East of Suez Market Update 14 Jan 2025

VLSFO and LSMGO prices in East of Suez ports have decreased, and availability of the two grades is good in Malaysia’s Port Klang.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Singapore ($11/mt), Fujairah ($7/mt) and Zhoushan ($3/mt)

- LSMGO prices down in Zhoushan ($42/mt), Singapore ($22/mt) and Fujairah ($4/mt)

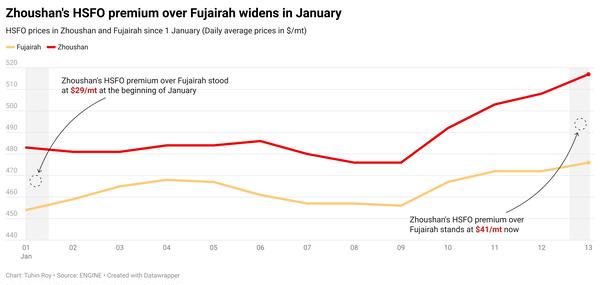

- HSFO prices up in Fujairah ($13/mt), unchanged in Zhoushan, and down in Singapore ($2/mt)

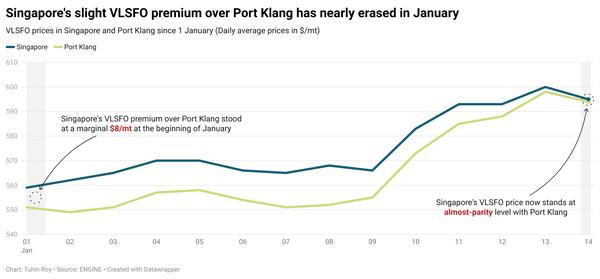

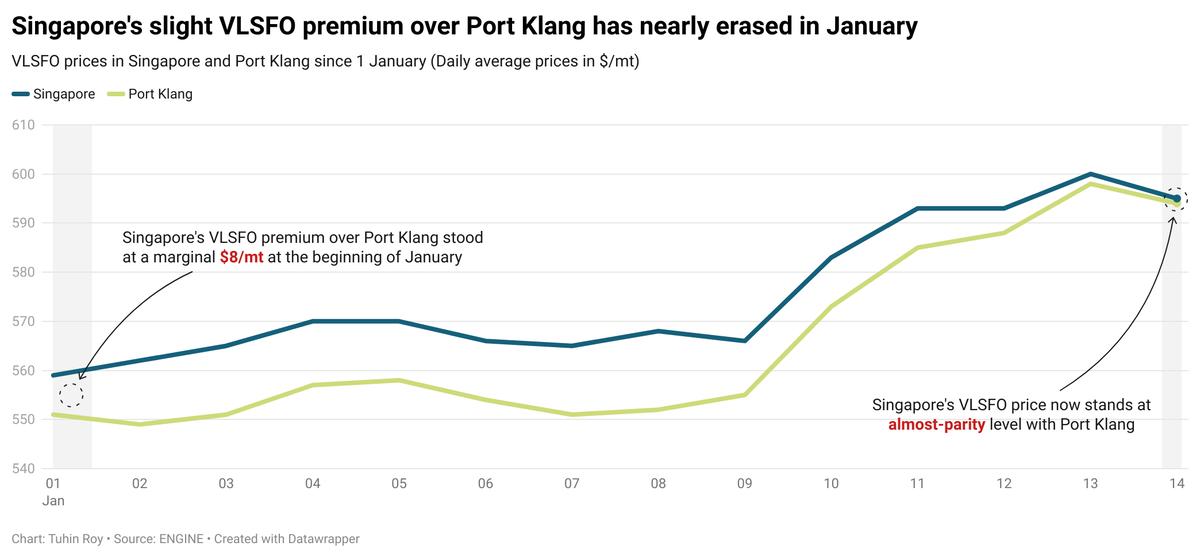

VLSFO benchmarks in East of Suez ports have dropped over the past day, with Singapore experiencing the largest decline of $11/mt. This drop is partly due to a lower-priced 150-500 mt VLSFO stem fixed at the port, which has pulled the benchmark down. Despite this, Singapore's VLSFO price remains at a premium of $11/mt over Fujairah and $7/mt over Zhoushan.

VLSFO availability in Singapore is still tight, with standard lead times of around 10 days, similar to last week. Expedited deliveries within five days are possible but at higher prices. HSFO lead times remain steady at 5-9 days, while LSMGO lead times have been adjusted to 3-9 days from 3-11 days last week.

At Malaysia's Port Klang, VLSFO and LSMGO supplies are plentiful, with prompt small-quantity deliveries readily available. However, HSFO supply remains constrained. Port Klang's VLSFO price is now nearly at parity with Singapore.

In Hong Kong, lead times for all fuel grades are around seven days, consistent with recent weeks. The port is forecast to experience bad weather conditions on Wednesday, which could disrupt bunker deliveries.

Brent

The front-month ICE Brent contract has lost $0.71/bbl on the day, to trade at $80.80/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has remained above $80/bbl, supported by oil demand growth during the winter season and supply risks from Russia amid stricter US sanctions.

The US Department of the Treasury has announced sweeping sanctions against Russia’s energy sector, targeting oil companies, tankers, insurers and traders, thereby raising oil supply concerns and supporting oil prices.

“These sanctions threaten global oil dynamics, particularly impacting countries like India and China, where 25% of Russian seaborne oil could face disruptions,” SPI Asset Management’s managing partner Stephen Innes said.

Brent’s price has found support from “a combination of strong winter-related demand… not least, the latest rounds of US sanctions on Russia’s oil industry, which went much further than expected,” Ole Hansen, head of commodity strategy at Saxo Bank said.

Downward pressure:

Brent crude shed the previous day’s gains ahead of US CPI data, which is scheduled to be out tomorrow.

Inflation rate in the US, measured by the change in the Consumer Price Index (CPI), is the key focus this week as markets await the US Federal Reserve's next steps on easing monetary policies in 2025.

Higher interest rates in the US can dampen demand for dollar-denominated commodities like oil, making it costlier for holders of other currencies.

“The mood in the broader financial markets remains downbeat, as investors continue to downgrade expectations of the Federal Reserve’s policy easing this year,” VANDA Insights’ founder and analyst Vandana Hari said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.