The IEA’s latest long term energy report shows a potentially bigger bunker market going forward

The IEA report is another influential study for us to consider

Three months ago, we highlighted BP’s analysis of the longer-term oil industry and the implications for the bunker market, taken from their ‘Energy Outlook’ report to 2050. Last week the IEA published their long term ‘World Energy Outlook’ to 2050, taking another look at how things could pan out under three different scenarios.

Here we take a dive into what this could mean for the oil industry, and then specifically what they are saying about shipping and the potential impacts on our markets for bunkers.

We know major changes will happen

There is a clear global direction away from oil (and other fossil fuels). The IEA report highlights this, plus the ongoing electrification of the overall energy system, and that clean electricity is the future.

Coming down to the more micro-level of shipping (and aviation), the IEA recognises that we are in a difficult industry to eliminate hydrocarbons. The phrase they use is that we are in a “hard to abate” sector.

Two scenarios showing a possible range, and a case to get to net zero by 2050

The three IEA scenarios are labelled as follows:

Stated Policy case – The course we are on based on policies and technologies currently in place.

Announced Pledges case – If all government/industry pledges and targets are met in full and on time.

Net Zero by 2050 – A path that would achieve net zero by 2050, limiting global warming to 1.50C

Oil is in decline: other energy forms (and efficiencies) will take over

There are a whole host of challenges to meet environmental targets, but the starting point is the world still ‘wants’ more energy. Economic growth in the developing and emerging economies, and the global population forecast to grow from 8.1 billion now, to 9.7 billion by 2050 (up 20%) are a testament to this.

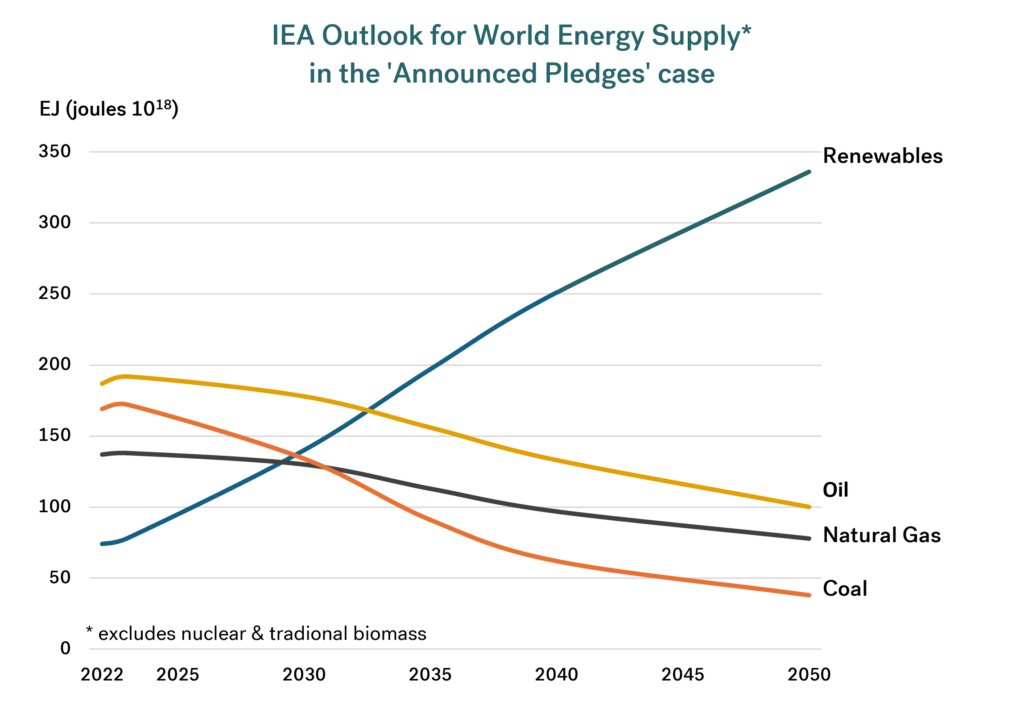

However, by the next decade this growth will be ‘fuelled’ without using more oil, natural gas, or coal, i.e. we only 6-7 years away from peak fossil fuel demand. Renewables (largely to produce electricity) and energy efficiency will be the new bywords in energy demand. The graph below illustrates the scale of these changes from fossil fuels to renewables and electricity under the IEA’s ‘Announced Pledges’ case.

