Why Bunker Prices Aren’t Dropping — Even as Oil Sinks Below $65

Brent prices even lower than a month ago

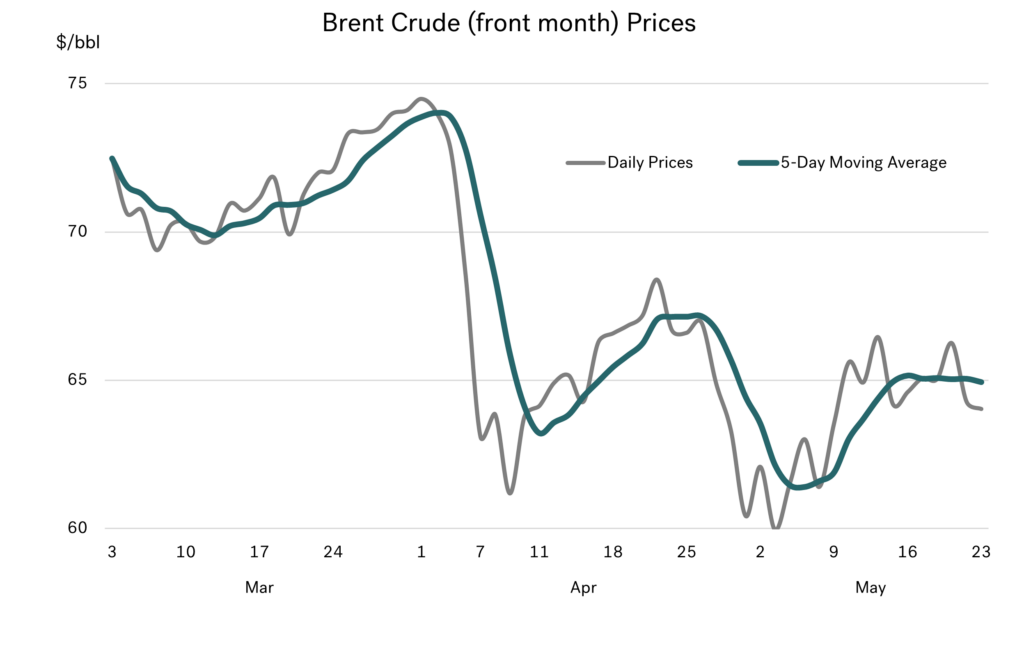

Brent prices are some $4/bbl lower than their peak at end April, and in the interim we have seen another dive back down towards $60/bbl. Its like the crude price chart reflects a ‘friendship rating’ between the US and China, with Brent $15/bbl lower than when Trump came to power. Instead of prices around $80/bbl at the start of the year, we are now generally trading in the $60-65/bbl range, and have been for almost two months.

Source: Integr8 Fuels

Source: Integr8 Fuels

We speculated last month that if President Trump and President Xi became ‘good friends’ it would trigger a return to confidence in global markets and higher oil and bunker prices. This clearly is not happening at the moment!

Much bigger increases in OPEC+ than previously planned

Brent crude prices have moved off their $60 lows, to around $65/bbl. Although there has been another delay in imposing the full US tariffs on China, the pickup in price is more a reflection of the latest round of tighter EU sanctions on Russia.

However, the good news for bunker buyers is that any rise in oil prices is being limited by OPEC+, as they start to unwind their voluntary production cutbacks. The process started in April, and the increases are much bigger than previously planned, rising by around 0.4 million b/d in April and another 0.4 million b/d anticipated in May (as opposed to an earlier planned rise of only some 0.15 million b/d each month).

So, although more EU sanctions on Russia is a bullish element to the market, this has been overshadowed by no political solution to the proposed US tariffs on China, and much bigger than expected increases in OPEC+ production. Hence, Brent is even lower than a month ago, and trading in the $60-65/bbl range.

But in bunkers, we are still not seeing the full effect of lower crude prices

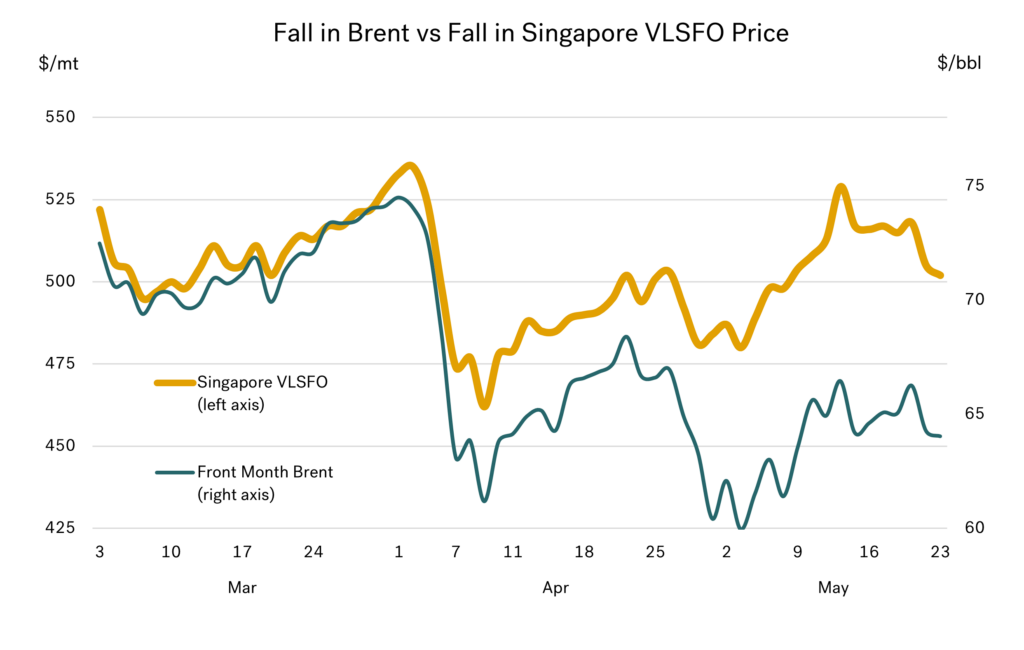

In last month’s report we highlighted the fact that the fall VLSFO prices was nowhere near as big as the fall in crude. If we had seen the same drop in bunkers as we saw in crude, then VLSFO in Singapore would have been another $25/mt lower in April.

