Widening Spreads: VLSFO Steady While HSFO Hits Two-Year Low

Relative strength in Singapore VLSFO has disappeared

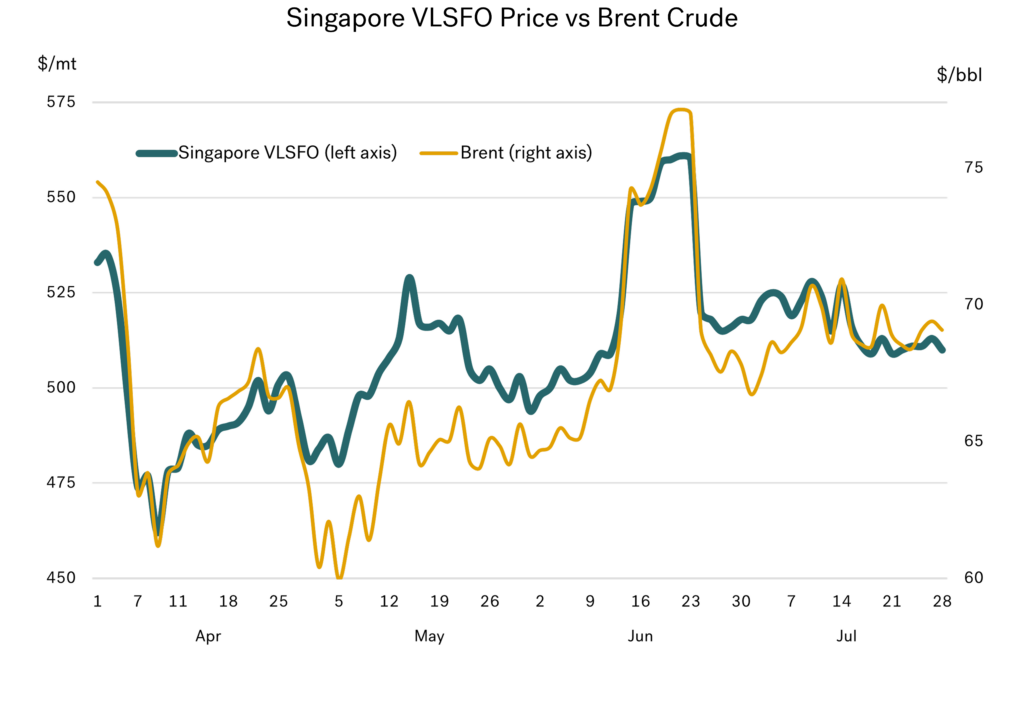

Two months ago, we wrote about how Singapore VLSFO prices had moved to a strong premium versus Brent crude. This took place in late April/early May, as crude prices fell sharply and bunker prices failed to follow. At the time Singapore VLSFO was about $40/mt ‘more expensive’ than if we had continued at a parity with crude.

Around mid-June there was a spike in all prices, in response to US, Israeli and Iranian attacks in the Middle East region. Since then, there has been a significant rebalancing of VLSFO supplies in Asia, with a big leap of supplies and components arriving in the region. Arbitrage volumes coming in so far this month are some 40% higher than in June, and also running well above the average year-to-date figure. The net result is that, after a period of relative strength, the past two weeks have seen Singapore VLSFO come back into line with Brent crude; a similar position to three months ago.

Source: Integr8 Fuels

Source: Integr8 Fuels

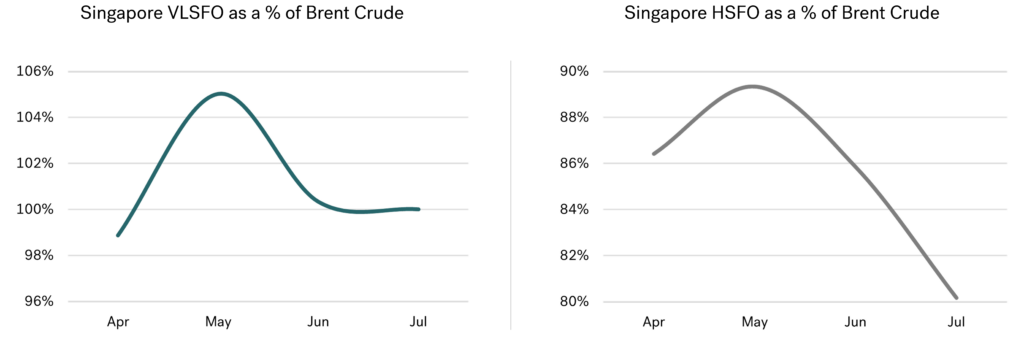

Hence, over the past four months we have seen Singapore VLSFO prices move up from around 99% to 105% of Brent crude, and now back down and stabilised at around 100%.

