Singapore VLSFO at its lowest price in 20 months; what’s next?

We have the lowest bunker prices in almost two years

For a number of months we have been ‘banging on’ about the analysts’ view of stronger oil fundamentals and higher prices, versus the reality of declining oil prices, and so lower bunker costs in our sector.

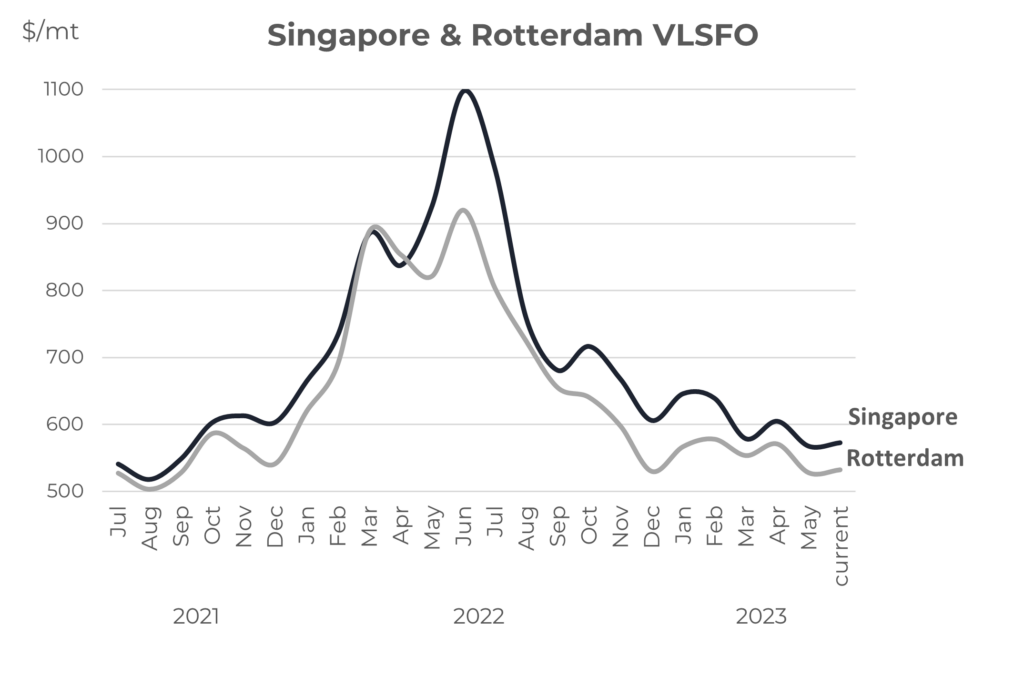

We are now at a point where monthly average Singapore and Rotterdam VLSFO prices are below their levels just prior to the Russian invasion of Ukraine, and at their lowest for 20 months. In fact, Singapore VLSFO prices have almost halved from their peak just 11 months ago.

Source: Integr8 Fuels

Can bunker prices go lower?

As we have seen over the past three years, forecasting prices can be a difficult challenge, especially in our area, which has been heavily influenced by a pandemic, let alone politics and war. So, the answer is: yes, prices can continue to slide.

Over the past 3-4 months market sentiment has strayed away from those bullish analytical forecasts and centred on some very worrying global economic developments. But we may now be at a ‘breathing space’ in the market, and if nothing else major happens like even higher inflation rates, significant hikes in bank rates or banks collapsing, then the industry may come back to look at what the analysts are saying. They haven’t really changed their fundamental views, and so if this does happen, then there will be a generally more bullish sentiment coming through.

Oil production could remain near unchanged through the next 6 months

In our report a month ago, we focused on oil production and how this is likely to be constrained over the rest of this year if key OPEC+ countries abide by their commitments to cut around 1.2 million b/d of supply (watch OPEC+ was the mantra). Forecast gains in non-OPEC+ production are similar to the planned OPEC+ cutbacks, and so on this basis oil supply would be relatively flat through the rest of this year.

