2025 in Review: A Cheerful Outlook for Bunker Buyers

2025 proves to be a good year for bunker buyers

As the year draws to a close, journals, newspapers, and online outlets reflect on the events of the past 12 months. We are adding our own review to that list—but with a difference. Ours is a good-news story for bunker buyers, highlighting a ‘cost saving’ of more than 25% over the past year.

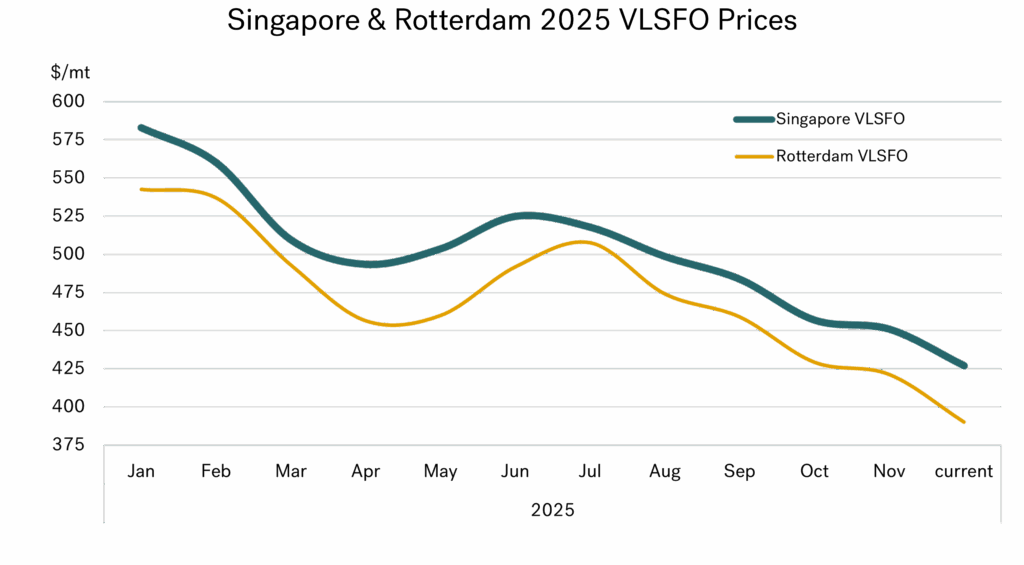

VLSFO buyers in Singapore started the year paying around $585/mt, now they are paying around $430/mt! It’s the same story in Rotterdam and Fujairah (among other ports); VLSFO prices are down by some $150/mt since January.

Source: Integr8 Fuels

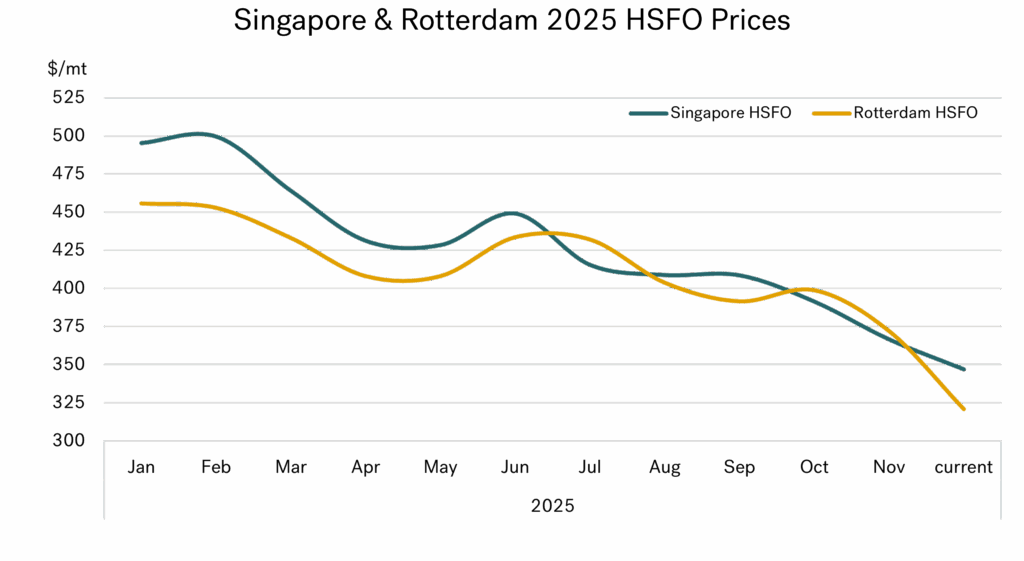

Source: Integr8 Fuels

We can also repeat the same story for HSFO buyers, with a bit more added! Prices here are down by 30%. Singapore buyers have seen prices fall from $500/mt to 350/mt, and for the past seven months they have paid more-or-less the same as buyers in Rotterdam.

Source: Integr8 Fuels

Source: Integr8 Fuels

HSFO prices in Fujairah also fell by a similar amount. This means that since the start of the year there has been a price fall of some $150/mt for Singapore VLSFO and HSFO, Fujairah VLSFO and HSFO and Rotterdam VLSFO. The only price to ‘fall short’ was for Rotterdam HSFO, but this still fell by $135/mt, and in percentage terms this drop was close to other main international bunker markets.

