What could the unstoppable environmental pressures mean for oil & especially the bunker market?

Natural gas & LNG prices have spiked & it has impacted on bunker prices

In the past, we have highlighted the impacts on the bunker market from demand and pricing issues for other oil products, such as gasoline, diesel and jet. However, we have just seen a surprising, larger narrowing in the VLSFO/HSFO price differential due to what is happening in the natural gas and LNG markets. Although the VLSFO/HSFO differential has widened again in the past few days, we are not necessarily ‘out of the woods’ and we have to extend the influences on supply and pricing in our markets in order to look at what is happening in the natural gas and LNG sectors.

Until now, it may have seemed strange that a bunker report was focused on what is happening in natural gas and LNG, but gas prices hit record highs earlier this month and have caused shock waves in power generation and industry. As a result, oil, and in particular HSFO, has become an attractive economic alternative into power generation.

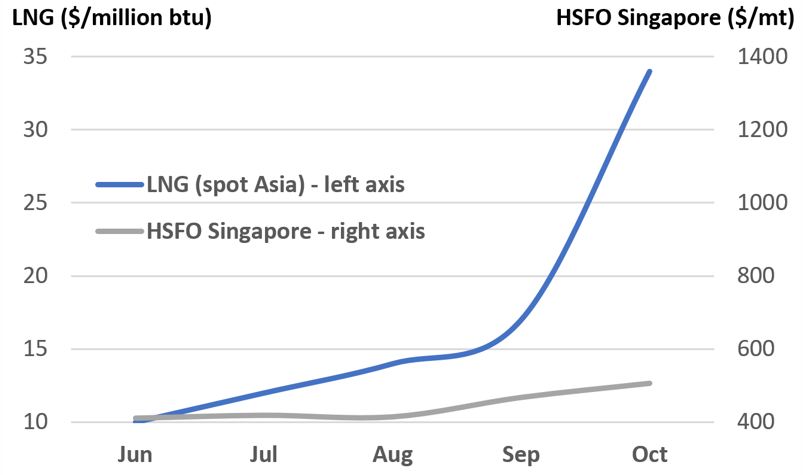

To give some backdrop to this, we are just starting the northern hemisphere winter and there has already been a tightness in stocks and rising demand for natural gas/LNG as we continue coming out of the pandemic. The net result has been spot LNG prices spiked at record highs of $56 per million btu earlier in October; up from $6 in May, $10 in June and around $17 in September. Prices have since eased back to around $34 per million btu, but they are still at exceptionally high levels.

Where-as spot LNG prices are up by almost 300% since July, monthly average crude prices are up by $9/bbl for Brent (plus 13%) and HSFO bunkers in Singapore up $87/mt (plus 21%). The graph below uses comparable scales on each axis and illustrates clearly the extent of the current price premium for LNG over oil. This explains why power generation companies with oil-fired capacity have come looking at ‘our’ market to use oil to produce electricity.

Source: Integr8 Fuels

Given the tight fundamentals in the natural gas (and coal) markets, this demand for oil in the power sector could hit at various times throughout the northern hemisphere winter, even if we see mild weather conditions. The current LNG forward curve suggests this, with prices above $30 per million btu right through to next March. There are forecasts of a colder winter, and if this is the case then demand on oil-fired power generation could be even greater.

New demand for HSFO into power generation

Although gasoil is part of the oil supply into power generation, especially in small, local back-up generators, big utilities have put out tenders for HSFO. For instance, Kuwait has already been in the market for 420,000 mt of HSFO in the third quarter and Pakistan was looking for 275,000 mt for November delivery (last November they were looking for 70,000 mt). There are wide ranging views of how much oil-fired power generation is available, but the vast majority of capacity is in Asia (Japan, Pakistan, Bangladesh and S. Korea) and the Middle East.

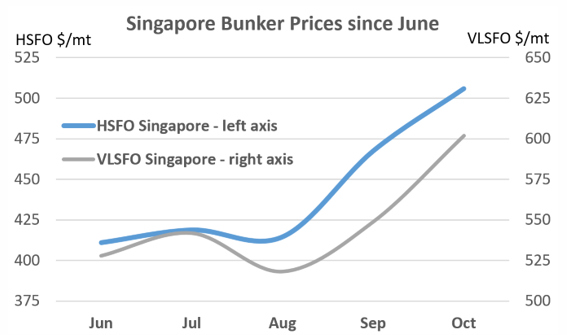

During this period when power utilities were buying oil, greater pricing pressures were on HSFO, rather than the 0.5% sulphur VLSFO. This is shown in the graph below, highlighting monthly average bunker price developments in Singapore HSFO and VLSFO since June (HSFO pricing is against the left axis with an axis range of $150/mt and VLSFO against the right-hand axis with the same $150/mt axis range).

Source: Integr8 Fuels

The emphasis in Singapore has been more on HSFO than VLSFO. The price of VLSFO largely tracked the increases in crude oil prices between July and mid-October, but the added demand for high sulphur fuel oil into power generation pushed the relative price of HSFO bunkers much higher.

