What could the unstoppable environmental pressures mean for oil & especially the bunker market?

The environment & COP 26 come back into focus

Over the past 18 months all of the talk has been related to the pandemic, but worldwide politics is shifting and the environmental question is coming back into focus. The build-up to COP 26 starting on October 31st in Glasgow is likely to re-energise the debate. In this report we take an overview of the longer-term prospects for the oil markets and where this could leave the bunker sector in the run-up to political targets set for 2050; it is intended to be agnostic and an attempt to summarise current expectations over the much longer term.

Oil demand forecast to continue growing for at least another 10 years

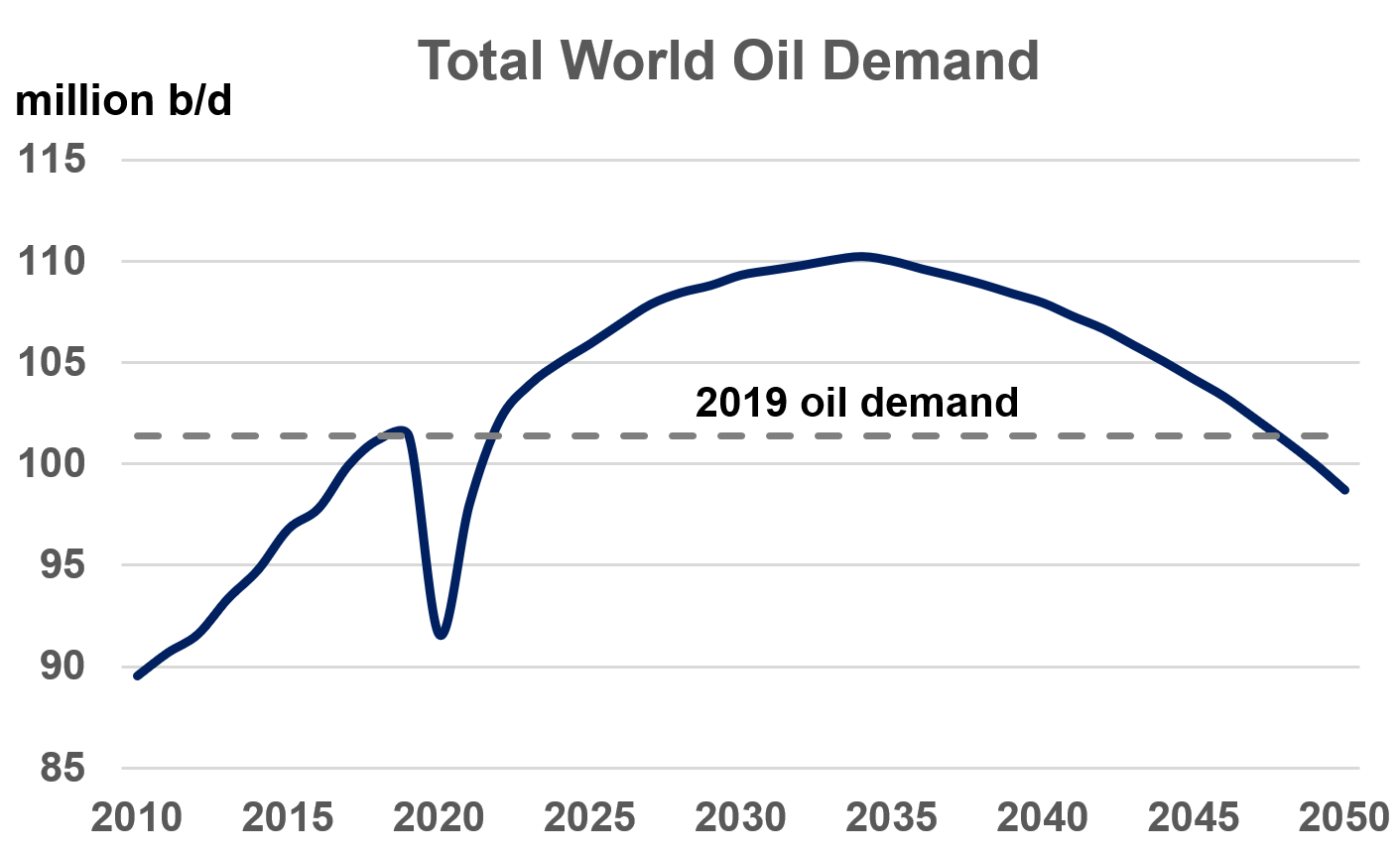

The first headline is that after the collapse in demand last year, expectations are that the oil market will continue to grow for at least another 10 years, with a number of analysts generally pointing to peak oil demand being reached in the early to mid-2030s.

A consensus view is that the political agenda, legislation, company strategies and personal choices will start to reverse growth in global oil demand from the mid-2030s onwards. The trajectory of decline is difficult to asses at this stage, and analysts have tended to set out various scenarios, but in the illustration here we show a decline that puts oil demand in 2050 just below the peak level seen in 2019 (and more-or-less at the same level as expected for this year).

Though environmental measures will hit oil & bunker demand

The oil market is huge, and structural changes take a long time; for example, most of the gasoline and diesel cars coming out of showrooms today will still be around in the early 2030s and fossil-fuelled ships from the yards will still be operating in the 2040s. However, during the 2040s almost all new cars sales are expected to be electric vehicles (EVs), along with a number of new electric commercial vehicles, leading to the reverse from a growth oil industry to a declining one. This is hugely significant and why companies are adapting (or will be forced to adapt) to this new ‘more environmental’ world, including the shipping and bunker sectors.

Different regions will be ‘hit’ at different times; Europe first?