This trend has not only continued into May, but has actually got even worse for us. Instead of using the crude headline of “even lower prices”, we must use “VLSFO prices are slightly higher than a month ago”. In fact, Singapore VLSFO prices have been above $500/mt for most of May, and higher than all but the first few days of April; something that can’t be said for the crude market. The graph below illustrates this recent divergence in prices between Brent and Singapore VLSFO, with both axes scaled the same.

Source: Integr8 Fuels

Source: Integr8 Fuels

Whereas last month we said that Singapore VLSFO would have been $25/mt lower if it had tracked crude; now we are saying Singapore VLSFO would be $50/mt lower if it had tracked crude!

There is relative strength in product prices

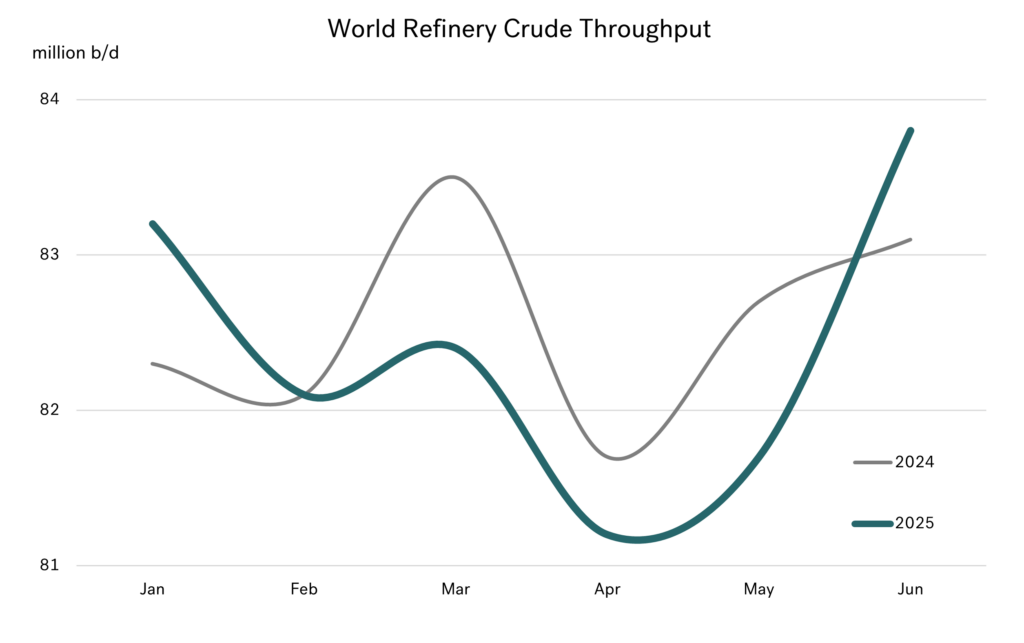

Planned refinery maintenance, plus some unplanned shutdowns, have hit refinery crude throughputs over April/May extremely hard. As a result, global throughputs are much lower than in the same period last year, and also lower than in April/May 2023.

Source: Integr8 Fuels

There is no adjustment to crude production during these periods of much lower crude processing. This year the situation is even more extreme, with a bigger drop in throughputs taking place at the same time as significant increases in OPEC+ production. Naturally, this has led to a relative weakness in crude prices.

The bottom line is lower crude throughputs mean tighter product availabilities and more ‘spare’ crude. Hence, we have seen crack spreads widen over April/May across most products and in most regions. For us, VLSFO crack spreads in Singapore and NW Europe both rose by some $6/bbl, which is equivalent to around $40/mt.

It’s therefore not surprising that recent VLSFO prices have not tracked crude prices to their lows.

When will VLSFO pricing fall back in line with crude?

There are early signs that things are changing. After a cutback in trade in April and May, the arb on light/sweet West African crudes moving to Asia is opening up, and cargoes are likely to load and go east, but this is for the June loading program. There are also expectations of more VLSFO arrivals into Singapore, but again not until later in June and July.

This ties in with the expectations of a strong rebound in refinery throughputs in June, to levels higher than last year, resulting in increasing product availabilities coming later in June and into July.

It’s a fix, but not a quick fix, with these pointers suggesting we still have a number of weeks where VLSFO will remain at a relative strength to crude, but this should start to ease back later June and into July.

The question then is: What are the pointers for VLSFO prices?

Bullish signs on oil prices could be if there is a quick end to the war in Ukraine, which isn’t looking likely at the moment. An even bigger bullish factor would be signs that President Xi and President Trump have become ‘good friends’ and end the planned use of high tariffs; again, not seen as a high probability in the very near term.

In the immediate short term, there are more bearish signals for VLSFO prices.

If the crude market is unchanged by the end of June, with Brent trading in the $60-65/bbl range, then we would expect Singapore VLSFO prices to fall from just above $500/mt, to the $450-475/mt level. If crude oil prices fall from current levels, to below $60/bbl, the fall in VLSFO prices will be even greater.

If crude prices remain the same, this means lower bunker prices; if crude prices fall this means even lower bunker prices!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.