Europe & Africa Fuel Availability Outlook 5 Feb 2025

Prompt HSFO and VLSFO still tight in the ARA

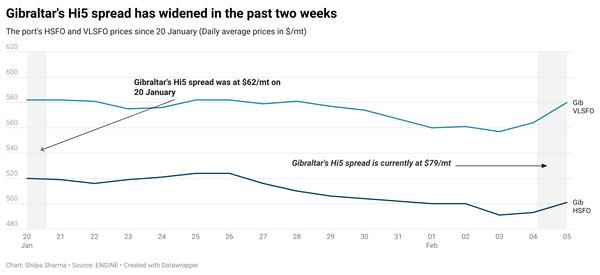

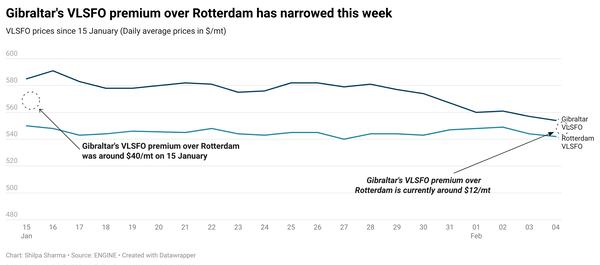

VLSFO and LSMGO supply constrained in Gibraltar

Bunker supply tight in Las Palmas

PHOTO: Aerial view of the Bay of Gibraltar. Getty Images

PHOTO: Aerial view of the Bay of Gibraltar. Getty Images

Northwest Europe

Prompt availability of HSFO and VLSFO remains tight in the ARA hub, requiring lead times of up to seven days for both grades. Supply of LSMGO is comparatively better, with recommended lead times of 3-5 days.

The ARA’s independently held fuel oil stocks averaged 7% higher in January compared to December, according to Insights Global data.

The region imported 287,000 b/d of fuel oil last month, up from 161,000 b/d imported in December, according to data from cargo tracker Vortexa. Saudi Arabia (17% of the total) emerged as the region’s biggest fuel oil import source, followed by the UK (16%), Greece (13%), Poland (11%) and Germany (7%).

The ARA hub’s independent gasoil inventories - which include diesel and heating oil - averaged 15% higher in January. The region imported 190,000 b/d of gasoil and diesel last month, down from 238,000 b/d imported in December, according to Vortexa data.

Rotterdam’s bio-bunker sales in 2024 increased by 1% on the year to 757,000 mt. Despite the rise, the port’s bio-bunker sales were 4% off the record 791,000 mt sold in 2022, according to the Port of Rotterdam Authority. The port’s bio-bunker sales include liquid biofuels blended into conventional bunker fuel grades as well as bio-methanol and bio-LNG.

Singapore overtook Rotterdam as the world’s biggest bio-bunker port last year, with 883,000 mt sold – 17% more than Rotterdam.

The port authority noted a decline in demand for bio-blended fuels in the second half of 2024. It attributed some of the slowdown in demand to “the increased availability of bio-blended fuels in Asia following the European Union’s imposition of anti-dumping duties on Chinese biofuel”.

EU slapped anti-dumping duties of up to 36.4% on biodiesel imports from China from last August. This prompted Chinese exporters to look for alternative outlets and more volumes flowed to Singapore’s bunker market. China is a major exporter of used cooking oil (UCO) feedstock and finished UCO methyl ester (UCOME) biodiesel.

Mediterranean

Securing prompt deliveries of VLSFO and LSMGO grades can be difficult in Gibraltar. Lead times of 7-8 days are recommended for full coverage from suppliers, a source said. Availability of HSFO is said to be normal in Gibraltar, requiring lead times of 3-5 days. Conducive weather conditions are forecast in Gibraltar this week, which would enable smooth bunkering.

Availability of all grades is said to be normal off Malta, requiring lead times of 3-5 days, a trader said. In the Greek port of Piraeus, supply of VLSFO and LSMGO grades is normal, while HSFO availability is subject to enquiries.

In Turkey’s Istanbul, bunker availability is good across all three grades, a trader said. Lead times of 3-5 days are recommended.

In the Canary Islands’ port of Las Palmas, prompt supply of all three grades is said to be tight. Lead times of 7-10 days are recommended for full coverage from suppliers. Smooth bunker deliveries in Las Palmas remain subject to weather conditions. High swells of up to 1.8 metres are forecast to hit Las Palmas on Thursday, which could complicate deliveries.

Africa

In the South African ports of Durban and Richards Bay, VLSFO supply is tight with recommended lead times of 7-10 days. Suppliers have run out of LSMGO stocks in Durban, a trader said.

Meanwhile, a stem was delivered off Algoa Bay on 29 January. British oil supplier BP sold the stem, which was delivered by a barge owned by African Marine Solutions (AMSOL), a source told ENGINE. This marked the first offshore bunker operation in Algoa Bay since deliveries were banned in 2023, according to the source.

However, the return of regular bunkering off Algoa Bay could take a longer time, as barge operators are still waiting for clarity on certain rules of the Customs and Excise Act, another source said.

In Mozambique’s Nacala port, supply of VLSFO, HSFO and LSMGO grades is good, according to a source. LSMGO availability is good in Maputo, while VLSFO supply is under pressure.

By Shilpa Sharma

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.