The price is right; but what is happening to VLSFO in Singapore?

A big push up on crude oil prices to 3-month highs

Oil prices have seen a strong hike over the past month, with Brent front month futures up by around $10/bbl, to $82/bbl. This is the highest price we have seen for 3 months and has revived the talk and forecasts of higher prices in the second half of this year.

Source: Integr8 Fuels

At the same time, heavier, more sour crude grades have strengthened by even more. We are now at a point where Oman is priced at around $1.50/bbl above Brent, when over the first half of this year it averaged a more typical $1.50/bbl below Brent. All of these moves have a heavy influence on bunker prices.

Forecasters have been talking about a price rise for some time

Since the start of this year we have been writing about how forecasters saw a potential rise in oil prices in the second half of the year. These views have been based on combined expectations of strength in oil demand coming from China and constraints in oil supply with cutbacks from OPEC+ (principally Saudi Arabia). Chinese oil demand has risen sharply and is now well above pre-pandemic levels (although there are concerns about the extent of future growth). At the same time OPEC+ has cut production, and these two developments together have pushed crude prices higher.

Crude prices usually drive product prices (although the reverse can also be true) and price direction is typically reflected across the barrel. There are obviously nuances between products, with different drivers impacting different sectors. However, a strong upward price for crude is usually a strong upward price for products.

What about HSFO bunker prices?

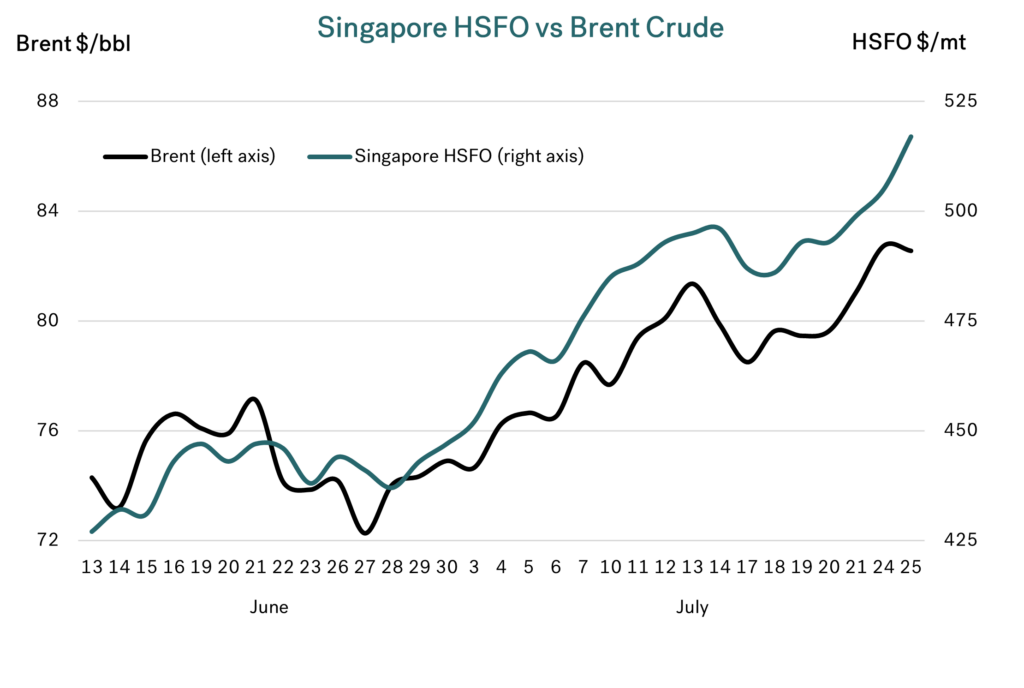

Looking first at Singapore HSFO prices, developments over the past month have been as expected given the rise in crude prices and the moves by OPEC+ (and Saudi Arabia in particular) to cut oil production. Singapore HSFO quotes moved higher as crude prices moved up. However, there has also been a further impact on this market, with fewer HSFO cargoes moving from the Middle East to Asia because of strong local demand for power generation in the Middle East.

