We are at a 3 year low in prices, but not for VLSFO in Singapore!

Crude prices have fallen to 3-year lows

In the monthly reports this year we have often highlighted the bearish fundamentals within the oil industry, especially those from the IEA. The IEA has for some time been forecasting very low growth in global oil demand for this year. Last month we also emphasised the shift in analysts’ views from a bullish to a bearish outlook on prices for 2024/25. These bearish fundamental views are certainly being fulfilled at the moment.

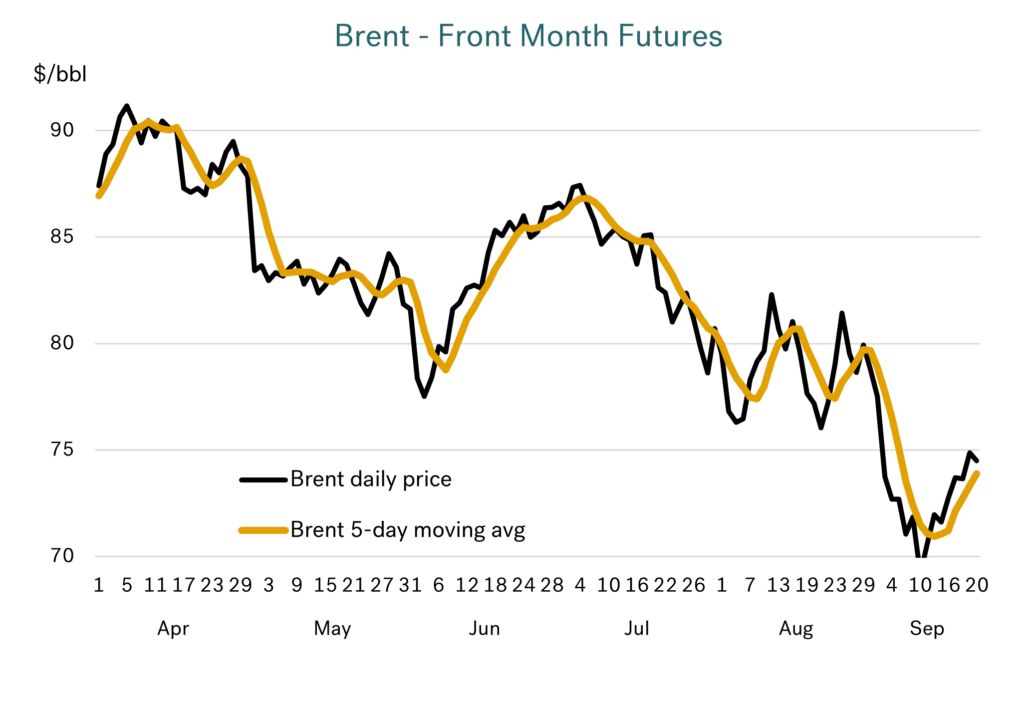

The graph below illustrates the downward moves in Brent crude prices over the past 6 months, falling from:

- around $90/bbl in April;

- to the $80s in May, June and July;

- to just below $80/bbl in August;

- and now into the low $70s (after falling to just below $70/bbl, its lowest since December 2021 – almost 3 years).

Source: Integr8 Fuels

Source: Integr8 Fuels

This equates to a 20% fall in crude prices since April and has taken place despite heightened tensions in the Middle East, relatively low oil stocks and OPEC+ recently deferring any increase in production by at least 2 months, until December.

The bearish fundamental signals are currently dominating the market and are clearly strong enough to overcome all the other political, war-related and OPEC+ factors!

