OPEC+ Kicks the Can with Bunker Costs Set to Fall by 10% in 2025

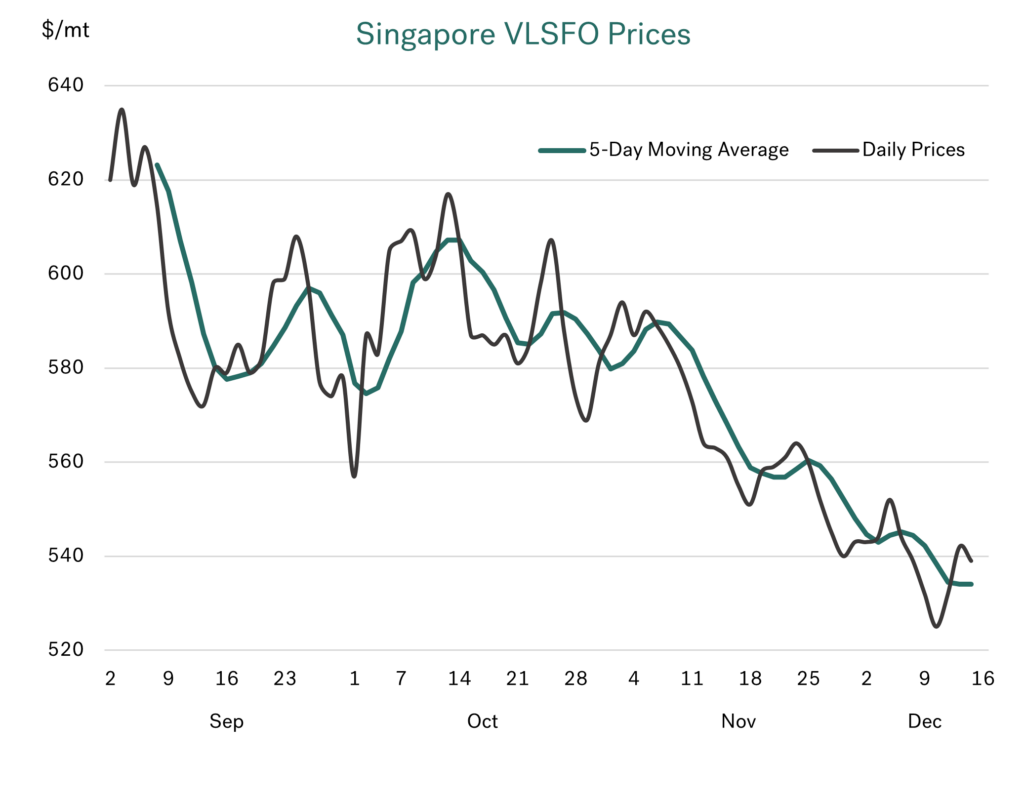

We have seen bunker prices slide for the past two months

For a number of months, we have pointed to bunker prices falling under the weight of very weak oil fundamentals. This has certainly come to fruition and bunker prices have continued to slide over the past two months. In Singapore, VLSFO prices are some $75/mt lower (minus 12%) than in mid-October, and in Rotterdam the drop has been around $50/mt (minus 10%).

Source: Integr8 Fuels

Source: Integr8 Fuels

In the HSFO markets, the drop has been greater in NW Europe, down $75/mt in Rotterdam over the last two months (minus 14%), with Singapore down $50/mt (minus 10%).

