VLSFO prices are falling and HSFO is holding relatively firm; what is happening?

Background

In the past couple of weeks we have seen VLSFO prices fall by around $75/mt in Singapore (down 10%), but at the same time HSFO prices have remained within a $20 range. The story is the same in Rotterdam, where the VLSFO price fall is slightly bigger than Singapore. In this report we look at what is driving these VLSFO and HSFO price movements and where things could go in the near term.

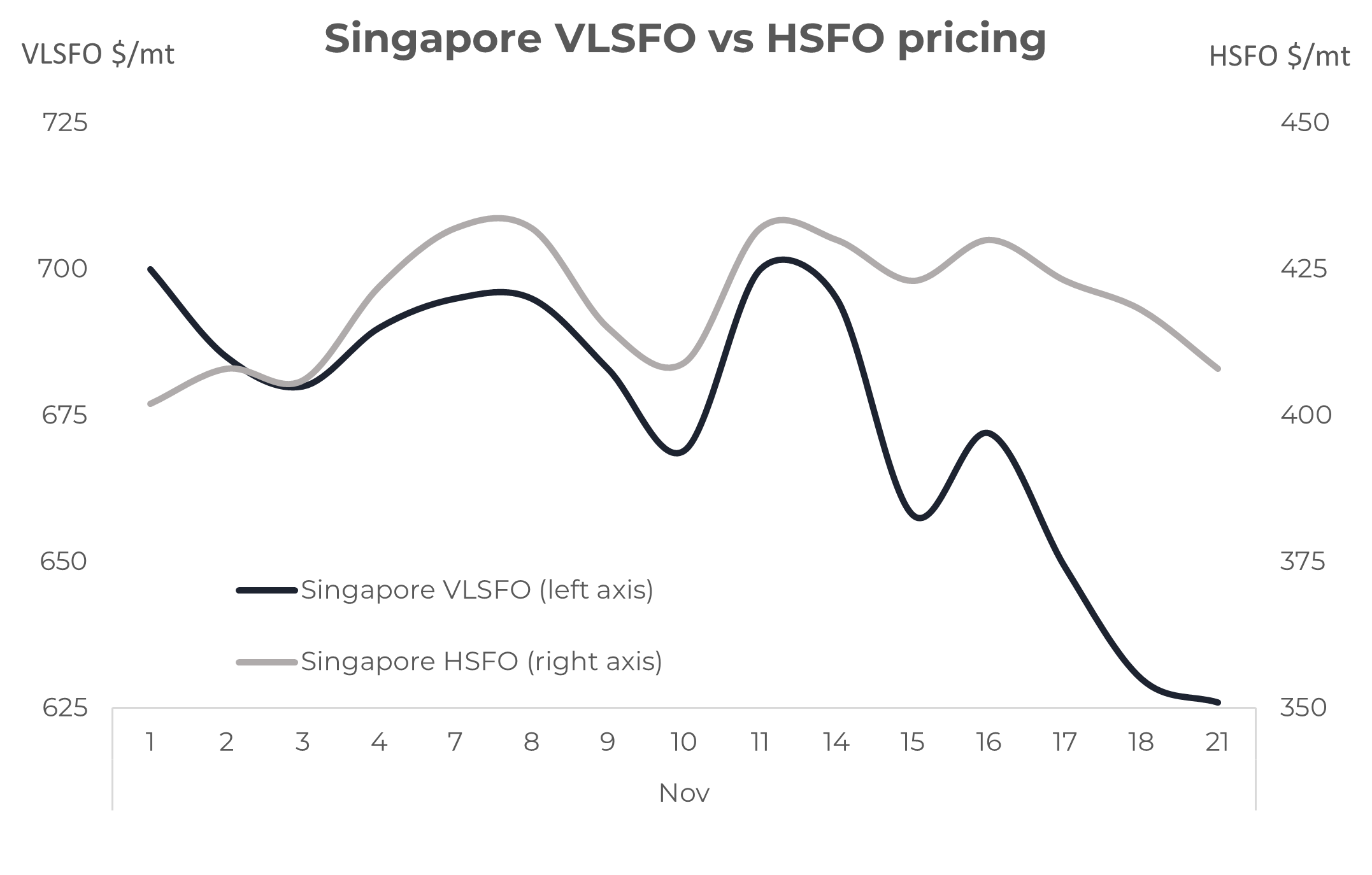

Source: Integr8 Fuels

The graph above shows Singapore delivered prices since the start of November, with HSFO remaining around $410-430/mt (right axis), versus VLSFO falling from close to $700/mt to around $625/mt (left axis) over the same period. Looking at this short-term snapshot does give us pricing developments in what is obviously a highly dynamic and fast paced bunker business. But to get some indication of where we are going, we have to take a step back, put current moves into perspective, and then pick out the key drivers that could affect our market going forward.