Singapore HSFO also strengthened April/May, but since then it’s been down and down

In April/May, Singapore HSFO prices similarly strengthened relative to Brent crude, up from around 86% to close to 90%. Like VLSFO, there was also a turning point in the Singapore HSFO market in May to June, but since then the Singapore HSFO market has just kept falling relative to Brent crude!

Source: Integr8 Fuels

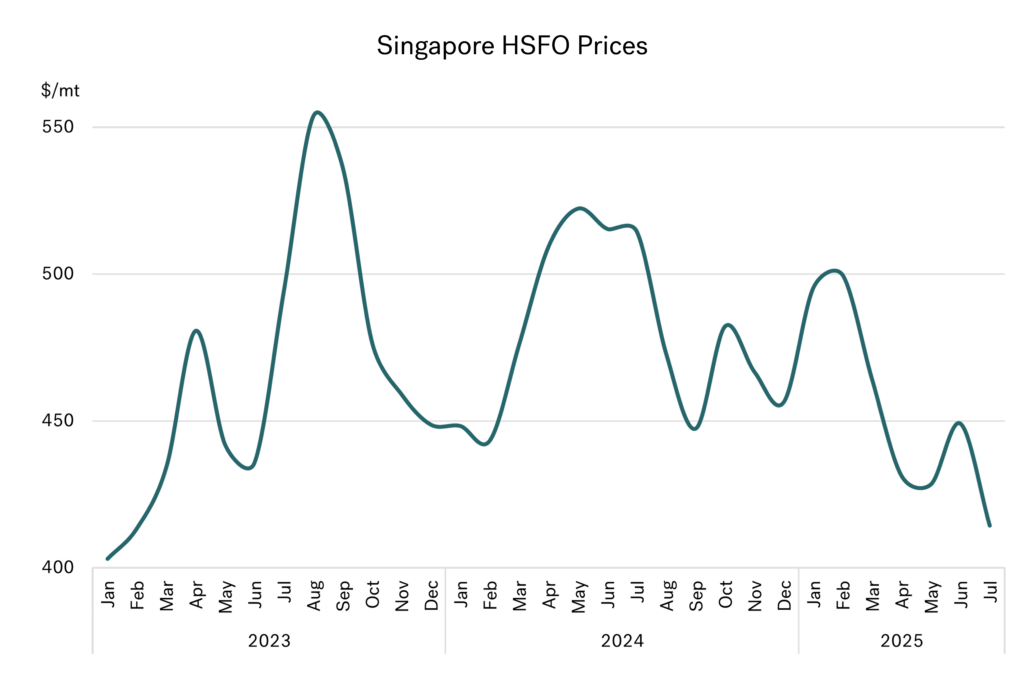

These market movements have led Singapore HSFO prices down to around $415/mt, which is the lowest level for more than two years.

The extent of the current weakness is reflected in the fact that Singapore HSFO prices have moved from backwardation into contango. The July/August contango is now at $6/mt, its most extreme for almost five years. This is not something that typically happens at this time of year when demand for HSFO in the Middle East power sector for air conditioning is usually high.

Source: Integr8 Fuels

Source: Integr8 Fuels

Why have Singapore prompt HSFO prices fallen so much?

In mid-June, the Israel/Iran conflict had raised concerns about natural gas supplies in the region, and this had bolstered HSFO prices as a replacement into power generation. However, the subsequent ceasefire then removed these worries and prices started to fall, and then fall sharply.

This unseasonably sharp drop in HSFO prices came about after stock levels had increased in June and then a significant number of cargoes came onto the market in July. There were several cargoes from at least four refiners in India that were made available, and on top of this volumes from Bahrain and Iraq were also put on the market in July. This is a rare occurrence.

At the same time, Saudi Arabia is on a strategy to burn less fuel oil in its power sector. It looks like Saudi Arabia imported around 70,000 b/d less fuel oil in June 2025 than in June 2024, and exported around 90,000 b/d more than the previous year. This alone is a net swing of 160,000 b/d in ‘available’ volumes in the HSFO market.