In addition, there is the prospect of a fall in high sulphur supplies with further cutbacks in Middle East crude production, which are predominantly heavier and higher sulphur grades. The net result has been an even greater increase in Singapore HSFO prices than in the crude market, and this is clearly shown in the chart below, with the left and right axes scaled the same.

Source: Integr8 Fuels

The current HSFO bunker market in Rotterdam is also broadly in line with crude, although there has been a difference in the timing of price rises.

Has VLSFO in Singapore moved in the same way?

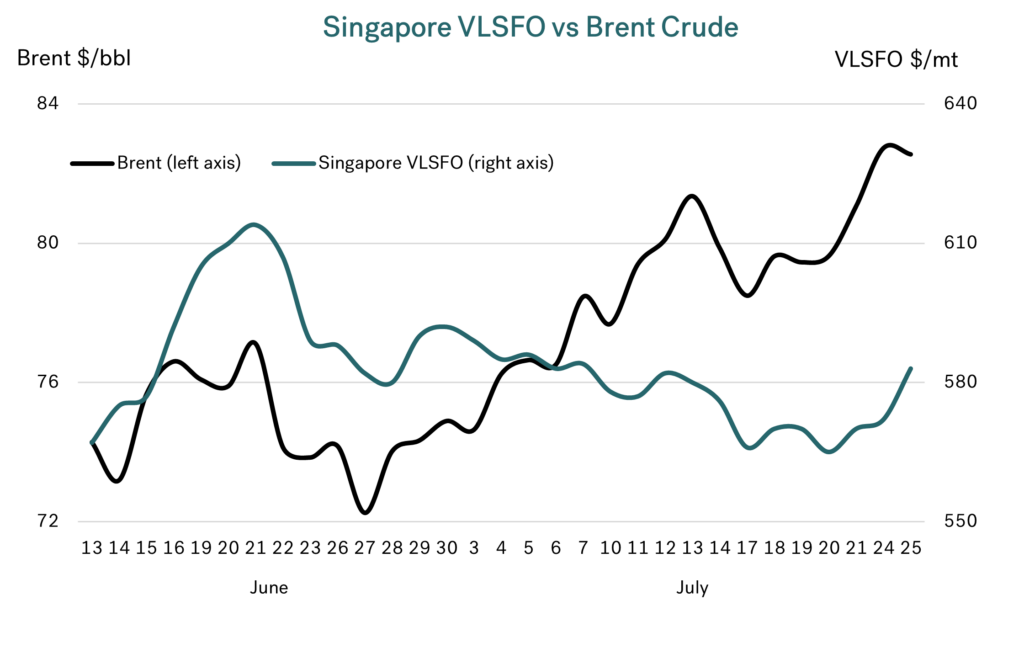

This is the focus of the report, and the simple answer is “NO”. In the second half of June, Singapore VLSFO prices rose and fell in line with Brent. However, since the start of July there has been a dramatic divergence in these prices. Singapore VLSFO has gone in the opposite direction to crude and HSFO and has actually fallen! This is contrary to usual expectations, but as the mantra says:

“The price is the price!”

The graph below shows these developments, again with the left and right axes scaled the same.

Source: Integr8 Fuels

The main reason for this Singapore VLSFO price ‘divergence’ is put down to an excess of low sulphur fuel oil in the region. This has come about with the West-East arb being open more recently and so several low sulphur fuel oil cargoes moving from NW Europe to Singapore. On top of this, there is an additional and ongoing low sulphur supply from Kuwait’s relatively new Al-Zour refinery.

This surge in low sulphur supply has been met with limited buying, and as a consequence sellers have been pricing very aggressively on the low side to try to clear this build-up of volumes. Hence, Singapore VLSFO prices have fallen, in sharp contrast to strong rises in crude and HSFO pricing.

What does this mean for Singapore VLSFO pricing in the near term?

