From Growth to Decline: The IEA’s 2030 Outlook and What It Means for Bunker Markets

The ‘Oil World’ will start to decline within the next 5 years

With oil prices in turmoil, moving much higher because of US, Israeli and Iranian attacks, and then much lower on what looks like a fragile ceasefire, it is perhaps a good time to take a ‘bigger picture’ look at the direction of the oil industry over the next 5 years. The IEA has just published its oil market outlook to 2030, and there is a lot within this analysis that will shape the bunker market over the rest of this decade.

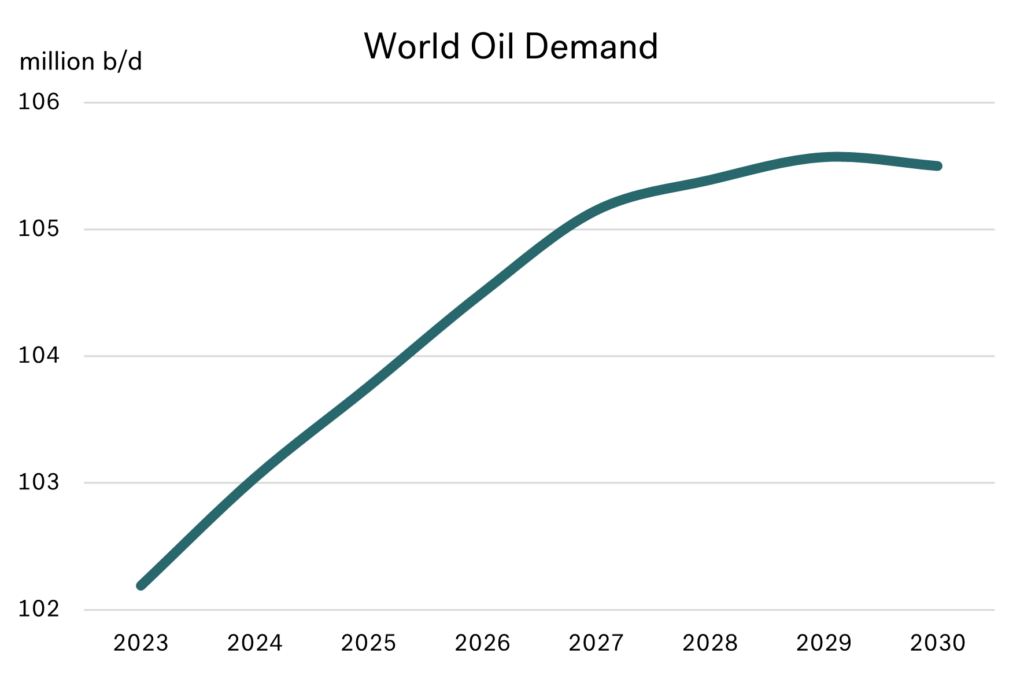

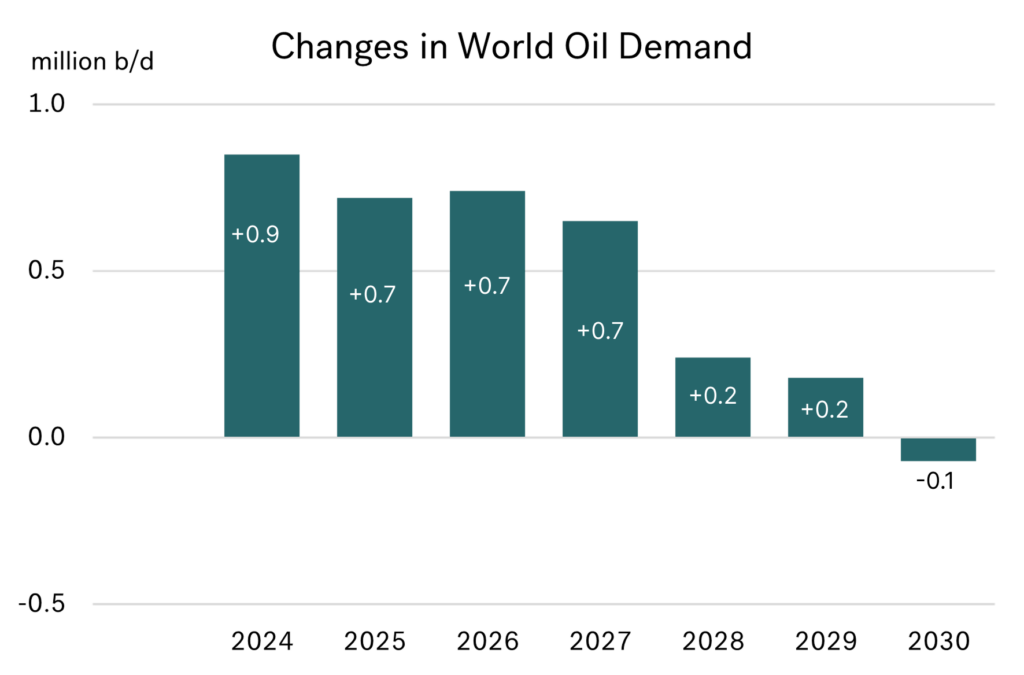

Importantly, we are moving from an industry that has been growing, to one that will soon be in decline. In the IEA outlook, world oil demand is forecast to show only modest gains over the next 2 years, with minimal gains in 2028/29 and then go into decline in 2030.

