Is it time to worry when all the analysts are in agreement?

Brent can’t stay above $90/bbl for very long!

For a number of months, we have pointed towards ‘weak’ fundamentals in the oil market and the counter effects of high geopolitical risks, with a net outcome of only limited movements in price.

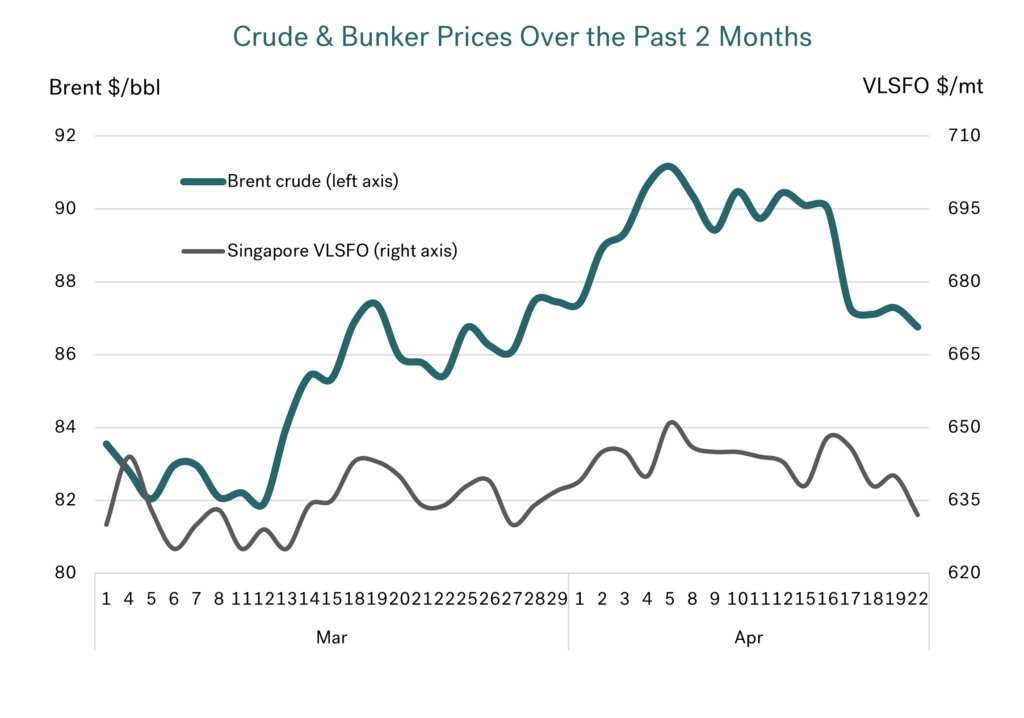

In the past month we have seen the geopolitical risks escalate again, with Iran now also involved in military operations. Brent futures did move up in response, from around $86/bbl to just above $91/bbl (it’s highest for 6 months). But this is only a gain of some $5/bbl, which doesn’t seem very much given military actions between Israel and Iran. To emphasise the limited ‘price concerns’ in these conditions, Brent futures have now fallen back to their earlier levels!

Source: Integr8 Fuels

Source: Integr8 Fuels

If, given the circumstances, crude price movements over the past month can be considered ‘muted’, then shifts in bunker prices have been ‘non-existent’ The graph above shows daily Brent futures prices alongside Singapore VLSFO, on comparable scales. In bunkers we haven’t seen the full extent of movements in crude futures prices, and looking at the daily Singapore VLSFO quotes, we haven’t seen a major uptick, and current prices are actually $2/mt lower than a month ago!

More for OPEC+ to do?

It is clear the market is currently ‘relaxed’ on oil supply; crude oil prices did move up on these actions and tensions, but they didn’t ‘want’ to go much higher, and they ‘wanted’ to come down pretty quickly. Looking further ahead, through to the end of next year, all the supply pointers suggest there will be more than enough oil to satisfy world needs. In fact, now it looks like the OPEC+ group will need to continue to extend their agreed and voluntary production cutbacks beyond June, and well into next year, to try to maintain prices around current levels.

Gains in non-OPEC+ production give confidence to the market and concerns to OPEC+