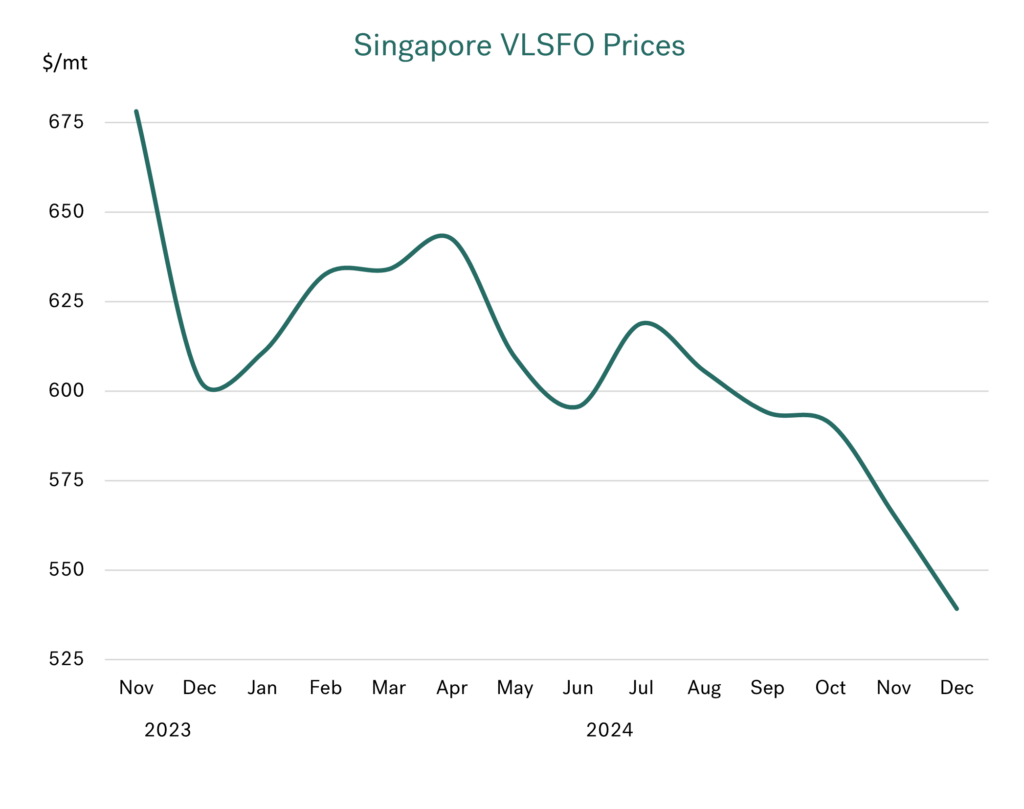

The decline is even clearer looking back to end 2023

The picture below is enough to illustrate how far bunker prices have fallen since the end of last year, and just how low we are today.

Source: Integr8 Fuels

Source: Integr8 Fuels

Has OPEC+ ‘come up with the goods’?

In our report last month, we highlighted the huge dilemma facing OPEC+, who at the time were looking to unwind their 2.2 million b/d of voluntary cutbacks starting in January next year. The problem was this was against a backdrop of weak growth in world oil demand and more than enough new non-OPEC+ production to meet additional demand. Consequently, it has been clear for some time that if OPEC+ wanted to maintain oil prices anywhere close to recent levels, then there was little, or no room for them to start increasing production anytime soon. The original strategy of reversing the cuts in January was almost certain to see Brent crude fall into the $60s (and Singapore VLSFO in the $450-500/mt range).

As is usually the case when faced with adversity, OPEC+ does ‘come up with the goods’. In this instance (at their early December meeting), they decided to shelve any idea of raising production in January, and pushed back the current target start date to April. They have also slowed the re-introduction period, now unwinding the cuts over 18 months, rather than the previously planned 12-month time frame.

At the same OPEC+ meeting, it was also agreed that the planned 0.3 million b/d increase in the UAE’s quota allocation would be pushed back by 3-months, to April and also be staged over 18-months (not 9-months as previously indicated).

The net result is that under current plans, OPEC+ production would increase by around 140,000 b/d each month starting in April, rather than increases of 210,000 b/d starting in January.

The market tells you everything

Looking at oil prices, they continued to slide through November. However, in the run-up to the early December OPEC+ meeting there were indications that the group would again delay (for the third time) any unwinding of the production cuts. The outcome has been for prices over the past 3-weeks to be maintained in the $72-74/bbl for Brent, and the $525-550/mt range for Singapore VLSFO.

The key here is, although prices appear to have held up after the OPEC+ meeting, there has been no significant rebound. The market does not believe at this stage that the new outcome will tighten oil fundamentals and push prices higher. OPEC+ may be ‘kicking the can down the road’ regarding the best timing to unwind production cuts, but they have come together to halt the slide in prices.

There is a strong view that when OPEC+ come to review the April start date, they will again have to delay unwinding production cutbacks.

