VLSFO prices are close to recent lows and could be even lower next year.

VLSFO prices have rebounded though they are still close to recent lows.

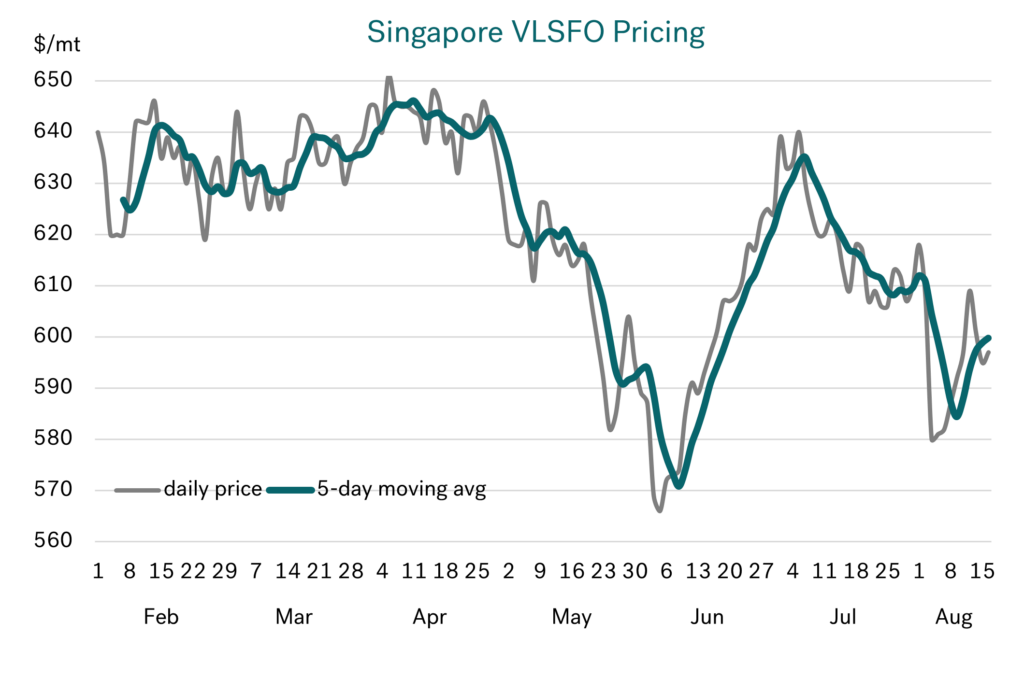

Since February, Singapore VLSFO prices have traded within the range $570-650/mt, and now are closer to the low of this range. Rotterdam prices have followed a very similar trend, but at around $50/mt below Singapore.

Source: Integr8 Fuels

Source: Integr8 Fuels

What have been the key recent developments?

We have previously highlighted the main driving forces behind these big changes in oil and bunker prices, with:

- The collapse in oil prices in May down to concerns about economic growth and weaker oil demand (especially in Europe), along with rising oil stock levels;

- The rise in June/July oil prices as ‘speculators’ aggressively bought back into the market after heavily unwinding positions in the previous month.

Since early July, prices have fallen back towards the lower end of the recent price range, as concerns about the US economy (based on unexpectedly weak employment data) triggered a sharp drop in global stock markets. However, these signals seem to have eased and stock markets and oil prices have rebounded over the past 1-2 weeks.

Crude prices are where we start

The starting point for all oil prices is ‘what is happening to crude’. For these reasons we always have to come back to the crude price, and in particular Brent and WTI futures on ICE and Nymex.