Source: Integr8 Fuels

Source: Integr8 Fuels

What is happening to oil demand?

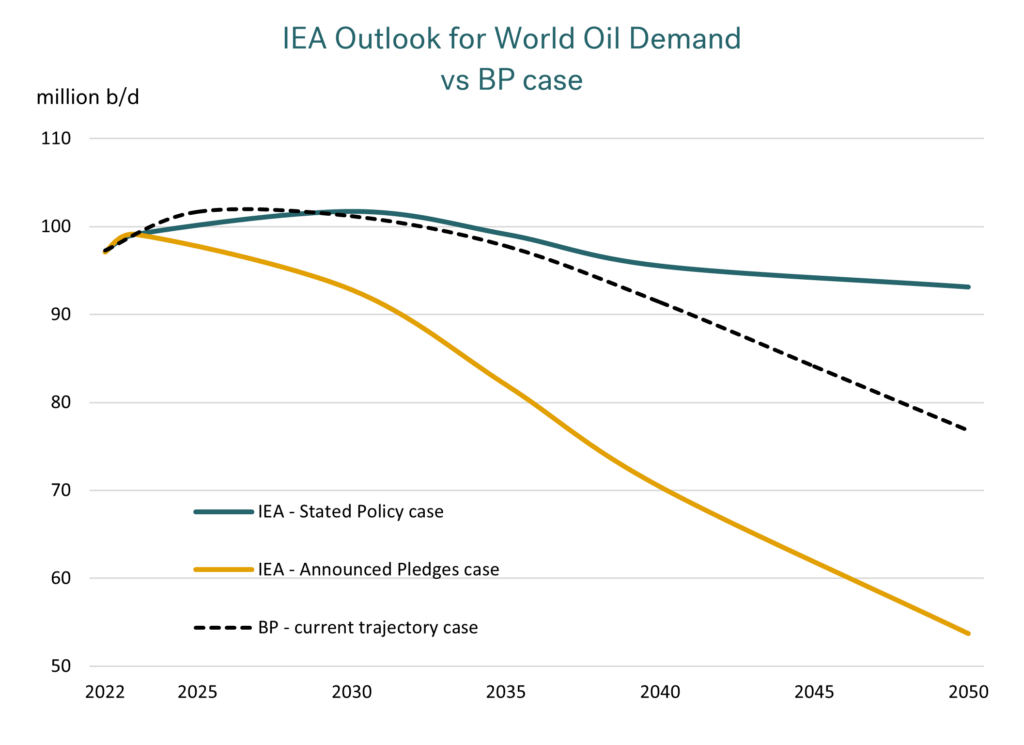

In the IEA’s ‘Stated Policy’ case, world oil demand remains just above 100 million b/d through to the early 2030s, and then only falls to around 93 million b/d by 2050. In terms of the discussion, this is likely to be at the very high end of oil demand forecasts. There is an expectation that more governments, industries, companies, and individuals will move towards greater environmental commitments, not least as the cost structure of new technologies is reduced.

The IEA’s second scenario, the ‘Announced Pledges’ case, reflects everyone actually doing what they have said they will do, and doing it on time. This illustrates a case where oil demand would fall to around 50 million b/d by 2050, half the size it is today and clearly a radical change in the market.

A ‘reality’ case may be somewhere between the two lines shown by the IEA, and this is where BP put their ‘Current Trajectory’ case three months ago (see graph below).

