Price Impacts on HSFO already well underway; VLSFO & MGO will be next

There will be a series of changes in bunker markets as we go through either side of the January 1st IMO 2020 implementation date, and recent price move- ments in HSFO is clear evidence the process is well underway.

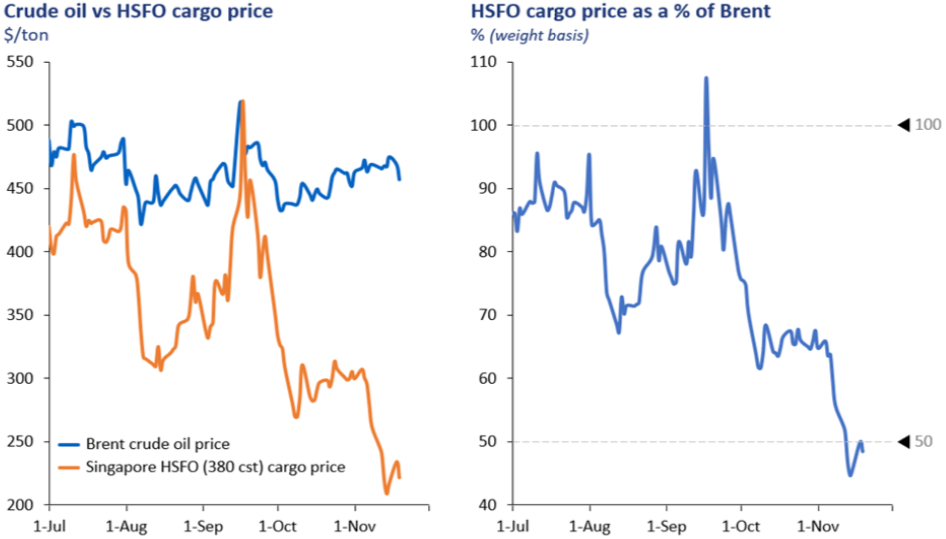

In mid-September cargo prices for HSFO rose sharply, even to above crude, as bunker demand for the high sulphur product remained ‘as usual’, but availa- bilities were becoming constrained with:

- the initial shift in refining and storage infrastructure from HSFO towards VLSFO and;

- limitations in HSFO trade flows as a result of the steep backwardation in prices because of the impending ‘collapse’ in demand.

As shipowners move to 0.5% sulphur bunkers, HSFO cargo prices have dropped by half price

However, this mid-September hike in HSFO prices was very short-lived. Since late September demand for HSFO bunkers has fallen away as shipowners re- duce purchases and start to build 0.5% sulphur bunkers onboard ahead of Jan- uary 1st. As a result, cargo prices have been in near free-fall and more than halved over the 2 months to mid-November (from above $500/ton to below $250/ton in Singapore), to a point where HSFO is now only 50% of the price of crude oil, compared with an underlying average of around 80%, and the more recent spike when HSFO went above crude. The initial moves and fall-out of the IMO 2020 change-over are clear to see in the extent of the price drop in HSFO; as it is often said “price tells you every- thing”.

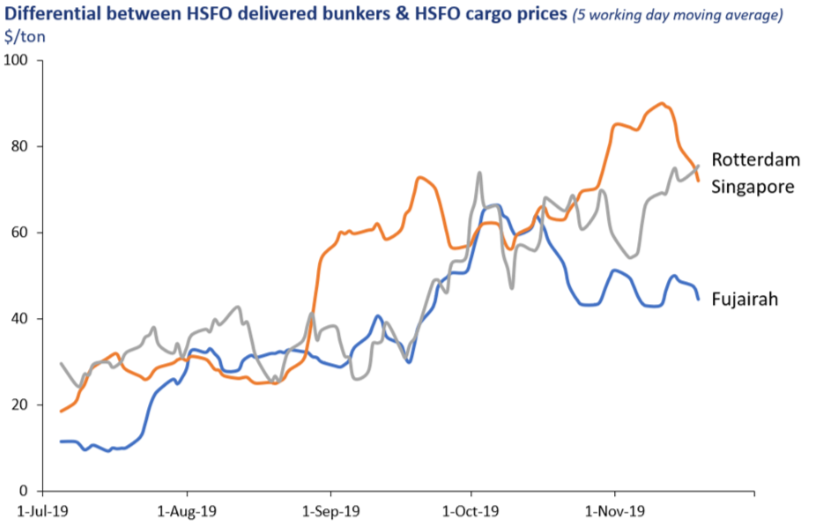

Shifts in HSFO barge and terminal infrastructure can be seen in the premium owners pay for HSFO delivered bunkers over and above the cargo price

This downwards pressure on HSFO prices is likely to continue as more ship- owners switch and build to use 0.5% compliant fuels onboard.

