Europe & Africa Market Update 10 Mar 2025

Bunker benchmarks in European and African ports have gone up with Brent, and inbound traffic movement has again been suspended in Gibraltar.

Changes on the day, from Friday to 09.00 GMT today:

- VLSFO up in Gibraltar ($11/mt) and Rotterdam ($1/mt), and down in Durban ($75/mt)

- LSMGO prices down in Gibraltar ($4/mt) and Rotterdam ($2/mt)

- HSFO prices up in Gibraltar ($4/mt) and Rotterdam ($2/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $19/mt to $204/mt

Rotterdam’s LSMGO price has fallen by $4/mt in the past day due to downward pressure from a lower-priced prompt delivery stem booked on Friday. LSMGO availability is good in Rotterdam and the wider ARA hub, with a trader advising a lead time of 3-5 days for optimal coverage.

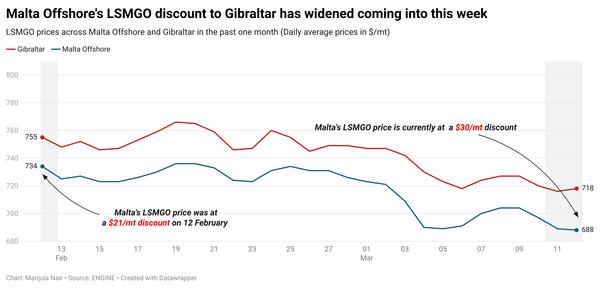

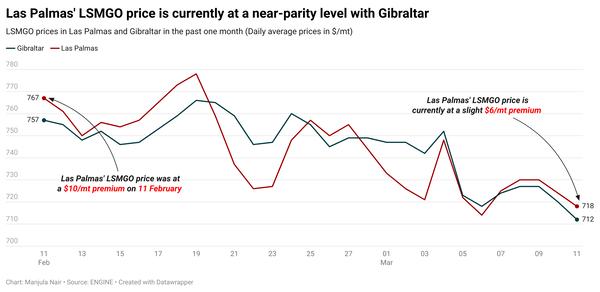

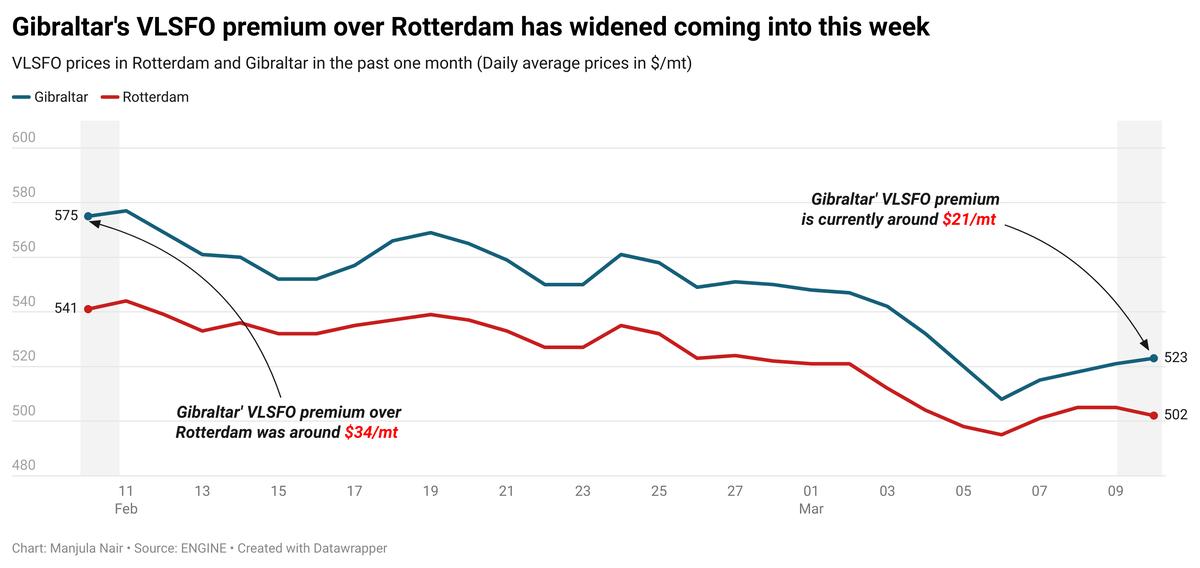

Gibraltar’s VLSFO price has gone up by a steep $11/mt in the past day, while Rotterdam’s VLSFO price has held steady. These diverging price moves have widened Gibraltar’s VLSFO premium over Rotterdam by $10/mt to around $21/mt now. Gibraltar’s HSFO price has also increased by a moderate $4/mt. These price moves have widened Gibraltar’s Hi5 spread from $27/mt to $34/mt now.

Inbound traffic at Gibraltar port has been suspended again until further notice, following a brief resumption last week, said port agent M H Bland, adding that bunkering operations in the Outer Port Limits (OPL) have also been suspended. Strong southwesterly wind gusts of around 40 knots are forecast in the port today.

A partial bunkering suspension is in force in nearby Ceuta, amid strong wind gusts of 29 knots forecast in the port area, said M H Bland, adding that some stems can be supplied via ex-pipe, but these deliveries are subject to discretion. Operations have been suspended for Ceuta’s sole bunker barge, the SPABunker Cuarenta, said shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has inched $0.02/bbl higher on the day from Friday, to trade at $70.25/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found little support after Kazakhstan’s Energy Minister Almassadam Satkaliyev said the government has instructed oil majors to cut production in an effort to stay within OPEC+’s designated output quotas, Reuters reported.

The country’s deputy energy minister Alibek Zhamauov said that oil production will be reduced through May 2025, as well as exports via the Caspian Pipeline Consortium (CPC), Kazakhstan’s biggest pipeline operator, will be slashed during the same period, the report added.

The country also plans on delaying the “full ramp-up of the Tengiz oil field to the second half of the year to comply with its OPEC+ quota,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Downward pressure:

Brent crude’s price gains were limited by the impending threat of a US trade war with Canada, Mexico and China, driven by tariff uncertainties that have rattled financial markets and weighed on demand growth sentiment.

“Though [Brent] prices managed to creep back above US$70/bbl… tariff uncertainty is a key driver behind the weakness,” two analysts from ING Bank said.

Besides, a Bloomberg report on Friday suggested that Russian President Vladimir Putin is now open to a ceasefire deal with Ukraine, which could hopefully end the three-year-long conflict between Kyiv and Moscow.

A ceasefire deal between Russia and Ukraine could see the US lifting its sanctions on Russian oil exports, which in turn could increase global oil supply, according to market analysts.

“The US is reportedly exploring ways to swiftly ease energy sanctions on Russia if it agrees Ukraine ceasefire deal,” Hari added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.