Speculators are buying;

it looks like prices are going up!

We are at a turning point; oil prices are rising

We have highlighted some major bearish factors over the past few months, such as weak prospects for oil demand growth and the huge challenges facing OPEC+ for them to even maintain oil prices. Prices had been tracking these developments, and in early June VLSFO fell to its lowest in almost

a year.

Though, looking at the graph below, things have taken a massive change in the past couple of weeks. The market has turned, and we should look to higher prices in the near-term; momentum today is definitely bullish.

Source: Integr8 Fuels

Source: Integr8 Fuels

Look at the changes in speculative positions in the market!

The ability for money to easily flow into and out of oil futures markets means shifts in price direction and price volatility can be extreme. This often comes from inflows and outflows of ‘speculative’ money. This is now generally termed as ‘managed money’, coming from hedge funds, pension funds and trading activities etc, and the players here can be very big! For the purposes of this report, we refer to this as ‘speculative’.

We are in one of these extremes right now, with a major reversal in ‘speculative’ funds taking place.

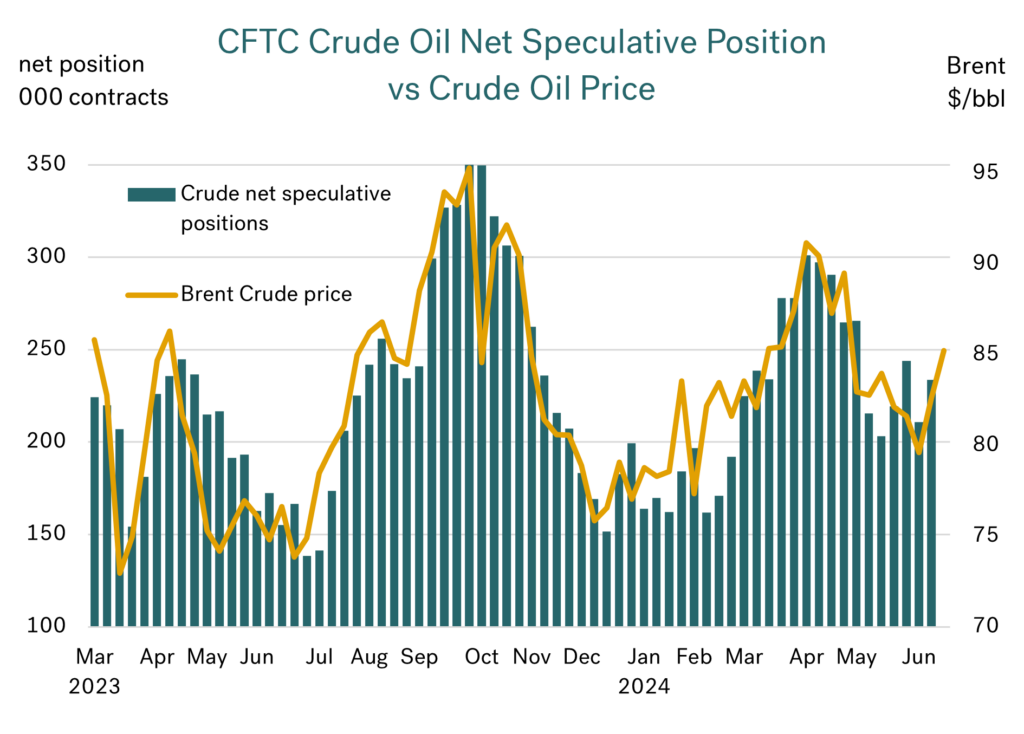

It doesn’t take much to link oil price direction and market volatility to shifts in the net position taken by traders/hedge funds etc. Of course, there are endless discussions about what drives what, and ultimately there must be ‘good’ reasons why players take a certain position. However, once the market ‘gets going’ there can be a period of self-fulfilling prophecy!

These dynamics are shown in the graph below, using data published by the US Commodity Futures Trading Commission (CFTC). It illustrates the net position taken by ‘speculators’ in US crude futures and options markets, and compares this with Brent front month futures price.

Source: Integr8 Fuels

Source: Integr8 Fuels

When speculators increase their net long positions, oil prices rise; when they reduce their net long positions, prices fall. From late April through to early June (even after the OPEC+ meeting), speculators were unloading their net long positions, and crude prices fell by more than $10/bbl. Hence the comparable $80/mt fall in VLSFO prices!

But we have now seen a reversal. Speculators are now buying back into the market and oil prices are up from their lows. Consequently, bunker prices are also moving higher.

Getting more granular on the speculators’ position

In these reports we often delve a bit deeper into the detail behind oil demand and price. In this case it is worth looking in greater detail on how the net speculative position is determined. In doing this we have to go down to the absolute number of long positions and short positions taken by these players. This will give us a greater understanding of what is driving the net position and just how

far things have changed. What it will show is that we could be at the start of a large-scale buying spree coming from ‘managed money’, and if so, this would push prices higher over the coming weeks/months.

