Stable prices at the moment, but wider VLSFO/ HSFO spread going forward?

A lot of market risk and uncertainty, but no movement in prices!

Something rare has happened in the bunker market over the past 40 days – VLSFO prices have remained near unchanged! Prices in Singapore have moved within a very narrow $27/mt range ($619-646/mt); you have to go back to 2021 to see when the last 40-day trading range was at this level. More often we have seen these trading ranges close to $100/mt and at times it has been $200-300/mt (admittedly at higher absolute prices).

The 40-day trading range in Fujairah and Rotterdam is similarly low (at $30 and 32/mt). So, looking at recent price movements we could say nothing is happening in the market and bunker buying is ‘easy’. But far from it, you only have to look at the front pages to know there is a lot of risk and uncertainty in the market, especially surrounding various events in the Middle East, along with developments in Russia and Ukraine.

Source: Integr8 Fuels

Source: Integr8 Fuels

Nothing lasts forever

We are in one of those very strange periods, where the political and war risks are high, but oil fundamentals going forward look weak (even though OPEC+ has just extended its cutbacks again through to mid-year). It seems the bearish side is perfectly counter-balancing the bullish side and so nothing is moving. It isn’t the case that buying bunkers is ‘easy’ – there is still a lot going on behind the scenes to keep prices this flat! And one thing we do know is ‘something will change…’.

Change: What could this mean for the VLSFO/HSFO price differential

In our report a month ago we highlighted a potential tightness in the middle distillate part of the barrel and how this could lead to relatively high VLSFO pricing as we go through this year. Here we take the discussion one step further, looking at implications for the VLSFO/HSFO price spread (and so the economic attractiveness of scrubber fitted vessels).

Where are we currently with the VLSFO/HSFO spread?

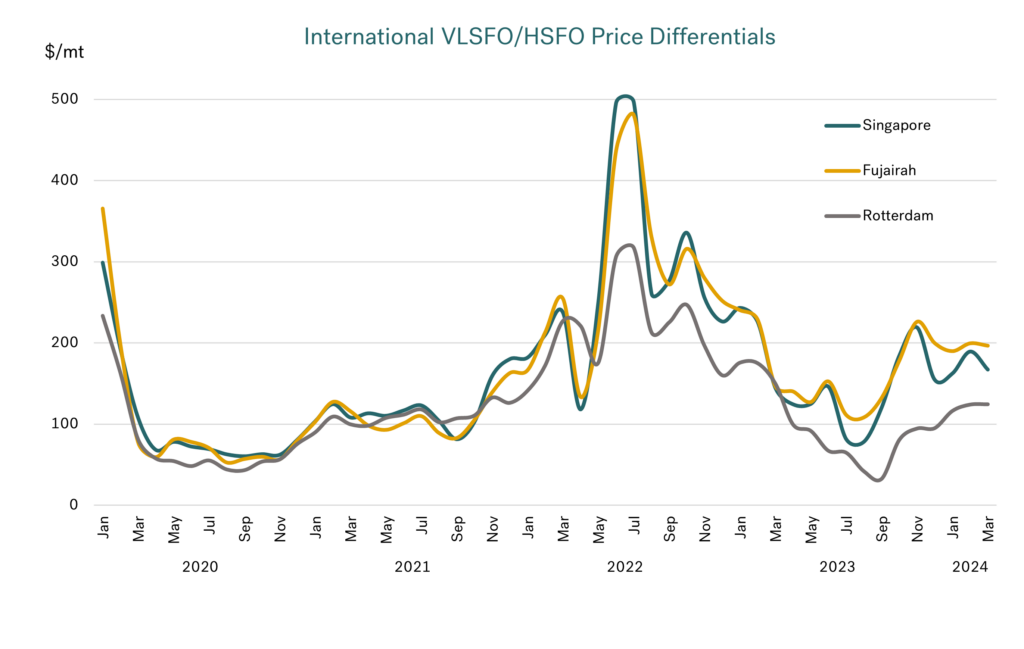

The VLSFO/HSFO spread has moved wildly since the legislation kicked-in at the start of 2020. The market rush and wide spreads at end 2019/early 2020 were quickly replaced by spreads of only $50-75/mt as COVID hit everything.

