VLSFO Prices Hit 5-Month Low Despite Flat Crude

Bunker prices are down, but crude remains flat

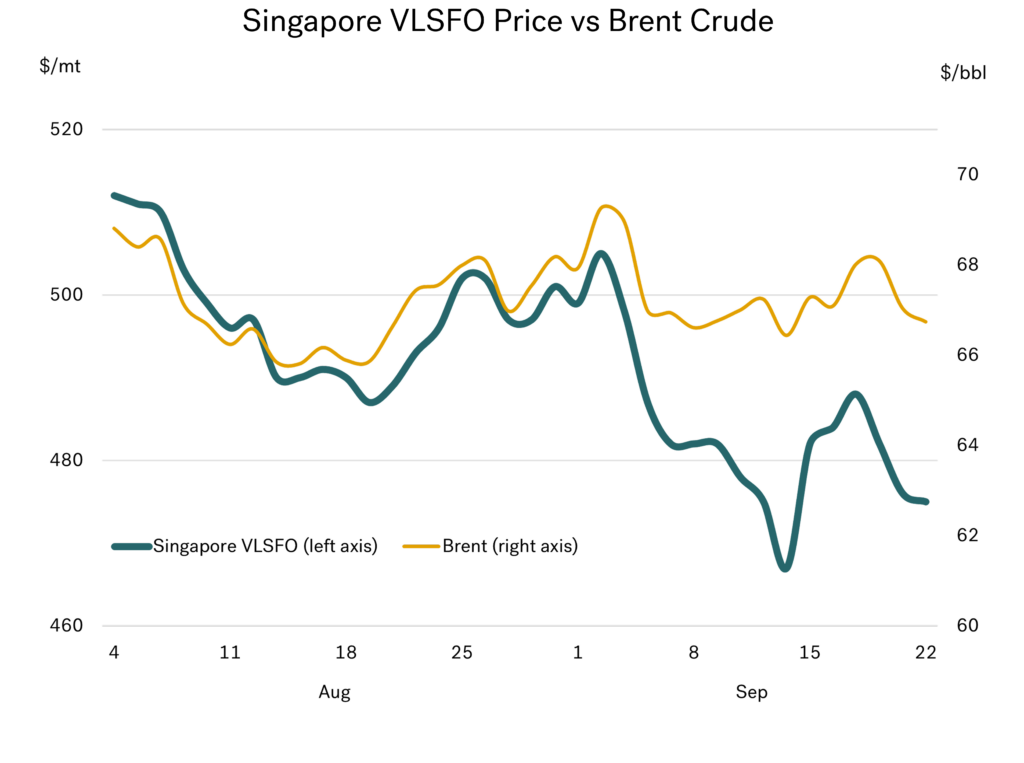

Over the past month we have seen crude prices remain flat, with Brent futures at around $67/bbl, but VLSFO prices have fallen by some $20-25/mt (and HSFO is down by almost $10/mt).

Source: Integr8 Fuels

Crude prices have been ‘held up’ by low stock levels in OECD countries, and concerns about possible limitations on supplies from Russia, Iran, and Venezuela. At the same time, VLSFO prices have eased, with more low sulphur straight run fuel oil availabilities, especially out of Nigeria and Malaysia. Hence, throughout September VLSFO prices have fallen relative to crude.

VLSFO prices are at their lowest for 5 months

So, even without crude prices moving, we still have VLSFO prices at their lowest since early May. This is a very encouraging sign for bunker buyers, especially as the overall oil market is looking bearish.

Source: Integr8 Fuels

China has mopped up the global oil surplus – so far

Published data on oil stocks is largely centred on the OECD countries, and these stocks have been running at very low levels since May, especially for crude oil. When the weekly oil stocks data come out of the US these usually report low stock levels, and so are price supportive.

On the face of it, this OECD stocks data goes against the overarching global fundamentals, which have implied a significant stock build this year. The answer could lie with China. Although Chinese stocks data is not published, a lot of effort goes into assessing all elements of the Chinese market (imports, exports, refinery throughputs, demand and stocks), and the strong view is that Chinese oil stocks have increased significantly since the start of the year, and largely ‘mopped up’ the global surplus in supply. There are indications that stocks in China have grown by an average of 1 million b/d for more than a year.

However, we are now at a stage where any growth in Chinese oil stocks could be minimal, and we could even start to see stock draws. This means that the forecast continuing surplus of oil (supply running at much higher levels than demand) is now more likely to show up in published OECD oil stocks data.

OPEC+ pushing more crude into the market in coming months

Earlier in September, OPEC+ surprised the market by announcing a ‘round 2’ in unwinding another 1.65 million b/d of production cuts. This follows the completion of unwinding 2.2 million b/d of cuts by September (although the actual increase in output has been lower than the headline figure, with some countries already hitting maximum output).

In this second phase, the group of eight participants (including Saudi Arabia, Iraq, Kuwait, and the UAE) did not put an exact timeline on when production will be ‘reintroduced’, but the plan is to raise output by 137,000 b/d in October.

Although the actual increases may be lower than stated, the writing is on the wall for more OPEC+ crude. Beyond October, the group said it will monitor the market before any decision to raise output is taken, which appears a pragmatic approach based on analysts’ views of weakening oil fundamentals on the horizon.

