Europe & Africa Market Update 7 Feb 2025

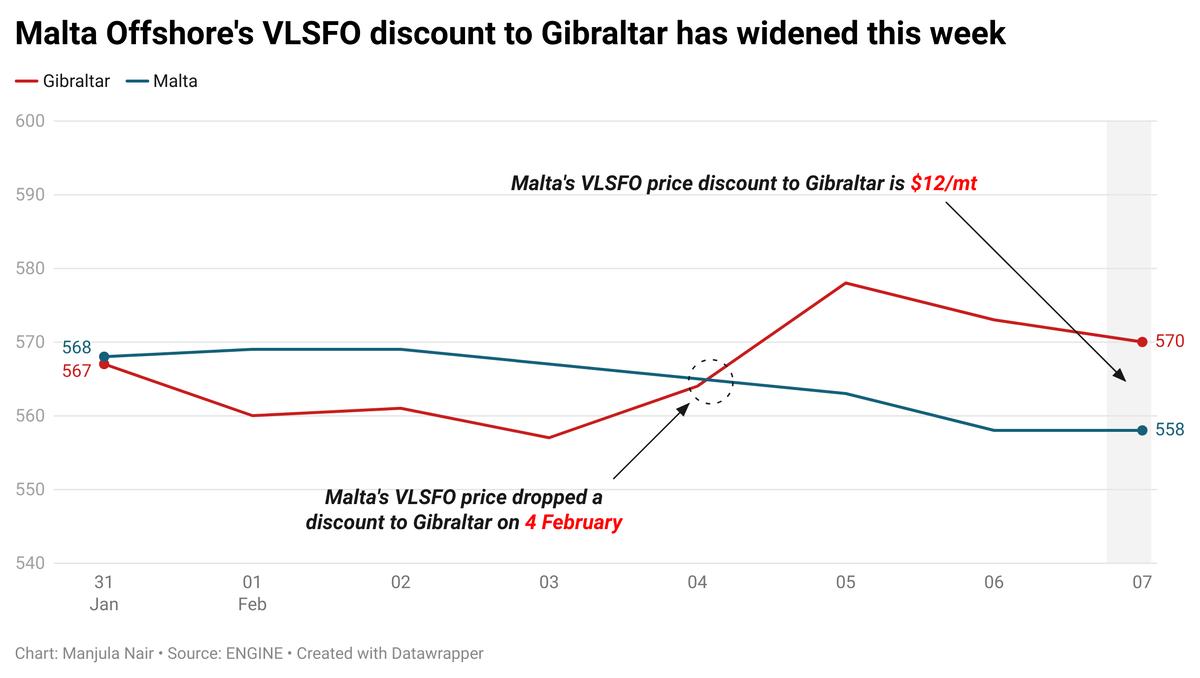

Bunker benchmarks have moved in mixed directions in European and African ports, and prompt availability is normal off Malta.

Changes on the day to 09.00 GMT today:

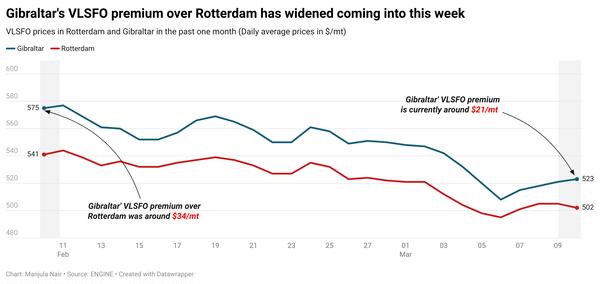

- VLSFO prices unchanged in Gibraltar, and down in Rotterdam ($2/mt) and Durban ($1/mt)

- LSMGO prices up in Rotterdam ($1/mt), and down in Gibraltar ($3/mt)

- HSFO prices up in Gibraltar ($3/mt) and Rotterdam ($2/mt)

- Rotterdam B30-VLSFO at a $195/mt premium over VLSFO

Rotterdam’s VLSFO price has countered Brent’s upward pull, and fallen in the past day, while its HSFO price has increased. These diverging price moves have narrowed the port’s Hi5 spread from $90/mt yesterday to $86/mt now. The spread is currently wider than Gibraltar’s, which is at $68/mt.