These price ‘divergences’ happen, but they are generally temporary, and price relationships do move back towards ‘the norm’ over a period of time. The ‘rebalancing’ will take place with the West-East arb closing and so reducing incoming supplies to Singapore. At the same time, buying interest will pick up, especially if buyers perceive a tighter market and higher prices on the horizon.

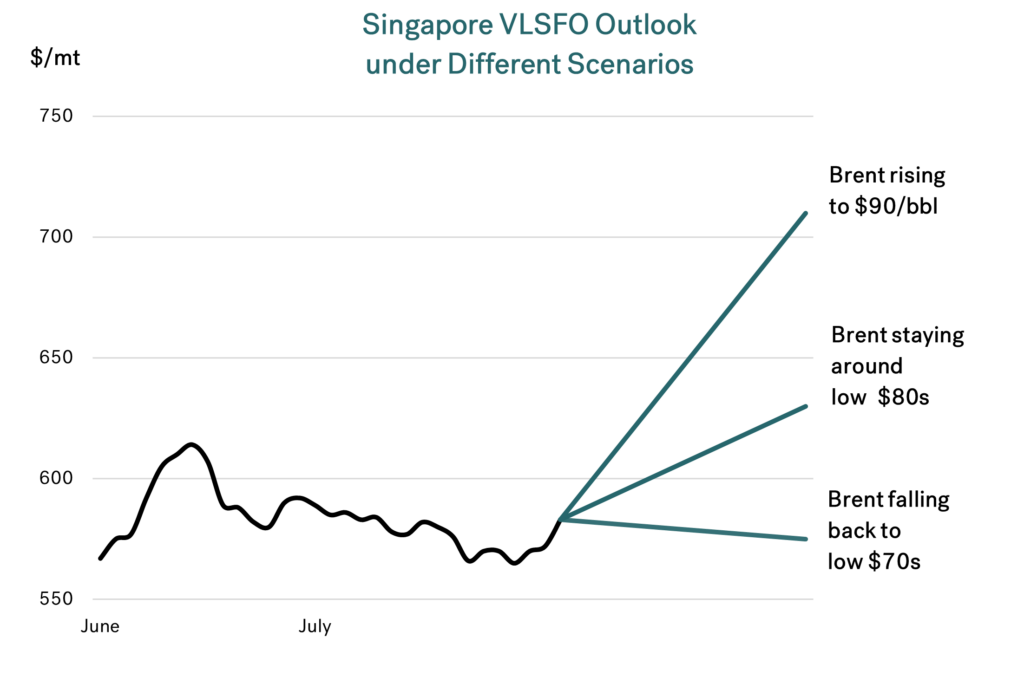

This can all happen over a brief period (weeks not months), and there are a number of scenarios that can play out here, including:

1. Brent crude stabilising in the low $80s

In this case Singapore VLSFO prices are likely to catch up with the recent hike in crude prices, and we could see Singapore VLSFO rise by around $50/mt from recent levels, to somewhere around $630/mt.

2. Brent crude falling back to the low $70s

Timings may not be the same as movements in the Singapore VLSFO market, but the main point is we would not expect Singapore VLSFO prices to be significantly lower even if Brent crude does return to the low $70s.

3. Brent crude continuing to rise (to say around $90/bbl)

Here we would not only see Singapore VLSFO prices rise to reflect the recent rise in Brent to $80/bbl, but then see additional bunker price gains as crude takes another step up. Picking $90/bbl as an arbitrary crude number, this would imply Singapore VLSFO rising by more than $100/mt from current levels, to around $700/mt.

Source: Integr8 Fuels

In two of these three cases it suggests Singapore VLSFO prices will rise; it will take a reverse in Brent prices to the low $70s to hold Singapore VLSFO around $580/mt. For VLSFO prices to fall significantly below these levels is likely to need Brent crude to drop into the $60s, which is not what the current OPEC+ strategy is working towards.

As always, forecasting is never straight forward, but having a framework to hang things on and then looking for key indicators can give us a better steer as to where Singapore VLSFO is likely to go.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.