However, there is another nuance to the market change-over, in that buyers of HSFO bunkers haven’t seen the full impact of this drop in cargo prices. This is because owners are switching away from HSFO and towards purchases of VLSFO, so the barge infrastructure is beginning to shift in the same direction. The lower availability of HSFO barges and the growing logistical constraints on the terminal side are clearly represented in the premium owners are paying for HSFO delivered bunkers over and above the cargo price for the product.

In the main bunkering centres, delivered HSFO bunkers were typically around $15-30/ton above published cargo prices. The ongoing transition in the barge markets has meant constrains in this part of the system for HSFO deliveries and these premiums above cargo prices have moved to extreme highs, of above $70/ton in Fujairah, more than $80/ton in Rotterdam and close to $100/ton in Singapore. At this stage, the premiums in Singapore are falling, but in Rotterdam they are rising. We are in the phase where HSFO is still in demand but falling, and the number of barges delivering this product are in decline, with a significant number having to prepare ahead of the large-scale move to VLSFO. Shifting premiums represent the pace at which barges are switching versus the pace of decline in HSFO demand.

Since late September, the differential between HSFO delivered bunkers and cargo prices has accelerated

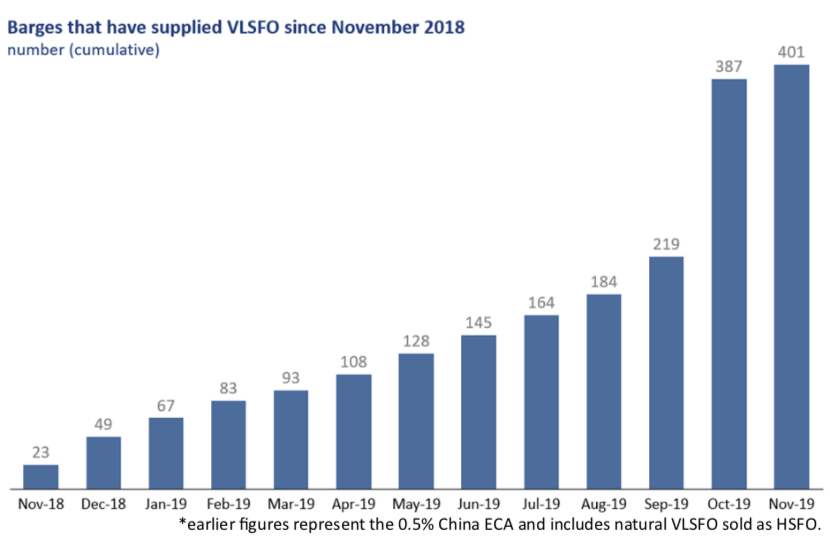

Through to mid-September our analysis indicates around 2-4 barges per week were switching into the VLSFO market. Since late September we can see this number has accelerated to around 40 per week and so clearly taking a toll on the capacity to supply HSFO to vessels.

In Singapore there are more than 300 bunker barges and we have identified 62 of these supplying VLSFO by mid-November (close to 20%). There are around 100 barges in Rotterdam and we have identified a similar 20% proportion that are supplying VLSFO. There is clearly the means to move barges between are- as, but globally we have measured around 12% of the barge market now carry- ing VLSFO and this is one of the factors why the price premium on HSFO bun- ker deliveries has moved to its recent highs.

However, over the same period we have seen virtually no change in the differ- ence between delivered MGO bunker prices and their corresponding cargo price in each region; on this basis it seems the demand and supply in this part of the bunker market has not yet changed significantly; but it will.

Barge premiums for MGO and VLSFO are now expected to rise

In terms of where we go from here, the HSFO premiums above cargo prices should ease as we go through to January, as demand for this product falls to only those owners with operational scrubbers on board. However, as this pre- mium declines, the barge premium for MGO deliveries is expected to rise (potentially to levels we have seen on the HSFO side), as those owners choos- ing MGO as their compliant fuel ramp up purchases. The same could be said for VLSFO as well.

Next year we would expect all premiums over the cargo market prices to be higher than the historical levels of $15-30/ton, given developments in the barge and terminal sectors. However, any ‘excessive’ premiums are likely to be short lived as the flexibility to move barges between markets will cap this, es- pecially in the main bunkering centres.

The number of barges will increase with conversions of small tankers

Given these developments and the added demand in the barge market from having to supply more products/grades than before, we are already seeing conversions of existing small tankers to bunker barges and the ordering of new bunker barges, which will at some stage boost availability at this point of the supply chain.

Overall, there are many moving parts to the bunker supply chain even at this stage. As the industry goes through the end of 2019 and well into 2020, even more changes to storage (land based and floating), barge numbers and opera- tions between HSFO, VLSFO and MGO and various product availabilities will take place. At Integr8 we are monitoring, measuring and closely analysing all these factors in the supply chain to minimise the greater operational and price challenges faced by shipowners and operators because of IMO 2020.

Steve Christy

Strategic Communications Director

P: +2074675860

E: SteveChristy@navig8group.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.