Source: Integr8 Fuels

Source: Integr8 Fuels

Source: Integr8 Fuels

Source: Integr8 Fuels

Petrochemicals and aviation is where the growth is

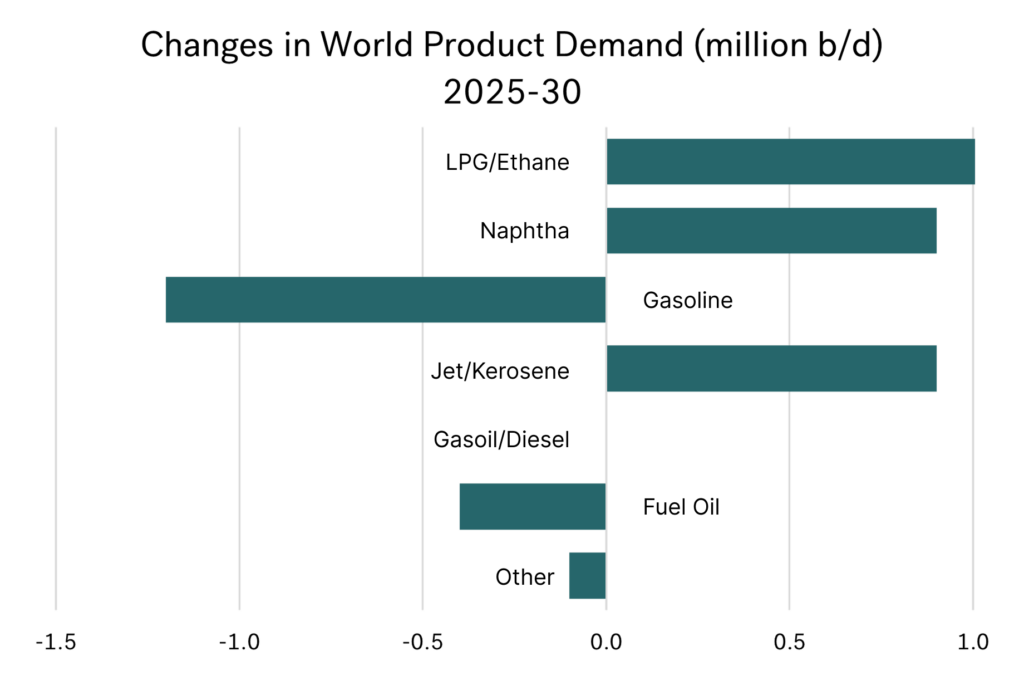

Looking at the key aspects of the oil products markets over the next 5 years, there are a few high-profile developments taking place. Firstly, there is significant growth in the petrochemical sector, and this will drive higher demand for LPG, ethane, and naphtha.

Secondly, there is also growth in jet demand. This follows the continued increases air travel and transport, and that jet fuel still essentially can only come from an oil refinery.

Source: Integr8 Fuels

Source: Integr8 Fuels

Bunker demand is expected to remain flat

Within their analysis, the IEA expects demand for bunkers to remain stable at around 5 million b/d over the outlook period. Their basis is that a 2% p.a. growth in tonne-kilometres demand will be offset by efficiency gains in the shipping industry and IMO regulations supporting some switching to lower emissions fuels, such as biofuels and ammonia.

Oil demand is falling as EVs are increasing

Gasoline and diesel have accounted for around 40% of total world oil demand. The main reason for oil demand starting to decline at the end of the decade is the expansion of electric vehicles (EVs) and the accompanying loss of gasoline and diesel demand in the transport sector.

For us in bunkers, it is the gasoil/diesel and fuel oil sectors that will be most influential.

Substantial changes in the outlook for US & China

- Two major changes from last year’s IEA report are that:

