Fuel Switch Snapshot: Green looks good for the first time

Biofuel is 2025’s cheapest fuel with EU regs

Dutch biofuel rebates drop from 2024 highs

Costs to burn fossil fuels on EU voyages surge

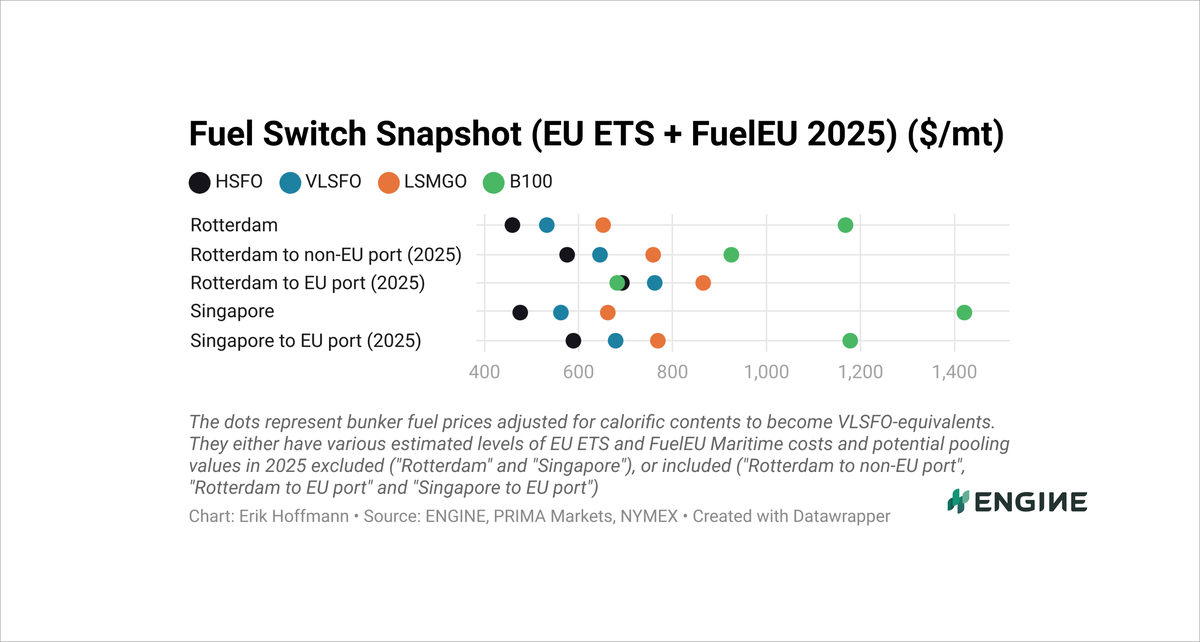

CHART: For ships sailing between two EU ports it is now, for the first time, cheaper to burn B100 biofuel than conventional fuels

CHART: For ships sailing between two EU ports it is now, for the first time, cheaper to burn B100 biofuel than conventional fuels

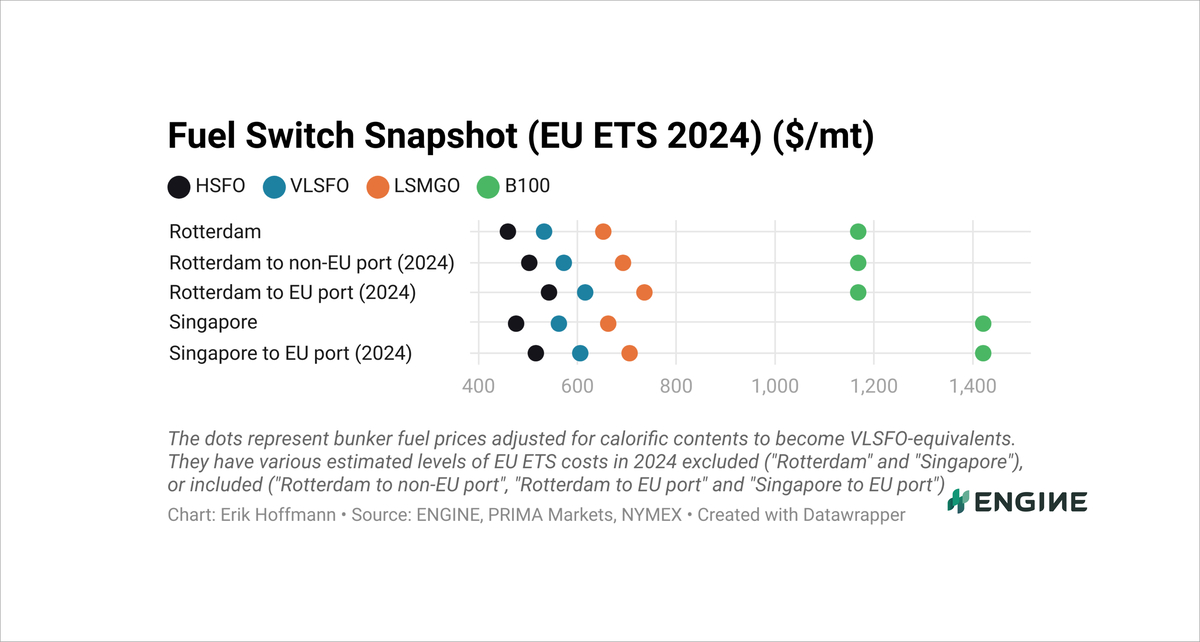

Up until New Year’s Eve, our prices in this Fuel Switch Snapshot have not included FuelEU Maritime penalties and potential pooling benefits. They took account of a 40% phased in EU Emissions Trading System (EU ETS), and had Dutch HBE rebates for 2024 deliveries baked into the biofuel prices. Fossil fuels still ruled in EU waters last year, while 100% biofuel (B100) was niche and only popular among some ship types.