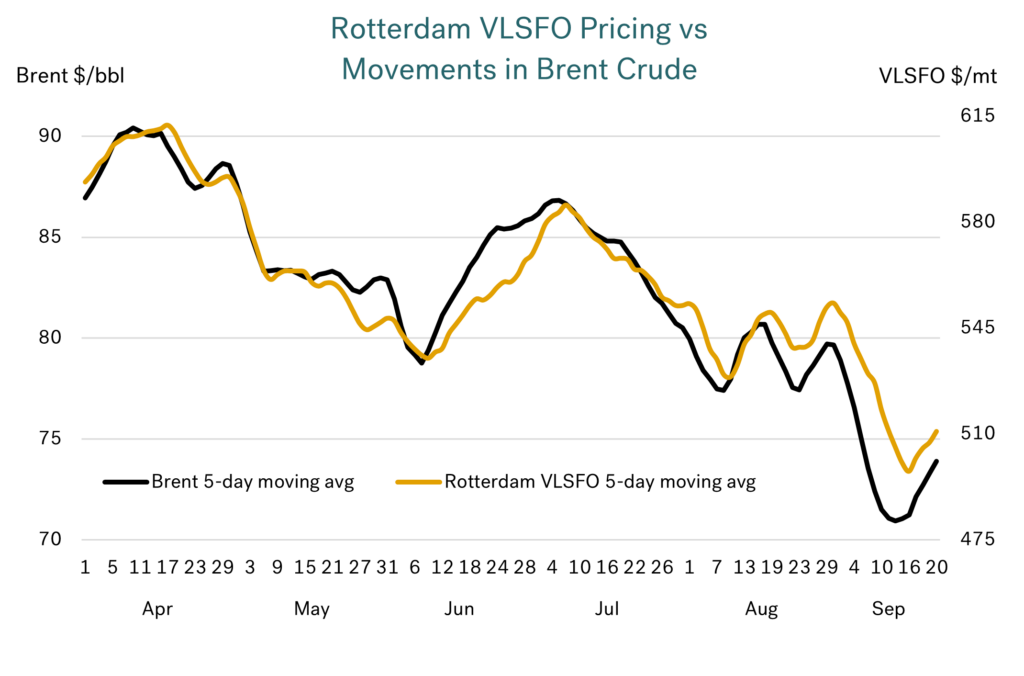

Rotterdam VLSFO prices have tracked crude

For us, the focus is what is happening to bunker prices, and the ‘easiest’ analysis is in the Rotterdam VLSFO market. Here, these bunker prices have closely tracked the developments in Brent crude, such that earlier this month Rotterdam VLSFO prices dipped below $500/mt and have been at their lowest for some 3 years. Current prices are slightly higher, at around $520/mt, but are still tracking the bearish sentiment of the crude market.

Source: Integr8 Fuels

Source: Integr8 Fuels

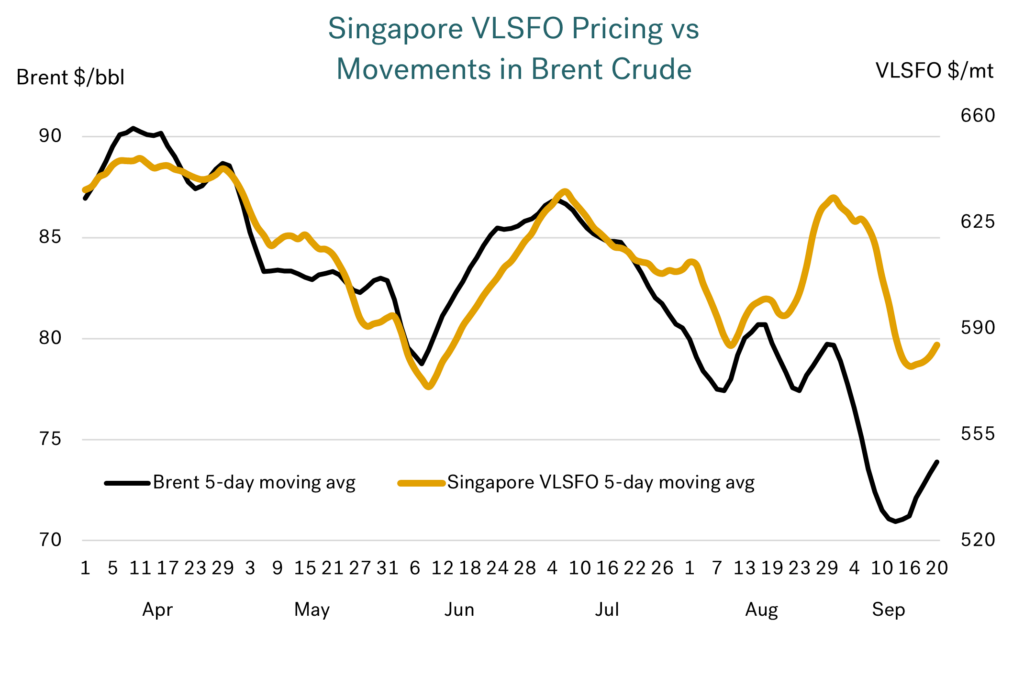

Singapore VLSFO prices have bucked the trend

There is a different story when it comes to the VLSFO market in Singapore. Here prices were tracking crude between April and early August, but Singapore VLSFO prices have not followed the recent drop in crude and Rotterdam VLSFO prices to their 3-year lows. In fact, Singapore VLSFO has remained either side of $600/mt since May. Ordinarily, if Singapore VLSFO prices had tracked crude (as in Rotterdam), then we may have expected a more recent drop of some $50/mt, towards $550/mt. It never happened and it’s never that simple!

Source: Integr8 Fuels

Source: Integr8 Fuels

As outlined in our weekly market updates, VLSFO supply has been very tight in Singapore, with strong backwardation in prices and lead times of 10-13 days. This has meant Singapore VLSFO prices have been well supported and moved to a strong premium versus crude (and other products).

Any rebalancing in the Singapore VLSFO market should see prices re-align with crude and other product prices. If this takes place whilst oil prices generally remain under downwards pressures, then we could expect a substantial drop in Singapore VLSFO prices.

Looking at the bigger picture: It is China

As always, it is worth understanding what is driving the market at any given time; in this case it is China.

Economic growth in China over the second quarter this year is assessed at 4.7%, which is slightly lower than the official 5% target rate.