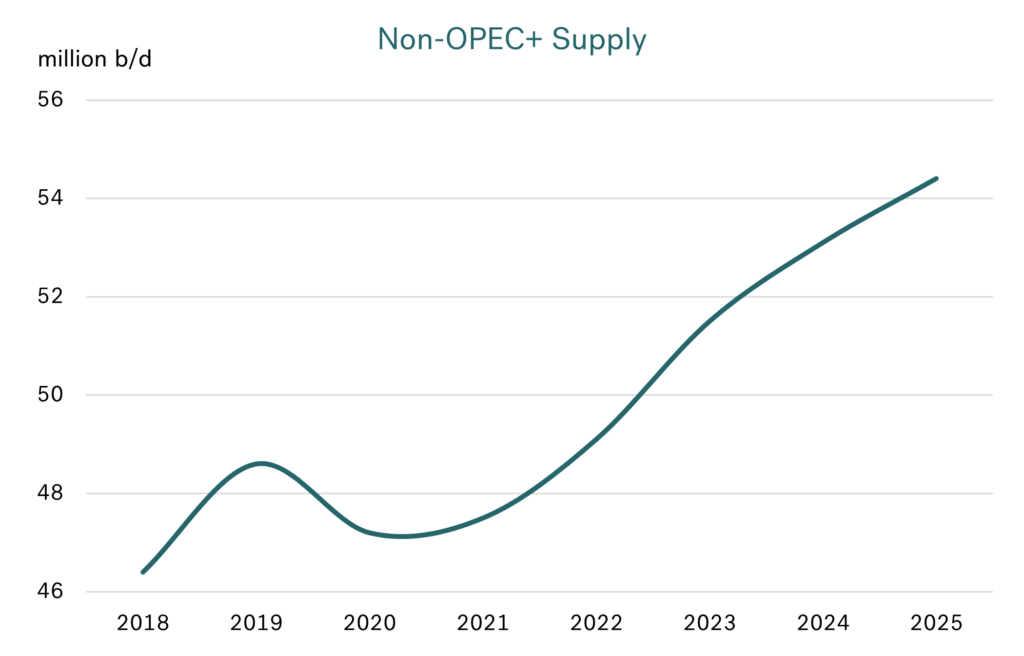

Work and investment in non-OPEC+ production certainly waned during covid, meaning depletion rates at existing fields were higher and new oil developments lower. Hence non-OPEC+ supply fell during 2020/21, then only showed a modest gain in 2022, and started to pick up in 2023.

But that has now all changed. Renewed capital commitments to existing oil and new projects suggest non-OPEC+ output will rise from 51.5 million b/d last year 54.5 million b/d by 2025. The ‘big hitters’ in this gain will be the US (shale and Gulf of Mexico oil), Brazil, Guyana, Canada, and Norway.

Source: Integr8 Fuels

Source: Integr8 Fuels

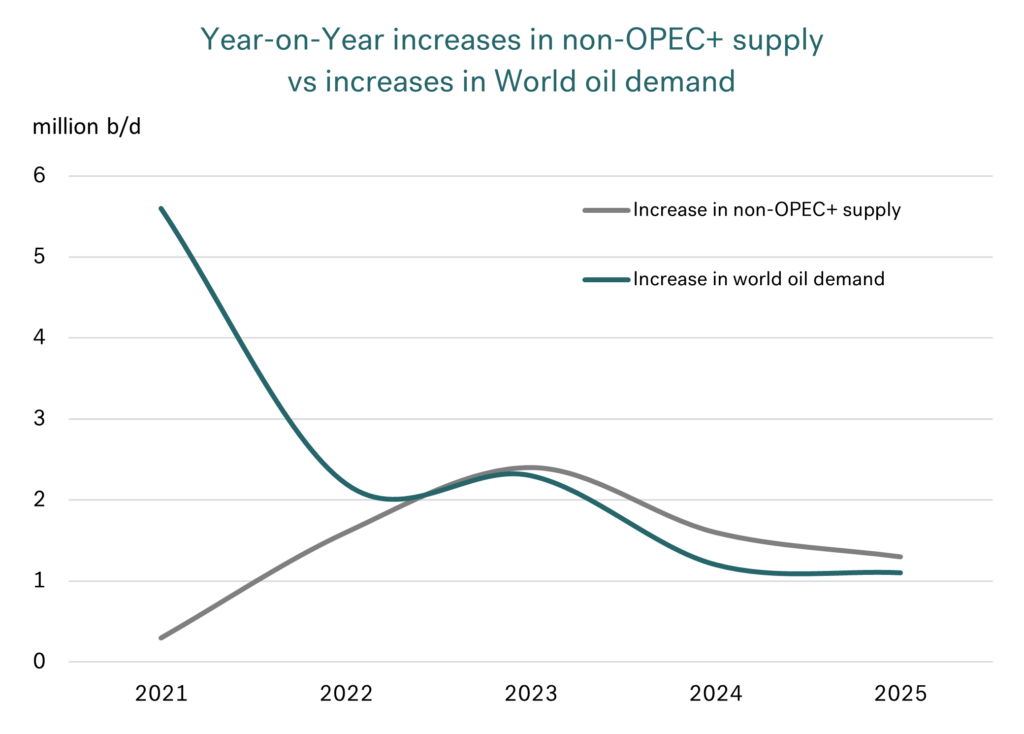

This 3 million b/d supply gain in non-OPEC+ over the 2 years to 2025 is expected to be in line with, or even slightly greater than increases in World oil demand. This means the world has shifted dramatically from 2021/22, when we were coming out of COVID and heavily reliant on OPEC+ raising output to meet the post-pandemic rebound in oil demand.

