What does the refining industry tell us about VLSFO for this year?

Bunker prices had been falling, even with more attacks on Red Sea shipping

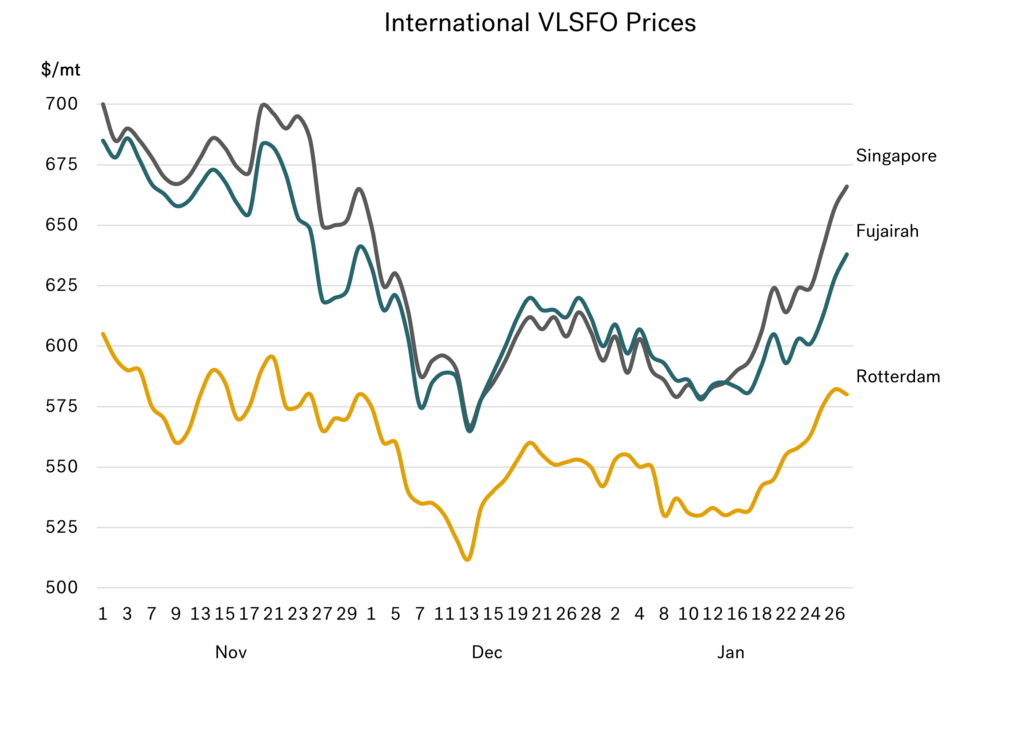

Bearish fundamentals and sentiment played out between mid-December and mid-January, with VLSFO prices on a downward slide. This was despite geopolitical tensions surrounding Houthi attacks on shipping in the Red Sea and the first US/UK air attack on Houthi targets on January 11th.

Source: Integr8 Fuels

Source: Integr8 Fuels

Something has changed, and prices are on the rise

However, over the past two weeks prices have increased, and are now back to early December levels. The main reasons behind the turning point have been:

- Stronger than expected economic growth in the US;

- More positive indications for growth in Chinese oil demand;

- Tighter product balances (because of disruptions to trade as ships re-route via the Cape of Good Hope and away from the Red Sea/Suez Canal*);

- Short-term crude production and refinery outages in the US because of cold weather.

*The main impact on oil markets so far on ships re-routing has been on diesel and jet trade from the Middle East/West Coast of India to Europe, and the naphtha and fuel oil trade from Europe to

It is these fundamental developments that have led prices higher, rather than a direct response to Houthi attacks. As a result, Rotterdam and Fujairah VLSFO prices are up by around $50/mt over the past two weeks, and Singapore VLSFO up by $80/mt.

The greater geopolitical risk now is any increased tensions/conflict between the US and Iran.

