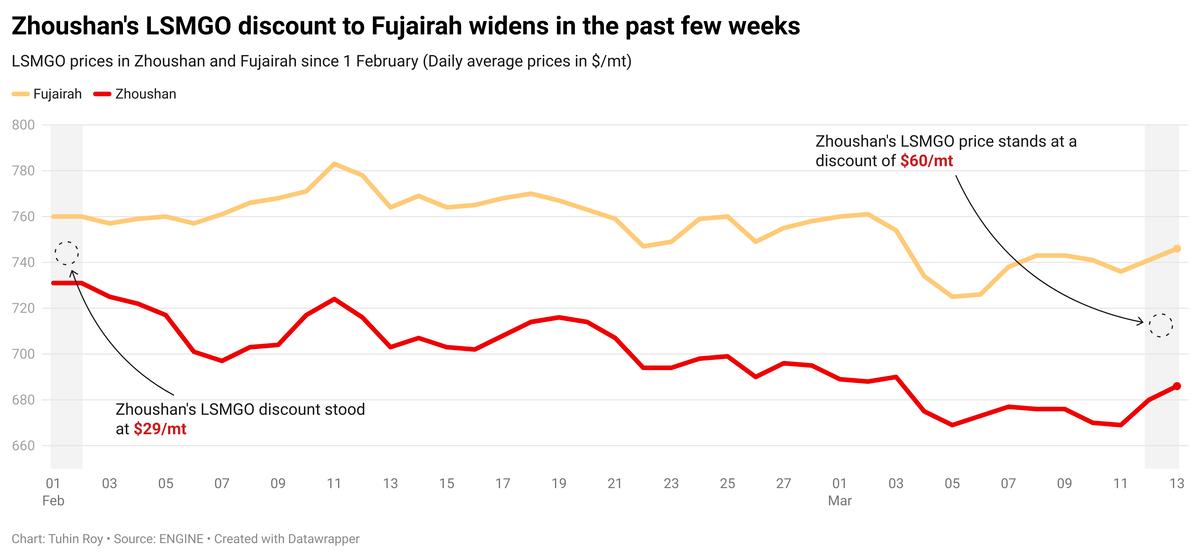

LSMGO price in Zhoushan has also risen significantly by $14/mt in the past day. It now carries a $44/mt premium over Singapore and a $60/mt discount to Fujairah.

VLSFO availability in Zhoushan has improved, with lead times shortening from eight days last week to about 4–6 days now. In contrast, lead times for LSMGO and HSFO have increased from around two days last week to 4–6 days now.

Bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages have been suspended since Monday due to adverse weather. Most suppliers remain uncertain about when full bunkering operations will resume, according to a source.

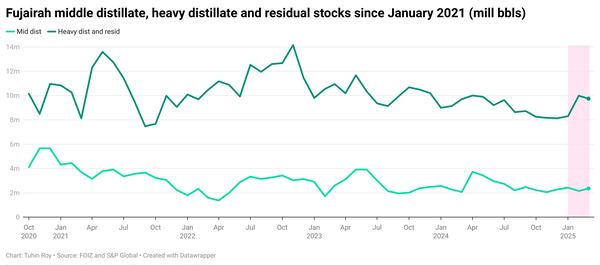

In Fujairah, prompt fuel availability remains tight, with lead times for all fuel grades holding steady at 5–7 days, unchanged from last week. Some suppliers can offer prompt deliveries, but at higher prices, a source reports.

Brent

The front-month ICE Brent contract has moved $1.17/bbl higher on the day, to trade at $71.01/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price moved higher on the back of alleviating economic concerns in the world’s largest crude oil consumer – the US.

The US inflation rate, based on the Consumer Price Index (CPI), rose by 0.2% in February, lower than the 0.5% increase recorded in the previous month, according to the US Bureau of Labor Statistics (BLS).

Oil prices have found support from the softer-than-expected CPI report as it opens the window for interest rate cuts by the US Federal Reserve (Fed) this year, market analysts said.

Brent’s gains have “priced in an uptick in economic sentiment in the broader financial markets spurred by relatively benign US February consumer inflation data,” VANDA Insights’ founder and analyst Vandana Hari said.

Besides, prices gained after OPEC left both demand and supply estimates unchanged for 2025 and 2026 in its latest monthly oil market report. OPEC continues to forecast that oil demand will grow by 1.45 million b/d and 1.43 million b/d in 2025 and 2026, respectively.

“OPEC remains fairly bullish on demand, with their numbers above both the EIA and the International Energy Agency (IEA),” two analysts from ING Bank noted.

Downward pressure:

Brent’s price gains were partially capped by a rise in US crude stocks.

Commercial US crude oil inventories increased by 1.4 million bbls to touch 435.2 million bbls for the week ending 7 March, according to data from the US Energy Information Administration (EIA).

A rise in US crude stocks indicates weakness in oil demand, which can put downward pressure on Brent crude’s price.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.