Source: Integr8 Fuels

Source: Integr8 Fuels

What would net zero by 2050 mean for oil?

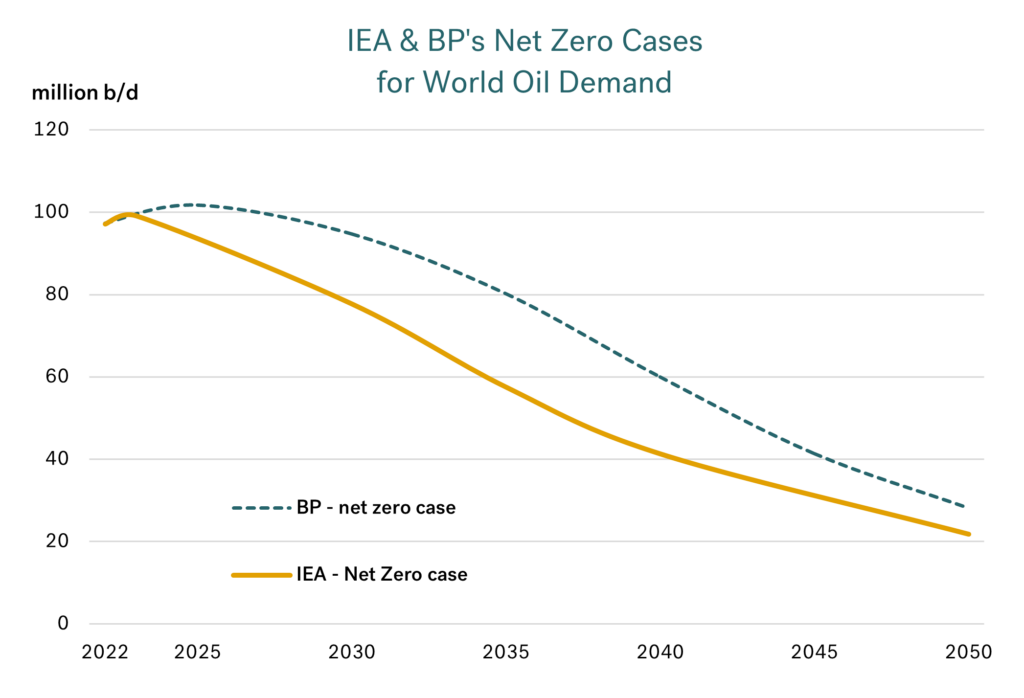

The ‘Net Zero’ case put forward by the IEA (and by BP) illustrate the kind of ‘oil world’ we would have to be in to achieve net zero by 2050. These are not forecasts, and at this stage seem highly unlikely to be achieved by 2050.

Source: Integr8 Fuels

Source: Integr8 Fuels

However, they still show the very credible implications for the oil industry at some stage in the future, based on the global moves away from fossil fuels. In both the IEA and BP scenarios we get to an oil industry of only 20-25 million b/d in a ‘Net Zero’ world. This is not a viable market size to maintain scaled-up oil infrastructure across the globe, and illustrates the direction the oil industry, and the oil bunker markets are going in the longer term. It just re-iterates the case that we must gear up for change.

We are in one of the ‘more difficult’ oil sectors

In all of this analysis, electrification is a key means of reducing CO2 emissions, and will play an enormous role in industry, buildings, and road transportation. However, for us in shipping (and in aviation) there is no obvious, easy, or low cost means of using electricity to power our needs. The IEA states that we are in “hard to abate” sectors, and that hydrocarbons will continue to play the leading role. However, they also state that we will go through significant policy changes (through the IMO and the EU) to decarbonise our market and this is assumed to be through biofuels, ammonia, methanol, hydrogen and hydrogen-based fuels, other low emission fuels, plus greater efficiencies being imposed.

Now for the good news!

There is a huge amount of analysis that goes into this IEA report, starting with economic forecasts and moving all the way through government/institutional policy, industry and consumer responses and ultimately ending up with a demand figure for distinct types of energy in each of the sectors.