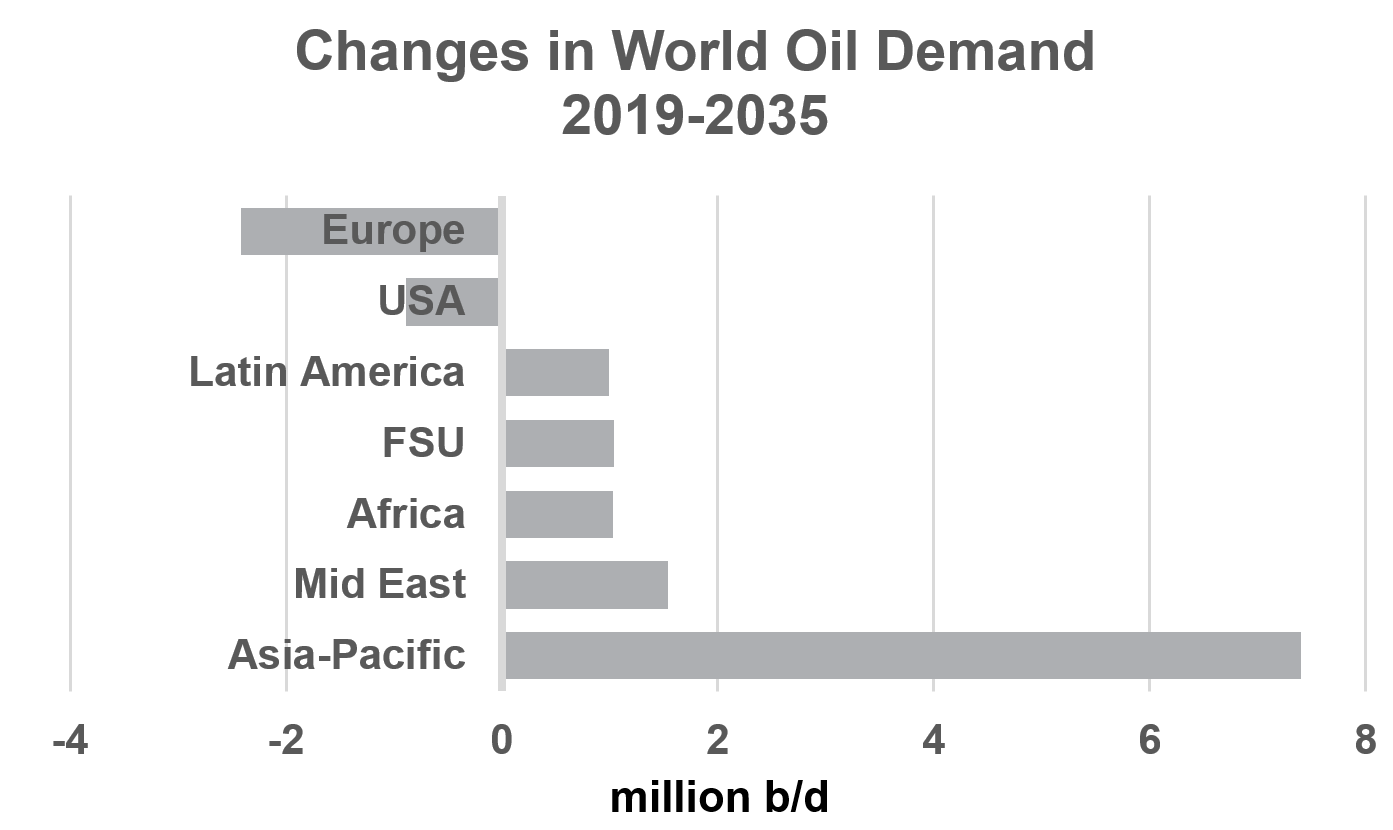

The ‘helicopter view’ of the global market shows this rise and fall through to 2050, but governments, economies and regions will all trend at a different pace. Generalising on Europe as a whole, this is a well-established, ‘low growth’ economy and structurally easier to achieve a reduction in oil demand; oil demand in Europe could fall by around 2 million b/d between 2019 and 2035 (close to a 15% drop).

The shift in the US administration is now expected to support greater environmental moves, and here oil demand is also expected to fall through to 2035, although at a lower rate of around 5%.

However, in all other regions oil demand is expected to continue growing, with economic developments outweighing the environmental shifts over the next 10-15 years. The obvious ‘power-house’ behind the oil markets in this period is Asia-Pacific.