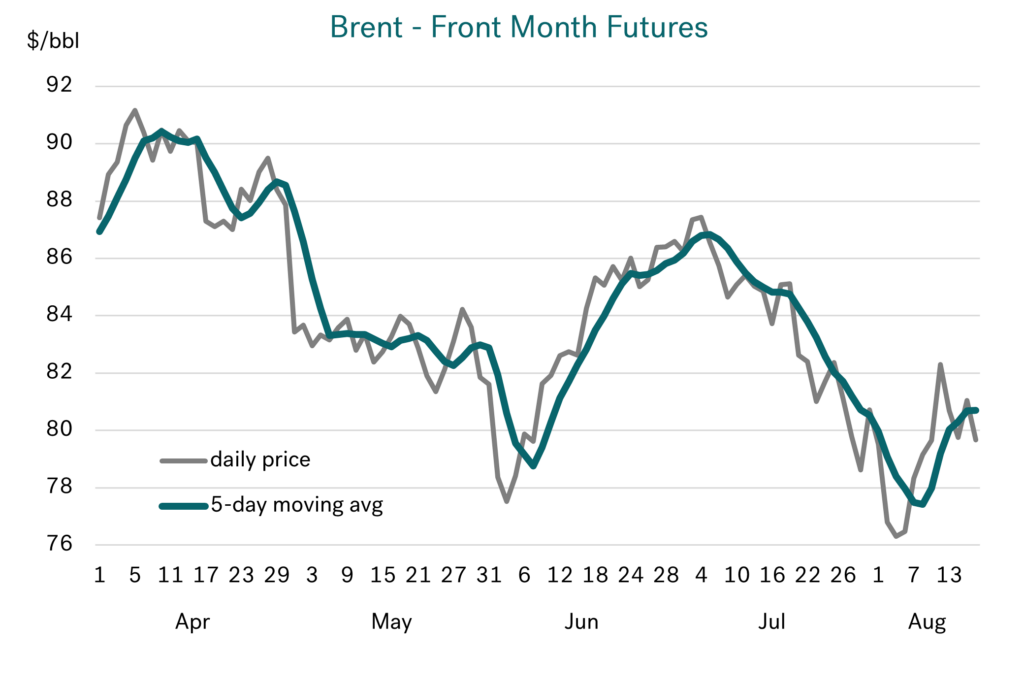

Over the past four and a half months, Brent front month futures have traded in the range $76-91/bbl, again with current prices just above recent lows and close to $80/bbl.

Source: Integr8 Fuels

Source: Integr8 Fuels

From the two graphs, the VLSFO price has closely tracked the same peaks and troughs as the Brent price.

What are the issues to look for going forward?

There are a lot of factors that can drive oil and bunker prices over the short term. Current geopolitical developments in the Middle East could push prices in either direction (ceasefire/continued war); at the time of writing there is more positive talk about a potential ceasefire between Hamas and Israel.

Similarly, the situation in Russia and Ukraine has the propensity to shift the market, although currently this seems to have taken a ‘back-seat’ in terms of oil prices.

Add to this the escalating rhetoric surrounding the November US presidential election, which is likely to create more noise in markets and prices.

However, it is often economic sentiment that can have a huge short-term bearing on prices, as we have just seen with US employment data triggering a bearish domino effect on to stock markets and commodity prices. Although prices have rebounded off these lows, there is still a nervousness about weak economic prospects in the US and China, which are the powerhouses behind global sentiment.

Given this, what are the prospects for oil demand next year?