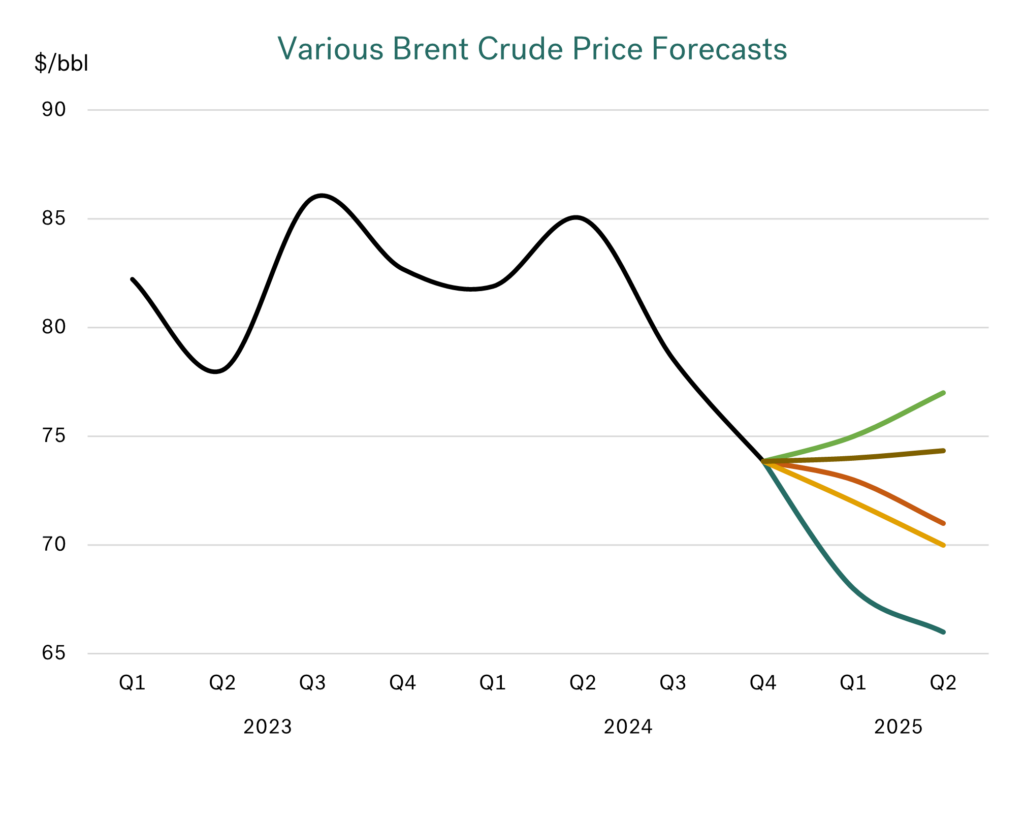

Analysts vary on their price views, but they don’t see a major rebound

A number of analysts have published crude price projections since the outcome of the latest OPEC+ meeting. As always, there are variations, but looking at views for Brent crude over Q1 and Q2 next year, there are a number within the range $70-75/bbl, which is within the trading range we have seen over the past month and in line with the current $73/bbl price.

Source: Integr8 Fuels

Source: Integr8 Fuels

Goldman Sachs are higher than this range, showing Brent moving up to $77/bbl in Q2, whilst Bank of America (BOA) are much lower, looking at $66/bbl in Q2 .

Based on $70-75/bbl crude price, Singapore VLSFO would be in a range of $525-550/mt (close to current prices). At the extremes, BOA’s view would imply Singapore VLSFO just below $500/mt, and Goldman Sachs at a high of $575/mt. Even at the outer reaches of these analyst views, the bunker market would not be in a ‘shock’ in the first half of next year.

