Fuel Switch Snapshot: LNG's price advantage dwindles

VLSFO prices defy Brent's upward push

LNG now only $9-16/mt cheaper than LSMGO

B24-VLSFO blends cost $63-81/mt more than LNG

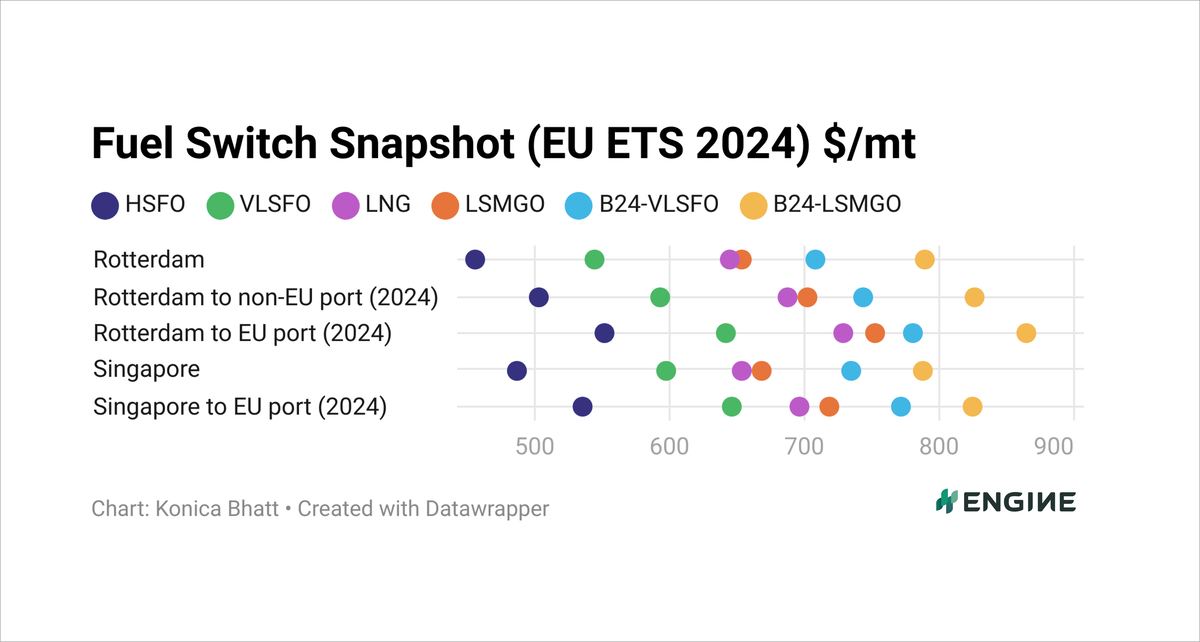

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

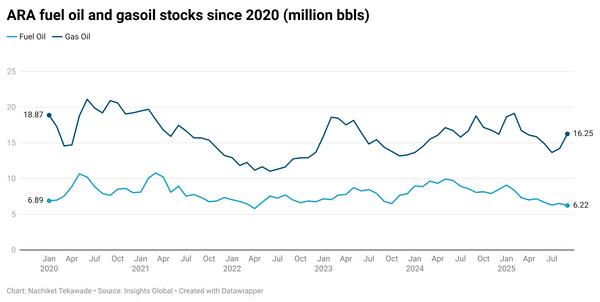

VLSFO prices have resisted rising Brent crude values as bunker availability has improved in Rotterdam and Singapore over the past week.

