Minimising density discrepancy to achieve bunker savings

With the rise in bunker prices, shipowners are increasingly focusing on achieving savings when buying fuel, particularly in the shipping sectors where earnings have not shown similar growth. This time we look into the importance of minimising the discrepancy between the BDN (bunker delivery note) and the tested density, also called density short lift, as well as highlight the best and the worst performing ports and discuss the options the shipowners have to manage this risk.

Higher bunker prices push to focus on savings

Bunker prices have been on the rise following the increases in Brent. This happens as oil demand continues to recover, despite the surge in the covid-19 cases in several countries.

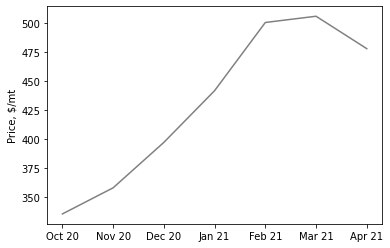

Figure 1: Average VLSFO monthly delivered price in Singapore (source: Integr8 Fuels)

As seen on Figure 1, the average VLSFO price in Singapore increased by over 40%, from around $335/mt in October to $480/mt in March, with a small correction in April, although recently Brent achieved a new multi-year high of around $70/bbl. The same pattern is seen around the ports globally.

As demand continues to recover, oil prices are likely to carry on going up, particularly as it is believed supply may not be able to react quickly to the changes in demand.

Goldman Sachs in its recent oil price forecast expect Brent to reach $80/bbl over the next six-month period, which will in turn continue pushing bunker prices higher with shipowners increasingly looking to make fuel bill savings.

In the previous articles we covered a number of ways to achieve such savings, from being flexible on the bunkering port and going beyond the main hubs to buying on calorific value and ensuring a longer lead time to avoid the prompt premiums. Another way to save money is to minimise the discrepancy between the BDN and the tested density.

Density short lift control as a way to reduce bunker bill

As bunker fuel is most often sold by metric tons, it is not only important to have the correct measurements of the volume and temperature taken before and after the transfer of the bunker fuel, but also to have the accurate density stated in the BDN as this directly impacts the metric tons bought and paid for.

Figure 2: Average difference between BDN and tested density in Jan-Apr 2021 (Source: Integr8 Fuels)

On average, as seen from Figure 2, the discrepancy between the BDN and the tested density is close to zero meaning that for a truly globally trading (or rather bunkering) fleet not much savings can be achieved here. The reality however is that a large share of the global fleet operates between or within a particular region and depending on the trade, the fleet could be exposed to buying in a limited number of ports with significant density short lifts.

Having analysed over 30,000 fuel quality tests as well as BDNs of over 4,000 stems covering the first four months of 2021, three Brazilian ports came at the top of the list, meaning that on average when buying bunkers in these ports the tested density of the fuel is higher than the density stated in the BDN, meaning a gain for the shipowner (Figure 3).

Figure 3: Top 3 and bottom 3 ports by density short lift in Jan-Apr 2021 (Source: Integr8 Fuels)

On the opposite, there was on average an over 1% density loss on the fuel bunkered in Hong Kong, Colombo, and Port Klang. In comparison, the average density discrepancy in Singapore is around 0% due to the use of mass flow meters. The fast-growing bunkering hub of Zhoushan has an average density discrepancy of -0.28%.

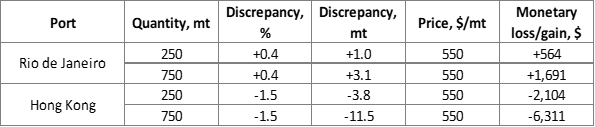

The scale of the gains and losses can be estimated through the examples shown in Figure 4.

Figure 4: Examples of density discrepancy gains and losses

In Rio de Janeiro, buying 750 mt of VLSFO at the current price would on average have resulted in an over $1,500 gain for the shipowner. While this is a somewhat extreme case, shipowners will still benefit from buying bunkers from all the other ports with positive density gains; examples would be Tenerife, Kingston, Santos, Barcelona, Lisbon, and others.

In Hong Kong a 750 mt VLSFO stem would on average result in an over $6,000 loss for the owner and this multiplied by the number of stems and vessels bunkered per year can add up substantially.

There are a number of reasons why some ports may have larger density discrepancies than others. It is often the case that a generic density is used in the BDNs across bunker deliveries, while the individual batches’ density may vary. It may also be down to lab testing or in some cases such discrepancies are simply the result of buying from the less reliable suppliers.

This is not to say that shipowners should avoid certain ports or suppliers, but to make the necessary adjustments to the quoted price with the density short lift in mind. When buying bunkers, it is often a dollar or two per mt that tips the scale in favour of a certain supplier or trader, and these could easily be “hidden” in the fuel’s density.

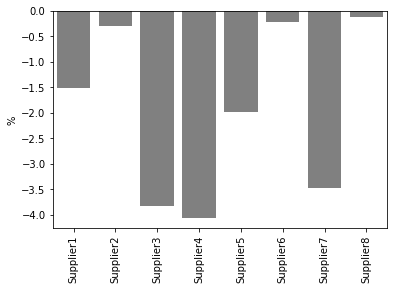

Figure 5: Suppliers in Hong Kong by average density short lift Jan-Apr 2021 (Source: Integr8 Fuels)

Even in Hong Kong, a port with a high average density short lift, shipowners should consider looking at the individual suppliers before fixing. Figure 5 shows that supplier 2, 6 and 8 are actually within the global average when it comes to the density short lift, however others may result in losses if such a difference is not reflected in the quoted price.

While it is not easy to avoid density short lift loss, there are some steps that shipowners can take to minimise it.

One way is for the shipowners to collect, structure and analyse the BDN and quality test data for their own fleet. This data could be consulted prior to enquiring or fixing a stem to see if there have been any recent cases of density discrepancy and if so, how these may affect the quoted price. Besides using the data, building trust and relationships with suppliers have been and will continue to be key.

Lastly, minimising density short lift is one out of the many solutions shipowners could use to achieve the bunker bill savings. Ideally, a combination of them should be used however this requires handing a vast amount of data and conducting continuous research and analysis, which could both be done in house or outsourced to an intermediary. Whatever the approach is, with the increasing bunker prices the desire to achieve savings will only grow stronger.

Anton Shamray, Senior Research Analyst, +44 207 4675 856

E: anton.s@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.