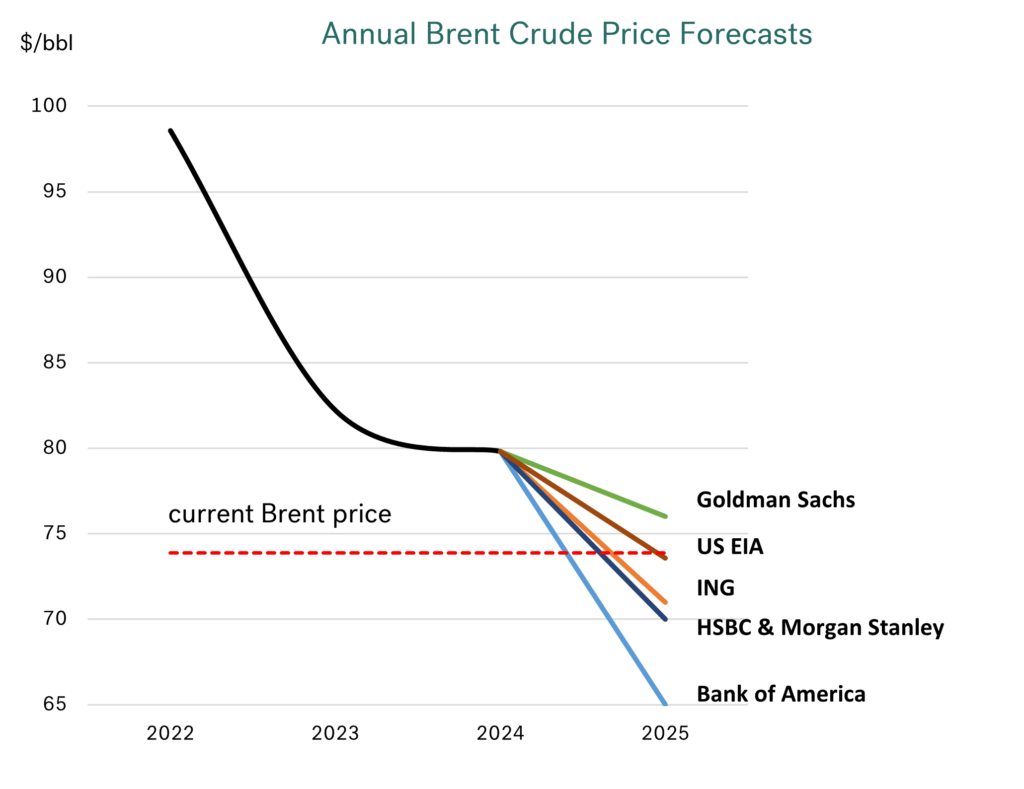

Good news for bunker buyers looking at annual budgeting

If you are in the office and looking at how much you are going to spend on bunkers in 2025, the analysts would suggest, a lot less than this year (and last year). Again, a core of 2025 forecasts lie in the $70-74/bbl range, with BOA at a low of $65/bbl, and Goldman Sachs at a high of $76/bbl; all lower than the $80/bbl average price seen in 2023 and in 2024.

Source: Integr8 Fuels

Source: Integr8 Fuels

UBS does have a higher price forecast of $80/bbl for Brent next year, but this was published before the OPEC+ decision to defer production increases, so perhaps should not be included.

Annual bunker costs 12% less in 2025?

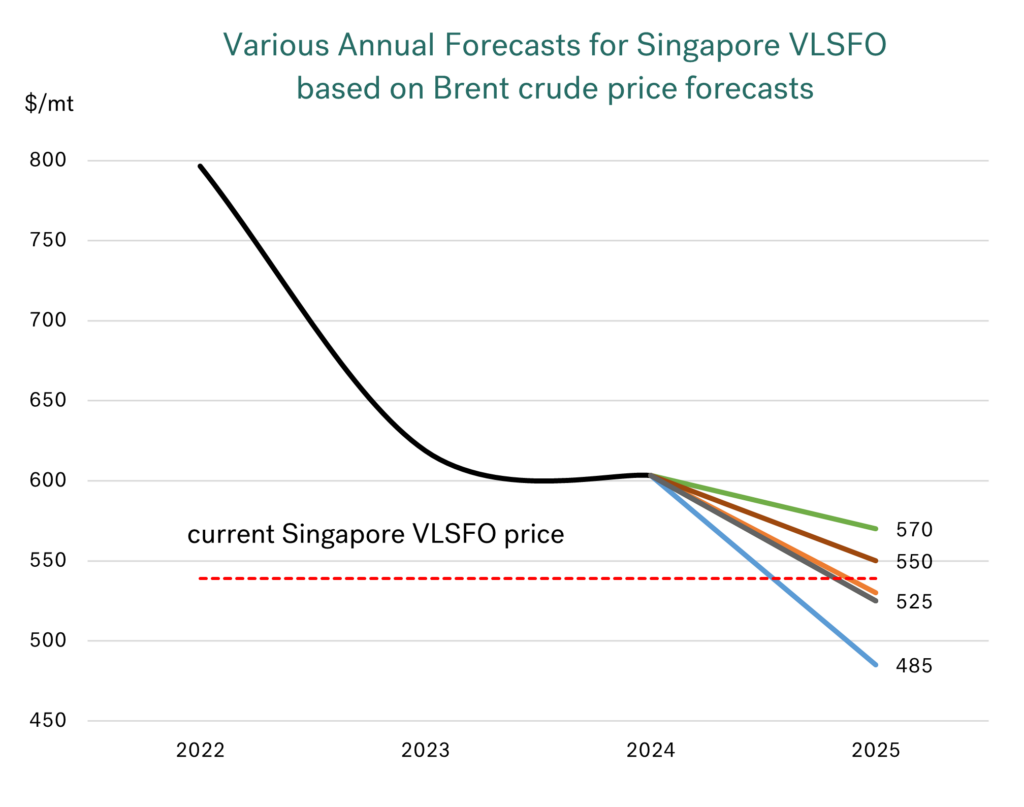

Using these analysts’ views on Brent prices, it implies the 2025 annual average price for Singapore VLSFO falls within a core range of $525-550/mt, with the outer limits up to $570/mt as a high (Goldman Sachs) and $485/mt as a low (BOA).

Source: Integr8 Fuels

Source: Integr8 Fuels

In terms of budgeting VLSFO bunker costs for 2025, it means the ‘core view’ is at least 10% lower than in this year. Even based on Goldman’s ‘higher’ price forecast, annual average bunker costs for 2025 will still be 5% lower than this year. Finally, using the BOA’s forecast suggests there will be a massive 20% reduction next year. Whichever way you look at it, the analysts are currently telling us that we will be spending less on bunkers in 2025!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.