To compound these weaker developments, during this period OPEC+ has been unwinding its voluntary crude production cuts. As part of this, Saudi Arabia increased its June production by a massive 700,000 b/d. This is mostly heavier and more sour grades, and so will ultimately have a positive impact on the amount of HSFO coming out of the refining system.

Lower demand, higher availabilities, and more trading; a recipe for lower prices

All these developments have led to a big increase in HSFO volumes in the market and a big increase in the amount of trading taking place. Given this, it clearly explains the current weakness in Singapore and Fujairah HSFO bunker prices. As this Saudi strategy to burn less fuel oil continues, and Saudi Arabia continues to increase (heavier and more sour) crude production as the OPEC+ cuts are unwound, then we are likely to see more HSFO cargoes in the market.

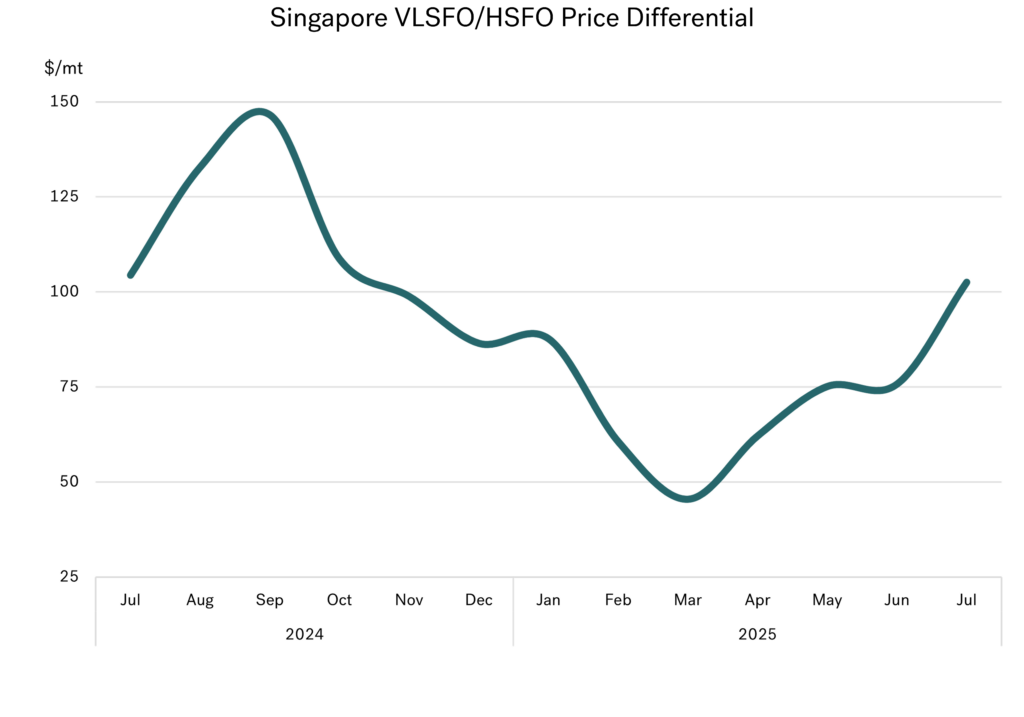

Slightly lower VLSFO prices & much lower HSFO prices

So, although Singapore VLSFO prices have moved down and back into line with Brent crude, the even bigger drop in HSFO bunker prices has led the VLSFO/HSFO differential to much wider levels. So far in July this spread has averaged more than $100/mt, it’s biggest for 8 months.

Source: Integr8 Fuels

Now to look at the future!

Looking ahead in the short to medium term, the oil supply/demand balance does look bearish, with increasing OPEC+ and non-OPEC+ production, against a backdrop of more limited increase in global oil demand. However, global conflicts and a more unpredictable political scene make this a far from a ‘done deal’ towards lower bunker prices. One subject now on everyone’s lips is Russia. The planned EU sanctions on banning imports of oil products derived from Russian crude starting in 2026 is one issue. But possible US sanctions against Russia in light of the President Trump/President Putin ‘relationship’ could be a far bigger deal.

Summing up what we all know, but what we can’t predict is: the fundamentals look bearish, the political risks look bullish and any solutions to the wars in Ukraine and Gaza could bring prices down. Not very helpful, but at least we know what we are looking at!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.