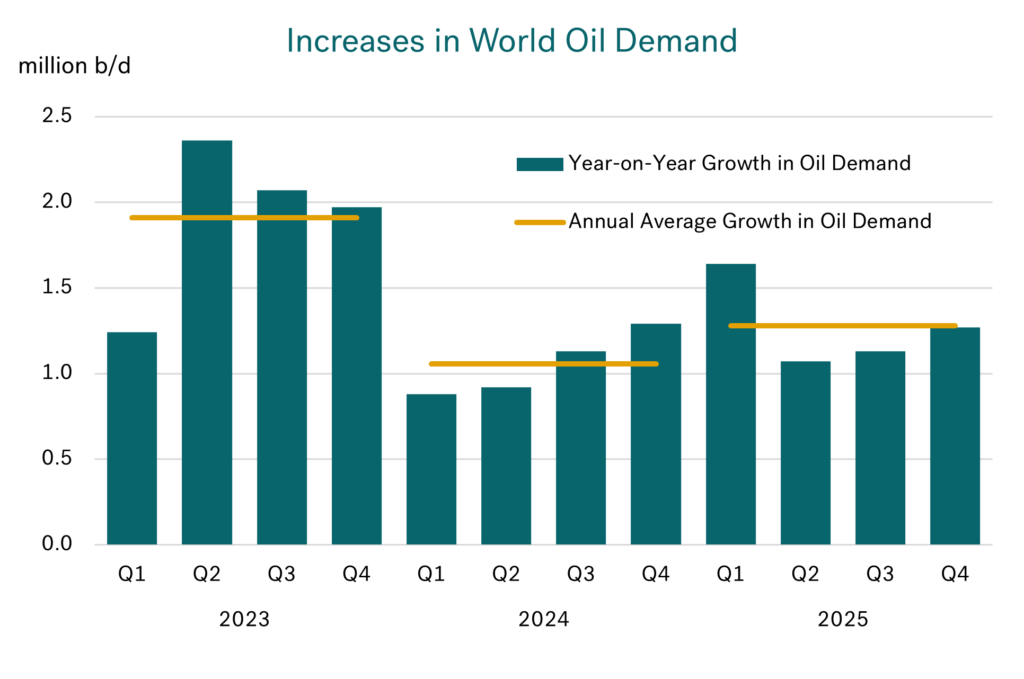

There are variations in oil demand forecasts for next year, with the IEA forecast for growth at the low end of the range, at less than 1 million b/d. The US EIA forecast is higher, with 2025 demand growth at 1.6 million b/d, and OPEC’s forecast is even higher, at 1.8 million b/d.

Taking a ‘representative’ average of these bullish and bearish cases and looking at the year-on-year quarterly developments, this shows a stronger growth pattern through the second half of this year and into the first quarter of next year. However, even then, it only hits 1.4-1.6 million b/d. From the second quarter next year onwards, year-on-year demand growth is less and only forecast at just above 1 million b/d.

Source: Integr8 Fuels

Source: Integr8 Fuels

Against this backdrop, non-OPEC+ production is forecast to increase by more than 2 million b/d through to the end of next year. This means that even if OPEC+ maintain their current voluntary and agreed production cutbacks through to the end of next year, the oil fundamentals will still weaken. If they start to unwind the cutbacks from October this year as planned, the fundamentals will be even weaker!

What does OPEC+ do in the circumstances?

A big question for the oil market is on OPEC+, and the ‘will they/won’t they’ question about starting to unwind their voluntary and agreed production cutbacks. This will clearly have a direct impact on oil and bunker prices.

The current plan was agreed in June and is for the 2.2 million b/d voluntary cutbacks to start unwinding in October, with the process continuing over the following 12 months through to September next year. If they go ahead, it will add 1.6 million b/d more oil from the Middle East, almost all of which are all high sulphur grades.

OPEC+ has stated that any unwinding of the cutbacks will be dependent on market conditions, and so if they are looking to at least maintain prices as close to current levels as possible, an extension of the current agreement well into next year would seem the outcome.

However, this is a collective OPEC+ agreement and so internal politics also play a role. If oil prices are falling and national revenues are ‘lost’, one way out is to produce more!

The question of market share also arises; with Saudi Arabia recently trying to defend its market by heavily reducing its formula prices for European buyers and making much smaller increases than expected for Asian buyers.

If OPEC+ does go ahead and raise production in October, this would send a very bearish signal to the market and oil prices are highly likely to fall.

All awaits OPEC+ on their decision, which could come next month, ahead of their next formal meeting on October 8th.

