East of Suez Market Update 10 Jan 2025

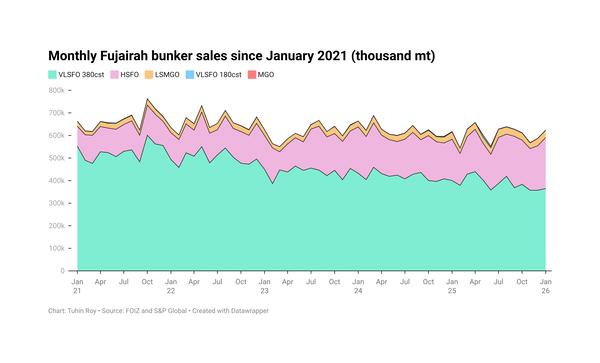

Prices in East of Suez ports have moved up, and prompt supply of all grades remains tight in the UAE ports of Fujairah and Khor Fakkan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah, Zhoushan ($19/mt) and Singapore ($15/mt)

- LSMGO prices up in Zhoushan ($20/mt), Fujairah ($16/mt) and Singapore ($14/mt)

- HSFO prices up in Zhoushan ($16/mt), Singapore ($11/mt) and Fujairah ($9/mt)

Bunker benchmarks in East of Suez ports have tracked Brent's upward movement, recording gains over the past day. VLSFO prices in Fujairah and Zhoushan have risen significantly by $19/mt each, while the grade's price in Singapore has risen by $15/mt. Despite Fujairah’s sharp price rise, its VLSFO price remains at discounts of $22/mt and $8/mt to Zhoushan and Singapore, respectively.

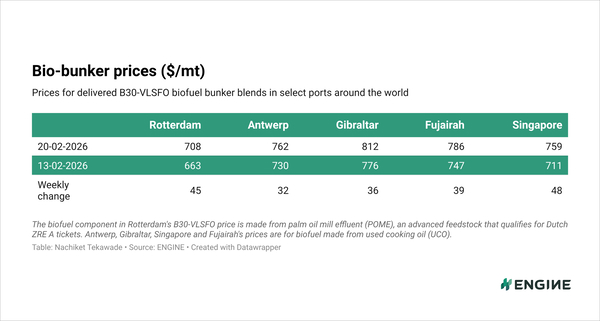

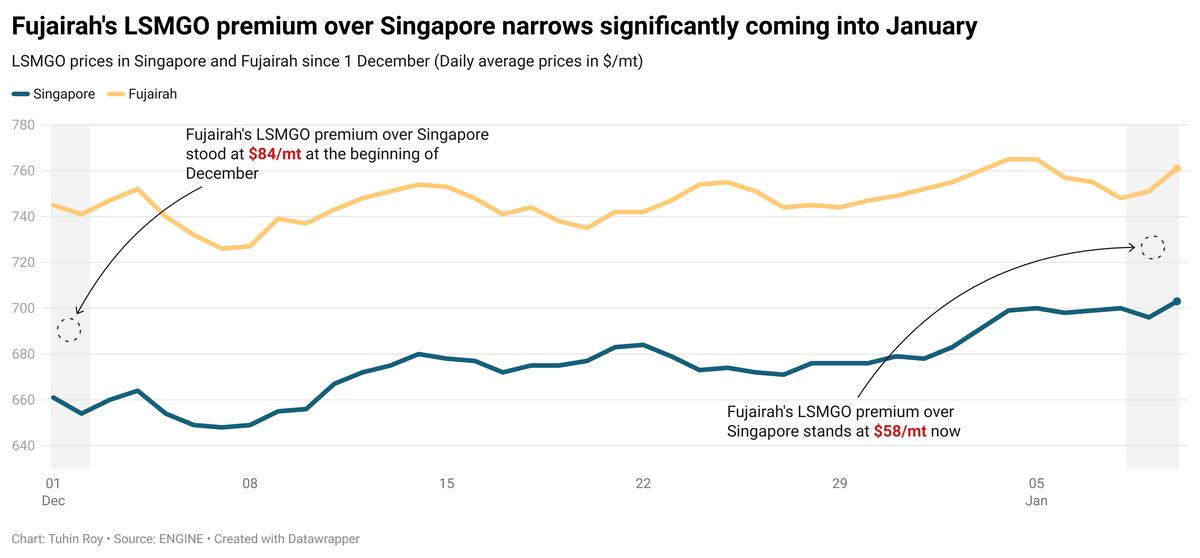

However, Fujairah continues to price its LSMGO higher than both Singapore and Zhoushan, with premiums of $58/mt and $45/mt, respectively.

In Fujairah, prompt availability is tight, with lead times for all grades holding steady at 5-7 days, unchanged from the previous week. Suppliers in Khor Fakkan are also advising lead times of 5-7 days for all grades.

In contrast, Saudi Arabia's Jeddah port has adequate supplies of both VLSFO and LSMGO. Meanwhile, Omani ports, including Sohar, Salalah, Muscat and Duqm, report ample LSMGO supplies with prompt deliveries readily available.

Brent

The front-month ICE Brent contract has gained $1.84/bbl on the day, to trade at $77.95/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil prices have risen, supported by cold conditions in parts of the US and Europe, which have driven up fuel demand.

The US weather bureau predicts below-average temperatures in central and eastern regions of the country. Similarly, many areas in Europe are experiencing extreme cold and are expected to see a colder-than-usual start to the year, boosting demand, Reuters reported citing JPMorgan analysts.

“Sentiment remains positive on the back of colder weather across parts of the Northern Hemisphere, which is likely to boost oil demand,” noted two analysts from ING Bank.

Brent futures were “reinvigorated by a winter storm hitting southern US and sub-zero conditions enveloping much of northern Europe,” Vandana Hari, founder and analyst at VANDA Insights, added.

Concerns over supply disruptions due to potential tightening of sanctions on Russia and Iran have further contributed to upward pressure on prices. Supplies could face more strain as US President Joe Biden is expected to announce new sanctions targeting Russia's economy this week to support Ukraine's war effort against Moscow, Reuters reported.

Uncertainty about President-elect Donald Trump’s policy on Iran has also influenced prices.

“Uncertainty over how hawkish Trump will be with Iran will be providing some support,” the ING Bank analysts added.

Downward pressure:

Brent futures faced some downward pressure despite a decline in US commercial crude oil stocks, due to increases in gasoline and distillate inventories.

According to the latest data from the US Energy Information Administration (EIA), gasoline stockpiles rose by 6.33 million barrels to 237 million barrels last week, while middle distillate inventories grew by 6.07 million barrels to 128 million barrels.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.