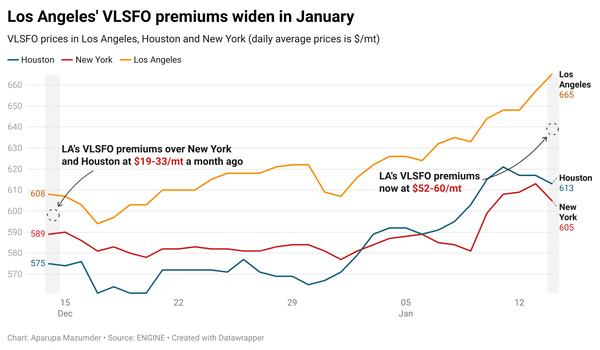

Americas Market Update 13 Jan 2025

Bunker prices in key Americas ports have moved in mixed directions and deliveries are suspended in the Galveston Offshore Lightering Area (GOLA).

PHOTO: A group of LPG tankers in port along the ship channel in Houston, Texas. Getty Images

PHOTO: A group of LPG tankers in port along the ship channel in Houston, Texas. Getty Images

Changes on the day, to 07.00 CST (13.00 GMT) today from Friday:

- VLSFO prices up in Zona Comun and Balboa ($13/mt), Los Angeles ($9/mt) and New York (6/mt), and down in Houston ($8/mt)

- LSMGO prices up in New York ($18/mt), Los Angeles ($9/mt) and Balboa ($7/mt), and down in Houston ($7/mt)

- HSFO prices up in Los Angeles ($21/mt), New York ($6/mt) and Houston ($3/mt), and down in Balboa ($6/mt)

Los Angeles' HSFO has shot up to narrow the port's Hi5 spread to $101/mt.

In the Panamanian port of Balboa, VLSFO and LSMGO prices gained over the weekend, while HSFO’s price declined.

A higher-priced 50-150 mt LSMGO stem has been fixed in Balboa with prompt delivery and put upward pressure on the benchmark. The port’s VLSFO price currently stands at a three-month high.

Bunker deliveries continue to be suspended in the Galveston Offshore Lightering Area (GOLA), where strong wind gusts are forecast until 17 January. “Prolonged delays are expected over next several days,” a source says.

New York could also face possible bunker disruptions throughout the week due to high wind gusts and rough weather conditions.

Brent

The front-month ICE Brent contract has gained $1.93/bbl on the day from Friday, to trade at $79.32/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price has surpassed the $80/bbl mark amid growing concerns about tight crude supplies in the global oil market.

The surge in Brent's price comes after the US government targeted Russia’s energy sector with increased sanctions on its major oil and tanker companies including Gazprom Neft and Surgutneftegas.

These sanctions “could affect tankers carrying approximately 1.5 million barrels per day [1.5 million b/d] of Russian crude - primarily destined for key Asian importers,” analysts from Saxo Bank said.

Brent futures gained more support amid expectations that President-elect Donald Trump will intensify oil sanctions on Iran. “Donald Trump has warned of maximum pressure on Iran, which could see additional sanctions introduced,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Downward pressure:

A key risk to Brent's price rise lies in the possibility of supply exceeding demand, particularly as OPEC+ prepares to bring additional oil barrels back into the market.

The Saudi Arabia-led coalition has already postponed its plan to unwind the 2.2 million b/d of voluntary cuts from 1 October 2024 to 1 April 2025, with room open for further delays.

Moreover, non-OPEC supply, primarily from the US, Brazil, Canada and Guyana, is expected to grow by 1.5 million b/d in 2025, according to the latest International Energy Agency (IEA) estimates.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.