East of Suez Fuel Availability Outlook 10 Sep 2024

VLSFO and HSFO supply is tight in Singapore

Several South Korean ports could face weather disruptions

Prompt availability is tight in Fujairah

PHOTO: An aerial view of Melbourne central business district, Victoria, Australia. Getty Images

PHOTO: An aerial view of Melbourne central business district, Victoria, Australia. Getty Images

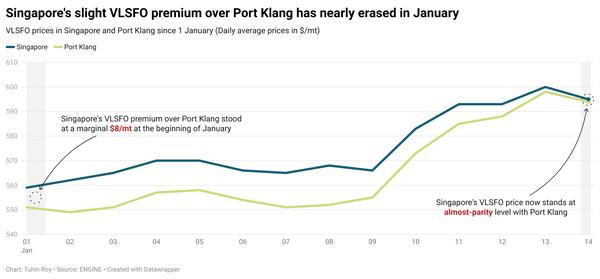

Singapore and Malaysia

VLSFO availability in Singapore has tightened, with lead times now extending up to 11 days. While prompt deliveries are still possible, they generally come at a higher price compared to those for dates further out.

Some suppliers are facing low VLSFO stock levels and barge loading delays, with some barges experiencing product loading delays of up to three hours at oil terminals.

LSMGO availability remains sufficient due to weak bunker demand, leading to a significant price drop. Most suppliers recommend lead times of around eight days for LSMGO, though some can offer deliveries in as little as two days.

This situation has narrowed the LSMGO-VLSFO price spread in Singapore to an average of around $35/mt this month, a level not seen since November 2021 and down from an average of around $84/mt last month.

HSFO supply in Singapore is also limited, with most suppliers advising lead times of 9-16 days.

In Malaysia's Port Klang, VLSFO and LSMGO supplies are strong, with some suppliers able to offer prompt deliveries for smaller quantities. However, HSFO availability remains limited.

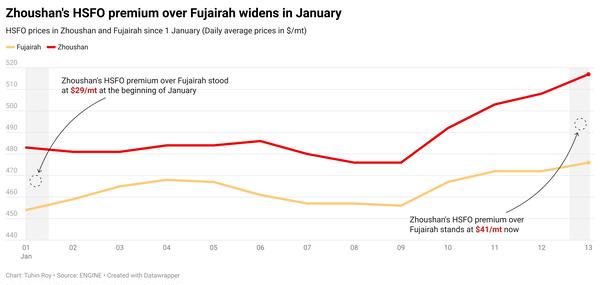

East Asia

Prompt VLSFO availability in Zhoushan remains tight, with some suppliers running on low stocks. Lead times of 5-7 days are recommended for the grade, similar to last week. According to a source, some suppliers expect VLSFO replenishment stocks to arrive by mid-month.

In contrast, HSFO and LSMGO grades are more readily available in Zhoushan, with lead times dropping from 5-7 days last week to 3-5 days now.

In Northern China, the ports of Dalian, Qingdao, and Tianjin have ample supplies of VLSFO and LSMGO, although HSFO availability is limited in Qingdao and Tianjin. Shanghai also offers strong VLSFO and LSMGO supplies, but HSFO availability is subject to inquiry. Fuzhou and Xiamen have good supplies of VLSFO and LSMGO, while prompt deliveries of both grades are under pressure in Guangzhou and Yangpu.

In Hong Kong, lead times of approximately seven days are recommended for all grades, which remains nearly the same as the previous week.

Supplies of VLSFO and LSMGO in the Taiwanese ports of Hualien, Taichung, and Keelung remain stable, with prompt lead times of about two days, similar to the previous week.

However, at the Taiwanese port of Kaohsiung, lead times for both grades have increased from around two days last week to 4-6 days due to a barge undergoing maintenance, according to a source.

In South Korean ports, VLSFO and LSMGO availability remains tight, with many suppliers recommending lead times of up to 10 days, although some can accommodate deliveries in as little as four days. HSFO availability has also tightened, with some suppliers running low on stocks. Lead times for HSFO have increased from approximately 3-6 days last week to 12-13 days now.

High waves are expected to affect the ports of Ulsan, Onsan, Busan, and Yeosu from 13-15 September, which could impact bunker operations at these ports.

In Japan, LSMGO supply remains good at the major ports of Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima, and Oita. HSFO availability is generally good, though prompt supply is limited in Oita. VLSFO is available at most Japanese ports, but supply is tight in Oita.

The port of Ho Chi Minh in Vietnam is expecting inclement weather on Saturday, which could disrupt bunkering operations.

Meanwhile, bunker deliveries at the northern Vietnamese ports of Quang Ninh and Hai Phong were partially suspended on Tuesday due to the aftermath of Typhoon Yagi, according to shipping agent Inchcape Shipping Services.

Hai Phong port is scheduled to resume normal operations by Tuesday night, allowing large vessels to dock without delays, while Quang Ninh port will remain closed until further notice.

Oceania

A bunker barge serving the Western Australian ports of Fremantle and Kwinana will be in dry dock from early September to mid-November, rendering VLSFO and LSMGO unavailable by barge at these ports during this time, according to a source. While VLSFO will not be available, LSMGO can still be supplied at berth.

In contrast, the Western Australian port of Kembla will remain unaffected by the barge dry docking, as bunker deliveries there are handled exclusively by truck and ex-pipe.

Melbourne and Geelong in Victoria have ample supplies of VLSFO and LSMGO, though prompt HSFO deliveries may be challenging. In Queensland, Brisbane and Gladstone ports offer sufficient VLSFO and LSMGO, with lead times of about 7-8 days. However, HSFO availability in Brisbane is limited.

New Zealand's Tauranga and Auckland have a good supply of VLSFO, with Auckland also offering a strong supply of LSMGO. However, intermittent rough weather is expected in Tauranga throughout the week, which could potentially affect bunker operations.

South Asia

VLSFO and LSMGO supply at Indian ports of Kandla, Tuticorin, Cochin, and Chennai remain limited, as they have been in recent weeks.

Conversely, the Sri Lankan ports of Colombo and Hambantota have good availability of all grades.

Middle East

Prompt availability of all fuel grades remains "super tight" in Fujairah, with most suppliers suggesting lead times of about 7-10 days for all grades, similar to last week. However, some suppliers can still offer prompt deliveries, according to a source.

Khor Fakkan is seeing similar conditions, with recommended lead times of 7-10 days. In contrast, Jeddah port in Saudi Arabia has sufficient supplies of both VLSFO and LSMGO. Djibouti is facing VLSFO shortages, but LSMGO is more readily available.

The Omani ports of Sohar, Salalah, Muscat, and Duqm have ample LSMGO supplies, with prompt delivery dates available.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.