Med ECA: Immediate Operational and Commercial Impact of Implementation

This article offers a preview of insights from our next bi-annual Bunker Quality Trends Report, coming September 2025. Sign up here to receive the full report when it’s published.

An early look at how the new sulphur limit is reshaping bunker demand, fuel availability and quality, and operational strategies across the Mediterranean.

Figure 1: Map of IMO ECAs in 2025

Source: Integr8 Fuels

Focus on the Mediterranean ECA

The Mediterranean Emission Control Area (Med ECA) came into force on 1 May 2025, requiring every ship in the Mediterranean Sea to burn fuel with no more than 0.10% m/m sulphur. Adopted under MARPOL Annex VI (MEPC.361(79)), it became the first ECA to cover an entire enclosed sea, marking a unified effort by all bordering states to curb regional shipping emissions. The rule applied immediately, with no grace period, to both international and domestic voyages, placing new demands on fuel procurement, supply infrastructure and quality assurance in ports that had not previously handled significant volumes of 0.10% fuel.

This paper’s role is to assess the immediate operational and commercial impacts of the Med ECA’s implementation, by:

- Evaluating shifts in regional fuel availability and quality statistics

- Identifying emerging non-conformance trends (e.g. total sediment potential (TSP), sulphur, water, ash) and their root causes

- Highlighting supply chain and storage practices that may exacerbate blend instability

- Offering practical guidance for buyers and ship operators on quality assurance, certificate scrutiny and risk mitigation in a post-ECA environment

Through data-driven analysis and targeted recommendations, the paper equips stakeholders to navigate the new low-sulphur landscape with greater confidence.

Availability and Fuel Mix

Fuel mix proportions have shifted markedly in the lead-up to and immediate aftermath of the ECA’s enforcement. Very Low Sulphur Fuel Oil (VLSFO) has declined from over 60% of Mediterranean supply in December to just 37.5% by May 2025. In contrast, Low Sulphur Marine Gas Oil (LSMGO) has risen steadily, making up nearly 30% of supply by May, representing proportional growth of over 120%, even if its absolute volume is still much lower than VLSFO. High Sulphur Fuel Oil (HSFO) has remained relatively stable given the continued demand from scrubber equipped tonnage across the basin.

Figure 2: Fuel Supply Share by Grade % – Med ECA

Source: Integr8 Fuels

The number of ports supplying LSMGO has also steadily increased across the Mediterranean, rising from 105 in December to 131 by May 2025, an overall gain of 24% over six months. In contrast, VLSFO availability has contracted sharply, with the number of active supply ports falling from 68 to just 36, a net decline of 47% over six months. The steepest monthly decline occurred in May, at 30.8%, highlighting the pivot away from 0.50% fuels toward 0.10% compliant distillates in a post-ECA environment.

Ultra Low Sulphur Fuel Oil (ULSFO) has historically been a niche product, with supply concentrated in Algeciras and limited operational uptake. However, recent data shows its share of the Mediterranean fuel mix has climbed from 0.3% in December to 3.6% by May 2025—a twelvefold relative increase. While volumes remain modest, this shift confirms a material resurgence in ULSFO liftings within the region. The extent to which this reflects structural change or opportunistic lifting remains to be seen, but the trend is now clearly established.

Those trends, long anticipated by industry analysts, are now materialising and will inevitably reshape the Mediterranean fuel-supply landscape over time.

Impacts on Quality

With any change in legislation comes a shift in supply chains, often resulting in unintended consequences for delivered quality. The introduction of the Med ECA on 1 May 2025 marked a clear step change to 0.10% sulphur fuels across the region. HSFO aside, quality data from Q1 through the changeover shows a familiar pattern: early volatility, tightening product tolerances, and operational strain around storage, segregation, and blend consistency. In the run-up to enforcement, there were rising cases of sulphur exceedance, elevated water content, and signs of instability in both VLSFO and ULSFO deliveries—reflecting the typical bedding-in period that follows major regulatory shifts.

The following sections provide a breakdown of developments by fuel grade, covering the period December 2024 to May 2025, with a focus on risk areas, supply patterns, and buyer impact under the new ECA framework.

VLSFO

VLSFO off specification prevalence in the Mediterranean rose from 1.5% in December 2024 to 3.8% in May 2025, indicating a general deterioration in delivered quality following the implementation of the Med ECA.

Figure 3: VLSFO Off Specification % by Parameter – Med ECA

Source: Integr8 Fuels

Sulphur non-compliance has remained broadly stable in recent months, holding between 0.7% and 0.8% from March to May. This relative consistency may reflect steady HSFO demand, which has limited the need for frequent barge switching and reduced the risk of sulphur cross-contamination between grades.

Reports of elevated water reached 1.1% in May, indicating a higher frequency of non-homogeneous fuels. This may coincide with a decline in VLSFO demand, which has slowed tank turnover and led to consolidation of residual stocks across the supply chain, increasing the risk of instability at the point of delivery.

