LNG Bunker Snapshot: Rotterdam’s price inches up on higher bunker premiums

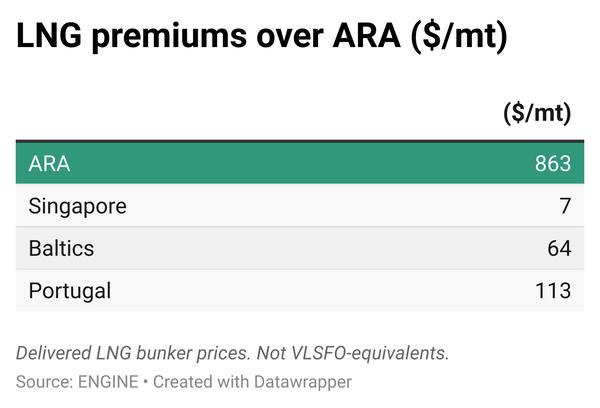

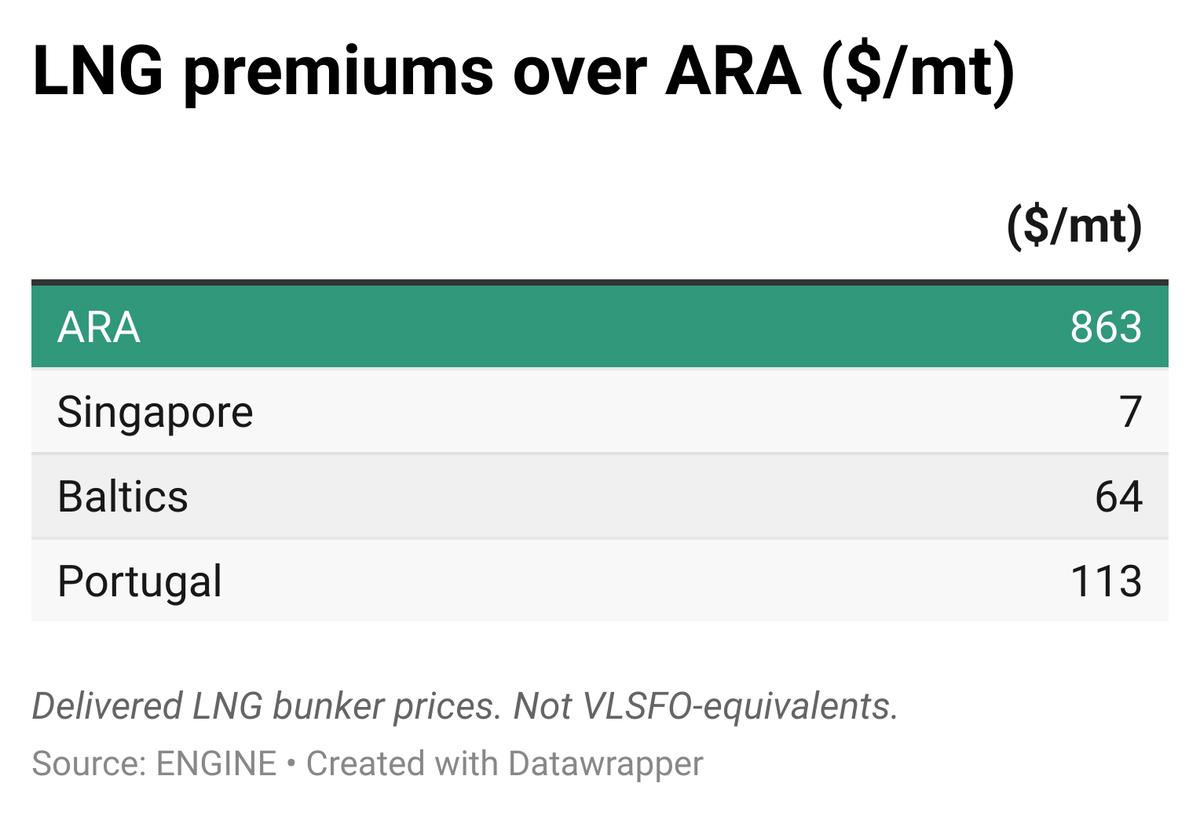

Rotterdam’s LNG bunker price has risen on higher bunker premiums, while Singapore’s price has been steady amid subdued demand in the broader Asian LNG market.

Changes in weekly LNG bunker prices:

- Rotterdam up by $15/mt to $863/mt

- Singapore up by $6/mt to $870/mt

Rotterdam

Rotterdam's LNG bunker price has risen by $15/mt over the past week, reaching $863/mt. This increase was mainly driven by a surge in LNG bunker premiums, which more than doubled from around $70/mt to $145/mt during this period.

Cold weather in Europe and high gas withdrawal rates have also added upward pressure on LNG prices. The gas withdrawal rate refers to the speed at which natural gas is extracted from storage to meet demand.

“Cold weather has been driving up heating demand and gas withdrawal rates have been faster than expected. EU storage has now dropped below 70% capacity, which is a bit below average for the time of year and far below the 85% we had heading into 2024,” said Emma Richards, associate director of oil and gas at research firm BMI.

Gas prices were also supported by an outage caused by a compressor failure at Equinor's Hammerfest LNG plant in northern Norway, which processes gas from the Snøhvit natural gas field.

“Snøhvit’s restart date was extended by 10 days to 19 January compared to the initial estimated restart date of 10 January, following a trip on 2 January. This may provide support for prices,” noted energy research firm Rystad Energy.

Meanwhile, the front-month Dutch TTF Natural Gas contract, a key European gas market benchmark, dropped by $1.16/MMBtu ($60/mt) to $13.81/MMBtu ($718/mt) during the same period.

Singapore

Singapore’s LNG bunker price has remained broadly stable in the past week, amid tepid demand in the overall Asian LNG market.

LNG bunker prices in the region are generally linked to NYMEX Japan/Korea Marker (JKM) values. The front-month JKM contract fell by $0.20/MMBtu ($10/mt) to $14.16/MMBtu ($736/mt) during the same period.

“Fundamentals remain weak in Asia with limited purchase interests stemming from China and South Korea, while some buyers such as CPC Corporation, Thailand's PTT, Bangladesh’s RPGCL and northeast Japanese power utility Tohoku Electric were seeking spot LNG for February and March delivery,” Rystad Energy said.

Going forward, Japanese LNG demand could get a boost from planned maintenances at two nuclear power plants in Takahama and Ohi.

“However, buying interests from Japanese importers remain limited as major importers have bought in advance,” Rystad said.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.