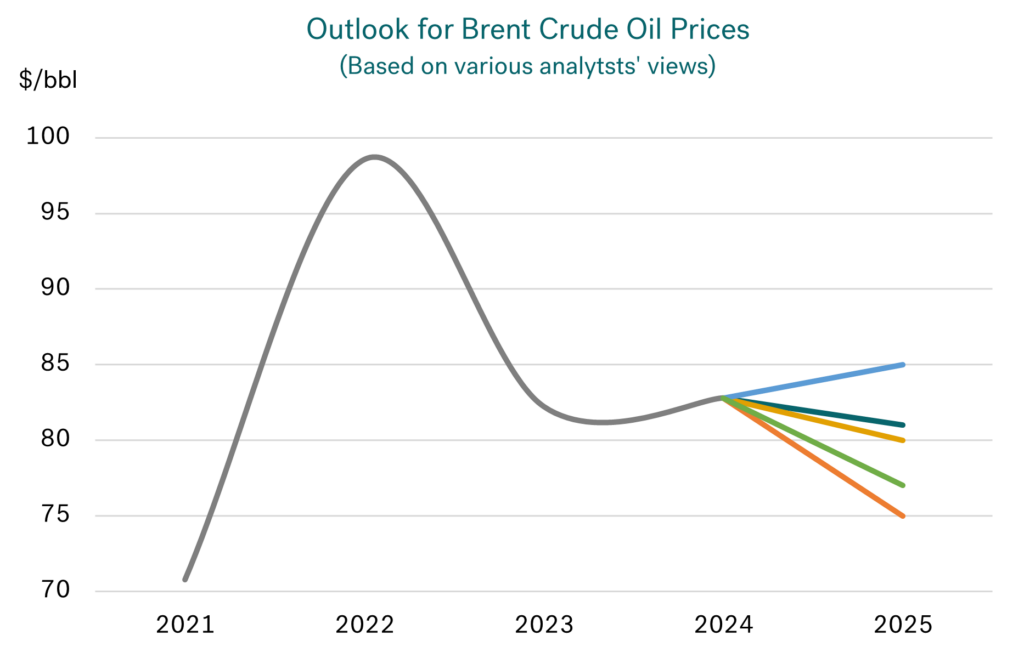

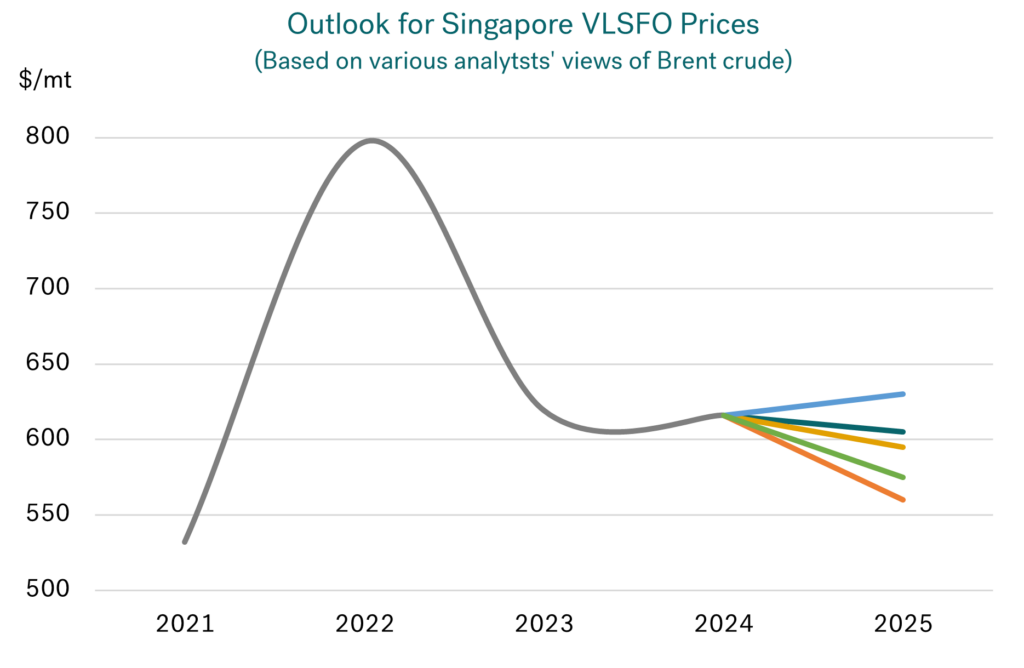

What are the crude price views for next year?

Given all these developments, most analysts have reversed their views from April this year, when they were typically forecasting a rising market in 2024 and Brent prices in the $85-90/bbl range. Now, four months later, most analysts are indicating lower expectations for this year, with Brent averaging $83-84/bbl, and a falling market in 2025, with Brent prices in the range $75-81/bbl. The US EIA is an exception, indicating a Brent price of $85/bbl for next year (but this is still only slightly higher than today).

Source: Integr8 Fuels

Source: Integr8 Fuels

Finally, what does this mean for bunker prices in 2025?

If (and this is a big IF) the analysts are right in their Brent forecasts, and VLSFO broadly tracks the price of Brent, then we are looking at lower bunker prices next year, with Singapore VLSFO in the $550-600/mt range.

Source: Integr8 Fuels

Source: Integr8 Fuels

Let’s keep watching and see what happens.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.