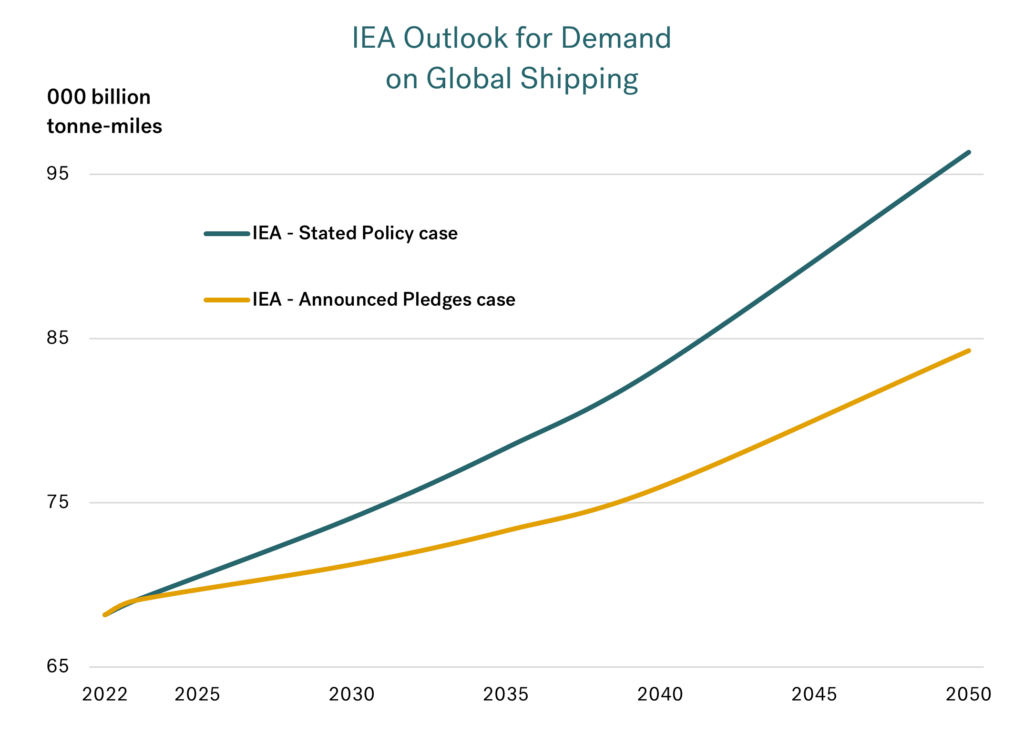

Within this work the IEA calculates the demand on shipping under their three different cases, and put a tonne-mile (or tonne-kilometre) figure on this. The graph below illustrates their tonne-mile demand for shipping in the ‘Stated Policy’ and ‘Announced Policy’ cases (the ‘Net Zero’ case being highly unlikely in the time-frame to 2050).

Source: Integr8 Fuels

Source: Integr8 Fuels

The IEA’s ‘Stated Policy’ case shows the tonne-mile demand for shipping rising by more than 35% by 2050. In their ‘Announced Policy’ scenario they show a gain of 20%. Working off a single, ‘credible’ case somewhere between these two scenarios would indicate a rising shipping requirement of around 25-30% over the next 25 years.

Although growth in the bunker market is likely to be less than this, with efficiency gains, we are still likely to be in a growth sector!

Conclusions are: Adapt, Change, and move into a bigger market!

We are in an industry where it is harder to use the existing technologies of electrification to achieve decarbonisation, but we will be pushed along decarbonising policies; we must adapt. And if the size of our market is getting bigger, then there could be more opportunities for us and other players/investors to get involved.

We have to continue to watch what is happening out there, in terms of fuels, technologies, developments and what people are doing. We can also have an influence. In this way we can be best prepared for the opportunities that will be there in a new, and potentially bigger bunker market.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.