East of Suez Market Update 1 Mar 2024

Most prices in East of Suez ports have come down, and bunker fuel availability remains tight in South Korean ports.

PHOTO: Industrial cargo ships in Busan port area, South Korea. Getty Images

PHOTO: Industrial cargo ships in Busan port area, South Korea. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

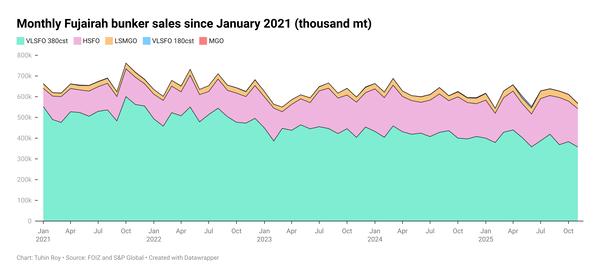

- VLSFO prices down in Singapore ($13/mt), Zhoushan ($11/mt) and Fujairah ($8/mt)

- LSMGO prices down in Zhoushan ($37/mt), Singapore ($22/mt) and Fujairah ($7/mt)

- HSFO prices down in Zhoushan ($19/mt), Fujairah ($9/mt) and Singapore ($8/mt)

Bunker fuel prices in East of Suez ports, particularly in Singapore, have followed Brent's downward trend, dropping significantly in the past day. Singapore's VLSFO price fell by $13/mt, the sharpest decline among major Asian ports. Despite this fall, Singapore maintains VLSFO premiums over Zhoushan and Fujairah at $9/mt and $3/mt, respectively.

In Singapore, some suppliers are facing challenges in fulfilling VLSFO delivery commitments due to tight supply, with lead times fluctuating between 4-11 days. A similar situation is observed in HSFO and LSMGO supply, with lead times ranging from 5 to 11 days and 2 to 9 days, respectively.

Meanwhile, LSMGO prices in all three major Asian bunker ports have declined, with a significant drop observed in Zhoushan. A lower-priced LSMGO stem fixed in the Chinese bunkering hub contributed to drag the benchmark down. Zhoushan's LSMGO price discount to Fujairah stands at $81/mt, while the grade's premium over Singapore stands at $21/mt.

Availability remains good across all bunker fuel grades in Zhoushan, with most suppliers recommending lead times of around five days for VLSFO and LSMGO, and six days for HSFO. However, bunker operations remain suspended at some anchorages in Zhoushan due to adverse weather conditions. Deliveries are expected to resume fully once weather conditions improve tomorrow.

Meanwhile, South Korean ports are experiencing tight availability across all bunker fuel grades, with lead times ranging from 8-14 days. Some suppliers can offer shorter lead times of around three days, but these depend on quantity of the stems. Adverse weather forecasts for key South Korean ports of Ulsan, Onsan, Busan, Daesan, Taean, and Yeosu may intermittently impact bunker deliveries between 1-6 March.

Brent

The front-month ICE Brent contract moved $1.00/bbl lower on the day, to trade at $82.18/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Supply tightness in the global oil market has supported Brent’s upward move this week.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies are expected to extend voluntary production cuts through the second quarter of this year at their upcoming meeting, which is scheduled in the first week of March, analysts said.

“The market looks ahead to OPEC’s decision on the extension of its current supply agreement,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Brent’s price will remain elevated if the Saudi-led coalition decides to extend its 2.2 million b/d supply cut into the second quarter of this year. “OPEC will extend the current supply agreement to the end of the second quarter,” Rystad Energy’s head of upstream research Espen Erlingsen said.

Downward pressure:

Brent futures plunged today due to concerns about slowing demand growth in the world’s leading oil consumers – the US and China.

“A bearish EIA inventory report weighed on the OPEC+ supply cut expectations,” said two analysts from ING Bank.

Commercial crude oil inventories in the US increased for the fifth straight week, adding 4 million bbls to reach 447.16 million bbls on 23 February, according to the US Energy Information Administration (EIA), indicating sluggish demand growth in the country.

China’s state-owned National Petroleum Corporation (CNPC) expects oil demand growth in the country to ease this year due to a slow pace of post-COVID recovery.

“The corporation now expects Chinese oil demand to grow by a modest 1% to 764 mt (15.3 million b/d), the lowest demand growth forecast in at least a decade excluding the COVID-19-affected period,” ING Bank’s analysts added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.