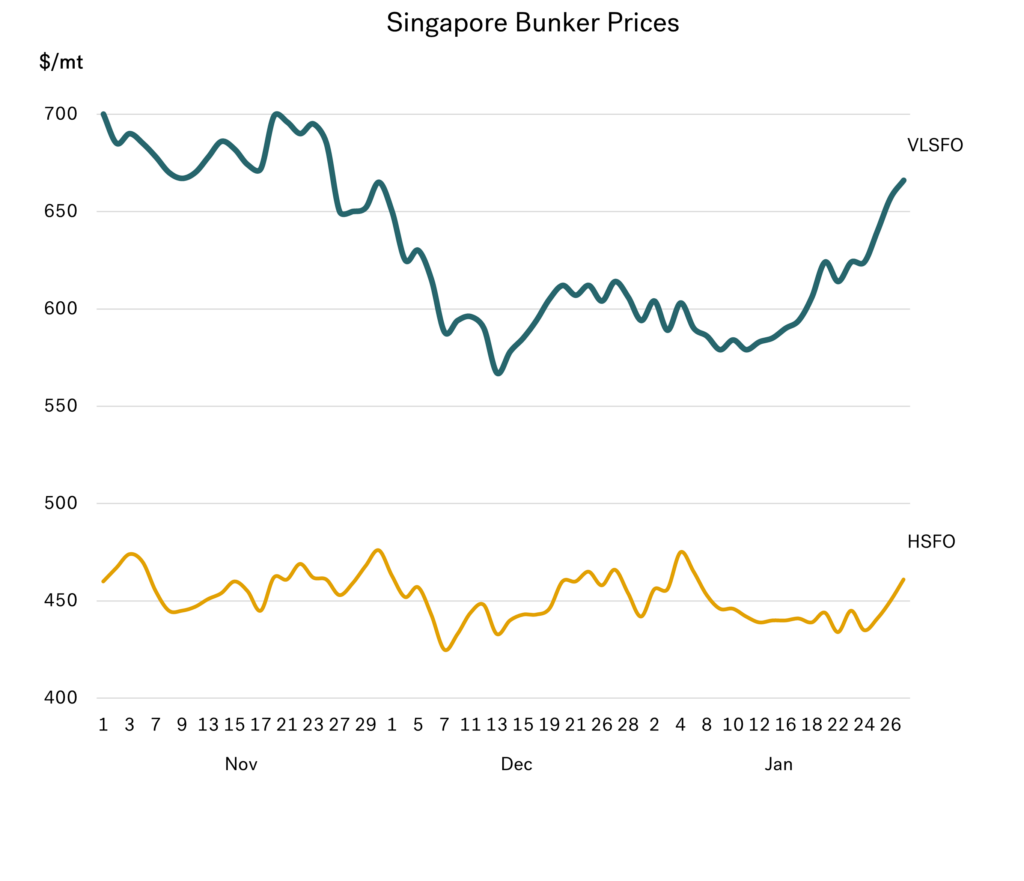

HSFO prices near ‘unchanged’

The same cannot be said for HSFO prices, which have only increased by around $20/mt in Rotterdam and Singapore over the past two weeks. An increase in heavy crude trade from the Middle East to Europe and a large-scale rise in HSFO exports from Kuwait to Asia has weakened the relative position of HSFO, in contrast to other products, including VLSFO. These price movements are shown in the graph below, with the net result that the Singapore VLSFO/HSFO spread has widened again to more than $200/mt (from $145/mt two weeks ago). This spread was last above $200/mt in late November.

Source: Integr8 Fuels

Source: Integr8 Fuels

Refinery crude throughputs will reach a record-high this year

Some of the price elements involved in today’s market are related to what is happening in the refining sector, and these influences are likely to be a continual feature this year.

Firstly, there have been a number of unplanned refinery outages, plus refinery maintenance programs are already higher than ‘normal’. Higher maintenance is expected to be a feature this year. This is because we have just been through two years of ‘light maintenance’ as margins have been so good; this year will be the time to ‘catch-up’.

Despite more maintenance, refinery crude throughput is still expected to hit a record high this year. New start-ups in Nigeria, China and Mexico, plus expansions and increased runs in the Middle East and India, will drive new capacity and throughputs much higher. These dynamics will have a significant impact on trade flows and volumes, and if the Red Sea/Suez Canal continues to be a ‘no-go’ zone, then disruptions and higher bunker demand may also be a continued feature of the market.