After OPEC+, it comes down to demand

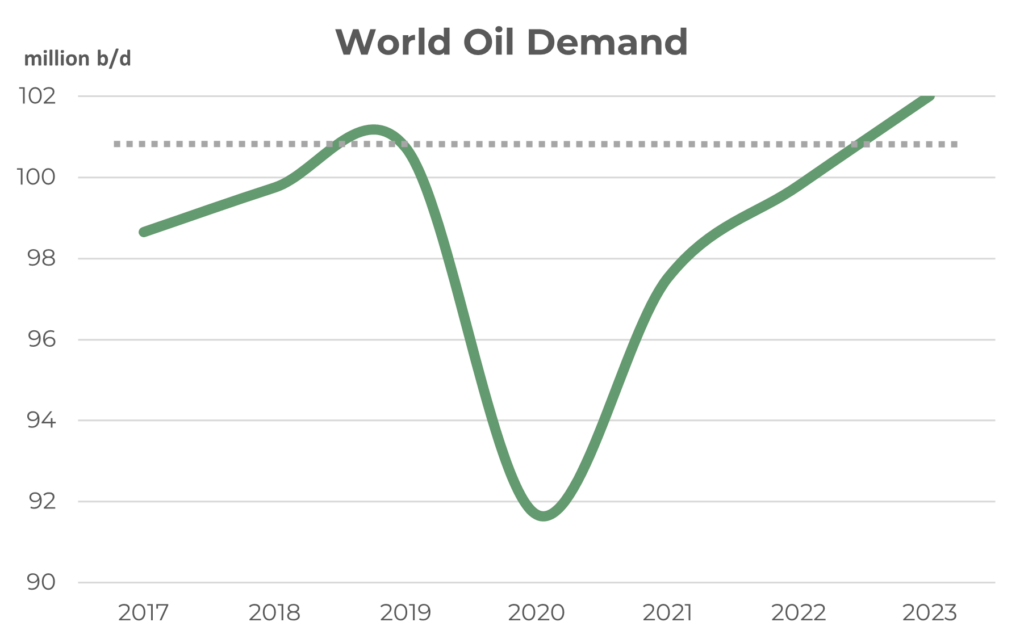

In this report we are focusing on oil demand. Current forecasts are that global oil demand will hit an all-time high this year, at an annual average of 102 million b/d. This is up 2 million b/d on last year and surpasses the pre-pandemic high of close to 101 million b/d seen in 2019.

Source: Integr8 Fuels

For all the talk of electrification in the auto sector, and anti-oil protests, global demand for oil is still rising, and is projected to continue rising for another 10 years or more. Electric vehicles will one day dominate and total oil demand will fall, it’s just that this is likely to be into the 2030s at the earliest.

The focus on demand definitely lies with China

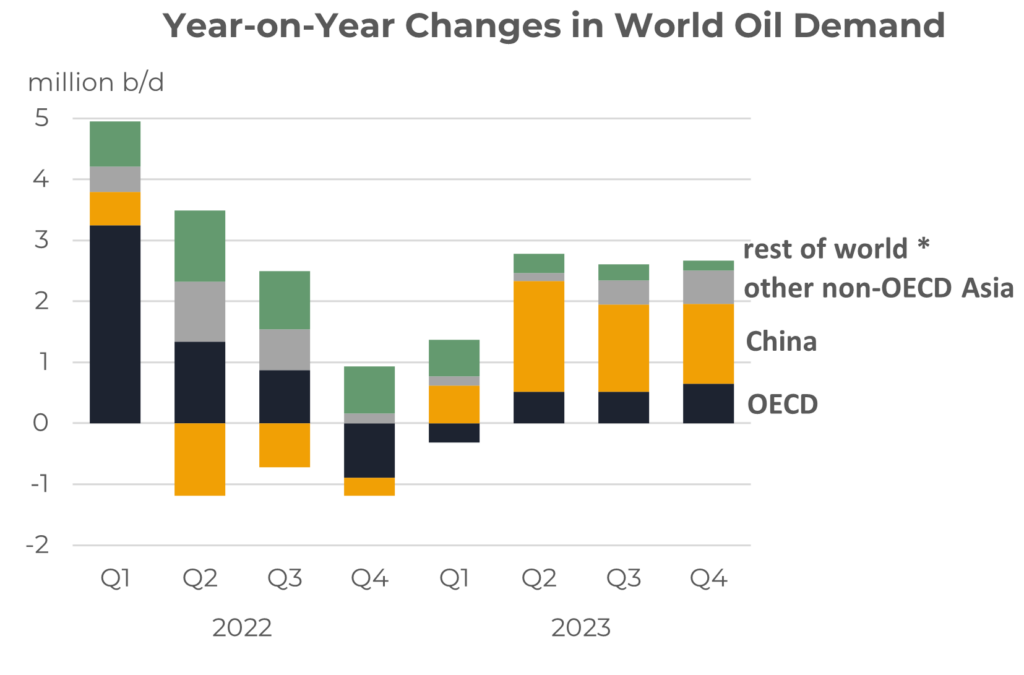

Coming back to more recent developments and the demand outlook for the rest of this year. The graph below illustrates year-on-year changes in oil demand by main region. The two main points here are that through the earlier parts of last year it was the OECD countries that were coming out of lockdown and driving increases in global oil demand (with China maintaining strict lockdowns). Now growth in OECD countries has stalled to only minimal levels and it is China that is the focus and powerhouse of new growth, with lockdowns finally removed and the economy ‘getting back into gear’.

