East of Suez Market Update 18 Nov 2024

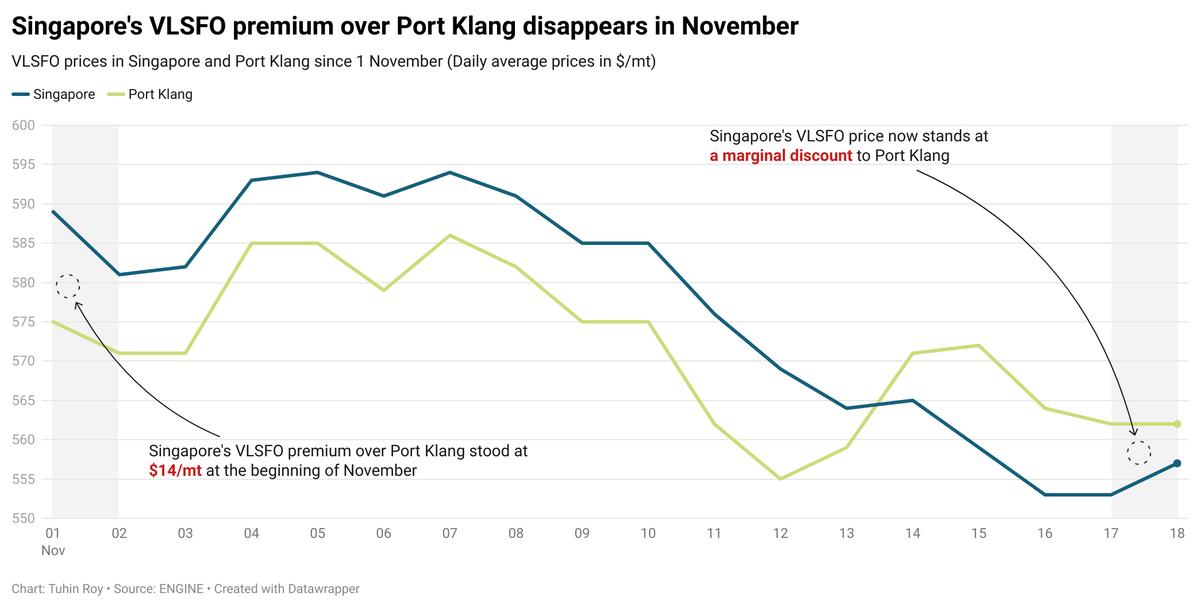

Prices in East of Suez ports have moved in mixed directions, and VLSFO and LSMGO availability remains good in Malaysia’s Port Klang.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

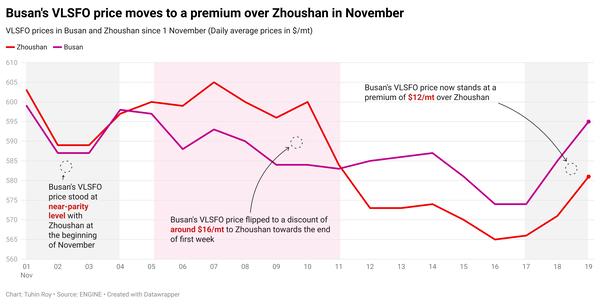

- VLSFO prices up in Singapore ($8/mt) and Fujairah ($2/mt), and down in Zhoushan ($3/mt)

- LSMGO prices down in Zhoushan ($11/mt), Fujairah ($6/mt) and Singapore ($5/mt)

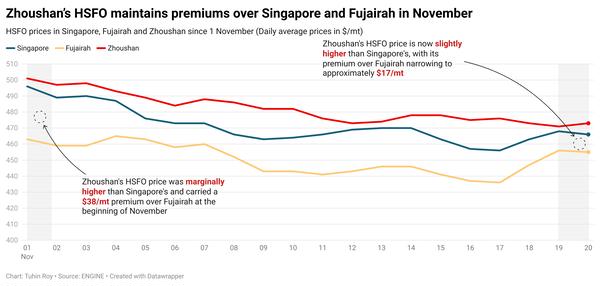

- HSFO prices unchanged in Zhoushan, and down in Singapore ($4/mt) and Fujairah ($1/mt)

Singapore’s VLSFO price has risen by $8/mt over the weekend, while prices in Fujairah and Zhoushan have remained largely stable. Two higher-priced VLSFO stems fixed on the day in Singapore, within a wide range of $16/mt, have supported the benchmark against the downward pressure from Brent. The price moves have erased Singapore’s VLSFO discount to Zhoushan, now standing at near-parity level. However, Singapore’s VLSFO premium over Fujairah has nearly doubled to $13/mt.

Suppliers are recommending lead times of 6-12 days for VLSFO deliveries in Singapore, while HSFO deliveries require 4–10 days. LSMGO availability remains stable with lead times of 2–7 days.

In Malaysia’s Port Klang, availability of VLSFO and LSMGO grades is good, with some suppliers offering prompt deliveries for smaller volumes. However, HSFO supply remains limited. The port's VLSFO benchmark is now at a slight premium over Singapore.

Bunker fuel availability in Zhoushan remains steady amid low demand. Suppliers recommend lead times of 5–7 days for VLSFO and slightly shorter lead times of 3–5 days for LSMGO and HSFO.

Brent

The front-month ICE Brent contract has moved $0.73/bbl lower on the day from Friday, to trade at $70.99/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price felt some upward pressure following massive shelling between Russia and Ukraine over the weekend, according to media reports.

In a significant escalation of the eastern European conflict, Russia launched one of the biggest airstrikes on Ukraine in three months, causing massive damage to the country’s power system on Sunday, Reuters reported. Meanwhile, Washington reversed its conflict policy after US President Joe Biden allowed Kyiv to use US-made weapons to strike into Moscow, the report added.

Further escalation of the Ukraine-Russia conflict can disrupt Russia’s energy infrastructure and put upward pressure on Brent's price, according to oil market analysts.

Brent futures gained some support after Ukraine and Russia “further ratcheted up drone and missile attacks against each other over the weekend,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

The latest oil consumption data from China has highlighted concerns about the country’s slow oil demand growth and pushed Brent’s price lower.

The country’s oil consumption in October plunged by 5.4% on the month, with refiners processing about 59.54 million mt of crude oil last month, according to data from the National Bureau of Statistics (NBS).

The fresh data from China “weighed on [oil] sentiment,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

The news has reminded the market of China’s weak economic health, despite Beijing’s latest stimulus packages. “This isn't just a blip—it's a red flag,” SPI Asset Management's managing partner Stephen Innes said, stating that China’s oil demand growth looks dismal.

Oil market reports from OPEC and the International Energy Agency (IEA) also disappointed investors as both agencies lowered their demand growth projections for 2024.

“Crude prices continued to be weighed down by China demand concerns… after both OPEC and the IEA lowered their demand forecasts,” analysts from Saxo Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.