We may be in an oil-dominated bunker market for at least another 10 years; but we cannot stand still!

BP’s latest analysis looking at the energy sector to 2050

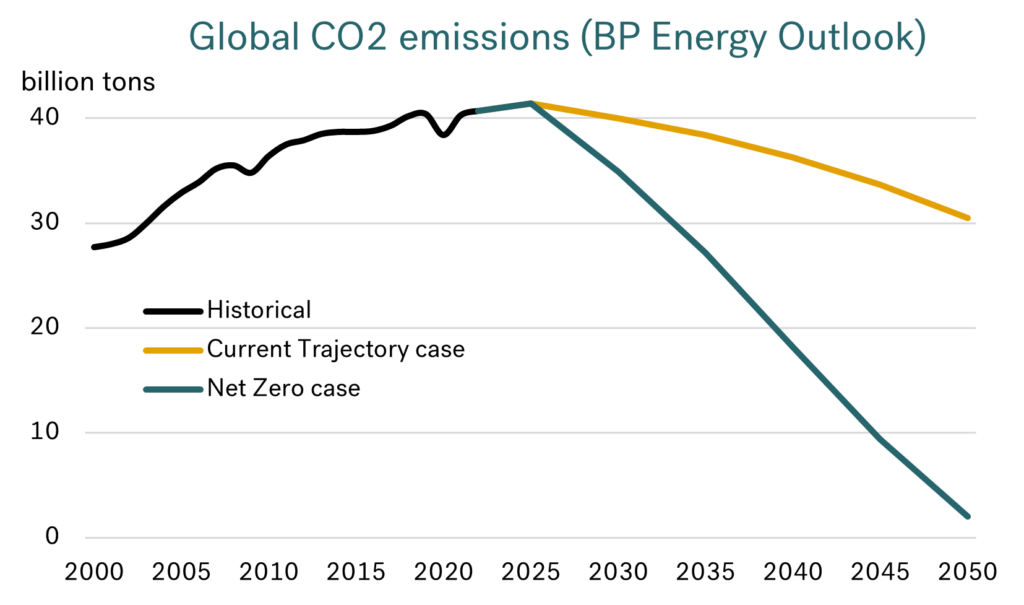

BP has just published its annual ‘Energy Outlook’ looking at two scenarios going through to 2050. These are not forecasts, but illustrate two cases, the first reflecting what it would take to reach ‘net zero’ by 2050, and the second showing a scenario if the world continues on its ‘current trajectory’ of policies and timings towards environmental measures.

A picture paints a thousand words!

Historically, the graph below shows how CO2 emissions have risen since 2000 and that the environmental measures taken so far have not been enough to stop increases in global CO2.

Source: BP

Source: BP

Looking to the future, the net zero case highlights the extreme challenges the world faces to achieve this target by 2050. It is literally the ‘bottom line’ for any scenario looking at the future for energy, and a 95% decline in CO2 emissions would clearly have an inconceivable impact on almost all industries, including our own.

Even BP’s ‘current trajectory’ case indicates a turning point and a 25% decline in CO2 emissions by 2050. This is still a major shift from where we are today and would require significant changes in bunker fuels to take place (as is shown later in this report).

A focus on BP’s oil and shipping analysis

In their outlook BP cover oil, gas, coal, power, and low carbon hydrogen. However, in this report we focus on BP’s scenarios for the oil sector and their cases for marine fuels.

The first main point is that in both scenarios there is a forecast major increase in seaborne trade; a 70% gain in the current trajectory and a 30% gain in the net zero case by 2050. Despite this, with greater efficiencies and shifts they see no net gain in energy demand for shipping under the current trajectory case, and a 20% decline in net zero.

The common theme in both cases is that BP see a move away from oil as a bunker fuel and a shift to what are currently viewed as ‘alternative fuels’. This is through the delivery of new ships capable of running on alternative fuels and the retro-fitting of older ships to use these alternative fuels. In this way, biofuels and low carbon hydrogen are potentially the biggest elements of the bunker market going forward, especially moving towards a ‘net zero’ world.

What is the outlook for oil demand in the two BP scenarios?

Electrification is going to be the major shift in the energy balance. The ever-falling cost structure of wind and solar power is accelerating this transition. For oil markets, there is already a seismic shift underway in the electrification of road transport markets, away from gasoline and diesel towards EVs (and electric trucks sometime in the future).

Although shipping is generally a ‘hard to electrify’ industry, we are not immune to what is happening elsewhere in the oil sector. The loss in gasoline and diesel demand could have a major knock-on effect on refining.