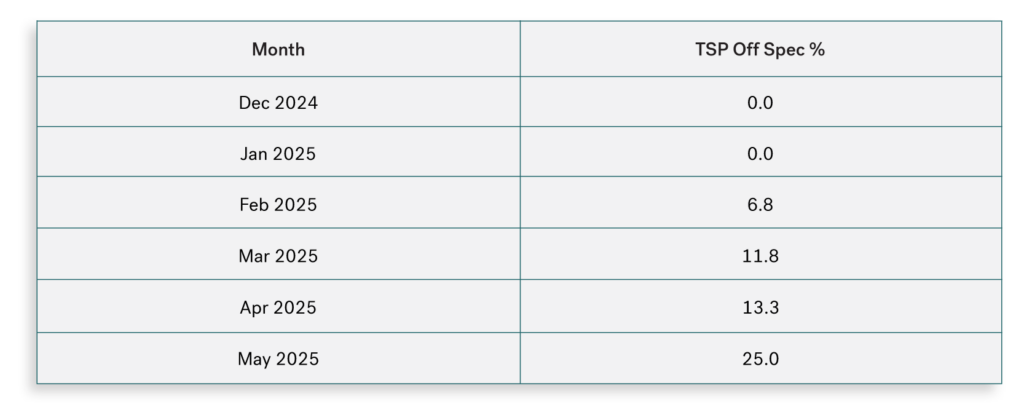

TSP infractions began to rise from February 2025 onwards, with no reported cases in either December or January. By May 2025, TSP accounted for 25% of all VLSFO notifications, highlighting the early possibility of a deteriorating trend in blend stability.

Figure 4: Total Sediment Potential Off Spec % – Med ECA

Figure 4: Total Sediment Potential Off Spec % – Med ECA

Source: Integr8 Fuels

TSP, or total sediment potential, is a measure of how likely a fuel is to form sludge due to unstable blending. When TSP levels rise, it signals that heavier components in the fuel, such as asphaltenes, are starting to separate—posing a risk of clogging filters and damaging engines.

Whether this is a temporary bump or a lasting shift remains to be seen. However, the increase may be attributed to several factors.

First, hydrodesulfurisation (HDS) in Mediterranean refineries has ramped up significantly since IMO 2020 to meet low sulphur targets. While highly effective at removing sulphur, HDS also reduces the fuel’s natural ability to keep asphaltenes suspended, making them more likely to manifest as sediment—leading to higher TSP readings and the possibility of handling issues on board the vessel.

Other quality strains were likely driven by extended in-tank storage, the consolidation of residual volumes during the VLSFO wind-down and temporary multi-grade barge operations—all of which increased the risk of instability at the point of delivery.

Although data on this trend is still limited it warrants caution, and buyers should scrutinise Certificates of Quality, particularly those issued well before lifting that show TSP values of 0.05 % Wt or higher (indicating moderate thermal instability and a risk that the fuel’s true properties may differ at delivery).

LSMGO

LSMGO off spec prevalence fluctuated between 2.8% and 3.5% from December 2024 through April 2025, before falling sharply to 1.2% in May. This recent reduction may reflect improved operational control or greater stability in post-ECA fuel streams, but further data is required to confirm whether this marks a sustained trend.

Figure 5: LSMGO Off Spec % by Parameter – Med ECA

Source: Integr8 Fuels

Flash point continues to be the dominant cause of quality non-conformance in LSMGO across the Mediterranean, responsible for more than two-thirds of all cases in most months. While sulphur, pour point, and other parameters remain largely stable, the consistently high incidence of flash point issues highlights the need for increased oversight—particularly in markets where EN590 automotive diesel may still be present in the marine distribution system. Fuels with a flash point below the SOLAS minimum of 60°C present both safety and regulatory risk and require urgent attention from buyers and operators.

These issues are not limited to minor or irregular supply points. Spain, Turkey, and Italy together account for over three-quarters of all flash point-related quality incidents across the region. Spain alone contributed nearly 30% of total recorded cases, while Turkey’s issue rate was disproportionately high relative to its supply volume. Italy followed closely, showing similar alignment between case count and fuel availability. Although France and Libya saw fewer liftings, both registered significantly higher non-conformance rates, indicating localised risk zones.

The recurrence of potential SOLAS infractions at key supply locations reflects the continued presence of low flash fuels with high kerosene content and low viscosity, often associated with inland or automotive grades. This reinforces the need to use quality data to pinpoint pools of lower flash fuels, to allow buyers to plan bunkering accordingly.

ULSFO

Test data remains limited for ULSFO, making it difficult to establish meaningful trends at this stage. However, when examining individual supply locations, more established ports such as Algeciras are performing markedly better, with a non-conformance rate of just 0.9%, compared to significantly higher rates in newer or more marginal ULSFO supply locations. This supports the recurring pattern seen throughout bunker supply history, where early implementation phases under new regulatory regimes often bring a degree of volatility and quality uncertainty.

Among the 10 reported ULSFO quality cases from January to May 2025, the breakdown is as follows: sulphur exceedance accounted for 50.0% of cases, total sediment potential for 30.0%, with the remainder split between water content (10.0%) and viscosity (10.0%). The majority of issues relate to sulphur slippage and signs of instability.

ULSFO is well known for its compatibility challenges, particularly when mixed with residual onboard product. As a result, sediment is formed which can trigger major operational difficulties on board the vessel, potentially rendering the fuel unusable. This risk makes segregation and pre-transfer checks critical to avoiding sediment-related issues in the early stages of ECA deployment.

Conclusion

- While supply availability has broadly kept pace with demand, the quality picture is more uneven.

- VLSFO has shown early signs of instability as tank turnover slows and residual inventories are cleared.

- LSMGO remains widely available but continues to carry flash point exposure in several key markets, raising the risk of potential SOLAS non-conformities.

- ULSFO volumes are rising but remain operationally complex, with sulphur and sediment issues emerging in early data.

These developments follow a familiar pattern seen in past regulatory transitions: early volatility, reduced product tolerance, and greater exposure at the point of delivery.

Buyers operating under the new ECA regime will need to remain vigilant—not only in terms of compliance, but in ensuring that the fuels they lift are operationally sound, physically segregated, and backed by robust documentation. The Med ECA may be a regional regulation, but the shift it has triggered will continue to influence sourcing practices, operational safeguards, and quality risk management across the broader marine fuel supply chain.

Chris Turner

Manager, Bunker Quality & Claims

chris.t@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.