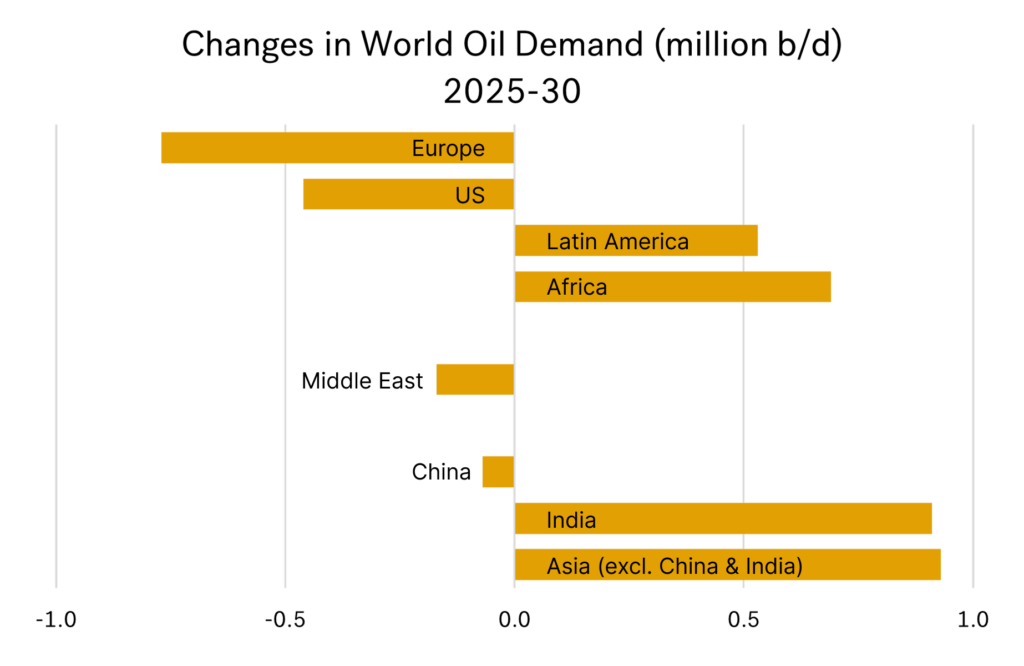

US oil demand is still forecast to fall, but at a much slower pace (which is not surprising under President Trump’s policies). - Oil demand in China will fall much earlier than previously anticipated.

China is now the world leader in EVs in terms of manufacturing and sales. This, along with massive investments in the high-speed rail network and structural shifts in the economy, mean the IEA is now expecting China’s oil demand to start falling within the next 4 years! This is a radical change, with China being the powerhouse behind increases in world oil demand in recent years.

In contrast, before President Trump was elected, the forecast was for US oil demand to fall by 1.5 million b/d between 2025 and 2030. Now, with Trump in power, the IEA has ‘downgraded’ this forecast decline to just 0.45 million b/d

Europe shows the biggest drop in oil demand

The agency has kept its previous expectation for a 0.8 million b/d drop in European oil demand between now and 2030. This means Europe is now at the forefront of changes in oil demand over the next 5 years.

There are no planned refinery closures in Europe after this year, but lower demand in the region will lead to lower refinery throughputs and product availabilities. It is how product balances unfold between cuts in refinery output versus the drop in oil demand; this will impact trade, pricing and how bunker markets are supplied in the region.

Limited changes in the US; but no market can stand alone

The situation in the US may be more balanced given the slower pace at which oil is removed from the energy mix. But we know how markets are ‘interwoven’, and no international bunker market is immune to what is happening elsewhere in the world.

Source: Integr8 Fuels

Latin America & African demand continues to rise

It is by coincidence that forecast declines in demand in Europe and the US are exactly matched by increases in oil demand in the growing economies of Latin America and Africa. This means that oil demand in the Atlantic Basin is expected to be close to current levels in 5 years time. However, with very few new refinery projects in the growth regions, it does stress the need for additional trade volumes to move between areas to achieve regional balances across different product groups. We in bunkers will be affected by these additional trade flows and price implications.

The Middle East not as it seems; its rising

On the face of it, there is a slight decline in Middle East oil demand over the next 5 years. However, once you dig into this, Saudi Arabia’s strategy to stop burning domestic oil for power generation and desalination plants* more than explains the cut. If this is taken out of the equation, Middle East product demand is forecast to increase by around 0.4-0.5 million b/d by 2030.

* part of this is a reduction is in fuel oil use, which could push more of this into the international market.

Nonetheless, the Middle East is one of the key areas where new refining capacity, upgrading and desulphurisation is taking place. Therefore, long haul product exports from the region are likely to continue to increase. This will cover some of the imbalances elsewhere in the world, but will also have price implications.

Asia & China could see the biggest changes for us

Finally, some of the biggest issues hitting the oil and bunker markets are likely to be seen in Asia As outlined, oil demand in China is expected to start falling by the end of the decade. But this is in contrast to what is happening in India and other Asian countries, where a combined growth of almost 2 million b/d is seen between now and 2030.

This is where trade flows, pricing and market influence could be interesting. Despite no growth in Chinese oil demand, there are still a number of refinery capacity additions in the pipeline. There are of course a number of scenarios surrounding these dynamics, but one obvious one is that China becomes an even bigger products exporter over the next 5 years. Again, this will have implications for all the major products, including what happens to us in bunkers.

This report poses more questions than answers

Clearly these are prominent issues for us in the bunker market. Longer term planners in our business will be assessing the potential surpluses and shortfalls by region for VLSFO, blending components and HSFO based on these demand and refining forecasts. It will be interesting to see how trade flows, bunker pricing and China influence our business over the next 5 years.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.