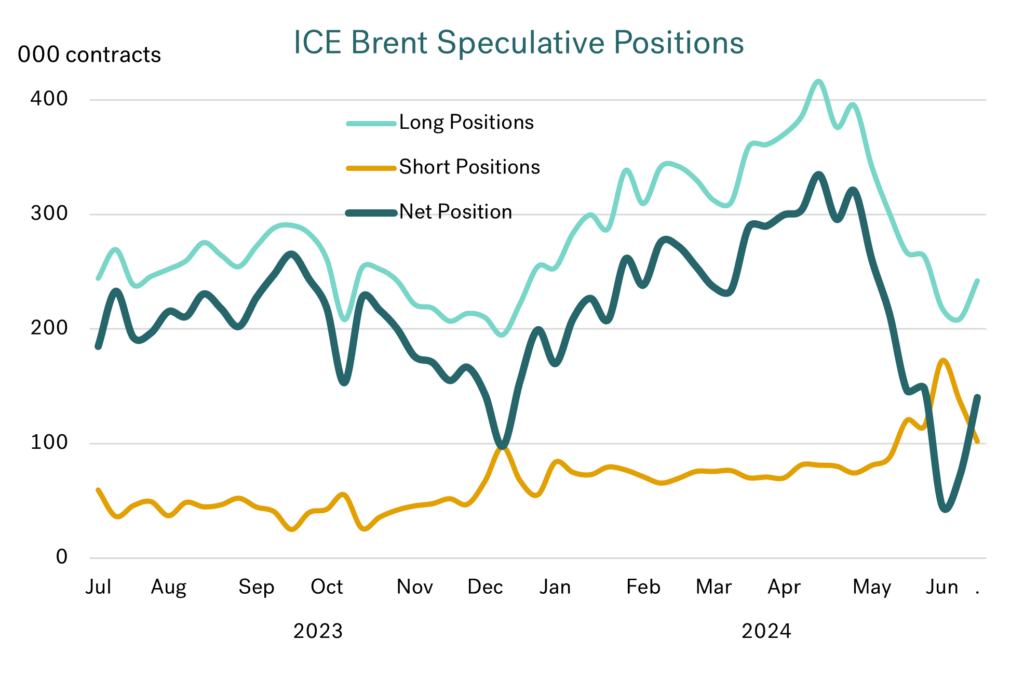

Digging into this detail, the graph below illustrates a breakdown of the ‘speculative’ positions taken in the ICE Brent crude market. It highlights the number of long positions, the number of short positions, and then the resulting net position held by speculators. From this it can be seen that outright long positions are the driving force behind this part of the speculative market. However, the recent rise and fall in short positions can cause a ‘double whammy’ in price movements.

Source: Integr8 Fuels

Source: Integr8 Fuels

Price rise to late April backed by extreme speculative length

Looking at developments this year, oil prices had been on an uptrend from the start of the year through to late April, with speculators here collectively doubling their long crude positions to a peak of over 400,000 contracts (equivalent to 400 million bbls) and its highest level since 2020. At the same time the speculative short position remained more-or-less flat, at around 75,000 contracts.

Price fall led by speculators going from one extreme to another

The price drop we have highlighted since end April was extreme and did involve a twist. Not only did the speculators unwind their extreme length, but they also collectively increased their short positions to the highest level since early 2020 and the start of the pandemic. The power of these trades could only mean a fall in oil prices.

So, by early June the net speculative position in ICE Brent crude was not only lower than at any time in the past 12 months, but it was also even lower than at the start of the pandemic, and in fact at its lowest since 2014 in this market. This shows the extremes to which the speculative position had fallen, and so just how potentially big the reversal can be!

Prices have just started to rise, but speculators could take them even higher!

So, there has been a speculative reversal over the past two weeks, moving away from the extreme low position in early June. Prices have risen with this; Brent is up $7/bbl and VLSFO up $30-40/mt. But speculators have only just started unwinding their short positions and buying back length; it looks like there is a lot more to go!

So, for the time being, any bearish talk on weak oil demand, more non-OPEC+ oil or low refinery margins is likely to be significantly outweighed by the bullish price sentiment from traders/hedge funds etc ‘re-balancing’ their exceptionally low speculative positions. In fact, there is already an impetus in some news stories backing this up. Pointers to a bullish European diesel market, stronger summer gasoil demand in the northern hemisphere and declining stock levels over the coming months are some topics being discussed.

So, perhaps forget any bearish fundamental stories for a while and hang on to the coat-tails of the trading community in a rising market?

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.