In Gibraltar, bunkering is proceeding smoothly with four vessels waiting for bunkers, unchanged from yesterday, said port agent MH Bland. A supplier is experiencing delays of 6-10 hours. Across the strait, all suppliers are facing delays in Algeciras, with one supplier reporting 8-12 hours of delay, MH Bland said.

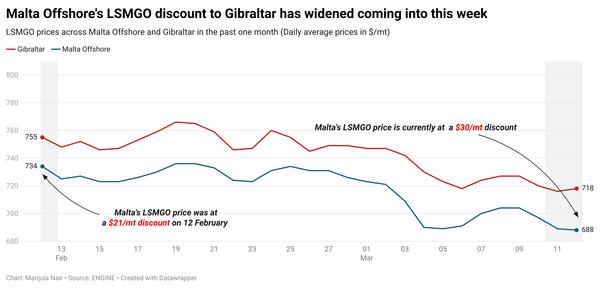

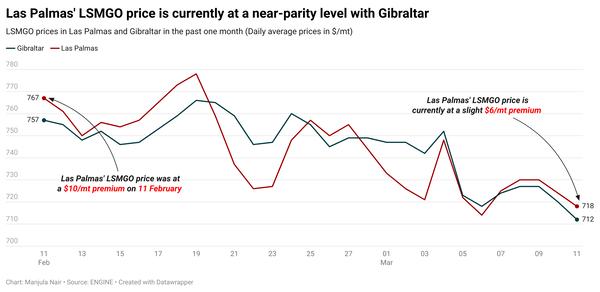

Meanwhile, several stems were booked off Malta in the past day. The port’s VLSFO price has defied Brent’s upward movement and held steady in the past day due to downward pressure from a lower-priced prompt stem. Malta’s VLSFO price, which was at parity with Gibraltar's last week, is currently trading at a $12/mt discount.

Bunkering is proceeding normally off Malta, according to MH Bland. Strong wind gusts of up to 31 knots may complicate bunkering tomorrow, MH Bland said. Availability of all grades is normal off Malta with recommended lead times of 3-5 days.

Brent

The front-month ICE Brent contract has moved $0.17/bbl higher on the day, to trade at $74.91/bbl at 09.00 GMT.

Upward pressure:

Brent crude oil’s price has ended the week on a higher note following sweeping US sanctions against Iran, one of OPEC’s largest oil producers.

Washington's recent measures targeting Iranian oil, which aim to reduce Tehran’s exports to zero has supported oil prices. The global oil market had already anticipated a hardline stance from the Trump administration on Middle Eastern affairs.

“Crude oil endured a volatile session as Trump reiterated tighter sanctions on Iran and higher oil output in the US,” ANZ Bank senior commodity strategist Daniel Hynes said.

The market’s focus will now be on OPEC+’s next decision on whether to increase production or maintain output at current levels. Earlier this week, the Saudi Arabia-led oil producer group decided to stick to its current production policy of gradually raising oil output from April.

The decision to extend production cuts into 2025 signals that OPEC+ believes demand growth might not be robust enough to accommodate the full return of supply anticipated in 2025.

“President Trump has already made it clear that he wants OPEC to increase output. If he is successful in convincing the group to do that, it would help offset any potential losses from Russia and/or Iran,” two analysts from ING Bank noted.

“However, convincing OPEC may prove difficult, particularly considering that Saudi Arabia has a fiscal breakeven oil price of above $90/bbl,” they added.

Downward pressure:

The US Energy Information Administration’s (EIA) crude stocks report on Wednesday, showing a larger-than-expected surge in US crude inventories has capped some of Brent’s price gains.

Commercial US crude oil inventories surged 8.7 million bbls higher to touch 423 million bbls for the week ending 31 January, according to data from the EIA.

The stock build came despite a one percentage point increase in US refinery utilisation, which reached 84.5%.

A surge in US crude stocks can indicate a drop in oil demand, which can keep a lid on Brent price rises.

“Oil prices tumbled as bids vanished, shaking up traders just a day after the U.S. reported a massive crude inventory build that blew past expectations,” SPI Asset Management managing partner Stephen Innes said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.