East of Suez Market Update 29 Nov 2024

Most prices in East of Suez ports have remained broadly rangebound, and VSLFO and LSMGO supply remains good in Malaysia’s Port Klang.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore and Zhoushan ($2/mt), and down in Fujairah ($2/mt)

- LSMGO prices up in Singapore ($10/mt), Fujairah and Zhoushan ($2/mt)

- HSFO prices up in Singapore ($2/mt) and Zhoushan ($1/mt), and down in Fujairah ($4/mt)

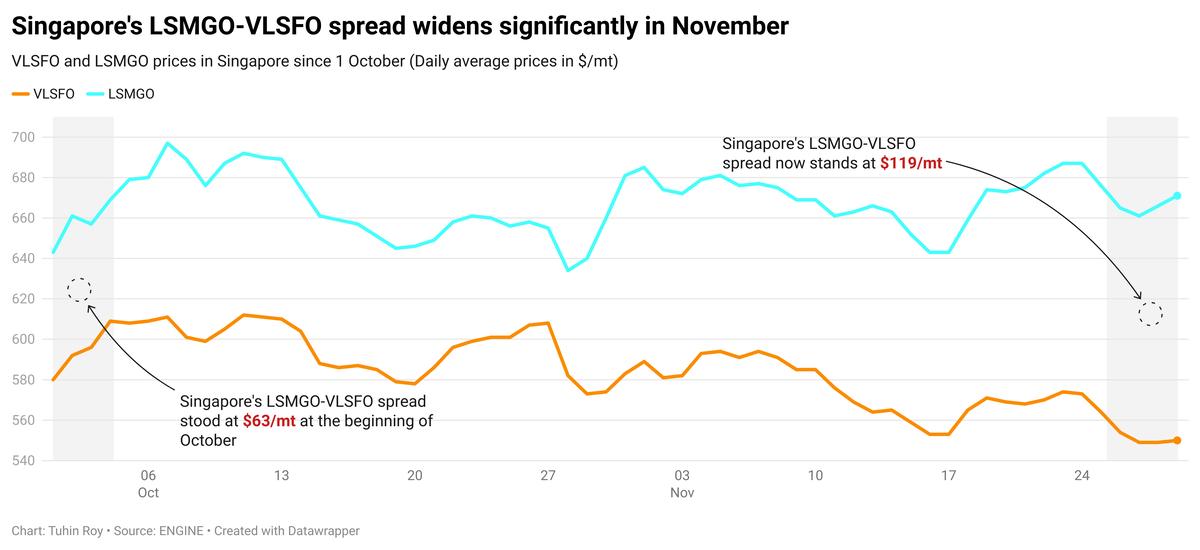

Singapore’s LSMGO price has increased by $10/mt over the past day, while prices in Zhoushan and Fujairah have remained relatively stable. In Singapore, four LSMGO stems were fixed yesterday within a wide range of $37/mt. Stems booked at the higher-end of the range have contributed to push the benchmark higher. Despite this increase, Singapore’s LSMGO price is $77/mt lower than Fujairah’s and $20/mt below Zhoushan’s.

The rise in Singapore's LSMGO price has outpaced the increase in its VLSFO benchmark, widening the LSMGO-VLSFO spread from $111/mt yesterday to $119/mt today. This spread remains significantly narrower than Fujairah’s $204/mt but is close to Zhoushan’s $117/mt.

For VLSFO in Singapore, suppliers recommend lead times of 8-10 days. HSFO supply remains tight, with lead times typically around 12 days, though some suppliers can deliver in as little as two days at higher prices. LSMGO supply is stable, with lead times of 4-7 days.

In Malaysia's Port Klang, VLSFO and LSMGO grades are readily available, with some suppliers offering prompt deliveries for smaller volumes. However, HSFO supply remains constrained.

Brent

The front-month ICE Brent contract has traded $0.30/bbl higher on the day, to trade at $72.83/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures gained momentum as the market shifted focus from geopolitical risk premiums to OPEC’s next move, after the oil consortium postponed its ministerial meeting to 5 December.

The Saudi Arabia-led oil producers’ group will discuss its plan to phase out its voluntary production cut of 2.2 million b/d at its upcoming virtual meeting. However, market analysts expect the group members to maintain production cuts through January 2025 to support prices.

“Crude oil prices were steady as the market contemplates the next move by OPEC,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Peace talks in Lebanon, mediated by the US and France, have eased supply disruption concerns in the oil market and put some downward pressure on Brent’s price.

A ceasefire deal between Israel and Iran-aligned Hezbollah armed group was achieved earlier this week. Israel’s war cabinet approved the agreement, effective Wednesday morning across the Lebanon-Israel border.

“A ceasefire agreement between Israel and Hezbollah giving us a ray of hope that maybe we can find a way out of the vicious cycle of war that has plagued the world over the last four years,” Price Futures Groups’ senior market analyst Phil Flynn remarked.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.