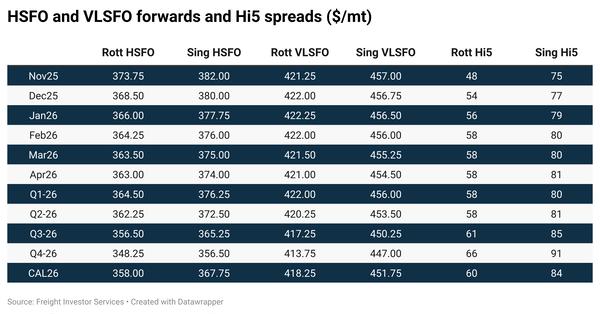

Rotterdam’s LNG premium over VLSFO has shot up by $56/mt to $100/mt in the past week. When including estimated EU Allowance (EUA) costs, LNG is $88-94/mt more expensive than VLSFO in Rotterdam.

Singapore’s LNG is at a $55/mt premium over its VLSFO without estimated EUA costs, and at a smaller $49/mt premium with EUAs.

The price gap between LNG and LSMGO has narrowed drastically in Rotterdam. Its VLSFO-equivalent LNG price is now just $9/mt lower than its LSMGO, as the discount has narrowed by a significant $66/mt over the past week. The gap is slightly larger in Singapore, where LNG is $16/mt cheaper than LSMGO.

When including estimated EUAs, LNG is $16-25/mt cheaper than LSMGO in Rotterdam. The EUAs slightly favour LNG over both LSMGO and VLSFO.

Dual-fuel shipowners will now have to pay $63/mt more for bunkering a B24-VLSFO HBE blend compared to bunkering LNG in Rotterdam, and $81/mt more for bunkering UCOME-based B24-VLSFO instead of LNG in Singapore.

When including estimated EUA costs, the gap narrows further to $52-57/mt in Rotterdam and to $76/mt in Singapore.

VLSFO

Rotterdam’s VLSFO price has remained almost steady with only a $2/mt dip, while Singapore’s VLSFO price has seen a slightly bigger $9/mt drop in the past week.

Prompt availability of VLSFO in Rotterdam has improved over the past week compared to the week before, a trader told ENGINE. This has come despite improved demand.

Prompt VLSFO availability remains tight in Singapore. But lead times for the grade have improved to 9-13 days in the port, a sharp reduction from 12-22 days a week earlier.

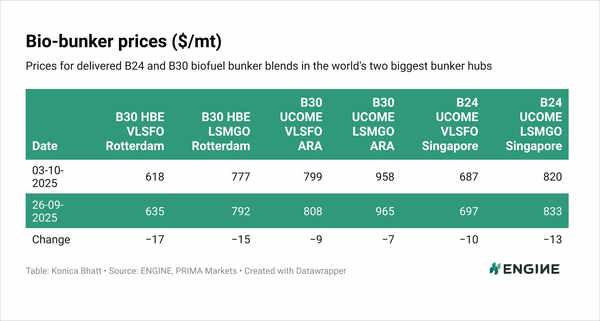

Biofuels

Bio-bunker prices in Rotterdam and Singapore have mostly been steady over the past week.

Rotterdam’s B24-VLSFO HBE price has shed $6/mt, while its B24-LSMGO HBE price has come down by a steeper $15/mt. A $32/mt drop in the price of palm oil mill effluent methyl ester (POMEME) has contributed to put downward pressure on the benchmarks.

Singapore’s B24-VLSFO price has seen a modest $4/mt decline over the past week while the underlying UCOME FOB China benchmark has held steady at $980/mt

“The Chinese market is waiting for the provisional anti-dumping duties by the European Commission to be set in stone, with trading restrictions on the likes of UCOME, FAME and HVO expected by mid-August [12 August],” PRIMA Markets said.

LNG

Rotterdam's LNG bunker price has jumped by a whopping $64/mt in the past week. The price gain has been driven by a sharp rise in the Dutch TTF Natural Gas contract. Delivery costs have also gone up by $18/mt to $117/mt.

Gas supply concerns in France and eastern Europe, coupled with high demand driven by unusually high temperatures in Europe, have contributed to drive up Rotterdam's LNG bunker price.

While Rotterdam's price has rallied higher, Singapore's has inched up by just $2/mt and is now just $11/mt higher than Rotterdam's.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.