East of Suez Fuel Availability Outlook 16 Apr 2024

Prompt HSFO availability improves in Singapore

VLSFO and LSMGO availability good across several Chinese ports

Several Middle East ports could face weather disruptions

PHOTO: A beautiful sunset over the port of Djibouti on the Red sea. Getty Images

PHOTO: A beautiful sunset over the port of Djibouti on the Red sea. Getty Images

Singapore and Southeast Asia

Bunker demand in Singapore has seen an uptick so far this week. Lead times for VLSFO in the port have shown significant fluctuations in recent weeks. Most suppliers advise up to 13 days for the grade, while some can accommodate within six days.

Prompt HSFO availability has slightly improved in the port, with recommended lead times now at 6-10 days, down from 8-14 days last week. LSMGO can be arranged within 2-6 days in Singapore.

According to Enterprise Singapore, the port's residual fuel oil stocks have remained relatively stable, matching March levels in the first week of April. The port’s fuel oil stocks have remained steady at 21 million bbls despite a 10% drop in the port's net fuel imports so far this month. Both imports and exports have decreased, with fuel oil imports down by 667,000 bbls, more than double the 249,000 bbls decline in exports. Conversely, middle distillate stocks in Singapore have averaged 9% higher this month.

In Malaysia's Port Klang, VLSFO and LSMGO grades are readily available, with some suppliers able to offer prompt dates for smaller parcel sizes. However, HSFO availability remains constrained due to limited product availability.

In the Indonesian ports of Jakarta and Surabaya, the availability of VLSFO and LSMGO remains good. Additionally, the port of Balikpapan has an ample supply of VLSFO.

China, East Asia and Oceania

All bunker fuel grades remain readily available in Zhoushan, with short lead times of 2-5 days recommended by several suppliers – virtually unchanged from last week.

In north China, Dalian port has ample VLSFO and LSMGO available. Similarly, Qingdao and Tianjin have abundant availability of VLSFO and LSMGO, while HSFO supply remains limited in both ports. The availability of VLSFO and LSMGO has improved in Shanghai, but HSFO remains constrained. In Fuzhou, Yangpu, and Xiamen, both VLSFO and LSMGO are readily available. However, in Guangzhou, the supply of low-sulphur fuel grades is limited for prompt delivery dates.

VLSFO and LSMGO remain readily available in the Taiwanese ports of Hualien, Kaohsiung, Taichung, and Keelung with recommended lead times of around two days.

All bunker fuel grades are readily available in Hong Kong. Lead times of seven days are typically recommended. But adverse weather conditions are predicted to hit Hong Kong on Sunday, which may impact bunker deliveries.

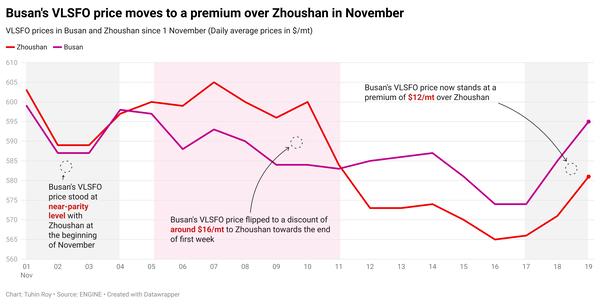

Despite subdued bunker demand, South Korean suppliers are maintaining competitive pricing for VLSFO. This is partly due to South Korean refineries offering bunkers at lower prices as they work to clear excess stockpiles. Busan's VLSFO price was trading at near parity levels with regional bunker ports such as Singapore and Zhoushan on Tuesday.

All bunker fuel grades remain readily available in South Korean ports, with most suppliers recommending lead times of 3-7 days. However, rough weather is forecasted over the weekend in South Korean ports including Ulsan, Onsan, Busan, Daesan, Taean, and Yeosu, which may potentially disrupt bunkering operations.

In Japan, sluggish bunker demand persists due to elevated prices and limited cargo availability. Tokyo's VLSFO was priced about $52/mt higher than Singapore's VLSFO on Tuesday and $48/mt higher than Zhoushan's. Lead times vary across key Japanese ports, from around five days in Tokyo, Chiba, Osaka, Kobe, Nagoya and Yokkaichi, to longer periods of 9-13 days in the ports of Mizushima and Oita.

In Western Australia, the ports of Kwinana and Fremantle have abundant supplies of VLSFO and LSMGO, with recommended lead times of 7-8 days in both ports. Moving to Sydney in New South Wales, prompt supply of LSMGO is available, while HSFO availability is limited.

In Victoria, Melbourne has an abundant supply of VLSFO and LSMGO, while Geelong also offers good availability of VLSFO. However, HSFO supply faces pressure in both Melbourne and Geelong. In Queensland, the ports of Brisbane and Gladstone have good VLSFO and LSMGO supply available, with recommended lead times of 7-8 days. HSFO availability remains limited in Brisbane.

Additionally, adverse weather conditions are predicted in the Thai ports of Koh Sichang and Leam Chabang between 19-22 April, and in the Vietnamese ports of Ho Chi Minh and Hai Phong on 16 April, posing potential challenges for bunker deliveries.

South Asia

VLSFO and LSMGO availability remains constrained in Indian ports, with most suppliers experiencing supply shortages.

Ports such as Mumbai, Kandla, Tuticorin, Chennai, Cochin, Visakhapatnam, Haldia and Paradip are encountering VLSFO and LSMGO shortages, leading to uncertain delivery schedules contingent on availability.

Sikka and Mumbai ports in India are forecast to experience adverse weather conditions on Wednesday and Thursday, which could disrupt bunkering.

Middle East

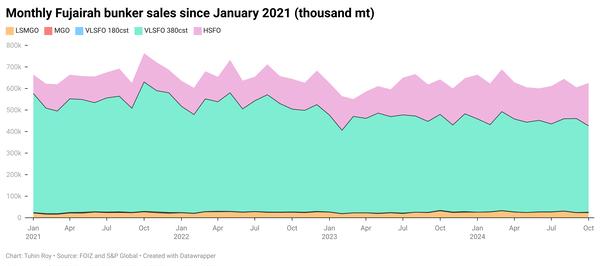

Bunker demand has improved in the UAE port of Fujairah. Most suppliers are advising lead times of around seven days for all grades in the port. However, the port was witnessing strong winds and waves on Tuesday, which might impact barge deliveries there. Bad weather conditions are forecast to persist until Thursday, which could complicate deliveries.

The other UAE ports of Khor Fakkan, Dubai, Saqr and Ras Al Khaimah are also facing adverse weather conditions, which are likely to continue until Thursday. Bad weather conditions could affect bunkering in these ports.

Most suppliers are recommending lead times of around seven days across all bunker fuel grades in Khor Fakkan.

Port operations in Dubai remain restricted, while the ports of Saqr and Ras Al Khaimah are on alert, according to GAC Hot Port News.

In the nearby Sohar port in Oman, bunker operations have largely remained unaffected by bad weather conditions, a trader says. There may be some delays, but bunkering so far has not been suspended in the port, the trader adds.

In Omani ports such as Sohar, Salalah, Muscat, and Duqm, LSMGO is readily available.

In Saudi Arabia's Jeddah port, both VLSFO and LSMGO remain good. However, in the nearby port of Djibouti, certain suppliers are experiencing VLSFO shortages, while LSMGO supply remains consistent.

Bad weather is predicted in the Egyptian ports of Suez and Said, Saudi Arabia's port of Jeddah and the Djiboutian port of Djibouti between Tuesday and Thursday, which may impact bunker operations.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.