Ultimately oil demand is expected to decline

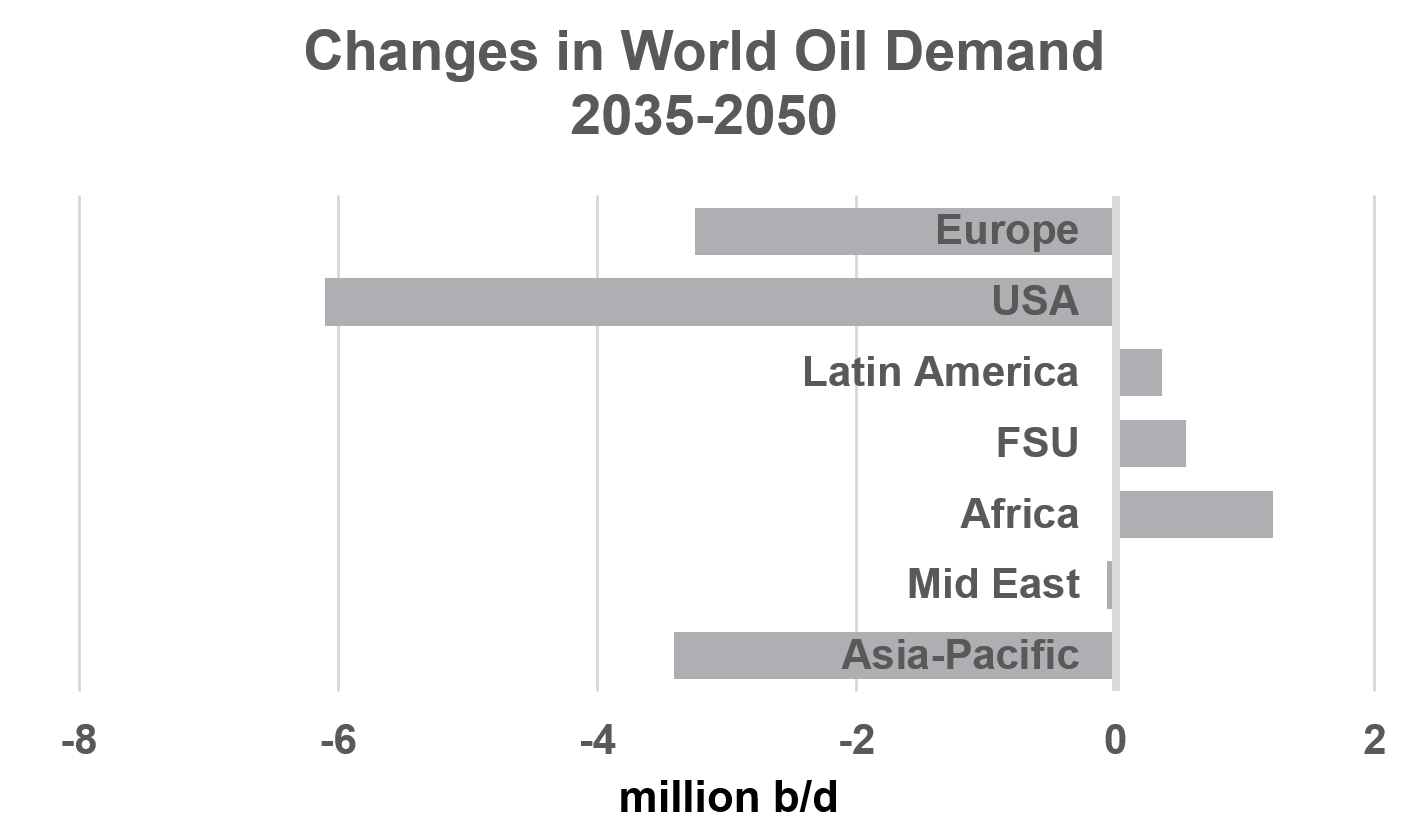

It is the long-term nature of structural changes in the oil sector that means the big, global shift in demand is more likely to start in the mid-2030s and accelerate through the 2040s. Changes in environmental regulations, consumer demands and company responses take time; existing legislation, decisions from COP 26 (and further down the line) are only likely to be seen on a global scale some 15-20 years from today.

It is in this longer time frame that all the big changes are likely to take place. European demand is expected to fall even further (down by around 20% over 2035-50), but the US market could see an even bigger structural change (down 30%), and significantly, demand in the Asian economies could be reversed and start to fall (by around 10% between 2035-50) as environmental developments overtake drivers from economic expansion.

Oil demand in some regions is still forecast to grow in this longer-term period, but the dominance of Asia-Pacific, the US and Europe all in ‘environmental mode’ would far outweigh developments in these other areas; oil demand globally would be in decline.