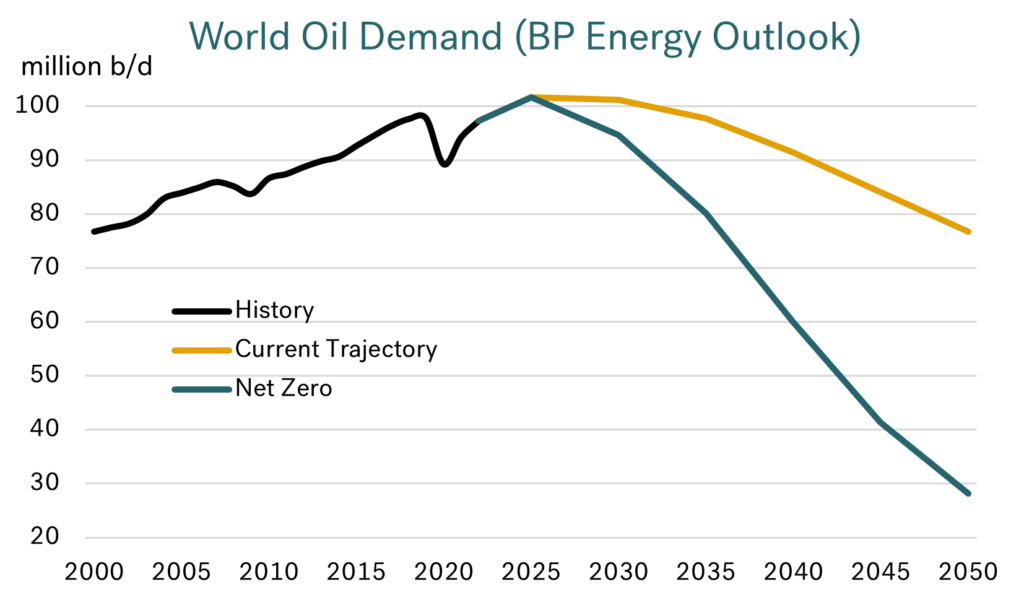

It is not surprising that the future profile for oil demand is very much aligned to the success, or not of reducing global CO2 emissions. Hitting the net zero target by 2050 (or whenever this may be) would mean a near non-existent oil industry.

Source: BP

Source: BP

In contrast, BP’s ‘current trajectory’ case would mean the size of the oil industry stays more-or-less the same as it is today through the next 10 years. It is only in the 2035-50 period that oil demand declines, and then only taking it back to the same size of the market we saw in 2000.

The make up of the oil industry is going to change, whatever happens

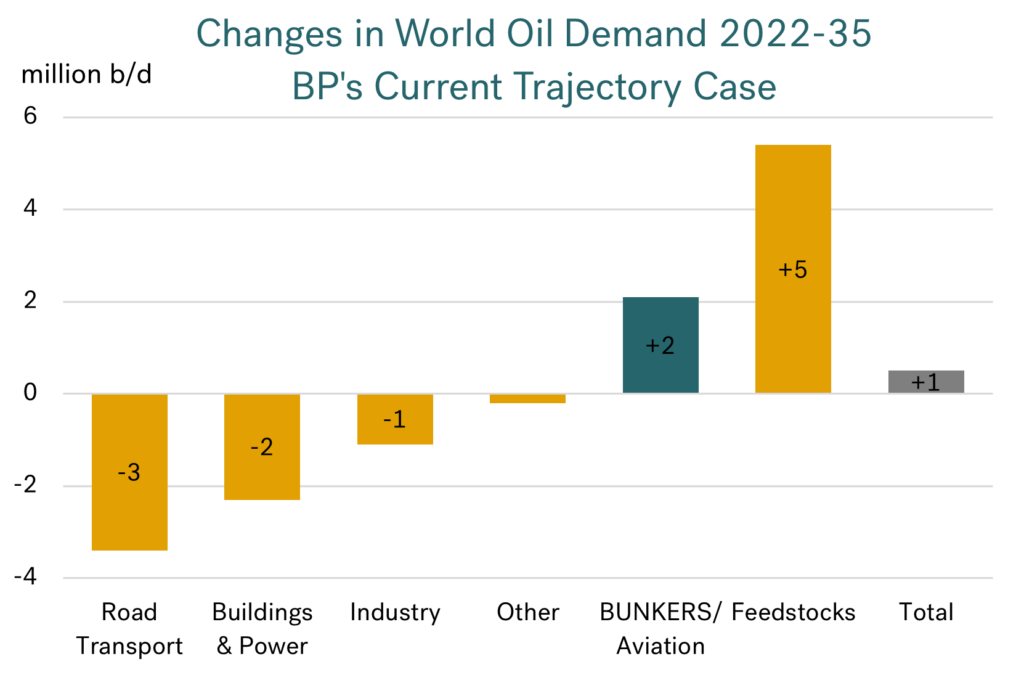

Even with very little change in the overall size of the oil market through to 2035 under the ‘current trajectory’ case, the refining industry must still adapt. The graph below highlights the shifts in demand for different sectors:

- moving away from gasoline, diesel, and gasoil; the products in decline because of electrification in road transport, buildings and industry;

- and towards the growth markets, including bunkers and aviation, but especially into lighter end products as feedstocks into the petchem industries.