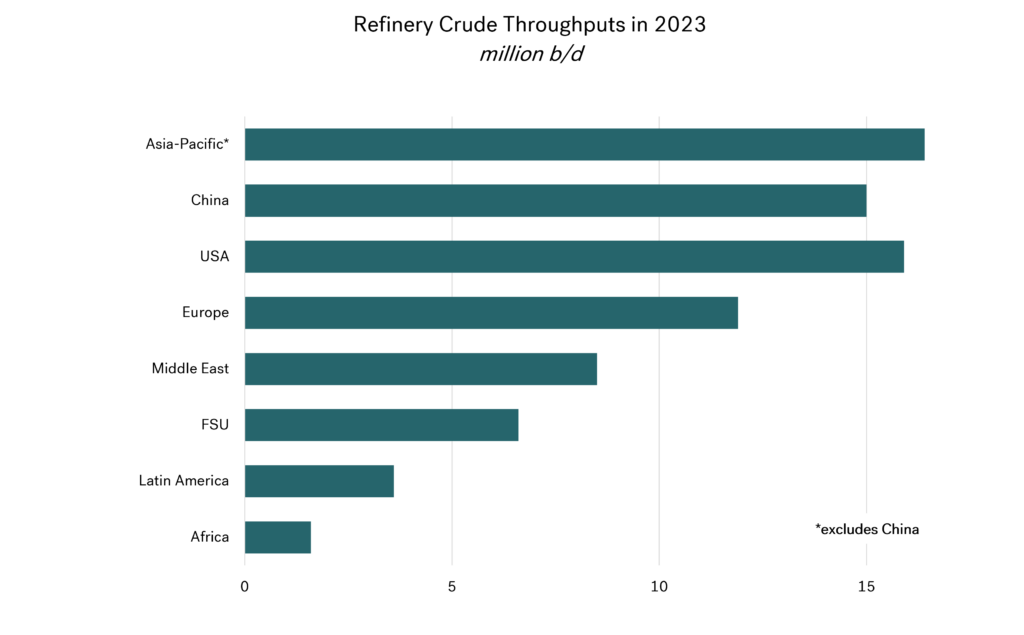

How big are the regional refining sectors?

Putting some context on what is happening in each region, last year China’s refinery crude throughput averaged around 15 million b/d, with the rest of Asia-Pacific at a similar level. This puts refinery crude throughput in Asia-Pacific at 31 million b/d, and way above any other area.

Source: Integr8 Fuels

Source: Integr8 Fuels

Crude throughput in the US was close to 16 million b/d, and then volumes scale back to 12 million b/d in Europe, 6.5 million b/d in the FSU, down to only 1.6 million b/d in Africa.

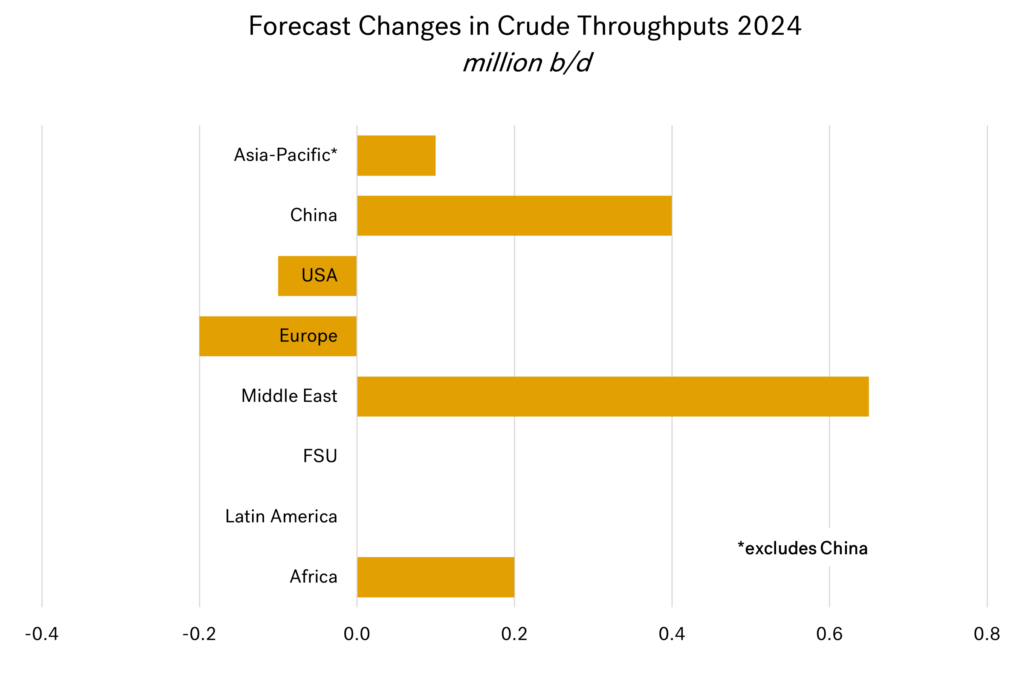

Where are the big throughput gains going to happen this year?

Firstly, the biggest increase in throughput this year is going to be in the Middle East, with gains in Kuwait, Saudi Arabia, Oman and Bahrain amounting to close to 0.7 million b/d more than 2023 levels (almost 8% higher).

Throughput in China is forecast to rise by around 0.4 million b/d, with the new 0.4 million b/d Yulong refinery expected to start up later this year and higher throughputs elsewhere. However, unlike other big refining centres, China has central control of crude imports and product exports, so there is always an upside and downside risk to throughput forecasts here.

Taking into account increases elsewhere, total crude throughputs in Asia-Pacific are projected to rise by some 0.5 million b/d this year (plus 2%).

Source: Integr8 Fuels

Source: Integr8 Fuels

There is a potential increase in African throughput, but this all hinges on the massive 650,000 b/d Dangote project in Nigeria. Like some other refinery projects, the start date has been pushed back numerous times. However, there are reports of crude oil moving into the site, which implies testing and commissioning of some units. Current expectations are for a start-up later this year, but this is one to watch closely as it will have significant implications for trade flows, potentially backing out gasoline from Europe to West Africa.