In 2022, we did see an extreme spike as most industrial sectors moved into ‘growth-mode’, at a time when refining was tight AND Russia had invaded Ukraine. This pushed oil prices and spreads to extreme levels, including the VLSFO/HSFO spread out as far as $500/mt East of Suez and $300/mt in Europe.

Source: Integr8 Fuels

Source: Integr8 Fuels

Between mid-2022 and mid-2023, markets became more balanced and oil prices fell sharply. Differentials would tend to narrow as prices fall, but the VLSFO/HSFO spread collapsed to only $50-100/mt; cuts in heavy/sour crude production from OPEC+ and European sanctions on Russian crude and product exports meant greater support to HSFO pricing than VLSFO.

Now things have changed again. Over the past 6 months we have seen this far greater strength in middle distillates than in HSFO, with the net result the VLSFO/HSFO price spread has moved back out to $175-200/mt East of Suez and $125/mt in NW Europe.

Is the spread likely to continue to widen?

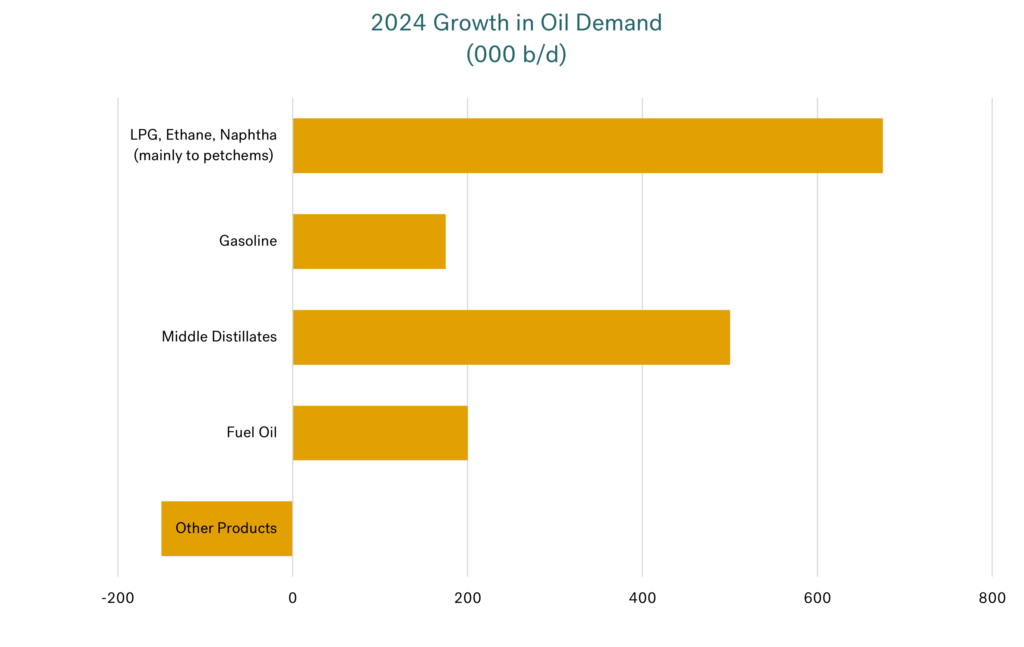

Looking at the bigger picture, growth in world oil demand this year is definitely centered on lighter end and middle distillate products.

Source: Integr8 Fuels

Source: Integr8 Fuels

There is a general shift in the oil industry towards petrochemicals, so, demand for LPG, ethane and naphtha are growth markets. In contrast, growth in demand for gasoline is low and at a turning point; the expansion in electric vehicle numbers in Europe, the US and China will mean gains in these regions will be minimal at best.

However, focusing on the VLSFO/HSFO spread this year, we need to look more closely at the middle distillates and fuel oil markets.

In absolute terms, middle distillate demand is the second biggest growth area this year, with gains evenly split between jet/kero and diesel/gasoil. Jet demand is generally increasing, with most regions now back to, or above their pre-pandemic levels. However, international airline travel in Asia is still below 2019 levels, and so a continued rebound here would give a further boost to jet demand. Also, even small positive developments in the economy will raise diesel/gasoil demand. The added factor to this is that middle distillate stock levels are very tight; so, prices here are likely to be ‘well supported’. With VLSFO pricing closely linked to middle distillates, it would mean VLSFO prices are also well supported.