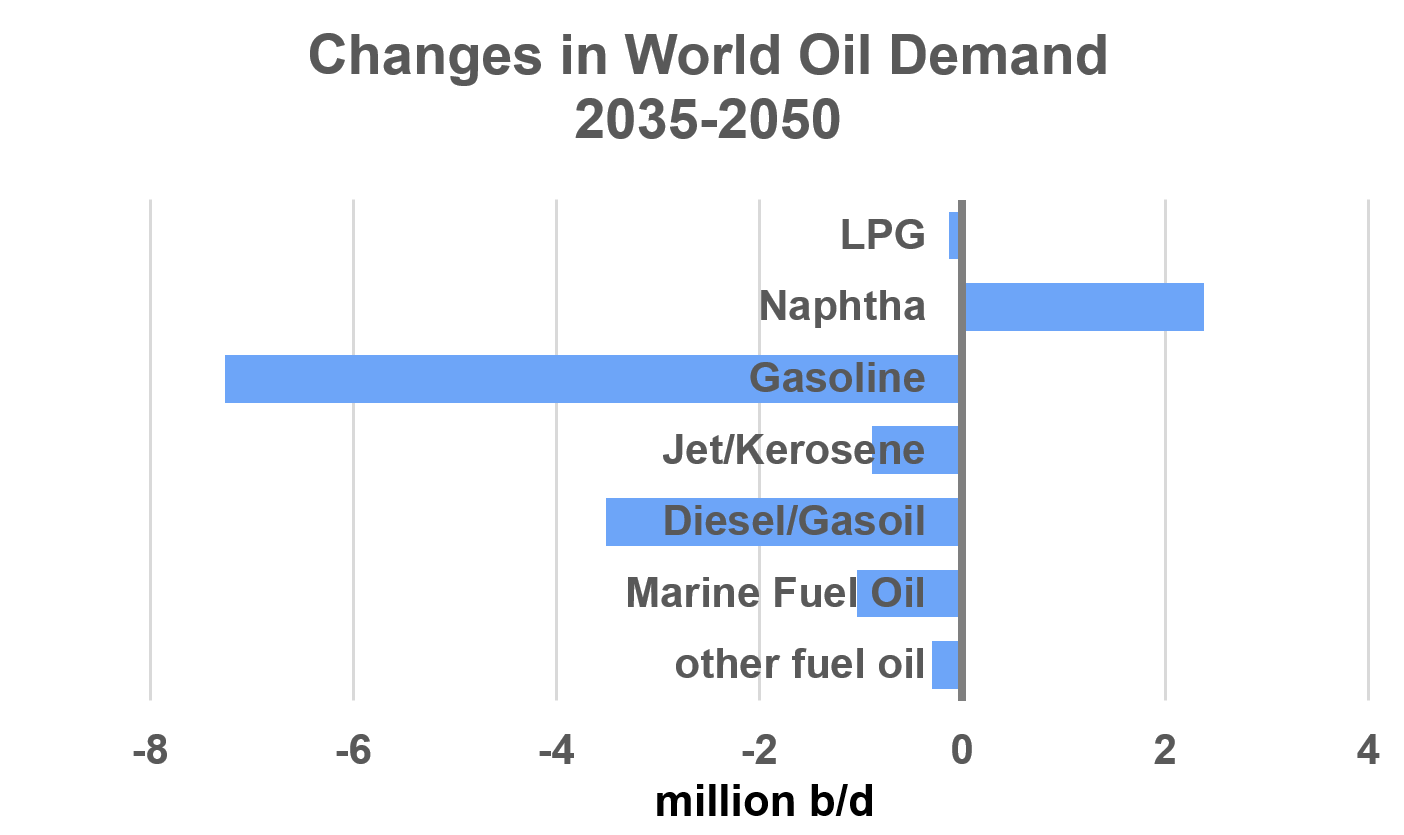

Impacts on demand for different oil products will also vary

So far, we have looked at overall oil demand globally and by region, but what about individual products, and specifically demand in our sector, the bunker market?

