Europe & Africa Market Update 6 Feb 2025

European and African bunker prices have declined with Brent, and prompt supply of HSFO and VLSFO is tight in the ARA.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($30/mt), Gibraltar ($13/mt) and Rotterdam ($6/mt)

- LSMGO prices down in Gibraltar ($12/mt) and Rotterdam ($7/mt)

- HSFO prices down in Rotterdam ($5/mt) and Gibraltar ($2/mt)

- Rotterdam B30-VLSFO at a $193/mt premium over VLSFO

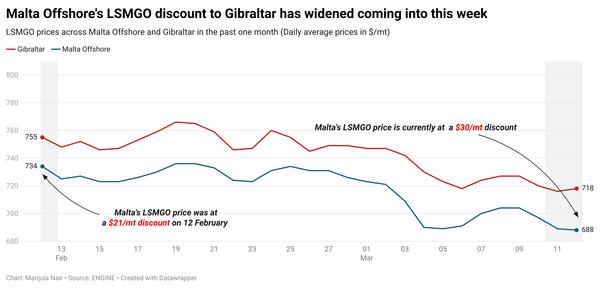

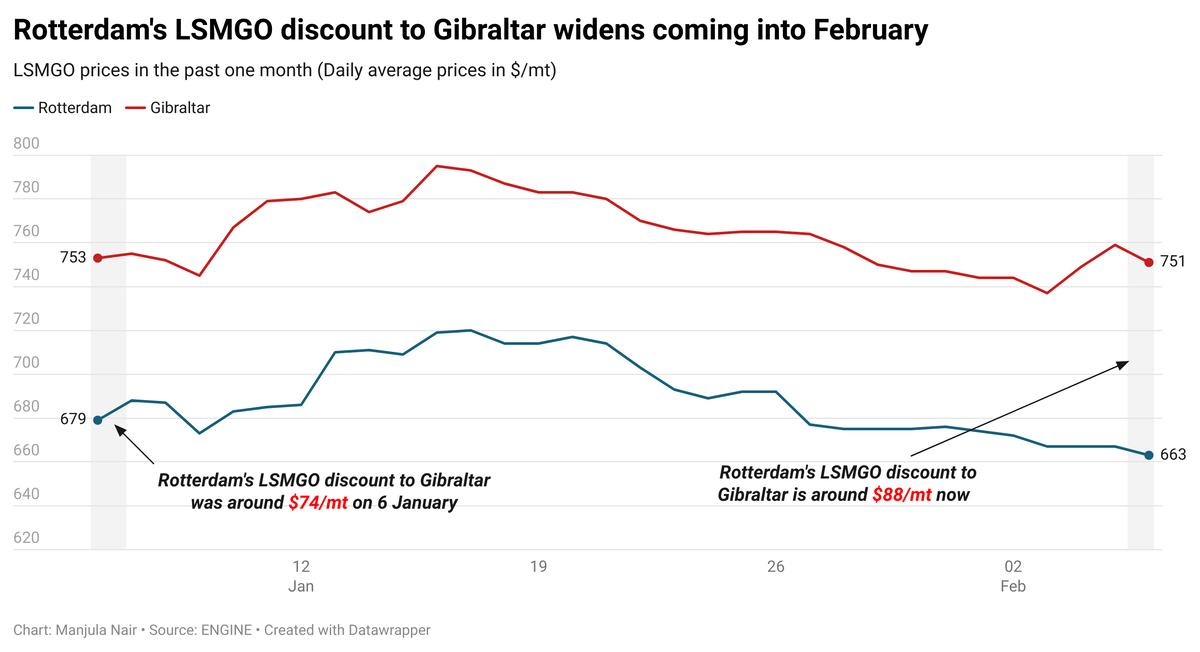

A lower-priced prompt LSMGO stem booked in Rotterdam in the past day has pulled the benchmark down. Rotterdam's LSMGO discount to Gibraltar has narrowed from $92/mt to $88/mt.

Securing prompt supply of HSFO and VLSFO is slightly difficult in the ARA hub, as both grades require lead times of up to seven days, a trader said. LSMGO supply is comparatively better, with recommended lead times of 3-5 days.

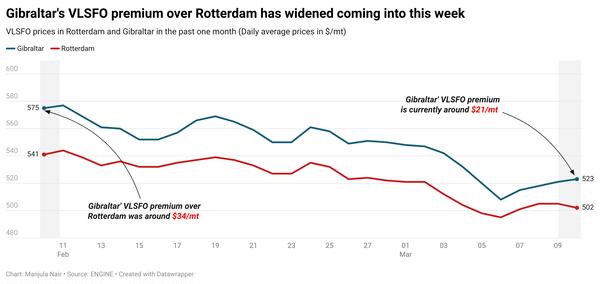

Gibraltar’s VLSFO price has plunged $13/mt lower in the past day, while its HSFO price has mostly held steady. These diverging price moves have narrowed Gibraltar’s Hi5 spread from $82/mt yesterday to $71/mt now.

In Gibraltar, four vessels are waiting for bunkers, up from two yesterday, according to port agent MH Bland. A supplier is facing 6-10 hours of delay in the port, MH Bland said.

In nearby Ceuta, bunkering is proceeding normally with around seven vessels due to arrive for bunkers today, down from 10 yesterday, said shipping agent Jose Salama & Co. One of the suppliers is delayed by 4-6 hours.

Brent

The front-month ICE Brent contract has lost $0.96/bbl on the day, to trade at $74.74/bbl at 09.00 GMT.

Upward pressure:

US President Donald Trump's stance on the Middle Eastern conflict was widely expected to be strict, with global markets bracing for extensive sanctions against one of the biggest oil producers of the region – Iran.

Brent’s price has drawn support from the recent bout of sanctions that Washington has placed on Iranian crude, with an aim to drive Tehran’s oil exports to zero.

Besides, oil prices reacted to Trump’s surprising statement on the US gaining complete control over the Gaza strip. “Oil traders are raising an eyebrow at Trump’s bold proclamation to take over Gaza and relocate Palestinians to neighbouring countries,” SPI Asset Management managing partner Stephen Innes remarked.

Trump said that he plans to completely transform the war-torn enclave into the “Riviera of the Middle East”, where more than 47,000 civilians have been displaced over the last 16 months due to the Israel-Hamas conflict.

“Markets are treating it with skepticism for now, but if there’s even a whisper of U.S. military deployment in the Middle East, expect the risk dial to shift dramatically,” Innes added.

Downward pressure:

Brent futures shed the previous day’s gains after the US Energy Information Administration reported a massive build in US crude stocks.

Commercial US crude oil inventories surged 8.7 million bbls higher to touch 423 million bbls for the week ending 31 January, according to data from the EIA.

“Crude oil benchmarks trade heavily near recent lows after a large build in US inventories reported yesterday,” analysts from Saxo Bank said.

The stock build came despite a one percentage point increase in US refinery utilisation, which reached 84.5%.

Earlier in the week, the American Petroleum Institute (API) also reported a sizeable build of about 5.02 million bbls in US crude inventories during the same time. A surge in US crude stocks can indicate a drop in oil demand, which can cap Brent's price rise.

“Crude oil fell amid signs of weaker demand in the US,” ANZ Bank’s senior commodity strategist Daniel Hynes said. US crude oil inventories are "now at their highest level since November 2024. The weekly build was also the largest in nearly a year,” he added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.