Fuel Switch Snapshot: LNG approaching bio-blend pricing

LNG inches closer to B24-VLSFO in Singapore

Rotterdam’s LNG at $120/mt premium over VLSFO

Singapore's B24-LSMGO priced just $9/mt higher than B24-VLSFO

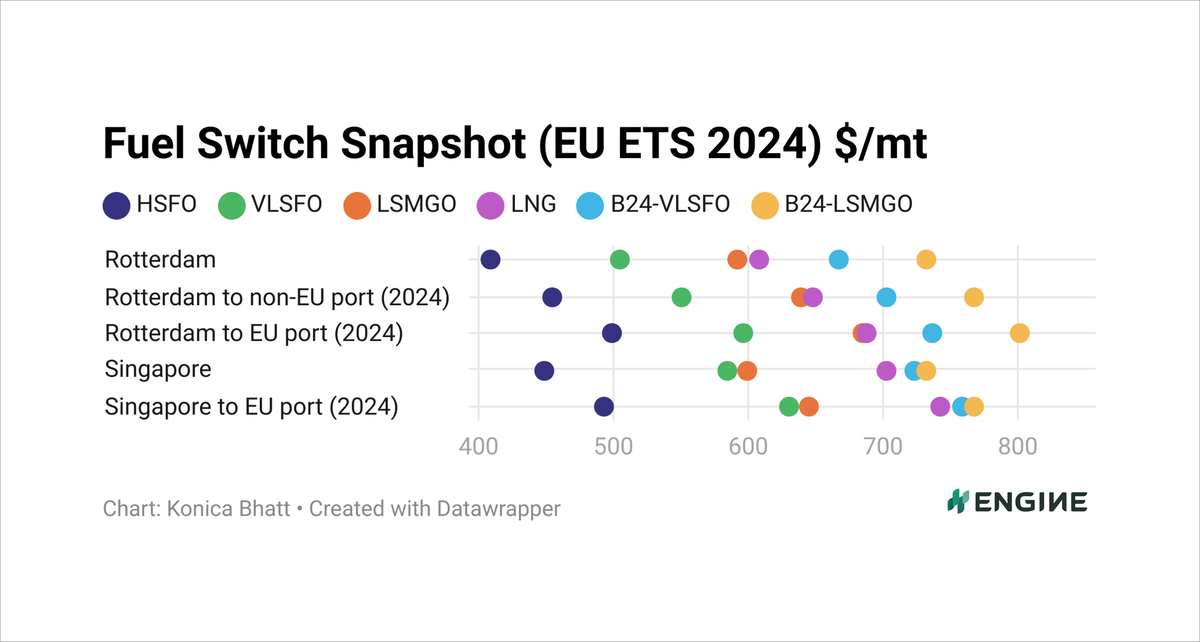

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

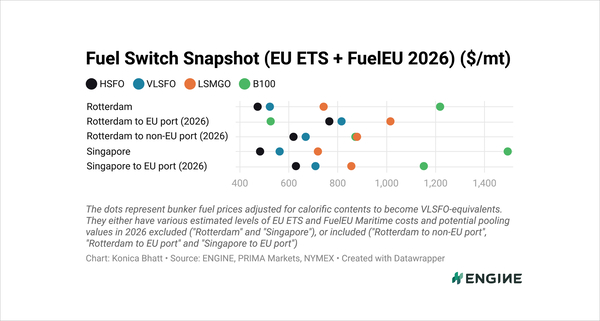

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

The front-month Brent futures contract has made a modest recovery in the past week, gaining $4/mt. This followed its largest weekly decline in 11 months the previous week.

In contrast, VLSFO benchmarks in Rotterdam and Singapore have suffered sharper declines, posting low-double-digit losses.

A rise in Rotterdam’s LNG benchmark has now pushed the benchmark to a $120/mt premium over the port's VLSFO bunker price, and to a $32/mt premium over its LSMGO.

LNG is now over $100/mt costlier than LSMGO in Singapore, and $96/mt higher with estimated EU Allowances (EUAs) included.

B24-VLSFO has moved unusually close to B24-LSMGO in Singapore, with only a $9/mt price difference between them.

VLSFO

Rotterdam’s VLSFO has dropped by $23/mt in the past week. VLSFO availability has been steady in Rotterdam and the wider ARA hub, but demand has been soft in the region, a source said. Another source said demand has not been great in Rotterdam

Singapore’s VLSFO benchmark has declined by $19/mt in the past week, and by a higher $20/mt when adjusted with the estimated EUA price for a voyage from Singapore to an EU port.

VLSFO availability in Singapore remains tight, with lead times now extending up to 11 days. While prompt deliveries are still possible, they are typically priced $30-40/mt higher than non-prompt deliveries dates, according to a source.

ENGINE has recorded 15 VLSFO stems in Singapore priced between $565-604/mt in the past week. Of these, 12 lower-priced stems were fixed for non-prompt deliveries (i.e. deliveries with a lead time of more than seven days), and only three were fixed for prompt deliveries. The lower-priced stems seem to have contributed to the benchmark's price drop.

Biofuels

Singapore’s B24-VLSFO UCOME price has dropped by $11/mt in the past week, while its B24-LSMGO UCOME price has shed $4/mt. A $19/mt decline in ENGINE's underlying conventional VLSFO price has contributed to drive down Singapore's B24-VLSFO UCOME price.

Rotterdam’s B24-VLSFO HBE price has declined by a sharp $26/mt over the past week, while its B24-LSMGO HBE price has declined more moderately, dropping by $12/mt.

PRIMA Market’s palm oil mill effluent methyl ester (POMEME) CIF ARA price has declined by $34/mt to $1,302/mt in the past week. This, coupled with a $23/mt decline in the underlying ENGINE conventional VLSFO price, has put downward pressure on the B30-VLSFO HBE price.

LNG

Rotterdam's LNG bunker price has risen due to lower natural gas flows from Norway and Russia, while Singapore’s price has dropped amid increased LNG supply and lower demand.

By Konica Bhatt, Debarati Bhattacharjee and Nithin Chandran

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.