IEA Outlook: Shipping oil demand steady, but alt fuels take the upside

The end of oil may be exaggerated

It’s that time of year when the International Energy Agency (IEA) publishes its longer-term energy outlook to 2050. This extensive, 500-page report is always worth looking at, to gain insights into what could happen in the energy sector, where the oil industry is potentially going, and what this could mean for us in the bunker market.

In their previous reports the IEA (along with many other analysts) has highlighted a clear move away from oil and other fossil fuels over the next 25 years. In this latest report there is a new, compelling case to say that oil demand could continue rising through to 2050!

A new scenario showing oil demand continuing to grow to 2050

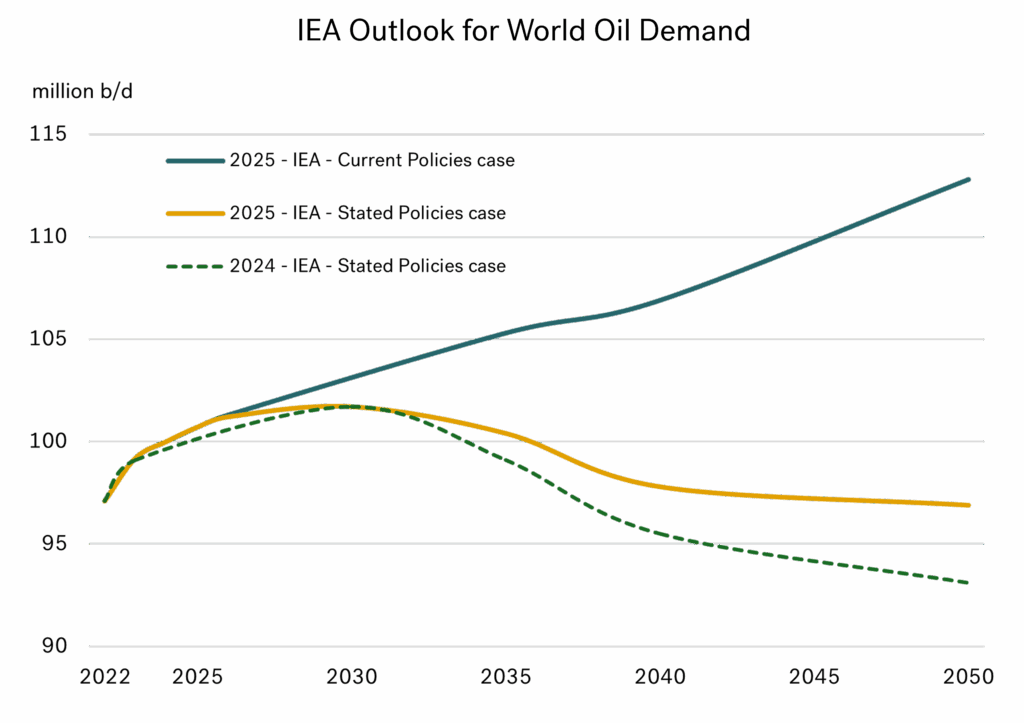

The IEA has again gone with three scenarios in their outlook to 2050. As in previous years, one is categorised as ‘Stated Policies’, which assumes a broad range of policies all being successfully implemented, including those put forward but not yet adopted.

The ‘Net Zero by 2050’ scenario is also one used previously. This is a theoretical case and shows a pathway that would achieve net zero CO2 emissions by 2050. We have not shown this case in the following analysis.

Finally, the new scenario is labelled ‘Current Policies’, based on policies and regulations already in place, plus a “cautious approach” regarding the pace at which new energy technologies are implemented. It is this latest scenario that shows oil demand continuing to rise all the way through to 2050.

The graph below illustrates the ‘Stated Policies’ outlook for world oil demand as shown in last year’s report (2024 IEA Stated Policies case). This was the highest level of oil demand of their three cases back in 2024, and showed a world where ‘peak oil’ was reached in the early 2030s.

Source: Integr8 Fuels

Source: Integr8 Fuels

The other two lines show oil demand profiles in this year’s report. The first is the latest ‘Stated Policies’ scenario and is around 3 million b/d higher than the same case in the 2024 report. Although it still shows ‘peak oil’ demand in the 2030s, the decline is very shallow and demand in 2050 is only some 4 4 million b/d (4%) lower than current levels.