Is it VLSFO weakening or HSFO strengthening that is driving these price moves?

The answer (conveniently) is ‘a bit of both’. Around mid-year, VLSFO was extraordinarily strong relative to crude oil and has now ‘fallen back into line’, whereas HSFO was extremely weak and is now regaining some of those earlier ‘loses’.

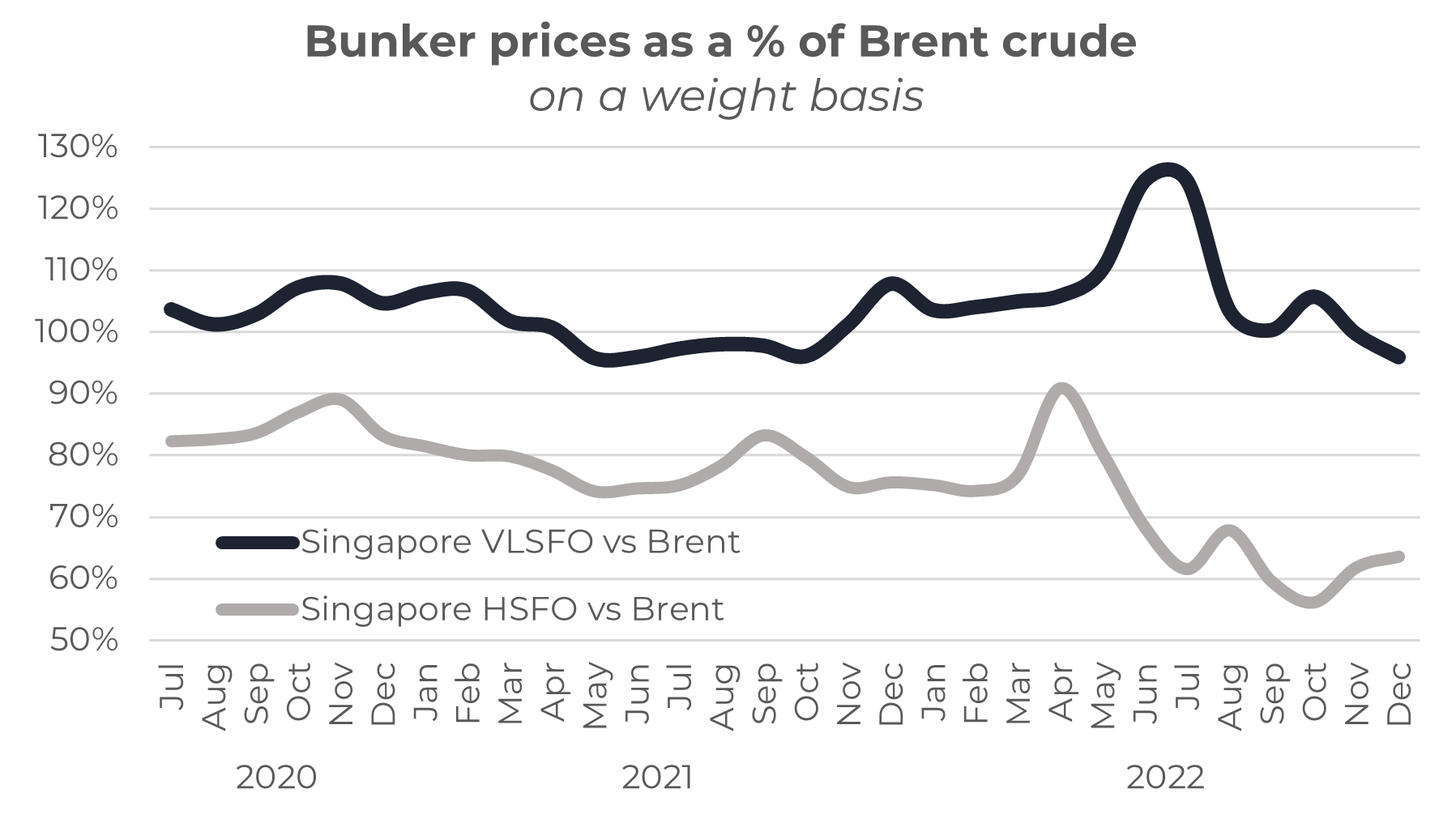

Between mid-2020 and early 2022 (i.e. after VLSFO supply and pricing had settled and before the Russian invasion of Ukraine) Singapore VLSFO pricing was around 95-105% of Brent crude. Around the middle of this year VLSFO strengthened to 125% of Brent, on the back of extreme tightness in the middle distillate and gasoline markets. Since then, most oil markets (apart from diesel and jet) have weakened considerably, in line with global economic pressures. On the back of this VLSFO prices have also fallen from their extreme highs, and have now ‘reverted back to normal’, albeit to around 96% of crude and towards the bottom of the historic range.

Source: Integr8 Fuels

At the same time, HSFO pricing fell from a long-run basis of around 75-85% of crude to a low of only some 60% of crude at mid-year. This relative low for HSFO came as refiners ramped up throughputs and production on the back of historic high margins for jet, diesel and gasoline. Higher refinery throughputs of course led to increased supplies of fuel oil (as a by-product), generating a ‘surplus’.

For the main part, the strength in refining has eased, throughputs are down and with it HSFO pricing is also reverting back to trend; i.e. strengthening relative to crude. However, HSFO pricing is still relatively low, at only 65% of crude.

If pricing does revert back to around historic norms, then going forward we could expect VLSFO to largely track movements in the crude oil price, but given where HSFO is today, we would expect a further relative strengthening in high sulphur bunker prices relative to Brent crude.

Do market indicators suggest VLSFO and HSFO prices are reverting back to historic norms?

Taking what looks like the easier part of the question first and looking at HSFO, the answer is ‘yes’. On the HSFO supply side, there is no expectation of extreme hikes in refinery throughputs. At the same time, OPEC+ has agreed cutbacks in crude production and these are most likely to fall on Middle East producers, which tend to be the heavier, higher sulphur grades. There is then the issues surrounding the December 5th ban on Russian crude imports into the EU and UK, which could have a big impact on pricing and trade flows. The G7 pricing cap for Russian exports may have little impact itself, as Russian prices are already heavily discounted and countries that will take Russian volumes are likely to work outside this remit.