Source: BP

Source: BP

What about in the much longer term?

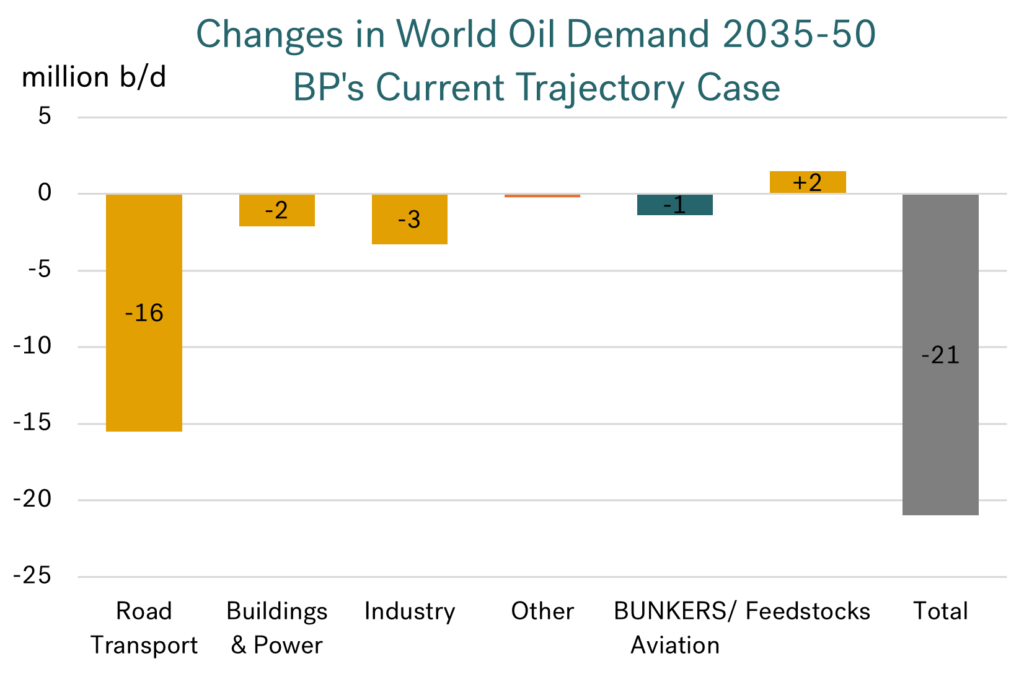

In this same BP case, the significant changes in the size of the oil industry and the balance in products takes place after 2035. The more rapid moves away from gasoline, diesel, and gasoil indicate a 20% decline in the size of the oil industry in this 2035-50 period (as opposed to the 1% gain over 2022-35).

Source: BP

Although the scenario shows only a small decline in oil use in bunkers and aviation, this is against significant increases in seaborne and air travel. The pointers are we are moving more towards alternative fuels.

The drive to alternative bunker fuels must continue

The current discussions, investments, and technologies in alternative fuels for shipping are testament to the future needs for our industry.

