Tariffs, Tensions, and Tumbling Oil: The Market Reacts

Another big drop in crude oil prices

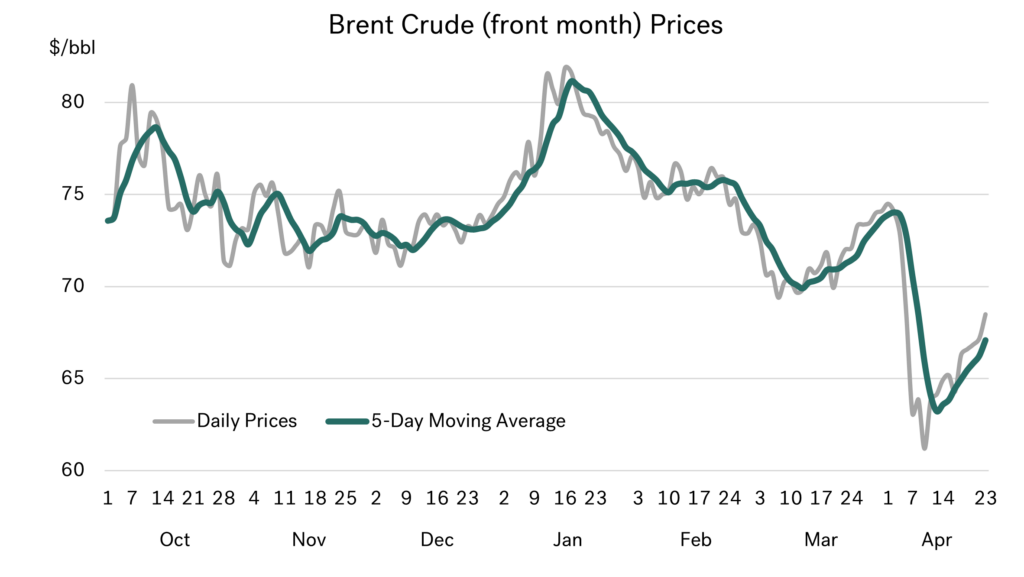

In these monthly reports we take a ‘bigger picture’ look at oil industry developments. We try to vary the aspects we focus on, but in recent months the only subject to talk about is price. In our end March report, we said that oil prices were likely to continue falling, but I am not sure we anticipated a drop of more than $13/bbl (18%) in front month Brent over just 9 days at the start of this month!

Source: Integr8 Fuels

Source: Integr8 Fuels

New US trade tariffs announced in early April, with reprisals from China and even greater fears of recession, all led prices down. If this wasn’t enough, some OPEC+ members also decided to start unwinding voluntary production cuts in April/May. The consequence was for Brent to fall to a 4-year low (back to COVID-19 times), and at one point drop below $59/bbl.

As it is under the Trump regime, there were further announcements and some delays/backtracking, and prices have moved back up off their lows. But prices are still low by recent standards. Everyone is acutely aware of the uncertainty surrounding President Trump’s announcements on tariffs, China’s responses, and high-profile institutions such as the International Monetary Fund (IMF) revising down their economic forecasts.

