East of Suez Market Update 20 Feb 2025

Bunker prices have moved up across the board, and B24-VLSFO prices can vary widely between Singapore suppliers.

PHOTO: Aerial view Zhoushan City, Zhejiang Province. Getty Images

PHOTO: Aerial view Zhoushan City, Zhejiang Province. Getty Images

Changes on the day, to 17.00 SGT (09.00 GMT) today:

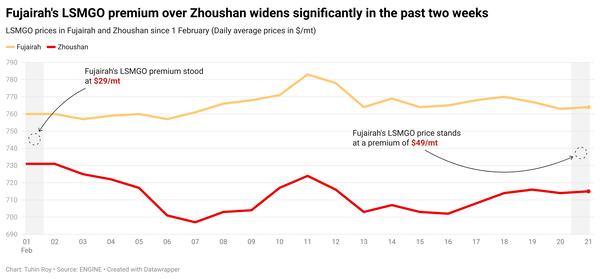

- VLSFO prices down in Zhoushan ($17/mt), Fujairah ($10/mt) and Singapore ($6/mt)

- LSMGO prices down in Fujairah ($15/mt), Zhoushan ($11/mt) and Singapore ($5/mt)

- HSFO prices down in Fujairah ($9/mt), Zhoushan ($4/mt) and Singapore ($2/mt)

- B24-VLSFO at a $153/mt premium over VLSFO in Singapore

- B24-VLSFO at a $231/mt premium over VLSFO in Fujairah

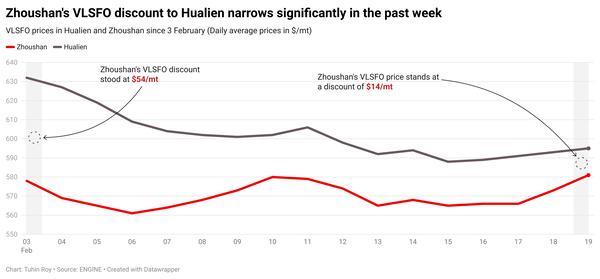

Fujairah’s VLSFO price has dropped to a larger $7/mt discount to Singapore. It is also $2/mt below Zhoushan’s price, which has shed the most in the past day under downward pressure from VLSFO stems fixed comfortably below yesterday’s benchmark.

Availability of VLSFO, LSMGO and HSFO has improved amid a slowdown in demand in Zhoushan, where a lead time of around three days is now advised. HSFO has become a lot more readily available in the port as it had a recommended lead time of 10 days last week.

B24-VLSFO has been indicated in a wide $30/mt range between the high and low in Singapore. The biofuel grade is priced at a $153/mt premium over pure VLSFO. That is a significantly smaller premium than the $231/mt we see for B24-VLSFO in Fujairah.

Brent

The front-month ICE Brent contract has lost $0.40/bbl on the day, to trade at $76.05/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has found some support amid uncertainties over global oil supply this year.

Earlier this week, Bloomberg reported that eight members of the OPEC+ consortium consider delaying the 2.2 million b/d supply increase, which was set to begin from April this year.

Disruptions to Kazakhstan’s oil exports have also supported Brent’s price this week. Several Ukrainian drones struck pipeline operator Caspian Pipeline Consortium’s (CPC) pumping station on Monday, temporarily shutting it down.

The facility is located in the Kavkazsky district of southern Russia and transports over two-thirds of all oil exports from Kazakhstan, and crude from Russian oil fields, including those in the Caspian Region, CPC said.

“Supply uncertainty continues to support the oil market, which faces multiple risks, including disruptions to Kazakh flows, the potential for a delay in the return of OPEC+ barrels,” two analysts from ING Bank noted.

Downward pressure:

Brent futures erased gains after the American Petroleum Institute (API) reported another spike in US crude stocks.

Crude oil inventories in the US surged by 3.34 million bbls in the week that ended 14 February, according to the API estimates.

Notably, a surge in US crude stocks can indicate a drop in oil demand, which can cap Brent's price rise. The broadly followed US government data on crude oil stockpiles from the US Energy Information Administration (EIA) is due later today.

By Erik Hoffmann and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.