It’s usually fundamentals versus geopolitics, and fundamentals are winning

Throughout the year we have highlighted and analysed the two main (and conflicting) issues for our business, weakening oil fundamentals versus wars/heightened geopolitical risks. Whether the peace process in Gaza can be finalised, and an end to the war in Ukraine can be achieved, the perceived geopolitical risks today are far lower than they were earlier in the year. This means the fundamentals have taken over as the main industry price driver; and the fundamentals are weak.

The drift down in prices over the past six months (as shown in both graphs) represents these shifts in market sentiment towards the more bearish view.

Where we are today

This bearish overhang is even more pronounced at the moment. Products markets have eased as the seasonal refinery maintenance programs come to an end, and crude markets have been weakened by increasing volumes of OPEC+ production and reports of a significant increase in the volumes of crude oil onboard tankers at sea. Despite tightening sanctions against Russia and US actions against Venezuela, there are no real concerns about oil supply today.

The general view is that we are still looking at an even bigger oil surplus next year. As evidence of this, Brent front month futures prices have fallen by $3/bbl in less than two weeks, to just $60/bbl.

Where will we be next year?

Many analysts still see relatively strong supply gains next year. This is despite OPEC+ recently announcing they would continue to unwind the previous production cutbacks and raise output in December, but then hold-off any increases during the first quarter of next year.

The analysts’ view of a supply-side boost next year is based on planned increases in crude output from Brazil and Guyana, along with the further gains in OPEC+ production. Assuming these supply increases are achieved, the focus then becomes ‘how much will oil demand grow by next year, and where will the balance lie?’.

It is here there are some divergent views. OPEC is looking at a reasonably strong level of demand growth in 2026 (at plus 1.4 million b/d), and so is projecting a relatively balanced market outlook. On this basis prices would be supported, and OPEC+ could continue to unwind cutbacks and increase production from the second quarter onwards. Some of the oil majors appear to be tending towards this view as well.

However, the IEA, EIA and many analysts are not as positive on oil demand growth and the overall oil balance. In this case oil prices are likely to remain close to current levels, or even fall. This is the view we have highlighted over a number of our reports this year.

A picture to conclude

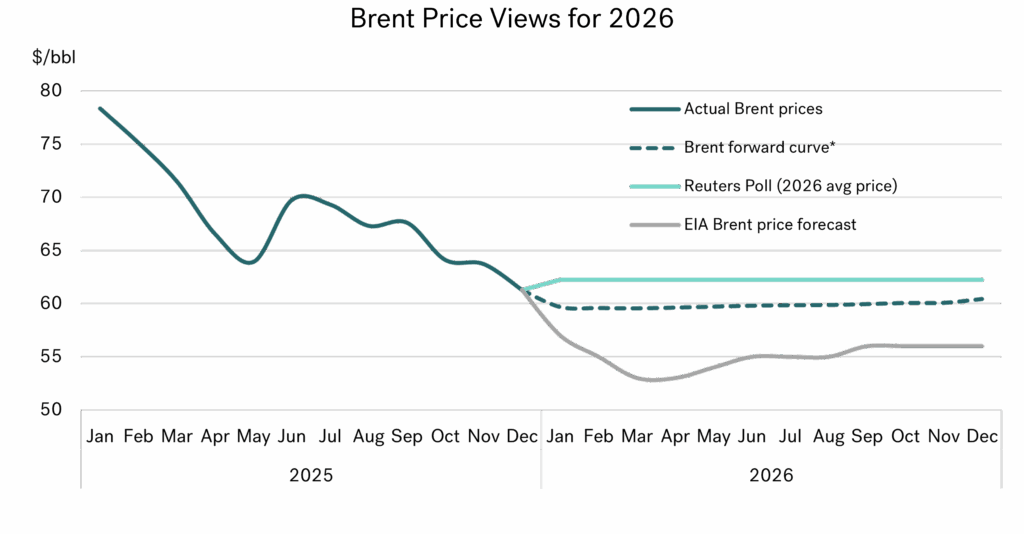

To summarise, a few analysts are towards the bullish side, but most see a growing oil surplus running into next year and Brent prices typically in the $55-62/bbl range.

The graph below illustrates some of these key findings. Brent has already fallen from $78/bbl to $60/bbl this year, and the current forward curve is extremely flat at close to $60/bbl. Although the forward curve is not a forecast, it does show the level at which people are prepared to trade; and Brent trading positions over the next 12 months are not very far away from current levels.

*the January 2026 forward curve price represents the ICE Brent contract for March, etc.

Source: Integr8 Fuels

Many of the published Brent price forecast for next year are in the $55-60/bbl range, and we have highlighted the US EIA’s forecast here, as one of the lower ones. The other line highlighted is the result of Reuters poll of 35 economists and analysts, giving an annual average Brent price of $62/bbl for next year. Clearly as an average, some participants will be higher than $62/bbl, and some lower, but the headline news story is one of low oil prices in 2026.

Taking the simplified view

From all the analysis, it looks like oil (and bunker) prices will be ‘low’ next year unless there we see something dramatic, like far greater geopolitical risks or a change in OPEC+ strategy to cut production and drive prices (and revenues) higher.

All we can do is reflect on the price drop this year and look out for any deflection away from a potential growing oil surplus and low prices next year.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.