The final, and highest line, is the new, ‘Current Policies’ case. Here oil growth is driven by demand for road transport, petrochemicals, air travel, and shipping in the emerging and developing economies (oil demand in the advanced economies is falling). In this case, oil demand in 2050 is some 12 million b/d (+12%) higher than today.

Neither of the two latest cases hint at a massive demise of the oil industry over the next 25 years. There are clearly practical and psychological nuances between a rising and a falling market, but both still imply a massive oil industry, with one continuing to grow (albeit at modest levels), and the other where demand only falls back to 2016 levels by 2050.

Not the same government enthusiasm to make rapid changes

It’s not surprising the IEA has developed this new scenario. Anecdotally, we know the pace of environmental change has slowed considerably, even though last year was the hottest on record and climate risks appear to be rising. The environmental headline is that last year we reached global temperatures of 1.5oC more than pre-industrial levels, and we could be looking at gains of 2-3oC. However, the reality is that a number of countries are easing, or even reversing their efforts to reduce emissions.

The headline story here is in the US, where President Trump’s ‘One Big Beautiful Bill Act’ has renewed support for the domestic oil, natural gas and coal sectors and at the same time aims to quickly phase out tax credits for electric vehicles (EVs), along with wind and solar energy projects. The US is not the only country on this path, there are also other nations looking to slow down the move away from fossil fuels. This has been demonstrated by the attendees at the recent COP30 in Brazil, and the challenges they faced in getting an acceptable agreement together, without the US even attending.

Renewables are still the biggest feature in terms of growth

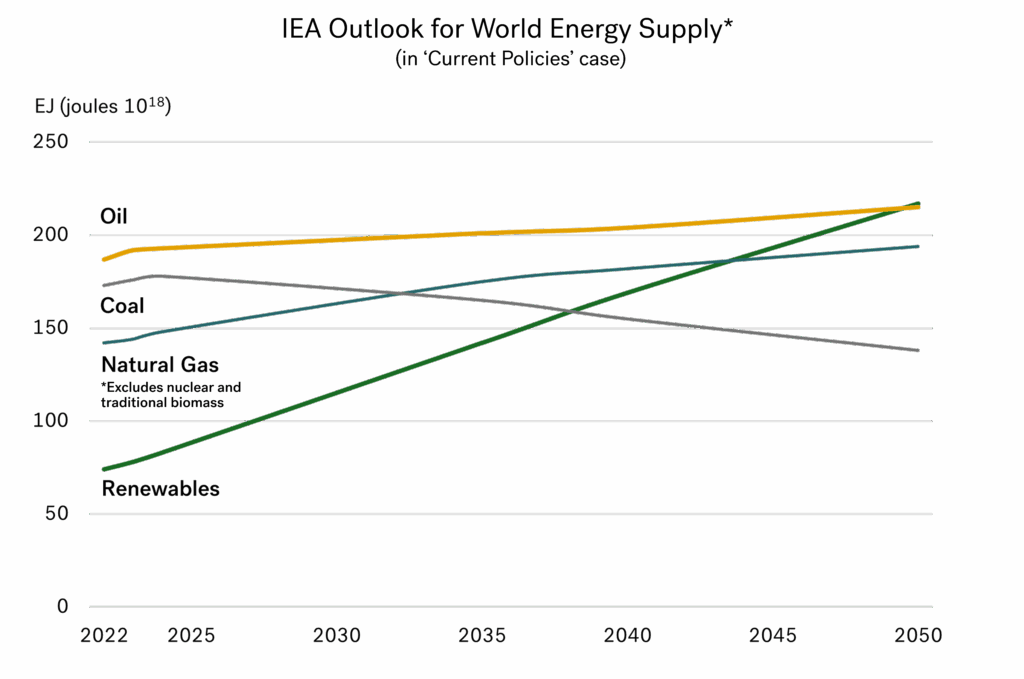

Against all these environmental issues, there is still a strong drive for more energy consumption, especially in India, SE Asia, the Middle East, Latin America, and Africa. Between the two scenarios, the IEA shows a 14% and a 28% growth in global energy demand between 2024-50.

Even though the IEA has developed a scenario where oil (and natural gas) demand continues to grow, these increases are very modest in terms of the energy demand projections. So, although the pace of growth in renewables is not as fast as in last year’s scenarios, they still account for the vast majority of incremental energy demand through to 2050.