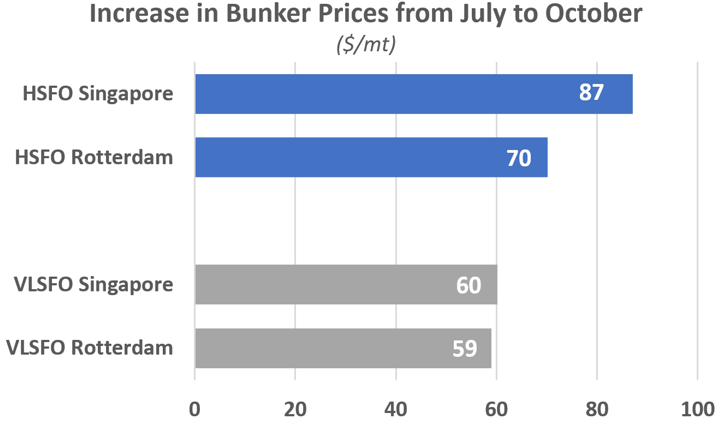

Because the vast majority of oil-fired power generation buying is east of Suez, so the recent impact was focused on the Singapore bunker market rather than in the West. Over the three months to October, average HSFO bunker prices in Rotterdam have still risen by more than VLSFO, but the strains have not been as great as in Singapore. Summarising the July to October period, VLSFO was up by around $60/mt in both markets, whereas HSFO was up $70/mt in Rotterdam, and Singapore was the most extreme with HSFO up $87/mt.

Source: Integr8 Fuels

High gas prices did narrow the Singapore VLSFO/HSFO spread

The outcome of these pressures and price movements was an unexpected shift in the VLSFO/HSFO spread in Singapore. In earlier reports we have highlighted the impact of the pandemic and that demand losses in the bunker market have been far less than most other oil products (e.g. gasoline, diesel, gasoil and especially jet). With VLSFO typically a blended product, the weakness in demand and pricing for these other products and components meant VLSFO pricing was relatively weak. In contrast HSFO pricing was relatively strong against the rest of the oil barrel because of the ‘better’ demand position and a huge cut in supply from much lower refinery throughputs.

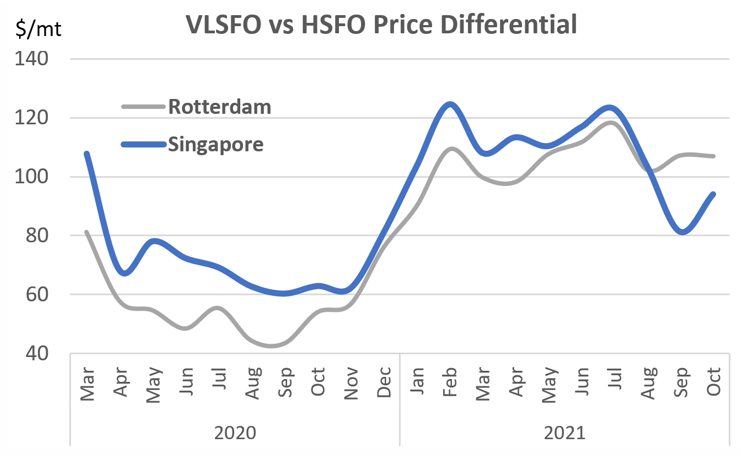

These divergent trends in VLSFO and HSFO pricing last year led to the squeeze in their price differential, to only $60/mt in Singapore and close to $40/mt in Rotterdam. Expectations were always that as global oil demand increased coming out of the pandemic, this squeeze would be reversed; higher demand for gasoline, diesel/gasoil and components would strengthen their relative prices and also drive the price of VLSFO along with it. At the same time, there would be only minimal gains in HSFO demand and refineries would operate at much higher levels, increasing the availabilities of HSFO; so, the relative pricing for HSFO would become weaker. All this played out ‘as expected’ from the back end of 2020 right through until early August this year; the VLSFO/HSFO spread doubled, to $110-120/mt in Singapore and to$100-110/mt in Rotterdam.

Source: Integr8 Fuels

Because of developments in natural gas/LNG pricing, all this started to change around mid-August. That was when power utility buyers entered the high sulphur fuel oil market and the VLSFO/HSFO spread ‘unexpectedly’ narrowed again, to average $80/mt in September and get as low as $60/mt in early October. The impact in the West was nowhere as evident, with the VLSFO/HSFO spread still averaging more than $100/mt.

These developments are not permanent, but could be repeated

In the past few days, we have seen another dramatic change, with the VLSFO/HSFO spread widening again to more than$120/mt in Singapore. Some of the contributing reasons for this have been a build in Singapore stocks and lull in power utilities buying or putting out tenders for fuel oil, with for instance Pakistan stepping back from the market.

However, we are still only at the start of the northern hemisphere winter and these pressures in the market for natural gas/LNG are expected to last through to February/March. We could easily see power utilities entering the market again with another buying surge for HSFO east of Suez.

We have to watch the weather, the natural gas/LNG markets and the potential buying from oil-fired power utilities and if this takes place, we could expect another narrowing across the VLSFO/HSFO spread in Asia this winter.

As we come out of winter, demand for oil-fired power generation is expected to ease and any pricing pressures on HSFO removed. However, the squeeze we have just seen at an early stage in the northern hemisphere winter may not be a one-off. The pressures look as though they could be here for a number of years to come and if so, we could see more squeezes and seasonality in the Singapore VLSFO/HSFO spread.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.