Europe & Africa Market Update 3 Feb 2025

Prices in most European and African bunker locations have decreased with Brent values, and bunkering has resumed in Huelva.

Changes on the day from Friday, to 09.00 GMT today:

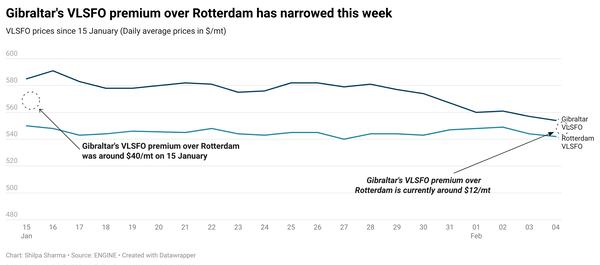

- VLSFO prices up in Rotterdam ($1/mt), and down in Gibraltar ($13/mt) and Durban ($5/mt)

- LSMGO prices down in Rotterdam ($13/mt) and Gibraltar ($6/mt)

- HSFO prices down in Gibraltar ($10/mt) and Rotterdam ($2/mt)

- Rotterdam B30-VLSFO at a $225/mt premium over VLSFO

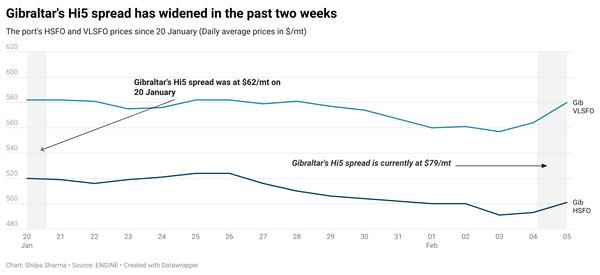

Gibraltar's HSFO and VLSFO prices have both come down over the weekend. A sharper fall in the port’s VLSFO price has narrowed its Hi5 spread by $3/mt, to $69/mt now. A lower-priced non-prompt VLSFO stem fixed in the port late last week has contributed to drag the benchmark down.

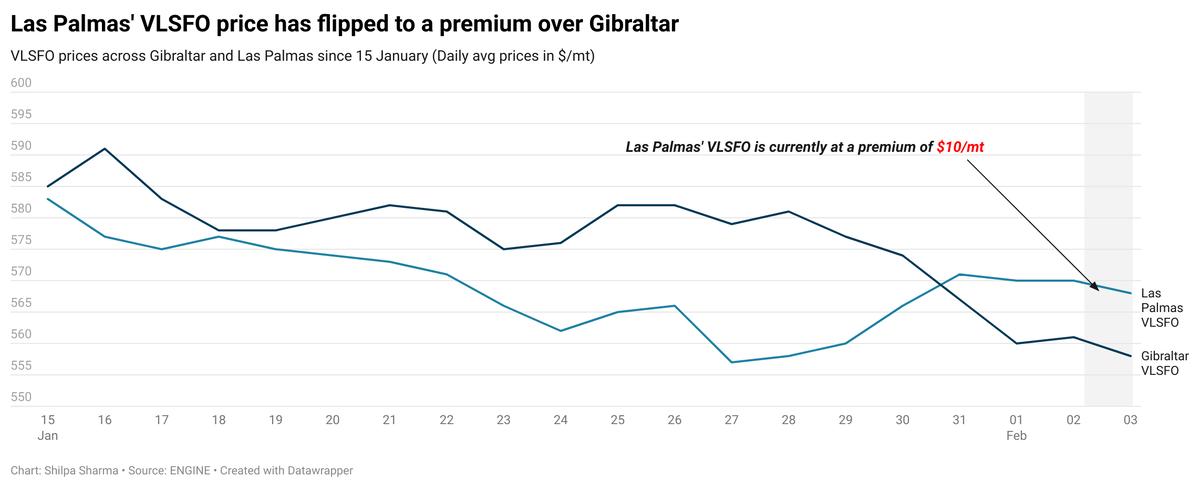

Meanwhile, the VLSFO price in Las Palmas has held steady over the weekend. This has flipped Las Palmas' VLSFO discount to Gibraltar to a premium. Las Palmas' VLSFO is currently at a $10/mt premium over Gibraltar.

Bunkering is progressing in Gibraltar, but some congestion has been reported today. Five vessels are currently waiting to receive bunkers in Gibraltar, according to port agent MH Bland. Strong wind gusts are forecast to hit the port on Wednesday, which could disrupt bunkering. Lead times of 5-7 days are advised for full coverage from suppliers.

Bunkering has resumed in Huelva today, after remaining suspended last week due to bad weather. Conducive weather conditions are forecast this week, MH Bland says.

Brent

The front-month ICE Brent contract has lost $0.47/bbl on the day from Friday, to trade at $76.44/bbl at 09.00 GMT.

Upward pressure:

Brent’s price moved higher over the weekend after US President Donald Trump imposed up to 25% tariffs on imports from Canada, Mexico and China, with effect from 4 February.

For Canadian energy imports, the Trump administration decided to impose a tariff of only 10%. “Oil prices surged… after Trump imposed significant tariffs on various imports, including crude oil from Canada and Mexico, raising concerns about higher gasoline and diesel costs for US consumers,” analysts from Saxo Bank said.

Canada is a key oil supplier to the US, with the latter importing about 4 million b/d of crude from Canada, Reuters reports.

“This is the first wave of what promises to be a relentless trade offensive against friends and foes alike,” SPI Asset Management managing partner Stephen Innes remarked. “In response, Canada and Mexico wasted no time announcing their retaliatory tariffs on US products, signalling that this trade battle is about to escalate quickly,” he added.

Downward pressure:

Oil investors are now waiting to see the impact of the new tariffs imposed by the US. Market participants fear that this move could trigger a tariff war globally.

“With global markets bracing for impact, the question isn’t if more tariffs are coming—but who’s next in Trump’s crosshairs,” Innes remarked.

Trump is due to speak to Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum Pardo later today, according to reports.

Additionally, commercial US crude oil inventories gained 3.5 million bbls to touch 415 million bbls for the week ending 24 January, according to data from the US Energy Information Administration (EIA).

A surge in US crude stocks can indicate a drop in oil demand, which can contribute to cap Brent's price rise. This was the first weekly rise in inventories this year.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.