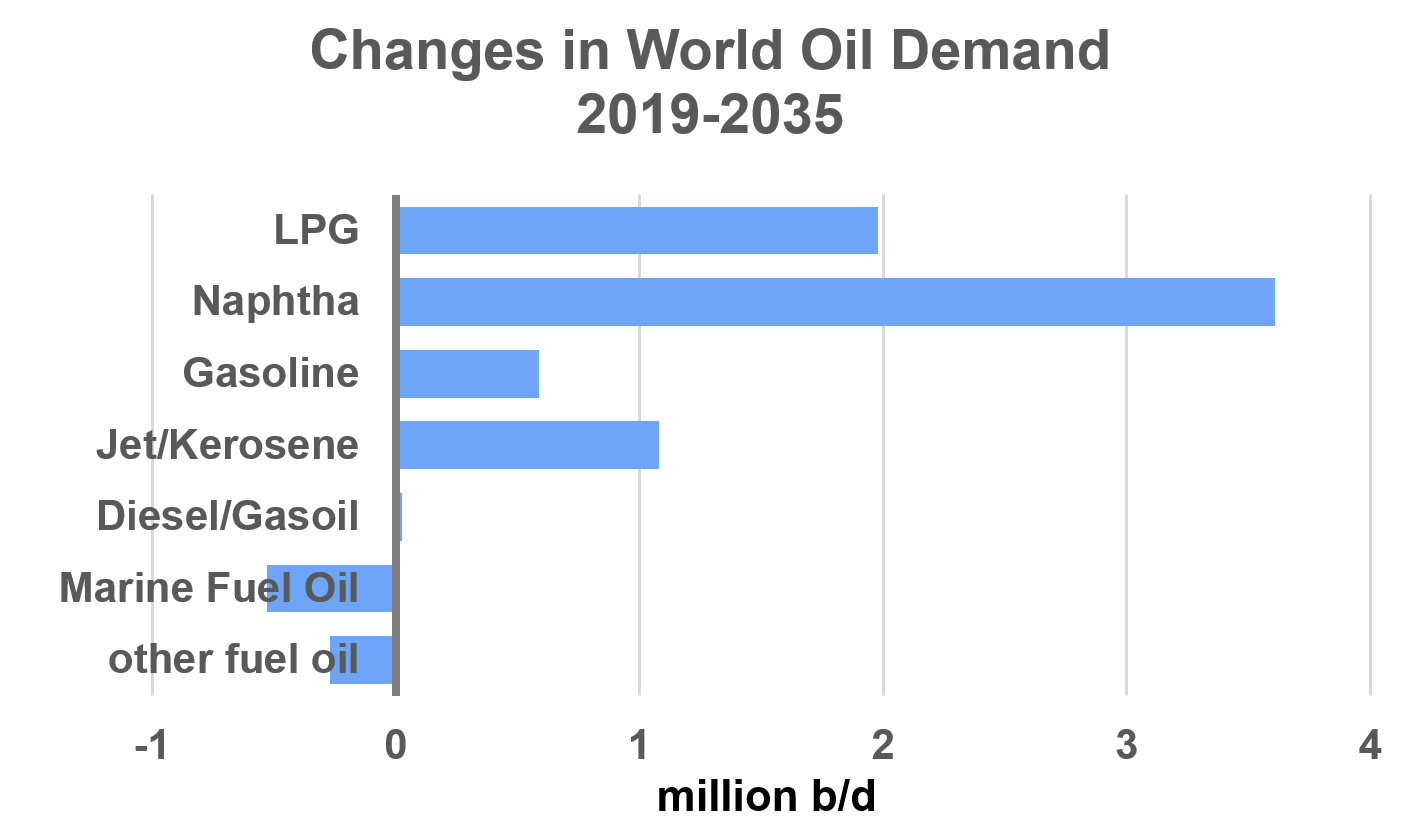

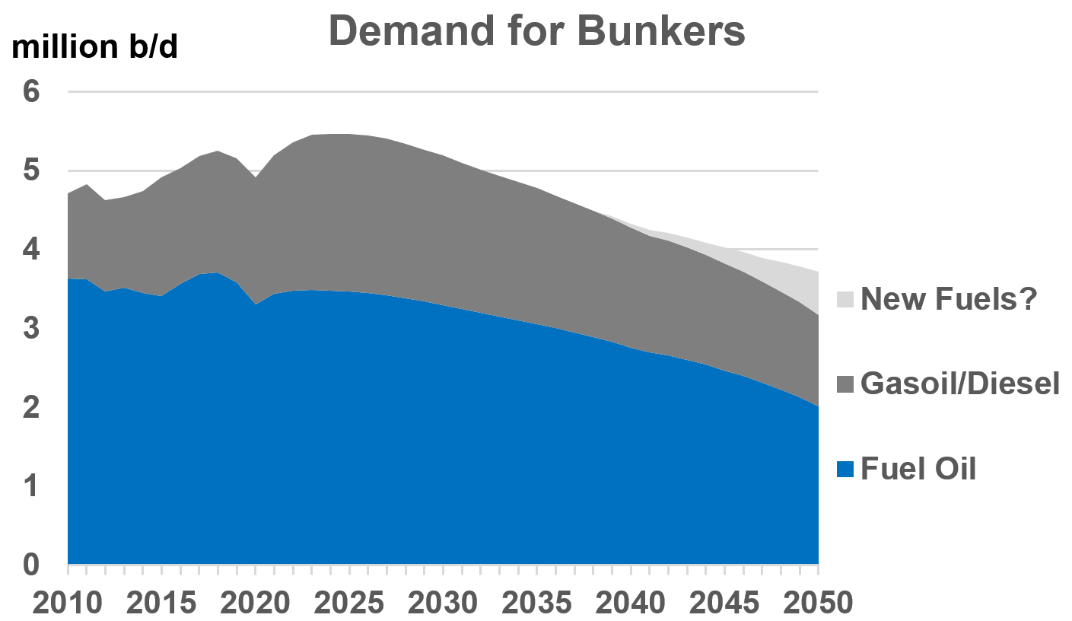

Growth in oil demand over the next 10-15 years is focused on petrochemicals (naphtha and LPG) and transport fuels in Asia-Pacific (gasoline and jet). The general view is that demand for marine fuel oil will start to fall in the next few years and that requirements could be some 0.4 million b/d (25 million tons p.a.) lower by the mid-2030s, equivalent to a 10% drop.

This shift is not surprising given the current push towards greater efficiency in the shipping industry and the IMO mapping out legislation and indices for the measurement of carbon intensities. These are destined to come into effect in 2023 with the Energy Efficiency Existing Ship Index (EEXI), the Ship Energy Efficiency Management Plan (SEEMP) and the Carbon Intensity Index (CII).

There is talk and discussion around alternative fuels, but even in this longer time-frame to 2050 the mainstay of the shipping industry is still likely to rely on fossil fuels and so any environmental gains are most likely to be met by the lower use of fuel oil and gasoil (i.e. greater efficiency).

In the longer-term period to 2050, petrochemical demand is still forecast to grow (although there is obviously a huge debate here about plastics use). However, the structural change towards electric vehicles (EVs) is expected to ‘kick-in’, hence a reversal in gasoline and diesel demand, with global gasoline falling by around 7 million b/d (minus 25%) and diesel by 3 million b/d (minus 10%). Jet fuel demand is also expected to fall, with increased aircraft efficiency and the use of biofuels.

In our business, bunker demand is expected to continue falling throughout the longer term to 2050, but other parts of the oil market are likely to overtake ours in terms of radical shifts. Again, the size of the bunker is expected to fall with greater environmental efficiency gains, rather than any decline for international trade and movements.

What could this mean for the size of the bunker market?

There are various indications of the total size of the bunker market, but for these purposes it is estimated at around 275 million tons p.a. for all ships (5 million b/d). The IMO has recently published a lower figure of 213 million tons p.a. for vessels above 5,000 GT in international trades.

With IMO legislation and strategies, plus political pressures from outside of our business and more stringent environmental requirements from the users of shipping, the demand on the shipping industry to hit environmental targets is clear.

Whilst there is talk of alternative fuels, ‘traditional’ fossil fuels are still likely to dominate our sector by 2050. This means the industry will have to achieve much greater efficiency (slower steaming for older vessels in the near term and technological advances in the longer term?). The bottom line is the size of the bunker market will fall from a current estimate of around 275 million tons p.a. and could reach around 250 million tons by 2035 and 175-200 million tons by 2050; its still a big business, but not as big as today; down 10% by 2035 and another 25%between 2035 to 2050?

It’s a long way out to forecast, but the environmental pressures are there

Summarising, this is a consensus case, where a number of higher and lower scenarios will also be valid. But it is always worth putting a ‘line in the sand’ and the discussions can move around this. Let’s see what the politicians and COP 26 come up with between now and November, and then the impact from the unstoppable moves towards a more environmentally acceptable path.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.