East of Suez Market Update 24 Aug 2023

VLSFO prices have moved down in East of Suez ports, and VLSFO availability remains good in most Indonesian ports.

PHOTO: Universal Terminal on Jurong Island is Singapore's largest independent oil storage terminal. Jurong Port Universal Terminal

PHOTO: Universal Terminal on Jurong Island is Singapore's largest independent oil storage terminal. Jurong Port Universal Terminal

Changes on the day to 17.00 SGT (09.00 GMT) today:

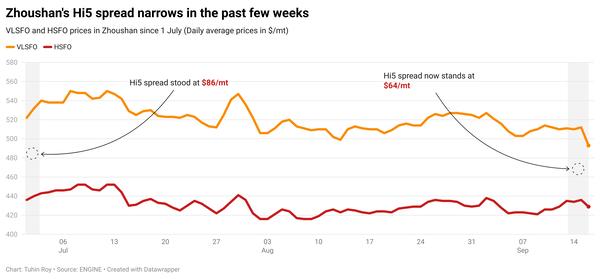

- VLSFO prices down in Fujairah and Zhoushan ($3/mt), and Singapore ($2/mt)

- LSMGO prices up in Singapore ($7/mt), and down in Fujairah and Zhoushan ($4/mt)

- HSFO prices unchanged in Fujairah, and down in Zhoushan ($13/mt) and Singapore ($12/mt)

VLSFO prices in major Asian bunker hubs have fallen in the small range of $2-3/mt in the past day. Zhoushan continues to price its VLSFO at elevated levels to Fujairah and Singapore. The Chinese bunkering hub’s VLSFO premiums over Fujairah and Singapore stand at $12/mt and $6/mt respectively.

VLSFO prices in Indonesia's Jakarta port continue to trade at a rare discount of around $6/mt to Singapore this week. Availability of the grade has been good across ports of Jakarta, Surabaya, Balikpapan, Muara Berau and Cigading in Indonesia, a supplier says.

While LSMGO prices in Fujairah and Zhoushan have dropped, the grade's price in Singapore has moved counter to the general market direction and gained $7/mt in the past day. A higher-priced LSMGO stem fixed in the past day supported the benchmark’s upward thrust.

Despite Singapore’s LSMGO price rise, its LSMGO discounts to Fujairah and Zhoushan stand at $26/mt and $22/mt, respectively.

Securing VLSFO prompt stems can be difficult in Singapore, with most suppliers recommending lead times of around 7-11 days – doubling from 3-5 days last week. Lead times of HSFO, on the other hand, have shrunk from 9-11 days last week to 6-8 days now. LSMGO remains readily available for prompt supply.

Brent

The front-month ICE Brent contract has inched lower by $0.25/bbl on the day, to trade at $83.34/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures continued to draw support from the supply cuts announced by Saudi Arabia-led oil-producer group OPEC+. Earlier this month, Saudi Arabia and Russia announced an extension of their voluntary production cuts into September.

“Saudi Arabia is so confident in the global demand outlook that they took steps of not only extending its lollipop 1.0 million barrel a day production cut [to include September] but also raised its selling price for its oil to Europe,” said Price Futures Group’s senior market analyst Phil Flynn.

“The cut could be extended or extended and deepened depending I guess, on their mood” he added in a note.

Downward pressure:

Downward pressures acting on the Brent price include easing of concerns about tight global supply.

Iran’s crude oil output will increase to 3.4 million b/d by the end of September from the current production level of 3.3 million b/d, the country's state media agency IRNA reported quoting Iran's oil minister Javad Owji as saying.

Additionally, the US government is drafting a proposal to ease sanctions on Venezuelan oil exports, allowing more US companies to buy crude from Venezuela, Reuters reported.

“Oil also sold off on hopes of a positive conclusion of talks between Iraq and Turkey to discuss several issues including the resumption of oil exports through the Ceyhan pipeline in the Turkish Mediterranean,” added Phil Flynn.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.