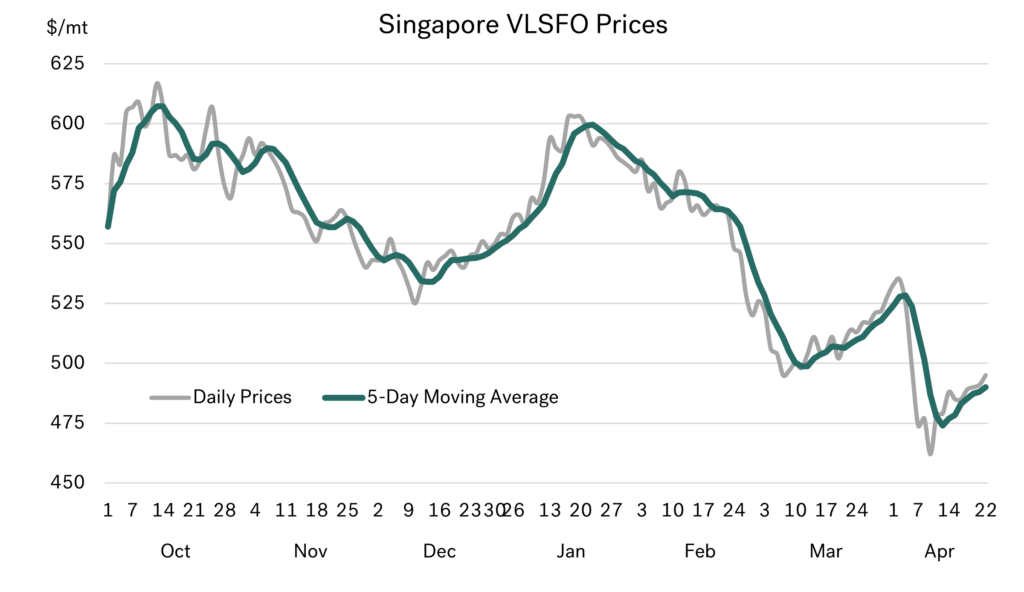

Of course, bunker prices have fallen

Given all these factors, it has been impossible to put a bullish slant on the market and of course bunker prices have also fallen. Across the main international markets, VLSFO prices dropped by around $70/mt (14%) in the first 9 days of April. There has been a rebound since then, but we are still $40/mt lower than at the start of the month.

Source: Integr8 Fuels

But bunker buyers have not benefitted as much as they might have

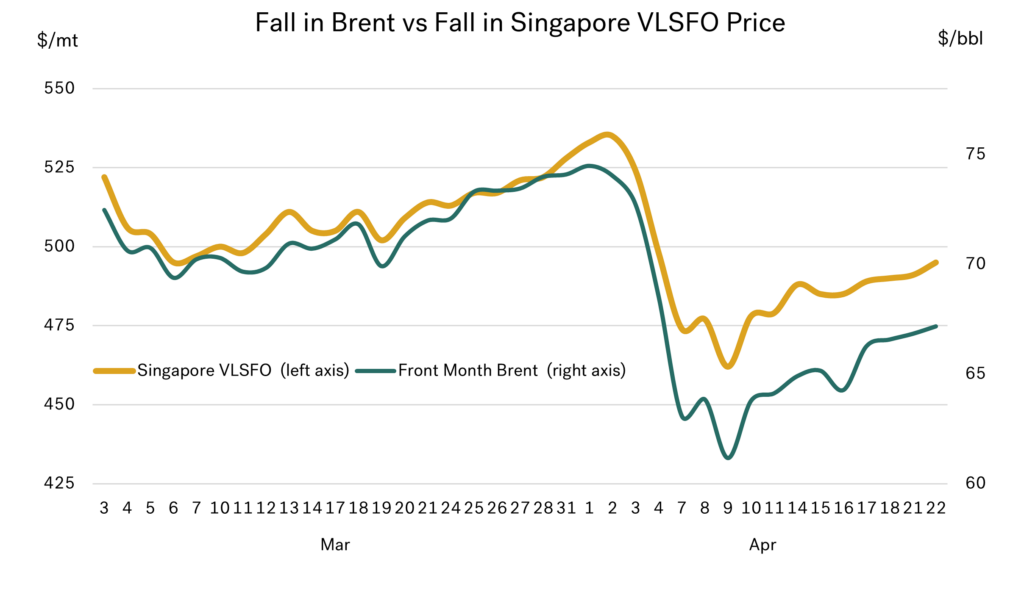

There are always nuances across crude and product prices, and in the VLSFO market the price drop has not been as big as for crude. The graph on the following page illustrates a disparity in the price drop between Singapore VLSFO and Brent crude – both axes are scaled the same, showing the bigger drop in crude. If all things were equal (they never are!), we would have seen Singapore VLSFO at lows of around $430/mt, and even now at prices close to $475/mt.

Source: Integr8 Fuels

Source: Integr8 Fuels

VLSFO prices in Asia are strengthening relative to crude. This is based on lower volumes of low sulphur material moving from west to east, potentially tightening supplies once again. The market pointers are also there, with increased backwardation and rising crack spreads. Speculation of increased bunker demand ahead of the 90-delay in US tariffs being implemented (except for China) has added another positive talking point. However, these are all nuances to VLSFO prices; the big story still surrounds tariffs and what President Trump does next.

Analysts are revising down everything

In the current market it is very difficult for us to write about anything other than Trump and oil/bunker prices. The precarious nature of political decisions, and the threats of recession mean the market is focusing on bearish sentiments and low oil prices. Oil industry forecasters have already revised down their outlook for oil demand for this year and next. In mid-April, the IEA lowered its forecast for oil demand in 2025 by 0.3 million b/d, whilst the US EIA reduced its 2025 forecast by 0.4 million b/d.