CHART: The picture was completely different before FuelEU Maritime kicked in. Last year, B100 biofuel only made sense on a voluntary basis for shipowners capable of selling on green freight

CHART: The picture was completely different before FuelEU Maritime kicked in. Last year, B100 biofuel only made sense on a voluntary basis for shipowners capable of selling on green freight

Since then, FuelEU has kicked into force and boosted the attractiveness of sustainable biofuels against conventional fossil oil products. A more phased in ETS has reenforced that dynamic by putting a cost on 70% of fuels’ CO2 emissions, which favours low-carbon alternatives.

The first week of the year has also seen HBE ticket prices for advanced biofuels sold in the Netherlands go down, which leaves a smaller potential rebate for B100 and other biofuel grades. PRIMA Markets estimates that B100’s rebate dropped from $371/mt on 31 December to $343/mt on 7 January.

Our prices have all been adjusted for calorific contents and estimated costs and benefits for complying with the EU’s increasingly strict environmental regulations. This is to make B100 (lower energy and carbon contents, and compliance costs) comparable with VLSFO, HSFO and LSMGO (higher energy and carbon contents, and compliance costs).

We see that for the first time, we have a regulation in place that makes it more expensive to burn fossil fuels than B100 biofuel!

Our calculations assume that bunker buyers can obtain both an estimated HBE rebate from sales of advanced biofuels in the Netherlands, and a lower EU ETS carbon bill. 100% biofuel (B100) is about 30 times more biofuel than a ship needs to comply with FuelEU on an EU-EU voyage if that B100 replaces heavy fuel oils (HFOs) like VLSFO or HSFO. Because this compliance surplus can be transferred or sold within a pool of ships, it holds great value.

We assume that the value of this surplus is equal to the price of the cheapest compliance option to make a ship just compliant with FuelEU. That is around 3% biofuel blended with HFO and about 2% blended with MGO. The amount of biofuel needed to make a ship just compliant is then multiplied by the number of undercompliant, HFO-fuelled and ships that the overcompliant, B100-fuelled ship can make compliant in a pooling arrangement. This potential pooling value is what makes B100 an attractive proposition.

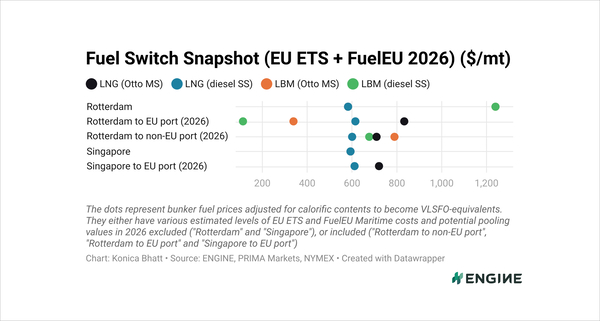

Next week we will also add liquefied natural gas (LNG) and liquefied biomethane (LBM) for various dual-fuel ship engines into the mix, to get a sense of whether bio-LNG packs a punch in the nascent FuelEU era.

VLSFO

Both Rotterdam and Singapore have seen VLSFO prices tick up with support from Brent crude in the past week. Fossil fuels consumed on EU-linked voyages have become extra costly since the turn of the new year as EU regulations tighten the screws on greenhouse gas (GHG) intensities and CO2 emissions.

Rotterdam’s VLSFO grade has become $162/mt more expensive for ships consuming it between two EU ports, and $87/mt more expensive between an EU port and a non-EU port.

With EU-EU port compliance costs and estimated pooling benefits added, VLSFO, LSMGO and even HSFO become more expensive than B100 biofuel sold in the Netherlands.

Singapore’s VLSFO, LSMGO and HSFO prices have also jumped in the past week when we include costs for sailing to EU ports. They are then $78-80/mt higher than on 31 December. But the fossil fuels are still the more tempting proposition in Singapore, where B100 is priced steep because only a few bunker suppliers with chemical tankers can offer the grade.

Biofuels

Some market participants have been talking about a slow start to the year after the holiday wind-down across Europe. Others have gotten busy securing biofuel spot volumes to comply with a now-active FuelEU Maritime regulation, or on a more continuous voluntary basis to sell on green freight to environmentally conscious cargo owners.

Rotterdam’s B30-VLSFO and B30-LSMGO HBE prices have come up in the past week. The gains have mainly been supported by $13/mt and $32/mt rises in ENGINE’s underlying VLSFO and LSMGO prices, respectively. These fossil fuels do, after all, make up 70% of the blends and a $17/mt weekly gain for front-month ICE Brent crude has had a knock-on effect on both the VLSFO, LSMGO and bio-blend prices.

Singapore’s B24-VLSFO and B24-LSMGO prices are both markedly up on the week, drawing support from a $25/mt gain in PRIMA Market’s UCOME FOB China price. Freight for that UCOME from China to Singapore has gone up by $0.25/mt to $13.75/mt, which is not enough to materially impact delivered prices.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.