After this, the bigger story is possible declines in European and US refinery operations. Higher refinery maintenance programs and current outages in the US because of cold weather will impact throughputs. However, there are also ongoing threats of closures in both regions, and an extended period of weaker margins could trigger these.

Implications for product trade and VLSFO pricing

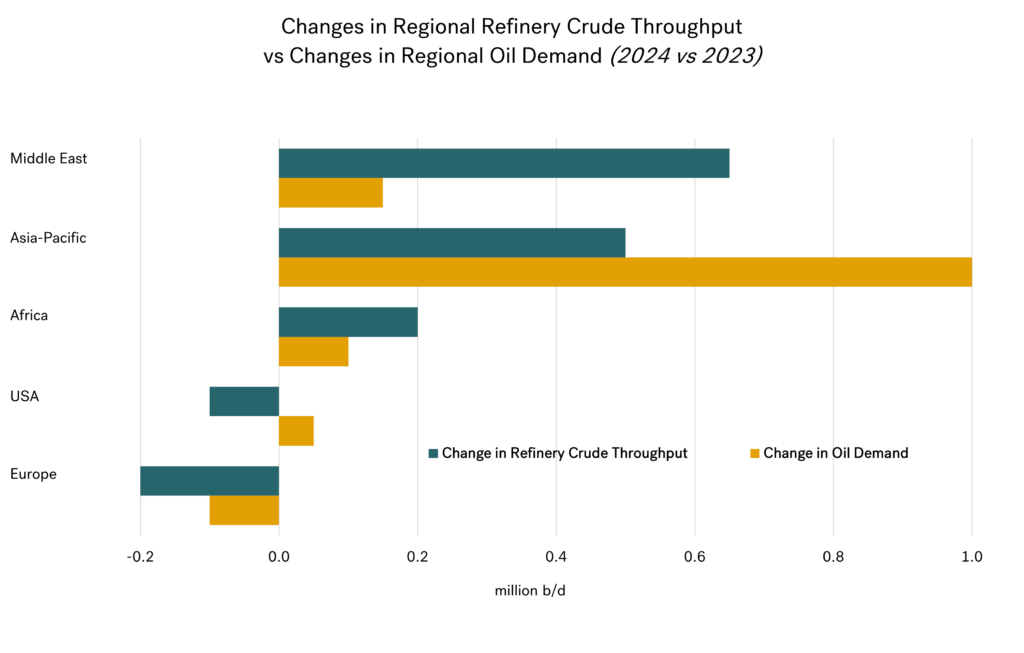

Bringing together increases in regional refinery throughputs and measuring these against regional increases in oil demand does offer a clear direction on trade flows and potential shifts in relative VLSFO pricing.

Two main pointers become clear. One is the increase in refinery runs in the Middle East this year will far exceed the gain in ‘local’ oil demand; runs up 0.65 million b/d and demand up 0.15 million b/d implies a rise of 0.5 million b/d in product exports.

At the same time, although refinery runs in Asia-Pacific are forecast to increase by 0.5 million b/d this year, oil demand is expected to be 1.0 million b/d higher. The implication is product imports into Asia need to increase by a net 0.5 million b/d this year.

Although the net imports into Asia match the forecast increase in Middle East exports, it doesn’t mean all incremental Middle East product exports will go east. Different products will have different surplus and deficit positions in all regions, so Middle East volumes will be pulled east and west; however, a bigger proportion of incremental Middle East exports are likely to go east.

Source: Integr8 Fuels

Source: Integr8 Fuels

As mentioned, the balance in Africa is highly dependent on the Dangote refinery project, but an increase in refinery throughput greater than the increase in regional demand would mean less product imports into the region and potentially product exports out.

Finally, oil demand in the OECD is ‘under threat’ and is at, or close to decline. At the same time, refinery operations in Europe and the US could also fall. It is then a question of which falls further, oil demand or refinery throughputs?

Based on this analysis, there could be an increase in demand for diesel and jet imports into Europe, which would have to be ‘pulled in’ from the Middle East/India. This is long haul trade, which could be made even longer if the situation in the Red Sea is not resolved.

In the US, the position is less clear, as both demand and refinery operations could go either way this year, although in the longer run both are expected to decline.

More product trade from the Middle East pulled east and west

Looking at the net product trade positions in the main bunkering centres of Singapore and Rotterdam, it seems both regions are going to need increased imports and that most of these volumes will have to come from the Middle East. This has implications for trade, delays, bunker demand, but importantly for us it implies no obvious oversupply or relative weakness in VLSFO pricing in either bunkering centre in 2024.

VLSFO is likely to trade at an increasing premium to crude oil in 2024. Watch crude, and then add a bit more!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.