Stock builds likely to switch to OECD countries; and the US publishes the most timely data

This latest move by OPEC+ only compounds the bearish fundamentals for the oil industry over the next 12 months or so, and that surplus oil has to go somewhere.

The most timely of all stocks data comes from the US, where weekly data is keenly watched by the market, and oil prices often move in response to the API (American Petroleum Institute) report out on Tuesdays, and the more detailed EIA (Energy Information Administration) report out on Wednesdays. These weekly releases will be watched closely, to see if the theory that there is no more Chinese stock building and the world’s surplus oil starts funneling its way into more visible locations (e.g. the US).

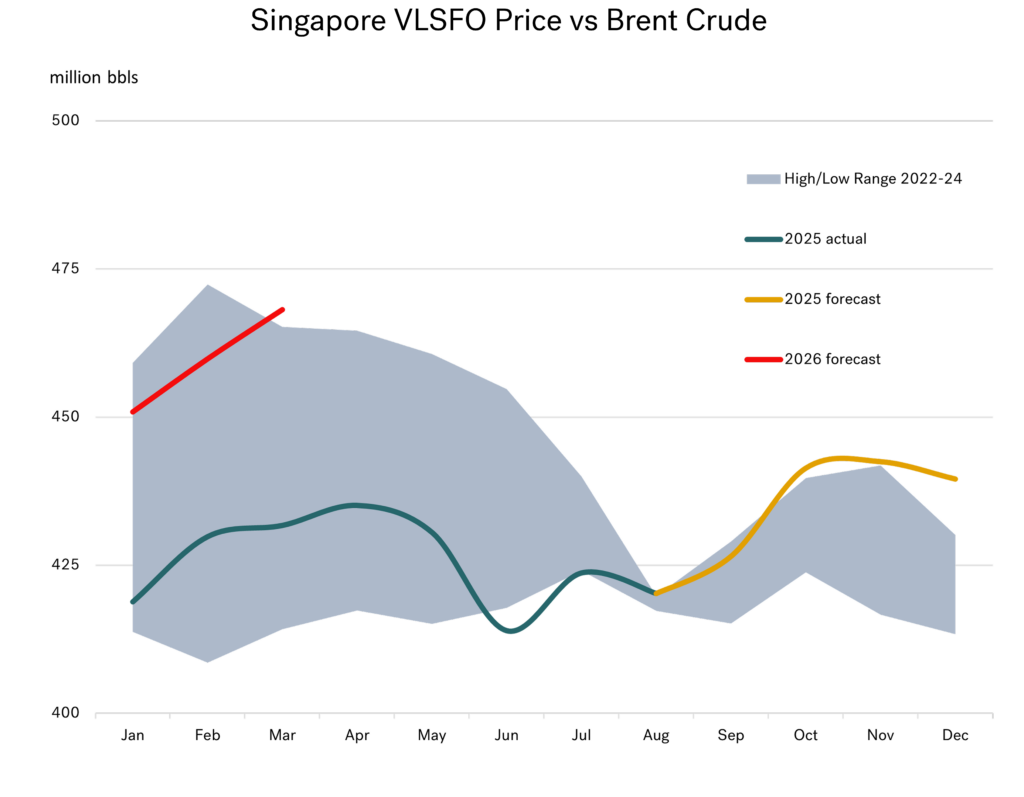

This is certainly a key feature of the analysis carried out by the US EIA. The graph on the following page illustrates their forecast of US crude stocks over the next six month, with a rapid change from current ‘low of the range’ levels, to high of the range in October, and even higher levels through the first quarter of next year.

Source: Integr8 Fuels

The US stocks data could be the barometer for a weaker oil market

If the published figures by the API and EIA do follow this forecast from around 420 towards 470 million bbls, then we are likely to see lower oil prices (and potential moves towards contango in the price structure for later in 2026). To highlight this, the latest EIA monthly price forecast for the first half of next year puts Brent crude at $49-51/bbl in each month, compared with around $67/bbl currently! Other forecasters also put Brent prices in the $50s for next year.

Products stocks may not increase by as much; but crude sets the scene!

We are now entering a period of seasonal refinery maintenance programmes, with refinery throughput expected to fall by more than 3 million b/d in October. This is at a time when OPEC+ are unwinding more crude production cutbacks, and non-OPEC+ output continues to rise. Therefore, the global oil surplus is likely to be seen more in a bulge in crude oil stocks, than in oil products.

Expectations are that product stocks could remain at relatively low levels during the northern hemisphere winter months. If the forecasts are right, this would mean that oil prices would move down sharply, but that we could see greater product premiums to crude, and so improved refinery margins. Nonetheless, such a crude stock build would see crude and product prices much lower than today. If Brent prices are in the $50s, then bunker prices will be much lower than today, even if product stocks are relatively low.

Conclusions towards further falls in bunker prices

Analysts’ projections for the rest of this year are looking at a seasonal fall off in oil demand, further increases in OPEC+ and non-OPEC+ crude oil production, and rising oil stocks. So, despite recent flat crude prices, expectations are still for a drop in oil prices as we go through the fourth quarter.

Concluding, although there has been a 4% fall in VLSFO prices over the past month, it seems that we are holding out for the further reductions in oil and bunker prices in the fourth quarter and into next year. Let’s see if the much weaker oil fundaments and a visible rise in crude oil stocks can ‘Trump’ any political and war-related bullish actions.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.