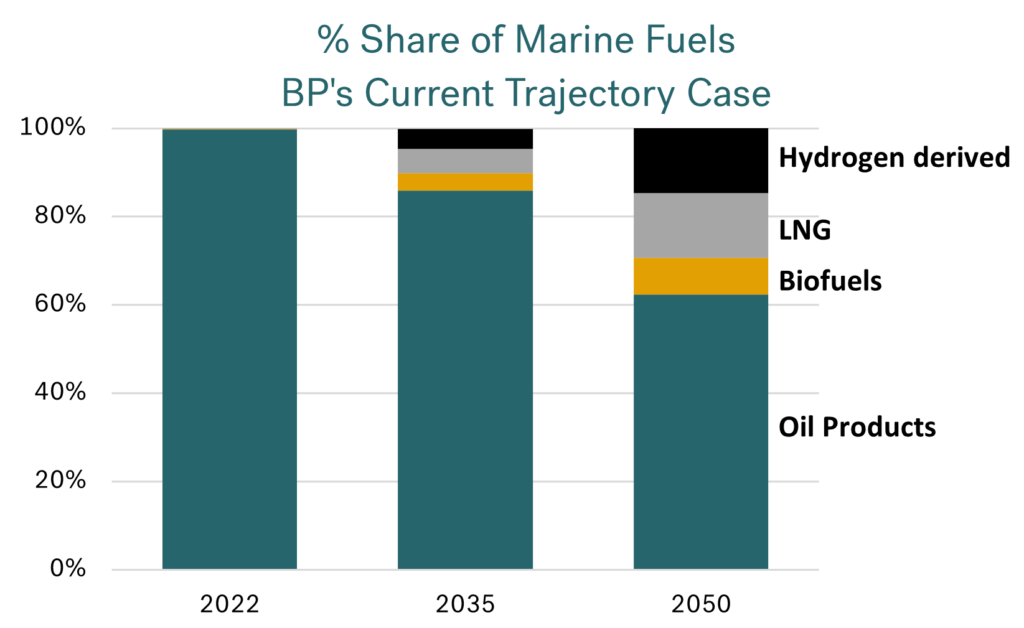

BP comment on this and in the next 10 years highlight LNG, biofuels (bio-methanol and biodiesel) and hydrogen derived fuels (ammonia and methanol). In their current trajectory case, they see these alternative fuels accounting for around 15% of the bunker market in 2035, BUT reaching close to 40% of the market by 2050.

Source: BP

Source: BP

For a 40% share of the bunker market by 2050 an enormous amount of work has to be done in low carbon shipping, especially considering the lead times in the industry.

What about the net zero case, whenever it may happen?

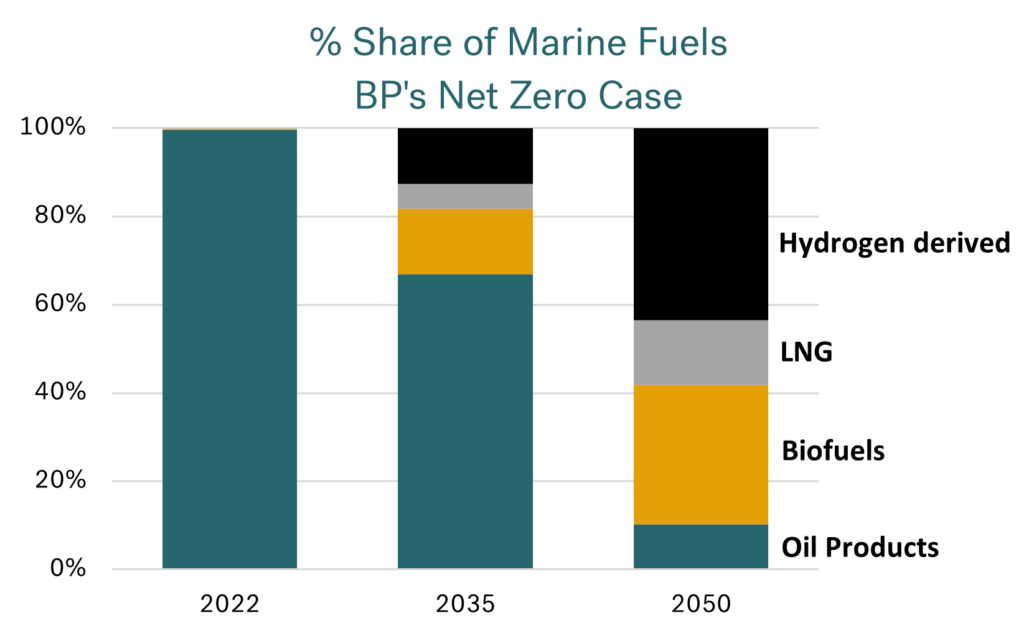

An even more radical approach must be adopted if ‘net zero’ is to be met, even if the target or achievement is after 2050. In their net zero case, BP put oil products at only 10% of the bunker market. The growth in LNG is also constrained in this case, again as it is a fossil fuel.

In a decarbonised world there would have to be a strong drive into biofuels and hydrogen derived fuels to achieve the ‘net zero’ balance.

Source: BP

Source: BP

As we are currently seeing in the wind and solar power sectors, we need high volumes and lower costs in hydrogen derived fuels to make low carbon shipping possible.

No big changes in the bunker market in the next 10 years, but that doesn’t mean we can do nothing!

In general terms, a number of analysts are still indicating oil demand rising through the next 10 years or so, and pushing the point of peak oil demand to around the mid-2030s. In fact, Goldman Sachs Research has just put out an article along these lines, with peak demand another decade away and then plateauing around this level for another few years (i.e. not falling until the late 2030s).

So, it seems oil is going to be the key supplier to the bunker market for at least the next 10 years or so. This could instil a degree of complacency, but given political direction, public sentiment and impacts on the oil industry outside the bunker sector, it is only a question of time when ‘alternative fuels’ dominate our business, even if it is post 2050.

Given the lead times and the technological advances needed, it is clear we have to continue to drive our industry forward along a low carbon path.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.