Rotterdam bio-bunker sales steady as Singapore pulls ahead

Rotterdam overtaken by Singapore volumes

Dutch biofuel less attractive after halved rebate

EU anti-dumping duty shifts UCOME to Singapore

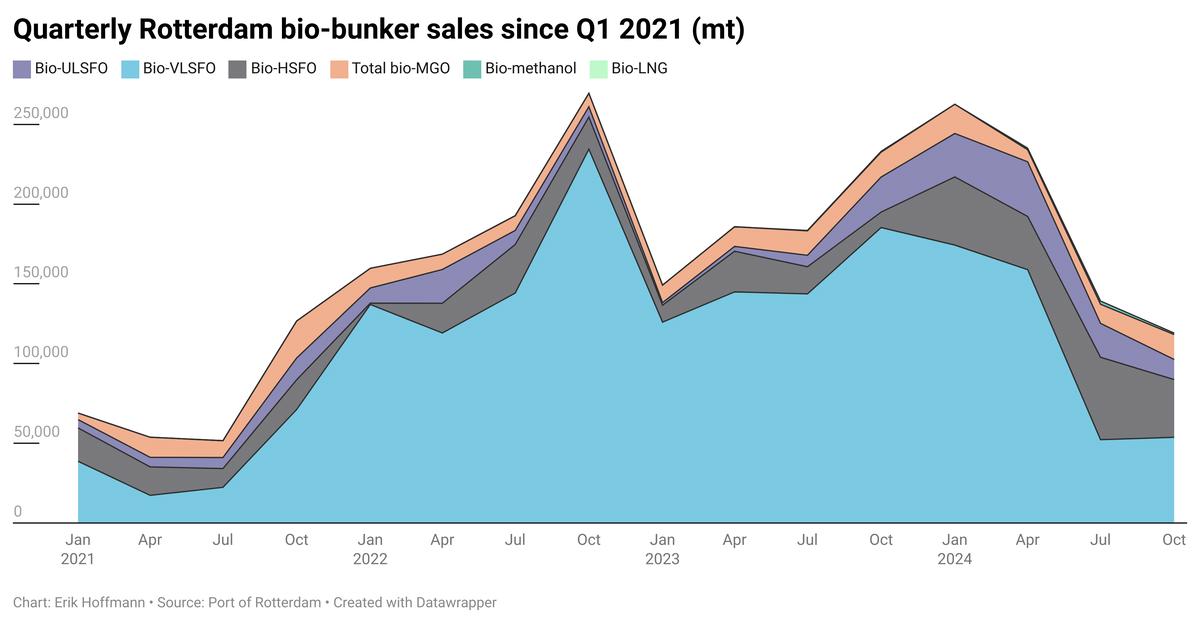

Changes in Rotterdam bio-bunker sales between 2023 and 2024:

- Bio-VLSFO sales down by 161,000 mt to 439,000 mt

- Bio-HSFO sales up by 101,000 mt to 164,000 mt

- Bio-MGO sales down by 1,000 mt to 53,000 mt

- Bio-ULSFO sales up by 62,000 mt to 95,000 mt

- Bio-methanol sales up by 3,000 mt to 4,000 mt

- Bio-LNG sales up by 1,000 mt to 1,000 mt

Rotterdam’s bio-bunker sales are made up of liquid biofuels blended into any of the conventional bunker grades (VLSFO, HSFO, MGO and ULSFO), as well as bio-methanol and bio-LNG. They can be pure bio products like B100 biofuel, or bio-fossil blends like B30-VLSFO.

A total of 757,000 mt bio-bunkers was supplied in Rotterdam last year. That was a 1% increase on the year, but still 4% off the record 791,000 mt sold in 2022, according to official Port of Rotterdam figures.

This is counterintuitive as we would expect biofuel sales to continue to rise with more environmental regulations in place last year and in 2023 than in 2022. The regional EU Emissions Trading System (EU ETS) came into effect for ships last year, and the global Carbon Intensity Indicator (CII) in 2023.

But none of these regulations have helped to bridge price gaps between higher-priced bio products and business-as-usual fossil fuels. A weakening of the Dutch HBE incentive to bunker biofuels in the Netherlands has also contributed to keep a lid on biofuels’ attractiveness in Rotterdam.

Rotterdam’s biofuel bunker prices soared $50-74/mt higher at the beginning of 2024 as the Dutch government halved the rebate multiplier for marine biofuel sales from 0.80 to 0.40.

Suppliers in Rotterdam and other ARA ports were frontrunners in launching sustainable biofuel bunker operations, and back in 2022 they faced less competition from other bunker locations like Singapore, which has come up rapidly in the past two years.

In fact, Singapore overtook Rotterdam as the world’s biggest bio-bunker port last year, with 883,000 mt sold – 17% more than Rotterdam.

The Port of Rotterdam Authority attributed the slowdown in demand to “the increased availability of bio-blended fuels in Asia following the European Union’s imposition of anti-dumping duties on Chinese biofuel”.

EU slapped anti-dumping duties of up to 36.4% on biodiesel imports from China from last August. China is a major exporter of used cooking oil (UCO) feedstock and finished UCO methyl ester (UCOME) biodiesel. Chinese exporters looked for alternative outlets and more volumes flowed to Singapore’s bunker market.

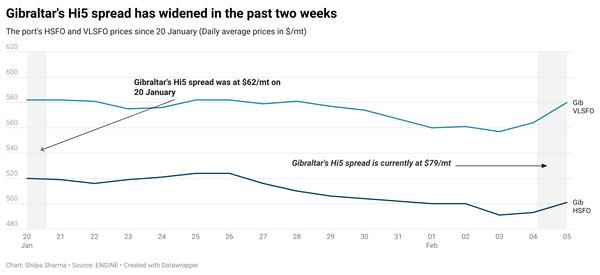

Rotterdam’s bio-bunker stagnation is perhaps most evident when we look at bio volumes as a share of total volumes. Bio-bunker sales made up 10-11% of total sales in the first half of 2024, before shrinking to 5-6% in the second half of the year.

“The demand for bio-blended fuels in 2024 exhibited a clear dichotomy: a slight growth in the first half of the year, followed by a sharp decline in the second half. That was particularly evident in the demand for bio-blended VLSFO, the largest of the bio-blends,” the Port of Rotterdam Authority commented.

Bunker suppliers operating in the Netherlands have told ENGINE that in the absence of regulations to incentivise bio-bunkering last year, demand was mostly voluntary. It mostly came from container liners and car carrier companies looking to improve their Scope 1 and Scope 3 emissions.

Scope 3 can be valuable for cargo owners that are customers of shipowners, and some shipowners have been able to pass on a lot of the extra fuel cost for bio products to cargo owners this way.

By Shilpa Sharma and Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.