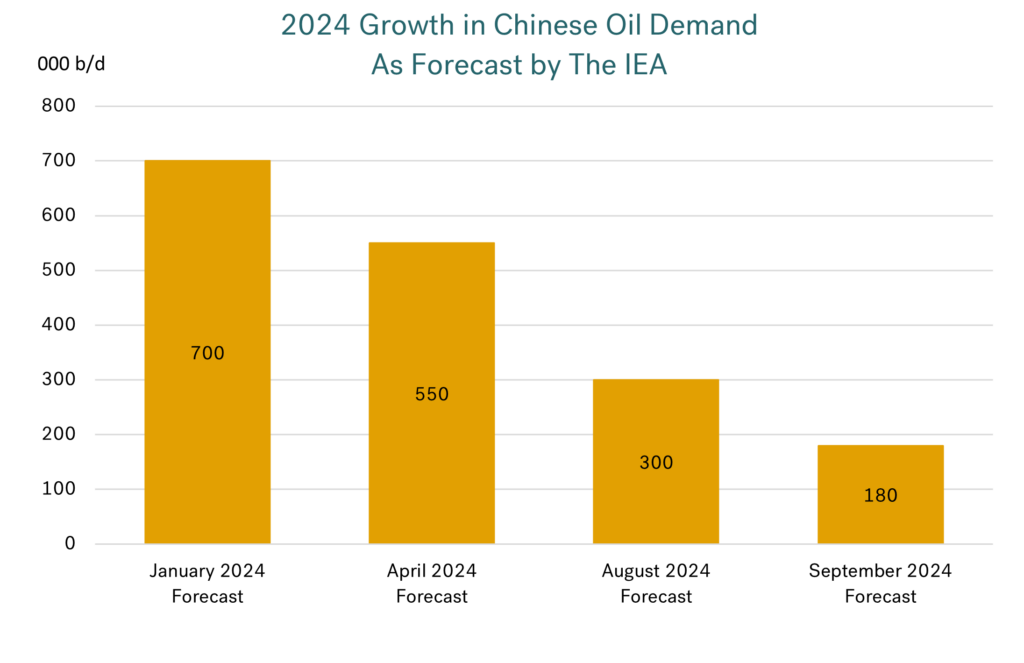

However, there have been massive downwards revisions to forecast growth in Chinese oil demand this year. Back in January the IEA forecast an increase of 700,000 b/d in Chinese oil demand for 2024. By April, expectations had dropped to a growth of 550,000 b/d this year, and by August growth in Chinese oil demand for 2024 was set at only 300,000 b/d. Though there has been another downwards revision this month, and the IEA now sees Chinese oil demand growing by just 180,000 b/d this year; massively different to expectations at the start of this year.

Source: Integr8 Fuels

Source: Integr8 Fuels

These ever-reducing expectations for oil demand growth in China is one of the key signals behind the current bearish sentiment and recent drop in global oil prices, to 3-year lows.

Getting more granular, the big changes in Chinese demand expectations have taken place in the naphtha and the gas/diesel oil sectors. Growth in Chinese naphtha demand is still positive, but has slowed, with delays in new petrochemical capacity coming onstream. However, Chinese gas/diesel is the most impacted product, with demand actually expected to fall this year. This is unheard of in the context of China’s meteoric rise as an economic powerhouse.

This decline in gas/diesel demand comes with weaker economic projections for the Chinese economy, major concerns about the property market and a greater use of alternative fuels in commercial road trucks.

The prospects for Chinese demand next year are equally low

Growth in Chinese oil demand next year looks equally constrained, with a forecast increase of around 250,000 b/d. Apart from higher volumes of LPG, ethane and naphtha going into the petrochemical sector, demand for all other main products looks like remaining near flat with 2024 levels. EVs already account for the majority of new car sales in China, along with an increasing number of ‘alternative’ trucks. This, plus the rapid expansion of an electrified high speed rail network (‘taking’ demand from domestic air travel), will limit any increase in the demand for gasoline, jet fuel and diesel in the next few years.

Looking further ahead, there are potential declines of close to 3% p.a. in the Chinese gasoline and diesel markets over the next 5 years, as the economy matures and the number of EVs continues

to increase.

Global fundamentals show no signs of higher oil prices

In the broader picture, cuts in global interest rates may signal some support and stimulate an element of growth in world oil demand; we did see a slight price hike when the US Fed cut interest rates for the first time in four years, by 0.5%. However, we are in a world where oil demand is flat-to-declining in the OECD countries, and growth is far less than it used to be in China.

Against these muted prospects for world oil demand, next year we are expecting strong increases in non-OPEC+ production and potential increases in OPEC+ production. These gains in supply are likely to be more than enough to put a cap on higher oil prices, even if oil demand is higher than expected.

Weak fundamentals versus threats of war

Today the risk of higher prices comes from heightened political tensions or war. It is this balance between weak fundamentals and the ‘war situations’ in the Middle East and Ukraine/Russia that the market is closely watching.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.