There is forecast growth in fuel oil demand this year, but in absolute terms it is far lower than for middle distillates and lighter products. So, looking at the demand side, the inference is towards stronger relative pricing for VLSFO than HSFO and therefore a widening of the VLSFO/HSFO spread.

The supply side and refining

We have already seen severe bottlenecks in the refining industry, leading to much stronger margins and wider product price spreads. With demand now focussed on the lighter and middle parts of the barrel, there is little refiners can do in the short term other than to process more and more lighter crudes.

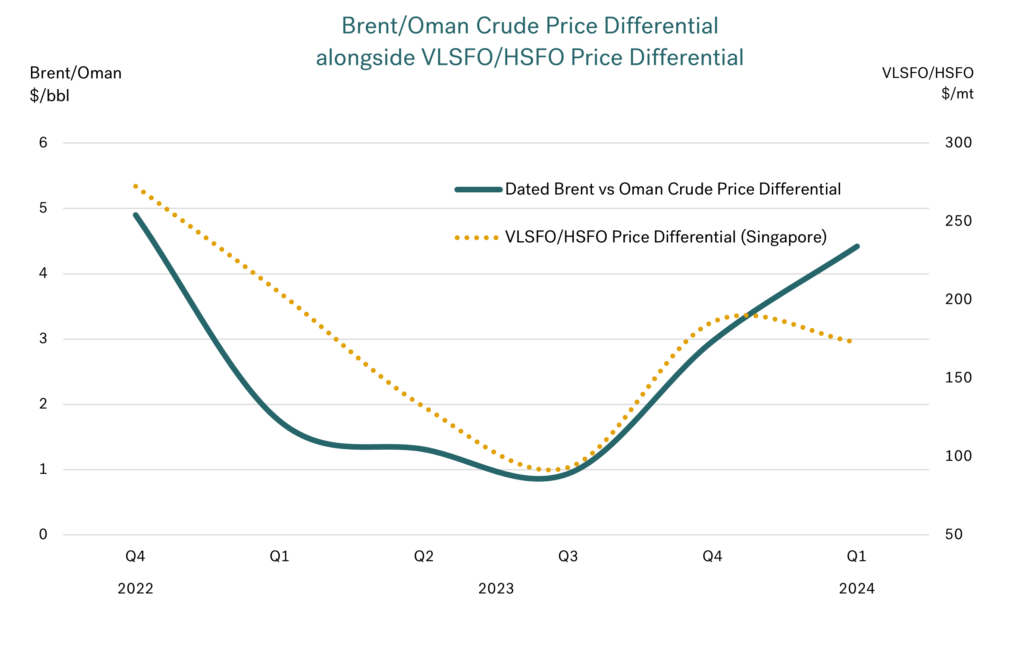

There are gains in production of these lighter crudes, but clearly not enough. The graph below shows the price spread between light/sweet and heavy/sour crudes (using dated Brent and Oman crudes as references) and then superimposing the Singapore VLSFO/HSFO differential.

Source: Integr8 Fuels

Source: Integr8 Fuels

The differential between the two crudes was squeezed to only $1/bbl through the first three quarters of 2023. This stemmed from the Russian situation and the agreed and voluntary cuts in OPEC+ production, which were dominant factors at the time and effectively lent support to fuel oil pricing.

But, even though OPEC+ has maintained their cuts and even extended them through to end June, the focus now is on refiners making more middle distillates. This has pushed demand for lighter crudes much higher, and with it this crude price differential is now back out and has averaged $4.50/bbl so far this year.

A wider VLSFO/HSFO price differential?

Given everything on the demand side and the limitations in the refining industry, it seems the pressure is on for a wider VLSFO/HSFO spread.

As an additional note, OPEC+ has managed the market and monthly average Brent futures prices have mostly remained in the $80-90/bbl for the past 18 months. As and when OPEC+ unwind these agreed and voluntary cutbacks, it will reintroduce more heavy/sour crude grades to the market and could put a further downwards pressure on HSFO prices.

The conclusion is that the VLSFO/HSFO differential could widen further this year, and if OPEC+ unwind any of their cutbacks the differential could be even bigger.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.