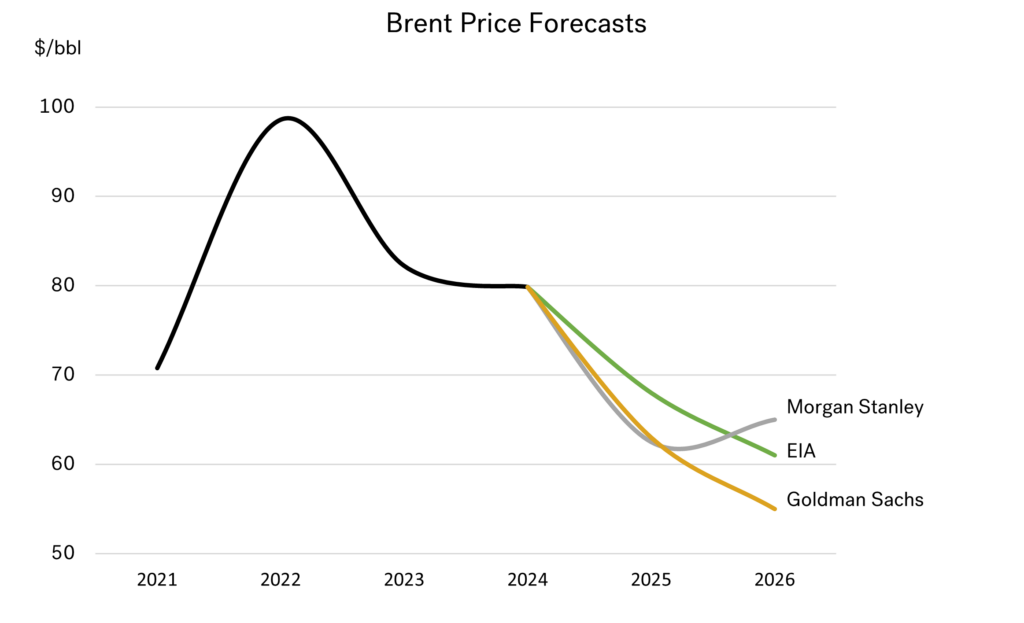

In the same context, oil price forecasts are also being revised down. The EIA has just lowered its 2025 and 2026 Brent price forecasts by $6-7/bbl, to average $68 this year and $61 next year. Morgan Stanley has reduced its 2025 Brent price by $5/bbl (to $62.50/bbl), and Goldman Sachs are down by $2/bbl (to $63/bbl). The general trend (at the moment) is for even lower prices next year, with Goldman Sachs at the low end of the range, at $55/bbl.

Source: Integr8 Fuels

Source: Integr8 Fuels

To re-enforce the bearish sentiment, these projections were made before publication of the IMF’s latest economic report, which came out this week. The IMF forecasts are downbeat, and it is no surprise that the biggest revision was to the US, where GDP growth for 2025 has been downgraded to 1.8%, from 2.7% projected in their January report. Downward revisions for other major economies have been set at around 0.4-0.5%. If based on this, it could be that the next round of oil demand forecasts are even lower.

We are only talking about one thing; Trump’s actions

US tariffs and international responses, particularly from China, are now at the forefront of everyone’s mind. There are still the wars in Ukraine and Gaza, and issues surrounding sanctions on Russia, Iran, and Venezuela, but still everyone’s focus comes back to President Trump and tariffs.

A lot of US policy decisions have been hugely unpredictable. Looking at tariffs, continual downwards revisions to the economy and corresponding downgrades of growth in oil demand, the pointers are towards lower bunker prices.

But we don’t know what is going to happen next. The day the IMF launched its more gloomy prospects for the economy, Trump hinted at a softer position with China, and the financial and oil markets both rose; Trump trumps the IMF?

It is still possible that President Trump could remove the planned tariffs, make international agreements, and be ‘good friends’ with China’s President Xi. We do know markets are very quick to respond, and any signs that the US is going to reverse its strategy on tariffs would trigger a return to confidence in the global economy, give us much stronger financial markets, and instantaneously push oil (and bunker) prices much higher.

If, or when this happens is the great unknown. As is always said, forecasts are only based on what we know today; the unpredictable nature of President Trump is that this may be completely different to what we know tomorrow!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.