Source: Integr8 Fuels

This story on Chinese oil demand is gaining momentum, with latest (March) data indicating an all-time high at 16 million b/d (this compares with the US at 20 million b/d, and the two countries combined, accounting for 35% of world oil consumption). Domestic air travel has also ‘taken off’, and is also back to pre-pandemic levels. Most analysts are indicating continued growth in these transport sectors, with a boom in international air travel on the cards for the second half of this year (at the moment international air travel is only around 70% of its pre-pandemic level).

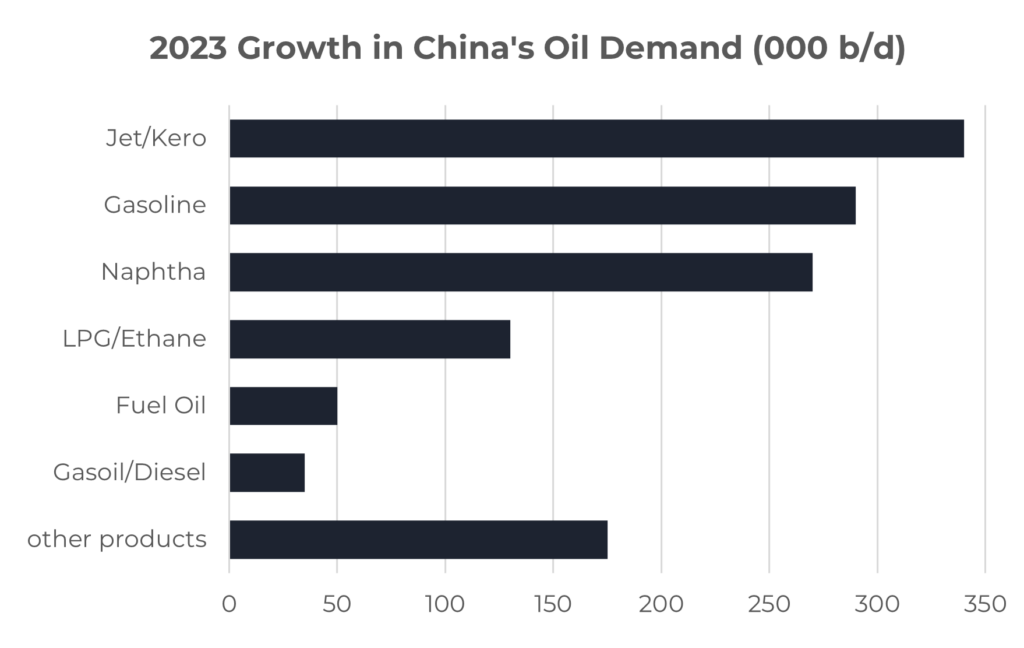

The graph below illustrates the forecast year-on-year growth in Chinese oil demand for this year by product, and clearly shows the emphasis on the air and road transport fuels of jet and gasoline. It is obviously that analysts looking at a strong growth in global oil demand this year are ‘pinning their hopes’ on these two products in China.

Source: Integr8 Fuels

Growth in naphtha demand in China is also very strong, with the major expansion in domestic petrochemical capacity.

In contrast, gasoil demand in China appears to be weak and this is a major concern because gasoil tends to be a ‘backbone’ to industrial activity. This does have further ramifications beyond the Chinese domestic market, as it is likely to limit any increase in exports and international trade. It also means a widening gap between levels of personal spending and industrial activity within China. However, the gains in travel are expected to far outweigh any limitations in the industrial sector.

Will market sentiment shift back to reflect what analysts are saying?

The IEA, Goldman Sachs, OPEC and the US EIA are some of the groups forecasting a tighter fundamental oil balance as we go through the rest of this year. There are some others that are less optimistic about China’s prospects and have greater concerns over economies in the OECD, but at the moment these seem to be in a minority.

It goes without saying that if there are heightened war or global political issues, then bunker prices are more likely to rise than fall. But summarising here, the fundamental outlook lies with the announced cuts in oil production from a few OPEC+ countries, along with the demand issues laid out in this report; in particular what is going to happen to oil demand in China. If no big, economic stories hit the headlines, and the sentiment shifts back to what various analysts are saying, then jet and gasoline demand in China will be a cornerstone in their thinking and oil prices over the rest of this year, including for us in bunkers.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.