Source: Integr8 Fuels

Source: Integr8 Fuels

Last year was the turning point, where non-OPEC+ output started to ramp up and OPEC+ made agreed and voluntary production cutbacks to support oil prices (with Brent in the $80s).

These OPEC+ cutbacks have been reviewed and extended a number of times. Also, a few OPEC+ countries are producing above their target levels, and there is pressure on these to cutback. However, given the expansion in non-OPEC+ supply, if the OPEC+ cartel want to keep prices anywhere close to current levels it looks like they will have to keep rolling over the current cutbacks well into next year (the next OPEC+ meeting is scheduled for early June).

OPEC+ restraint means more spare production capacity in the world

With the cutbacks and restraint in OPEC+ production, it means there is a close to 6 million b/d spare oil production capacity in the system. Apart from the covid period, this is historically, a high level. Almost all of this spare capacity lies in four countries in the Middle East; Saudi Arabia holding 3.2 million b/d, the UAE 1.1 million b/d, with Kuwait and Iran each reportedly at around 0.5 million b/d. Russia also has reported spare capacity of around 0.4 million b/d, but in current circumstances this is likely to be seen as more-or-less irrelevant.

There is a very modest gain in OPEC+ production capacity expected next year, and so spare capacity could be even higher in 2025. Given the expansion of non-OPEC+ production and the large-scale spare capacity in the Middle East, plus how recent disruptions have been overcome, it is no surprise the market is ‘comfortable’ on supply.

Analysts converging on their price forecasts.

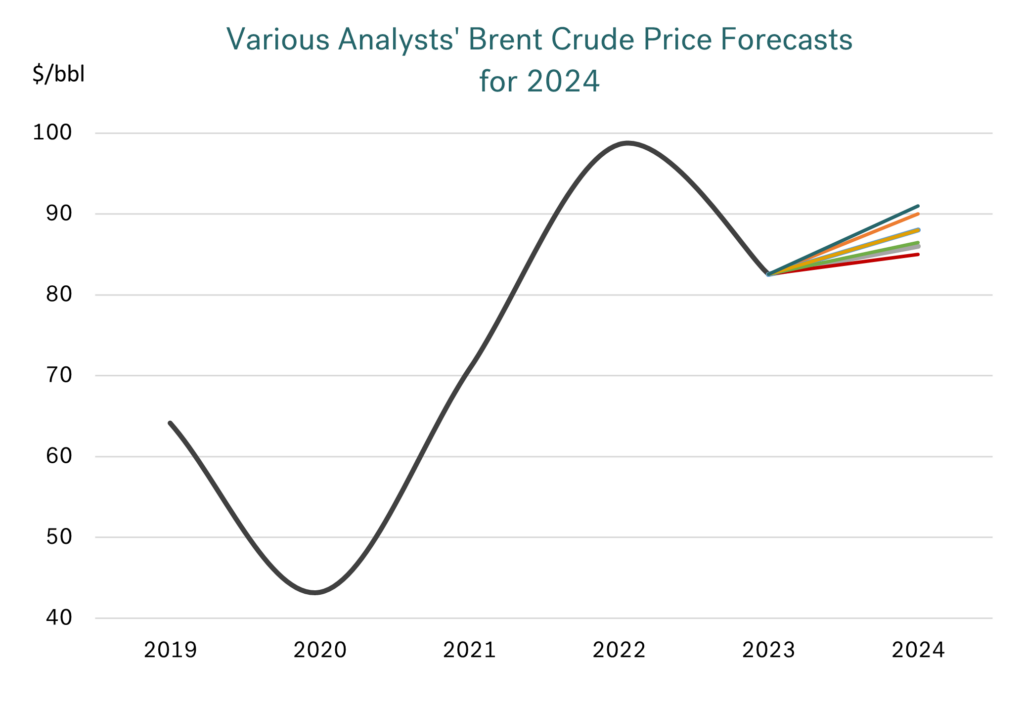

Given how the market has responded over the last year to what in the past would have been considered extreme ‘high risk’ geopolitical and military events, it is not surprising that analysts have ‘put a lid’ on their oil price forecasts for this year, typically at $90/bbl for Brent. The range of forecasts is now very narrow, with almost everyone in the $85-90/bbl as an average for Brent this year. A few have put a slightly higher number of up to $94/bbl for the third quarter average, based on some more positive economic indicators coming out. But in comparison to other times, there is not that much of a difference between analysts’ price views.

Source: Integr8 Fuels

Source: Integr8 Fuels

Is it time to be worried when everyone is in agreement?

Going forward, IF the geopolitical risks are even greater than we have seen (and they have already been extreme!), OR OPEC+ is prepared to make even further production cutbacks, then prices would likely rise and stay well above $90/bbl. BUT, if the situation in the Middle East becomes more settled, then, given the fundamentals, prices are more likely to fall.

So far this year, Brent front month futures has averaged $83.30/bbl. From a perspective here and what we have seen so far this year, it is surprising that none of these analysts looking at average 2024 Brent prices have put a figure lower than last year’s average of $82.50/bbl.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.