Near-term signs on the demand side are also towards a strengthening HSFO position. As we go into the northern hemisphere winter there is the potential for some power generating companies to switch from high priced natural gas to fuel oil as a feedstock. If this happens it would again tighten the HSFO bunker market. So yes, HSFO prices could continue to strengthen relative to crude over the coming months.

It’s a more difficult area looking at VLSFO. Prices here are already at the low end relative to crude. Diesel and jet refinery margins are very strong at the moment, and even though these may ease, there could be enough in these markets to support VLSFO pricing; in contrast, gasoline margins are extremely weak.

Also, the ban on Russian product exports to the EU and UK kicks in from 5th February, and like the crude export ban next month, it could create uncertainty, plus distortions in price and trade flows. If anything, this is likely to push the relative price of VLSFO higher in the first quarter of next year, and potentially oil prices higher overall. At the same time, it is likely to see more Russian fuel oil going to Asia, lowering the relative price of HSFO in Singapore.

Therefore, we could see HSFO prices strengthening a bit more relative to VLSFO over the next couple of months. But, as we come out of the northern hemisphere winter any upwards pressure on HSFO could ease, and at the same time seasonal strengthening on transportation fuels (gasoline, diesel and jet) could see VLSFO prices rising relative to HSFO.

What this could mean for the VLSFO/HSFO spread

Pulling this together and looking at the implications for the VLSFO/HSFO spread. Through the ‘covid times’ of 2020/21, the spread was extremely narrow, at only $100/mt. The extreme market conditions in mid-2022 saw this spread widen to $300/mt in Rotterdam, and a massive $500/mt in Singapore. These times have changed, and based on the pointers outlined above in this report, the spread is now down to around $200/mt.

Source: Integr8 Fuels

As always, we need to track bigger picture developments in the oil markets, and here there are a number of key factors going on, including the global economy and its impact on overall oil demand; what is happening in China; the fall out from the EU/UK ban on Russian imports and what OPEC does.

But taking the focus of this report, the conclusions are that the VLSFO/HSFO spread may continue to narrow a bit further over the next 2-3 months, but then could widen again as we move through Q1 next year and into Q2.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.