Source: Integr8 Fuels

Source: Integr8 Fuels

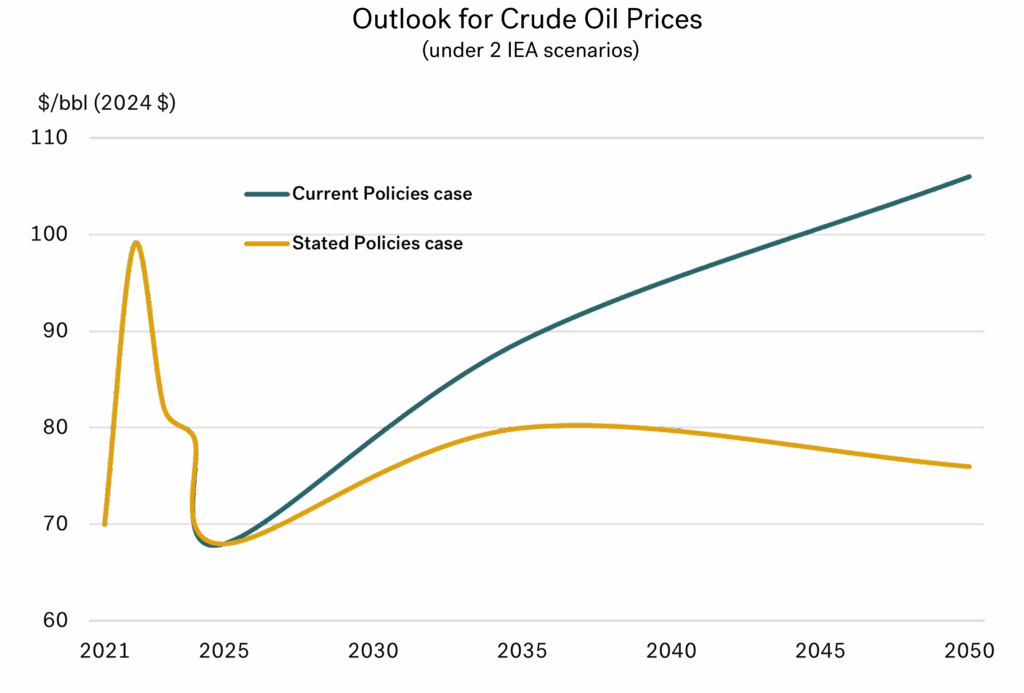

Higher oil (& bunker) prices; but not too high

Focusing back on oil. If oil demand does continue to grow, then upstream investment in the industry will be required to keep pace, and prices are likely to rise with these investment needs. The graph below illustrates the IEA scenario outlook for crude prices to 2050 in real terms, with one case showing prices not much higher than current levels, and the other to levels just above $100/bbl.

Source: Integr8 Fuels

Source: Integr8 Fuels

What it all means for the bunker market

The IEA does reference the shipping industry in its report, outlining changes in tonne-km demand and changes in the fuel mix for ship engines. The first pointer is they see a significant rise in demand for shipping in both scenarios, up by 40-50% over the next 25 years (in terms of tonne-km). However, they also see a significant increase in energy efficiency in the shipping sector.

As an overview, they see shipping’s dependency on oil falling from 90% in today’s market, to around 80% in 2035 and then to 70% by 2050. By 2050 the scenario is that natural gas and bioenergy will make up around 25% of the market, with a further 5% coming from methanol, hydrogen, ammonia, and other sources.

However, the overall shipping sector itself is growing throughout this period. So, under the ‘Stated Policies’ case, demand for oil bunkers would remain more-or-less at today’s levels over the next 25 years, and there could be a very modest increase in oil bunkers under the ‘Current Policies’ case. It means that in volume terms the size of the oil bunker market could continue at close to today’s levels for the next 25 years! At the same time, we would see a growing alternative fuels bunker market that could be equivalent to around 40% the size of the oil bunker market.

Looking at the two IEA scenarios, the growth in powering ships in the future will be taken up by alternative fuels and efficiency gains, but it doesn’t look like the size of the oil bunker market will fall. On this basis, we could see an overall industry strategy of carrying on with the oil bunker market as it is, and look towards the growing markets of alternative fuels as the area of expansion.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.